PENN Entertainment, Inc. (“PENN” or the “Company”) (Nasdaq:

PENN) today reported financial results for the three months and

year ended December 31, 2022.

2022 Fourth Quarter Highlights:

- Revenues of $1.6 billion, an increase of 0.8%

year-over-year;

- Net income of $20.8 million and net income margin of

1.3%, as compared to net income of $44.8 million and net income

margin of 2.8% in the prior year;

- Adjusted EBITDAR of $468.3 million, a decrease of 2.5%

year-over-year;

- Adjusted EBITDA of $438.3 million an increase of 18.8%

year-over-year; and

- Adjusted EBITDAR margins of 29.5%, a decline of 110bps

year-over-year.

- Omni-Channel, Tech-Forward Engagement Delivering Tangible

Benefits

- Strong Conclusion to Fourth Quarter Retail Operations;

Momentum Continues Into January

- Interactive Segment Achieves Profitable Quarter

- Repurchased $91.0 million of Common Stock at an Average

Price of $31.69 Under the February 2022 Share Repurchase

Authorization

- Initiates 2023 Guidance – Full Year Revenue Range of $6.15

billion to $6.58 billion and Adjusted EBITDAR Range of $1.875

billion to $2.0 billion

For further information, the Company has posted a presentation

to its website regarding the fourth quarter highlights and

accomplishments, which can be found here.

Jay Snowden, Chief Executive Officer and President, commented:

“2022 was a solid year for PENN despite ongoing macroeconomic

headwinds. I’m proud of PENN’s numerous financial and operational

achievements in the past year as well as our continued progress on

the ESG front. We remained focused on executing our leading

omni-channel strategy, which drove database growth and further

engagement with our expanding 21-44 year old cohort. Fourth quarter

revenues of $1.6 billion and Adjusted EBITDAR of $468.3 million

were impacted by severe weather in certain parts of the country in

December. Importantly, we also achieved profitability in our

Interactive segment notwithstanding an unfavorable sports betting

outcome in the World Series. The quarter ended on a high note with

strong performance between Christmas and New Year’s across the

portfolio, which has continued through January. In 2023, we have

numerous near-term growth opportunities, including the transition

of the Barstool Sportsbook to our own proprietary technology

platform in the U.S. this summer. For 2023, we are guiding to a

revenue range of $6.15 billion to $6.58 billion and an Adjusted

EBITDAR range of $1.875 billion to $2.0 billion1. This outlook

reflects our momentum in both our Retail and Interactive segments

and the potential for further economic headwinds as well as

increased supply in a few of our markets.

Omni-Channel, Tech-Forward Engagement Delivering Tangible

Benefits

Property level highlights2:

- Revenues of $1.4 billion;

- Adjusted EBITDAR of $487.1 million; and

- Adjusted EBITDAR margins of 35.2%.

“Our focused marketing strategy, diverse product offerings and

technology enhancements generated approximately 1.3 million new

rated customers last year in our mychoice database.

Approximately 300,000 of these guests signed up in the fourth

quarter, representing a 15% year-over-year increase. Over 50% of

the database growth this quarter came from our online offerings,

and our emphasis on delivering high-quality customer experiences

has led to a 25% increase in guests who engage with us across

multiple channels. In addition, our 21-44 year-old demographic has

steadily grown their share of total retail theoretical to 18.5% by

year end. We also saw positive momentum in our mychoice app

downloads and the adoption of our industry leading cashless,

cardless and contactless technology (“3C’s”), which is now deployed

at twenty-one properties representing approximately 70% of our

retail EBITDAR. Our guests who use the digital wallet enjoy a

better guest experience and demonstrate superior loyalty through

increased visitation, time on device, and total theoretical.

Interactive Segment Achieves Profitable Quarter

Interactive Segment highlights:

- Revenues of $208.0 million (including tax gross up of $82.9

million); and

- Adjusted EBITDA of $5.2 million.

“Our Interactive segment generated positive Adjusted EBITDA for

the quarter inclusive of expenses related to online sports betting

launches in Maryland and Ohio and unfavorable hold driven by VVIP

play. Following our successful playbook in Kansas and Maryland, our

omni-channel marketing approach in Ohio led to one of our strongest

launches to date of our Barstool Sportsbook. Our deep customer

database, retail footprint, and powerful Barstool Sports marketing

engine contributed to a record number of first-time depositors at

launch this January despite minimal external marketing expense.

