Permianville Royalty Trust Announces Monthly Cash Distribution

17 Fevereiro 2023 - 6:15PM

Business Wire

Permianville Royalty Trust (NYSE: PVL, the “Trust”) today

announced a cash distribution to the holders of its units of

beneficial interest of $0.019200 per unit, payable on March 13,

2023 to unitholders of record on February 28, 2023. The net profits

interest calculation represents reported oil production for the

month of November 2022 and reported natural gas production during

October 2022. The calculation includes accrued costs incurred in

December 2022.

The following table displays reported underlying oil and natural

gas sales volumes and average received wellhead prices attributable

to the current and prior month recorded net profits interest

calculations.

Underlying Sales

Volumes

Average Price

Oil

Natural Gas

Oil

Natural Gas

Bbls

Bbls/D

Mcf

Mcf/D

(per Bbl)

(per Mcf)

Current Month

38.056

1.269

217.262

7.008

$

80.01

$

5.19

Prior Month

36,796

1,187

222,785

7,426

$

85.39

$

6.89

Recorded oil cash receipts from the oil and gas properties

underlying the Trust (the “Underlying Properties”) totaled $3.0

million for the current month on realized wellhead prices of

$80.01/Bbl, down $0.1 million from the prior month’s oil cash

receipts.

Recorded natural gas cash receipts from the Underlying

Properties totaled $1.1 million for the current month on realized

wellhead prices of $5.19/Mcf, down $0.4 million from the prior

month.

Total accrued operating expenses for the period were $2.4

million, an increase of $0.4 million from the prior period. Capital

expenditures increased $1.7 million from the prior period to $1.9

million. The increase in capital expenditures in the current month

were predominately associated with 10 newly drilled wells, four of

which were drilled by a large investment-grade operator in the

Midland Basin, and six of which were drilled by two different,

private equity-backed Delaware Basin operators.

Given the increase in monthly capital expenditures on the

Underlying Properties in the current month compared to recent

months, COERT Holdings 1 LLC (the “Sponsor”) is releasing $0.9

million from the previously announced net profits interest capital

expenditure reserve to partially fund the current month’s capital

expenditures. The remaining reserve of $0.1 million will be held to

fund incremental future development expenses; however, if those

expenses are ultimately delayed or are less than expected, or if

the outlook changes, amounts reserved but unspent will be released

as an incremental cash distribution in a future period.

The Sponsor has informed the Trustee that it intends to provide

in the Trust’s upcoming Annual Report on Form 10-K to be filed in

March 2023 a more detailed update regarding the progress to date

under the Sponsor’s capital expenditure program and the 2023

outlook for the Underlying Properties and anticipated operator

activity, consistent with the drilling activity update provided in

the Trust’s third quarter 2022 Quarterly Report on Form 10-Q.

About Permianville Royalty Trust

Permianville Royalty Trust is a Delaware statutory trust formed

to own a net profits interest representing the right to receive 80%

of the net profits from the sale of oil and natural gas production

from certain, predominantly non-operated, oil and gas properties in

the states of Texas, Louisiana and New Mexico. As described in the

Trust’s filings with the Securities and Exchange Commission (the

“SEC”), the amount of the periodic distributions is expected to

fluctuate, depending on the proceeds received by the Trust as a

result of actual production volumes, oil and gas prices, the amount

and timing of capital expenditures, and the Trust’s administrative

expenses, among other factors. Future distributions are expected to

be made on a monthly basis. For additional information on the

Trust, please visit www.permianvilleroyaltytrust.com.

Forward-Looking Statements and Cautionary Statements

This press release contains statements that are “forward-looking

statements” within the meaning of Section 21E of the Securities

Exchange Act of 1934, as amended. All statements contained in this

press release, other than statements of historical facts, are

“forward-looking statements” for purposes of these provisions.

These forward-looking statements include the amount and date of any

anticipated distribution to unitholders, expectations regarding the

cash reserve for future development expenses and expectations

regarding current and future capital expenditures and development

activities on the Underlying Properties. The anticipated

distribution is based, in large part, on the amount of cash

received or expected to be received by the Trust from the Sponsor

with respect to the relevant period. The amount of such cash

received or expected to be received by the Trust (and its ability

to pay distributions) has been and will continue to be directly

affected by the volatility in commodity prices, which have

experienced significant fluctuation since the beginning of 2020 as

a result of a variety of factors that are beyond the control of the

Trust and the Sponsor. Low oil and natural gas prices will reduce

profits to which the Trust is entitled, which will reduce the

amount of cash available for distribution to unitholders and in

certain periods could result in no distributions to unitholders.

Other important factors that could cause actual results to differ

materially include expenses of the Trust, reserves for anticipated

future expenses and the effect, impact, potential duration or other

implications of the COVID-19 pandemic. In addition, future monthly

capital expenditures may exceed the average levels experienced in

2022 and prior periods. Statements made in this press release are

qualified by the cautionary statements made in this press release.

Neither the Sponsor nor the Trustee intends, and neither assumes

any obligation, to update any of the statements included in this

press release. An investment in units issued by the Trust is

subject to the risks described in the Trust’s filings with the SEC,

including the risks described in the Trust’s Annual Report on Form

10-K for the year ended December 31, 2021, filed with the SEC on

March 25, 2022. The Trust’s quarterly and other filed reports are

or will be available over the Internet at the SEC’s website at

http://www.sec.gov.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230217005265/en/

Permianville Royalty Trust The Bank of New York Mellon Trust

Company, N.A., as Trustee Sarah Newell 1 (512) 236-6555

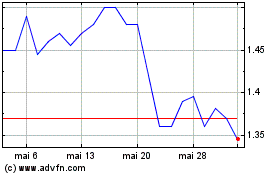

Permianville Royalty (NYSE:PVL)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Permianville Royalty (NYSE:PVL)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025