The Alkaline Water Company Announces 15 for-1 Reverse Stock Split

04 Abril 2023 - 10:15AM

Business Wire

Company Aims to Satisfy Nasdaq’s Minimum Bid

Price Continued Listing Requirement

The Alkaline Water Company Inc. (NASDAQ and CSE: WTER) (the

“Company), the nation's largest independent alkaline water company

and the Clean Beverage® company, today announced that its board of

directors approved a 15-for-1 reverse stock split of the Company’s

authorized and issued and outstanding shares of common stock, which

will be effective under Nevada law on April 5, 2023. The Company's

common stock will continue to trade on The Nasdaq Capital Market

under the current trading symbol, “WTER,” and will be open for

trading on a split-adjusted basis on April 5, 2023.

As a result of the reverse stock split, the Company’s authorized

common stock will decrease from 200,000,000 shares of common stock,

with a par value of US$0.001 per share, to 13,333,333 shares of

common stock, with a par value of US$0.001 per share, and the

number of the Company’s issued and outstanding shares of common

stock is expected to decrease from approximately 152,080,692 to

approximately 10,138,713. Any fractional shares resulting from the

reverse stock split will be rounded up to the next nearest whole

number.

The Company’s authorized preferred stock will not be affected by

the reverse stock split and will continue to be 100,000,000 shares

of preferred stock, with a par value of US$0.001 per share.

The Company is effectuating the reverse stock split to increase

the per share trading price of the Company’s common stock in order

to satisfy the US$1.00 minimum bid price requirement for continued

listing on The Nasdaq Capital Market.

In association with the reverse stock split, the Company's CUSIP

number will change to 01643A306 as of April 5, 2023. Stockholders

holding their shares electronically in book-entry form are not

required to take any action to receive post-split shares.

Stockholders with shares held electronically in book-entry form

need not take any action to obtain post-split shares. Stockholders

who own shares via a bank, broker, or other nominee will experience

an automatic adjustment of their positions to reflect the reverse

stock split, subject to the specific processes of particular banks,

brokers or other nominees. For stockholders in possession of

physical stock certificates, the Company’s transfer agent,

Transhare, will provide instructions detailing how to exchange

those certificates for electronically held shares in book-entry

form or new certificates, both of which will represent the adjusted

number of shares post-split.

About The Alkaline Water Company:

The Alkaline Water Company is the Clean Beverage® company making

a difference in the water you drink and the world we share.

Founded in 2012, The Alkaline Water Company (NASDAQ and CSE:

WTER) is headquartered in Scottsdale, Arizona. Its flagship

product, Alkaline88®, is a leading premier alkaline water brand

available in bulk and single-serve sizes along with eco-friendly

aluminum packaging options. With its innovative, state-of-the-art

proprietary electrolysis process, Alkaline88® delivers perfect 8.8

pH alkaline drinking water with trace minerals and electrolytes and

boasts our trademarked label “Clean Beverage.” In 2021, The

Alkaline Water Company was pleased to welcome Shaquille O’Neal to

its board of advisors and to serve as the celebrity brand

ambassador for Alkaline88®.

To purchase The Alkaline Water Company’s products online, visit

us at www.alkaline88.com.

To learn more about The Alkaline Water Company, please visit

www.thealkalinewaterco.com or connect with us on Facebook, Twitter,

Instagram, or LinkedIn.

Notice Regarding Forward-Looking Statements:

This news release contains “forward-looking statements.”

Statements in this news release that are not purely historical are

forward-looking statements and include any statements regarding

beliefs, plans, expectations, or intentions regarding the future.

Such forward-looking statements include, among other things, that

the Company aims to satisfy Nasdaq’s minimum bid price continued

listing requirement; and that the Company is effectuating the

reverse stock split to increase the per share trading price of the

Company’s common stock in order to satisfy the US$1.00 minimum bid

price requirement for continued listing on The Nasdaq Capital

Market. The material assumptions supporting these forward-looking

statements include, among others, that the Company’s per share

stock will increase in proportion to the reverse stock split or at

least to the level to satisfy the US$1.00 minimum bid price

requirement for continued listing on The Nasdaq Capital Market;

that the Company will be able to comply with all other continued

listing requirements of The Nasdaq Capital Market; and that the

Company will be able to obtain additional capital to satisfy the

capital expenditure requirements. Actual results could differ from

those projected in any forward-looking statements due to numerous

factors. Such factors include, among others, the Company’s ability

to raise the additional funding that it will need to continue to

pursue its business, planned capital expansion and sales activity.

These forward-looking statements are made as of the date of this

news release, and the Company assumes no obligation to update the

forward-looking statements, or to update the reasons why actual

results could differ from those projected in the forward-looking

statements, except as required by applicable law, including the

securities laws of the United States and Canada. Although the

Company believes that any beliefs, plans, expectations, and

intentions contained in this news release are reasonable, there can

be no assurance that any such beliefs, plans, expectations, or

intentions will prove to be accurate. Readers should consult all of

the information set forth herein and should also refer to the risk

factors disclosure outlined in the reports and other documents the

Company files with the SEC, available at www.sec.gov, and on the

SEDAR, available at www.sedar.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230404005217/en/

The Alkaline Water Company Inc. Jeff Wright Director of

Investor Relations 866-242-0240

investors@thealkalinewaterco.com

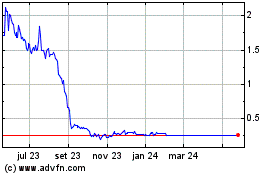

Alkaline Water (NASDAQ:WTER)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

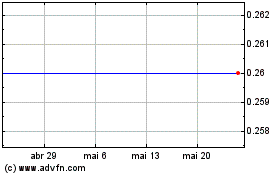

Alkaline Water (NASDAQ:WTER)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024