Meanwhile, in Ontario, theScore Bet continues to experience strong

momentum, achieving record gaming revenue in December for both

sports betting and iCasino. The transition to our proprietary

technology platform last summer has resulted in higher customer

engagement and a noticeable increase in hold rates. Greater control

over our product offering and advanced promotional capabilities is

contributing to encouraging retention metrics and cross-sell rates

to iCasino. Looking ahead, we remain on-track to migrate the

Barstool Sportsbook and Casino to our proprietary technology

solution this summer. In addition to expected cost synergies, our

Ontario success suggests that there is meaningful revenue potential

post-migration once we are able to leverage our advanced trading

and promotional tools. Finally, we are excited about our recent

launch of the Barstool Sportsbook in Massachusetts at Plainridge

Park Casino and are looking forward to our launch of online sports

betting in March.

Compelling Media Content With New Verticals

“Despite well-known headwinds in the digital media space,

theScore’s media business and Barstool Sports continue to produce

impressive revenue and engagement results, driven by compelling

content and an exceptional product experience. theScore’s mobile

media audience is more engaged than ever with both quarterly and

annual user session growth. In addition, we completed the initial

integration of the Barstool Sportsbook into theScore media app in

October, highlighting the benefits of our owned media strategy. We

are also excited about the upcoming acquisition of the remainder of

Barstool Sports, which we expect will close February 17. Barstool

achieved record revenue in 2022 while investing in and expanding

into new verticals, including coverage of live sporting events such

as the Barstool Invitational college basketball tournament on

November 11 and the Arizona Bowl on December 30. The combination of

Barstool’s vast, loyal audience with theScore’s fully integrated

media and betting platform will provide us with compelling

competitive advantages and organic cross-selling opportunities.

ESG – Caring for our People, our Communities and our

Planet

“During the fourth quarter, we finalized our Scope 1 and 2

greenhouse gas emissions assessment, which along with our inaugural

Sustainability Accounting Standards Board (“SASB”) disclosure, will

be released in April in conjunction with our upcoming FY2022

Corporate Social Responsibility Report. In addition, we completed

our companywide diversity, equity, and inclusion training and will

soon begin a second phase of training focused on our leadership

teams. Finally, we are proud to report that PENN Interactive

received ‘RG Check iGaming Accreditation’ from the Responsible

Gambling Council for its online gaming operations. PENN Interactive

is the first U.S. operator to undergo this accreditation process,

which is widely regarded as one of the most comprehensive

responsible gambling accreditation programs in the world.”

Share Repurchase Authorization Update

On December 6, 2022, the Company’s Board of Directors authorized

a new $750 million share repurchase program which expires on

December 31, 2025 and is incremental to the Company’s existing $750

million share repurchase program authorized in February 2022.

During the three months ended December 31, 2022, the Company

repurchased 2,870,894 shares of its common stock in open market

transactions for $91.0 million at an average price of $31.69 per

share.

Subsequent to the year ended December 31, 2022, the Company

repurchased 1,008,744 shares of its common stock at an average

price of $31.20 per share for an aggregate amount of $31.5 million.

The remaining availability under our February 2022 authorization

was $117.8 million and $750.0 million under our December 2022

authorization as of February 1, 2023.

Liquidity Remains Strong

Total liquidity as of December 31, 2022 was $2.6 billion

inclusive of $1.6 billion in cash and cash equivalents. Traditional

net debt as of the end of the quarter was $1.1 billion, an increase

of $189.6 million from December 31, 2021 due to a lower cash

balance reflecting recent activity under our share repurchase

program. Lease-adjusted net leverage as of December 31, 2022 was

4.4x compared to 4.1x as of December 31, 2021.

Additional information on PENN’s reported results, including a

reconciliation of the non-GAAP results to their most comparable

GAAP measures, is included in the financial tables below. The

Company does not provide a reconciliation of projected Adjusted

EBITDA and Adjusted EBITDAR because it is unable to predict with

reasonable accuracy the value of certain adjustments that may

significantly impact the Company’s results, including realized and

unrealized gains and losses on equity securities, re-measurement of

cash-settled stock-based awards, contingent purchase payments

associated with prior acquisitions, and income tax (benefit)

expense, which are dependent on future events that are out of the

Company’s control or that may not be reasonably predicted.

Summary of Fourth Quarter Results

For the three months ended

December 31,

(in millions,

except per share data, unaudited)

2022

2021

Revenues

$

1,585.6

$

1,572.5

Net income

$

20.8

$

44.8

Adjusted EBITDA (1)

$

438.3

$

369.0

Rent expense associated with triple net

operating leases (2)

30.0

111.5

Adjusted EBITDAR (1)

$

468.3

$

480.5

Payments to our REIT Landlords under

Triple Net Leases (3)

$

231.9

$

228.8

Diluted earnings per common

share

$

0.13

$

0.26

(1)

See the “Non-GAAP Financial Measures” section below for more

information as well as the definitions of Adjusted EBITDA and

Adjusted EBITDAR. Additionally, see below for reconciliations of

these Non-GAAP financial measures to their GAAP equivalent

financial measure.

(2)

Consists of the operating lease components contained within our

triple net master lease dated November 1, 2013 with Gaming and

Leisure Properties, Inc. (Nasdaq: GLPI) ("GLPI") and the triple net

master lease assumed in connection with our acquisition of Pinnacle

Entertainment, Inc. (individually referred to as the PENN Master

Lease and Pinnacle Master Lease, respectively, and are collectively

referred to as our “Master Leases”), as well as our individual

triple net leases with GLPI for the real estate assets used in the

operation of Tropicana Las Vegas Hotel and Casino, Inc. (terminated

on September 26, 2022) and Hollywood Casino at The Meadows, and our

individual triple net leases with VICI Properties Inc. (NYSE: VICI)

(“VICI”) for the real estate assets used in the operations of

Margaritaville Resort Casino and Hollywood Casino at Greektown

(referred to collectively as our “triple net operating

leases”).

On January 14, 2022, the Company and GLPI

amended certain terms of the Master Leases which were concluded to

be lease modifications under Accounting Standards Codification

Topic 842, “Leases.” As a result of the lease modification events,

only the land and building components associated with the

operations of Hollywood Gaming at Dayton Raceway and Hollywood

Gaming at Mahoning Valley Race Course are classified as operating

leases which are recorded to rent expense, as compared to prior to

the lease modification events, whereby the land components of

substantially all of the Master Lease properties were classified as

operating leases and recorded to rent expense. Subsequent to the

lease modification events, the land components associated with the

Master Lease properties are primarily classified as finance

leases.

(3)

Consists of payments made to GLPI and VICI (referred to

collectively as our “REIT Landlords”) under the Master Leases, the

Perryville Lease, the Meadows Lease, the Margaritaville Lease, the

Greektown Lease and the Morgantown Lease. Although we collectively

refer to the Master Leases, the Perryville Lease, the Meadows

Lease, the Margaritaville Lease, the Greektown Lease, the

Morgantown Lease and the Tropicana Lease as our “Triple Net

Leases,” the rent under the Tropicana Lease was nominal prior to

lease termination.

PENN ENTERTAINMENT, INC. AND

SUBSIDIARIES

Segment Information

The Company aggregates its operations into

five reportable segments: Northeast, South, West, Midwest, and

Interactive.

For the three months ended

December 31,

For the year ended December

31,

(in millions, unaudited)

2022

2021

2022

2021

Revenues:

Northeast segment (1)

$

667.1

$

656.6

$

2,695.9

$

2,552.4

South segment (2)

304.4

339.9

1,314.2

1,322.2

West segment (3)

130.7

138.7

581.9

521.4

Midwest segment (4)

282.0

287.5

1,159.6

1,102.7

Interactive (5)

208.0

157.6

663.1

432.9

Other (6)

3.9

3.8

21.3

10.6

Intersegment eliminations (7)

(10.5

)

(11.6

)

(34.3

)

(37.2

)

Total revenues

$

1,585.6

$

1,572.5

$

6,401.7

$

5,905.0

Adjusted EBITDAR:

Northeast segment (1)

$

205.0

$

202.5

$

842.5

$

848.4

South segment (2)

118.4

139.0

548.1

587.0

West segment (3)

48.7

43.9

220.1

195.0

Midwest segment (4)

115.0

126.1

501.2

500.1

Interactive (5)

5.2

(5.9

)

(74.9

)

(35.4

)

Other (6)

(24.0

)

(25.1

)

(97.6

)

(100.7

)

Total Adjusted EBITDAR (8)

$

468.3

$

480.5

$

1,939.4

$

1,994.4

(1)

The Northeast segment consists of

the following properties: Ameristar East Chicago, Hollywood Casino

at Greektown, Hollywood Casino Bangor, Hollywood Casino at Charles

Town Races, Hollywood Casino Columbus, Hollywood Casino

Lawrenceburg, Hollywood Casino Morgantown (opened December 22,

2021), Hollywood Casino at PENN National Race Course, Hollywood

Casino Perryville (acquired July 1, 2021), Hollywood Casino Toledo,

Hollywood Casino York (opened August 12, 2021), Hollywood Gaming at

Dayton Raceway, Hollywood Gaming at Mahoning Valley Race Course,

Marquee by PENN, Hollywood Casino at The Meadows, and Plainridge

Park Casino.

(2)

The South segment consists of the

following properties: 1st Jackpot Casino, Ameristar Vicksburg,

Boomtown Biloxi, Boomtown Bossier City, Boomtown New Orleans,

Hollywood Casino Gulf Coast, Hollywood Casino Tunica, L’Auberge

Baton Rouge, L’Auberge Lake Charles, and Margaritaville Resort

Casino.

(3)

The West segment consists of the

following properties: Ameristar Black Hawk, Cactus Petes and

Horseshu, M Resort, Tropicana Las Vegas Hotel and Casino (sold on

September 26, 2022), and Zia Park Casino.

(4)

The Midwest segment consists of

the following properties: Ameristar Council Bluffs, Argosy Casino

Alton, Argosy Casino Riverside, Hollywood Casino Aurora, Hollywood

Casino Joliet, our 50% investment in Kansas Entertainment, LLC,

which owns Hollywood Casino at Kansas Speedway, Hollywood Casino

St. Louis, Prairie State Gaming, and River City Casino.

(5)

The Interactive segment includes

all of our iCasino and online sports betting operations, management

of retail sports betting, media, and our proportionate share of

earnings attributable to our equity method investment in Barstool

Sports, Inc. (“Barstool”). Interactive revenues are inclusive of a

tax gross-up of $82.9 million and $251.6 million for the three and

twelve months ended December 31, 2022, respectively, as compared to

$50.7 million and $180.2 million for the three and twelve months

ended December 31, 2021, respectively.

(6)

The Other category, included in

the tables to reconcile the segment information to the consolidated

information, consists of the Company’s stand-alone racing

operations, namely Sanford-Orlando Kennel Club, Sam Houston and

Valley Race Parks (the remaining 50% was acquired by PENN on August

1, 2021), the Company’s JV interests in Freehold Raceway and our

management contract for Retama Park Racetrack. The Other category

also includes corporate overhead costs, which consist of certain

expenses, such as: payroll, professional fees, travel expenses and

other general and administrative expenses that do not directly

relate to or have not otherwise been allocated to a property.

(7)

Primarily represents the

elimination of intersegment revenues associated with our

internally-branded retail sportsbooks, which are operated by PENN

Interactive.

(8)

As noted within the “Non-GAAP

Financial Measures” section below, Adjusted EBITDAR is presented on

a consolidated basis outside the financial statements solely as a

valuation metric or for reconciliation purposes.

PENN ENTERTAINMENT, INC. AND

SUBSIDIARIES

Reconciliation of Comparable

GAAP Financial Measure to Adjusted EBITDA,

Adjusted EBITDAR, and Adjusted

EBITDAR Margin

For the three months ended

December 31,

For the year ended December

31,

(in millions,

unaudited)

2022

2021

2022

2021

Net income

$

20.8

$

44.8

$

221.7

$

420.5

Income tax (benefit) expense

31.7

8.5

(46.4

)

118.6

Loss on early extinguishment of debt

—

—

10.4

—

Income from unconsolidated affiliates

(6.6

)

(10.9

)

(23.7

)

(38.7

)

Interest expense, net

203.5

143.5

758.2

562.8

Interest income

(11.3

)

(0.4

)

(18.3

)

(1.1

)

Other (income) expenses

4.8

40.6

72.1

(2.5

)

Operating income

242.9

226.1

974.0

1,059.6

Stock-based compensation

13.0

13.2

58.1

35.1

Cash-settled stock-based awards variance

(1)

0.7

(13.1

)

(15.5

)

1.2

Loss on disposal of assets

0.9

1.0

7.9

1.1

Contingent purchase price

0.3

—

(0.6

)

1.9

Pre-opening expenses (2)

—

2.6

4.1

5.4

Depreciation and amortization

150.3

97.6

567.5

344.5

Impairment losses (3)

13.6

—

118.2

—

Insurance recoveries, net of deductible

charges

—

—

(10.7

)

—

Income from unconsolidated affiliates

6.6

10.9

23.7

38.7

Non-operating items of equity method

investments (4)

3.2

1.7

7.9

7.7

Other expenses (2)(5)

6.8

29.0

55.2

44.8

Adjusted EBITDA

438.3

369.0

1,789.8

1,540.0

Rent expense associated with triple net

operating leases

30.0

111.5

149.6

454.4

Adjusted EBITDAR

$

468.3

$

480.5

$

1,939.4

$

1,994.4

Net income margin

1.3

%

2.8

%

3.5

%

7.1

%

Adjusted EBITDAR margin

29.5

%

30.6

%

30.3

%

33.8

%

(1)

Our cash-settled stock-based awards are

adjusted to fair value each reporting period based primarily on the

price of the Company’s common stock. As such, significant

fluctuations in the price of the Company’s common stock during any

reporting period could cause significant variances to budget on

cash-settled stock-based awards.

(2)

During the first quarter of 2021,

acquisition costs were included within pre-opening and acquisition

costs. Beginning with the quarter ended June 30, 2021, acquisition

costs are presented as part of other expenses.

(3)

Amount primarily relates to $116.4 million

of impairment charges in the Northeast segment.

(4)

Consists principally of interest expense,

net, income taxes, depreciation and amortization, and stock-based

compensation expense associated with Barstool and our Kansas

Entertainment, LLC joint venture. We record our portion of Barstool

Sports’ net income or loss, including adjustments to arrive at

Adjusted EBITDAR, one quarter in arrears.

(5)

Consists of non-recurring acquisition and

transaction costs, and finance transformation costs associated with

the implementation of our new Enterprise Resource Management

system.

PENN ENTERTAINMENT, INC. AND

SUBSIDIARIES

Consolidated Statements of

Operations

For the three months ended

December 31,

For the year ended December

31,

(in millions, except per share data,

unaudited)

2022

2021

2022

2021

Revenues

Gaming

$

1,267.4

$

1,301.6

$

5,201.7

$

4,945.3

Food, beverage, hotel and other

318.2

270.9

1,200.0

959.7

Total revenues

1,585.6

1,572.5

6,401.7

5,905.0

Operating expenses

Gaming

706.3

739.6

2,864.4

2,540.7

Food, beverage, hotel and other

209.3

175.5

767.2

607.3

General and administrative

263.2

333.7

1,110.4

1,352.9

Depreciation and amortization

150.3

97.6

567.5

344.5

Impairment losses

13.6

—

118.2

—

Total operating expenses

1,342.7

1,346.4

5,427.7

4,845.4

Operating income

242.9

226.1

974.0

1,059.6

Other income (expenses)

Interest expense, net

(203.5

)

(143.5

)

(758.2

)

(562.8

)

Interest income

11.3

0.4

18.3

1.1

Income from unconsolidated affiliates

6.6

10.9

23.7

38.7

Loss on early extinguishment of debt

—

—

(10.4

)

—

Other

(4.8

)

(40.6

)

(72.1

)

2.5

Total other expenses

(190.4

)

(172.8

)

(798.7

)

(520.5

)

Income before income taxes

52.5

53.3

175.3

539.1

Income tax benefit (expense)

(31.7

)

(8.5

)

46.4

(118.6

)

Net income

20.8

44.8

221.7

420.5

Less: Net loss attributable to

non-controlling interest

—

0.2

0.4

0.3

Net income attributable to PENN

Entertainment

$

20.8

$

45.0

$

222.1

$

420.8

Earnings per share:

Basic earnings per share

$

0.13

$

0.27

$

1.37

$

2.64

Diluted earnings per share

$

0.13

$

0.26

$

1.29

$

2.48

Weighted-average common shares

outstanding—basic

154.2

166.9

161.2

158.7

Weighted-average common shares

outstanding—diluted

169.7

169.2

176.6

175.5

Selected Financial Information

Balance Sheet Data

(in millions,

unaudited)

December 31, 2022

December 31, 2021

Cash and cash equivalents

$

1,624.0

$

1,863.9

Bank debt

$

1,531.2

$

1,563.7

Notes (1)

1,130.5

1,130.5

Other long-term obligations (2)

38.1

55.9

Total traditional debt

2,699.8

2,750.1

Financing obligation (3)

118.0

90.4

Less: Debt discounts and debt issuance

costs (4)

(40.3

)

(103.7

)

$

2,777.5

$

2,736.8

Total traditional debt

$

2,699.8

$

2,750.1

Less: Cash and cash equivalents

(1,624.0

)

(1,863.9

)

Traditional net debt (5)

$

1,075.8

$

886.2

(1)

Inclusive of our 5.625% Notes due

2027, 4.125% Notes due 2029 and our 2.75% Convertible Notes due

2026.

(2)

Other long-term obligations as of

December 31, 2022 primarily includes $27.4 million related to

relocation fees due for both Hollywood Gaming at Dayton Raceway and

Hollywood Gaming at Mahoning Valley Race Course, and $10.7 million

related to our repayment obligation on a hotel and event center

located near Hollywood Casino Lawrenceburg.

(3)

Represents cash proceeds received

and non-cash interest on certain claims of which the principal

repayment is contingent and classified as a financing obligation

under Accounting Standards Codification Topic 470, “Debt.”

(4)

On January 1, 2022, the Company

adopted ASU 2020-06, which resulted in a net $71.7 million

reclassification of the equity component originally recognized as a

debt discount under the previously bifurcated cash conversion

feature of the 2.75% convertible senior notes due May 2026. Under

ASU 2020-06, bifurcation for a cash conversion feature is no longer

permitted. Additionally, we incurred debt discounts and debt

issuance costs due to the May 2022 refinancing of our Senior

Secured Credit Facilities.

(5)

Traditional net debt in the table

above is calculated as “Total traditional debt,” which is the

principal amount of debt outstanding (excludes the financing

obligation associated with cash proceeds received and non-cash

interest on certain claims of which the principal repayment is

contingent) less “Cash and cash equivalents.” Management believes

that Traditional net debt is an important measure to monitor

leverage and evaluate the balance sheet. With respect to

Traditional net debt, cash and cash equivalents are subtracted from

the GAAP measure because they could be used to reduce the Company’s

debt obligations. A limitation associated with using traditional

net debt is that it subtracts cash and cash equivalents and

therefore may imply that there is less Company debt than the most

comparable GAAP measure indicates. Management believes that

investors may find it useful to monitor leverage and evaluate the

balance sheet.

Cash Flow Data

The table below summarizes certain cash expenditures incurred by

the Company.

For the three months ended

December 31,

For the year ended December

31,

(in millions,

unaudited)

2022

2021

2022

2021

Cash payments to our REIT Landlords under

Triple Net Leases

$

231.9

$

228.8

$

925.0

$

912.4

Cash payments related to income taxes,

net

$

26.5

$

32.7

$

72.8

$

108.3

Cash paid for interest on traditional

debt

$

29.1

$

14.8

$

115.9

$

79.8

Capital expenditures

$

73.8

$

55.3

$

263.4

$

146.6

Non-GAAP Financial Measures

The Non-GAAP Financial Measures used in this press release

include Adjusted EBITDA, Adjusted EBITDAR, and Adjusted EBITDAR

margin. These non-GAAP financial measures should not be considered

a substitute for, nor superior to, financial results and measures

determined or calculated in accordance with GAAP.

We define Adjusted EBITDA as earnings before interest expense,

net; interest income; income taxes; depreciation and amortization;

stock-based compensation; debt extinguishment charges; impairment

losses; insurance recoveries, net of deductible charges; changes in

the estimated fair value of our contingent purchase price

obligations; gain or loss on disposal of assets; the difference

between budget and actual expense for cash-settled stock-based

awards; pre-opening expenses; and other. Adjusted EBITDA is

inclusive of income or loss from unconsolidated affiliates, with

our share of non-operating items (such as interest expense, net;

income taxes; depreciation and amortization; and stock-based

compensation expense) added back for Barstool Sports, Inc.

(“Barstool”) and our Kansas Entertainment, LLC joint venture.

Adjusted EBITDA is inclusive of rent expense associated with our

triple net operating leases (the operating lease components

contained within our triple net master lease dated November 1, 2013

with Gaming and Leisure Properties, Inc. (Nasdaq: GLPI) and the

triple net master lease assumed in connection with our acquisition

of Pinnacle Entertainment, Inc., our individual triple net leases

with GLPI for the real estate assets used in the operations of

Tropicana Las Vegas Hotel and Casino, Inc. (terminated on September

26, 2022) and Hollywood Casino at The Meadows, and our individual

triple net leases with VICI Properties Inc. (NYSE: VICI) for the

real estate assets used in the operations of Margaritaville Resort

Casino and Hollywood Casino at Greektown). Although Adjusted EBITDA

includes rent expense associated with our triple net operating

leases, we believe Adjusted EBITDA is useful as a supplemental

measure in evaluating the performance of our consolidated results

of operations.

Adjusted EBITDA has economic substance because it is used by

management as a performance measure to analyze the performance of

our business, and is especially relevant in evaluating large,

long-lived casino-hotel projects because it provides a perspective

on the current effects of operating decisions separated from the

substantial non-operational depreciation charges and financing

costs of such projects. We present Adjusted EBITDA because it is

used by some investors and creditors as an indicator of the

strength and performance of ongoing business operations, including

our ability to service debt, and to fund capital expenditures,

acquisitions and operations. These calculations are commonly used

as a basis for investors, analysts and credit rating agencies to

evaluate and compare operating performance and value companies

within our industry. In order to view the operations of their

casinos on a more stand-alone basis, gaming companies, including

us, have historically excluded from their Adjusted EBITDA

calculations of certain corporate expenses that do not relate to

the management of specific casino properties. However, Adjusted

EBITDA is not a measure of performance or liquidity calculated in

accordance with GAAP. Adjusted EBITDA information is presented as a

supplemental disclosure, as management believes that it is a

commonly used measure of performance in the gaming industry and

that it is considered by many to be a key indicator of the

Company’s operating results.

We define Adjusted EBITDAR as Adjusted EBITDA (as defined above)

plus rent expense associated with triple net operating leases

(which is a normal, recurring cash operating expense necessary to

operate our business). Adjusted EBITDAR is presented on a

consolidated basis outside the financial statements solely as a

valuation metric. Management believes that Adjusted EBITDAR is an

additional metric traditionally used by analysts in valuing gaming

companies subject to triple net leases since it eliminates the

effects of variability in leasing methods and capital structures.

This metric is included as a supplemental disclosure because (i) we

believe Adjusted EBITDAR is traditionally used by gaming operator

analysts and investors to determine the equity value of gaming

operators and (ii) Adjusted EBITDAR is one of the metrics used by

other financial analysts in valuing our business. We believe

Adjusted EBITDAR is useful for equity valuation purposes because

(i) its calculation isolates the effects of financing real estate;

and (ii) using a multiple of Adjusted EBITDAR to calculate

enterprise value allows for an adjustment to the balance sheet to

recognize estimated liabilities arising from operating leases

related to real estate. However, Adjusted EBITDAR when presented on

a consolidated basis is not a financial measure in accordance with

GAAP, and should not be viewed as a measure of overall operating

performance or considered in isolation or as an alternative to net

income because it excludes the rent expense associated with our

triple net operating leases and is provided for the limited

purposes referenced herein. Adjusted EBITDAR margin is defined as

Adjusted EBITDAR on a consolidated basis (as defined above) divided

by revenues on a consolidated basis. Adjusted EBITDAR margin is

presented on a consolidated basis outside the financial statements

solely as a valuation metric.

Each of these non-GAAP financial measures is not calculated in

the same manner by all companies and, accordingly, may not be an

appropriate measure of comparing performance among different

companies. See the table above, which presents reconciliations of

these measures to the GAAP equivalent financial measures.

Management Presentation, Conference Call, Webcast and Replay

Details

PENN is hosting a conference call and simultaneous webcast at

9:00 am ET today, both of which are open to the general public.

During the call, management will review an earnings presentation

that can be accessed at

https://investors.pennentertainment.com/events-and-presentations/presentations.

The conference call number is 212-231-2922; please call five

minutes in advance to ensure that you are connected prior to the

presentation. Interested parties may also access the live call at

www.pennentertainment.com; allow 15 minutes to register and

download and install any necessary software. Questions and answers

will be reserved for call-in analysts and investors. A replay of

the call can be accessed for thirty days at

www.pennentertainment.com.

This press release, which includes financial information to be

discussed by management during the conference call and disclosure

and reconciliation of non-GAAP financial measures, is available on

the Company’s web site, www.pennentertainment.com, in the

“Investors” section (select link for “Press Releases”).

About PENN Entertainment

PENN Entertainment, Inc. (Nasdaq: PENN) is North America’s

leading provider of integrated entertainment, sports content and

casino gaming experiences. PENN operates 43 properties in 20

states, online sports betting in 16 jurisdictions and iCasino in

five jurisdictions under a portfolio of well-recognized brands

including Hollywood Casino®, L’Auberge®, Barstool Sportsbook® and

theScore Bet Sportsbook and Casino®. PENN’s highly differentiated

strategy, which is focused on organic cross-sell opportunities, is

reinforced by its investments in market-leading retail casinos,

sports media assets, technology, including a state-of-the-art,

fully integrated digital sports and online casino betting platform,

and an in-house iCasino content studio. The Company’s portfolio is

further bolstered by its industry-leading mychoice® customer

loyalty program, which offers our approximately 26 million members

a unique set of rewards and experiences across business channels.

PENN is deeply committed to fostering a culture that welcomes a

diverse set of customers and dedicated team members. The Company

has been consistently ranked in the top two as “Employer of First

Choice” over the last nine years in the Bristol Associates-Spectrum

Gaming’s Executive Satisfaction Survey. In addition, as a

long-standing good corporate citizen, PENN is also committed to

being a trusted and valued member of its communities and a

responsible steward of our finite natural resources.

Forward Looking Statements

This press release contains “forward-looking statements” within

the meaning of the Private Securities Litigation Reform Act of

1995. These statements can be identified by the use of

forward-looking terminology such as “expects,” “believes,”

“estimates,” “projects,” “intends,” “plans,” “goal,” “seeks,”

“may,” “will,” “should,” or “anticipates” or the negative or other

variations of these or similar words, or by discussions of future

events, strategies or risks and uncertainties. Specifically,

forward-looking statements include, but are not limited to,

statements regarding: future revenue and Adjusted EBITDAR; the

Company’s anticipated share repurchases; the Company’s expectations

of future results of operations and financial condition, including

the scale and timing of the Company’s product and technology

investments; the Company’s expectations regarding results, and the

impact of competition, in retail/mobile/online sportsbooks, iGaming

and retail operations; the Company’s development and launch of its

Interactive segment’s products in new jurisdictions and

enhancements to existing Interactive segment products, including

the content for the Barstool and theScore Bet iCasino apps and the

migration of the Barstool Sportsbook into both our proprietary

player account management system and risk and trading platforms;

the Company’s expectations regarding its acquisition of Barstool

Sports and the future success of its products; the Company’s

expectations with respect to the integration and synergies related

to the Company’s integration of theScore and Barstool Sports; the

continued growth and monetization of the Company’s media business;

the Company’s expectations with respect to the ongoing introduction

and the potential benefits of the cashless, cardless and

contactless (3C’s) technology; the Company’s development projects,

including the prospective development projects at Hollywood Casinos

Aurora, Joliet, Columbus, and the M Resort Spa Casino; our ability

to obtain financing for our development projects on attractive

terms; and the timing, cost and expected impact of planned capital

expenditures on the Company’s results of operations; the actions of

regulatory, legislative, executive or judicial decisions at the

federal, state, provincial or local level with regard to our

business and the impact of any such actions.

Such statements are all subject to risks, uncertainties and

changes in circumstances that could significantly affect the

Company’s future financial results and business. Accordingly, the

Company cautions that the forward-looking statements contained

herein are qualified by important factors that could cause actual

results to differ materially from those reflected by such

statements. Such factors include: the effects of economic and

market conditions in the markets in which the Company operates;

competition with other entertainment, sports content, and casino

gaming experiences; the timing, cost and expected impact of product

and technology investments; risks relating to international

operations, permits, licenses, financings, approvals and other

contingencies in connection with growth in new or existing

jurisdictions; and additional risks and uncertainties described in

the Company’s Annual Report on Form 10-K for the year ended

December 31, 2021, subsequent Quarterly Reports on Form 10-Q and

Current Reports on Form 8-K, each as filed with the U.S. Securities

and Exchange Commission. The Company does not intend to update

publicly any forward-looking statements except as required by law.

Considering these risks, uncertainties and assumptions, the

forward-looking events discussed in this press release may not

occur.

1 2023 revenue and Adjusted EBITDAR guidance does not include

the acquisition of the remainder of Barstool Sports, which we

expect will close on February 17. 2 Property level consists of

retail operating segments which are composed of our Northeast,

South, West, and Midwest reportable segments.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230202005342/en/

Felicia Hendrix Chief Financial Officer PENN Entertainment

610-373-2400

Joseph N. Jaffoni, Richard Land JCIR 212-835-8500 or

penn@jcir.com

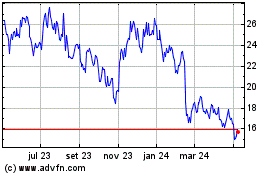

PENN Entertainment (NASDAQ:PENN)

Gráfico Histórico do Ativo

De Mar 2025 até Abr 2025

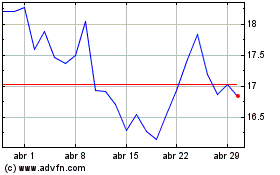

PENN Entertainment (NASDAQ:PENN)

Gráfico Histórico do Ativo

De Abr 2024 até Abr 2025