Wells Fargo Announces Transition Information for Outstanding U.S. Dollar LIBOR-Linked Instruments

12 Maio 2023 - 9:00AM

Business Wire

Wells Fargo & Company (NYSE: WFC) (“Wells Fargo”) and

certain of its consolidated subsidiaries have issued debt

securities, certificates of deposit, trust preferred securities and

preferred stock and related depositary shares that reference the

London Interbank Offered Rate (LIBOR) for deposits in U.S. dollars

for a three-month tenor. The instruments addressed in this press

release are governed by U.S. law or the laws of a U.S. State.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20230512005060/en/

Wells Fargo (Photo: Wells Fargo)

Debt Securities, Certificates of Deposit and Trust Preferred

Securities

Wells Fargo is issuing this press release to advise that in

accordance with (i) the Adjustable Interest Rate (LIBOR) Act and

the final rule adopted by the Federal Reserve or (ii) the terms of

such instruments, as applicable, after June 30, 2023 Three-month

USD LIBOR in applicable debt securities, certificates of deposit,

and trust preferred securities (the “Specified Instruments”) will

be replaced with the CME Term SOFR Reference Rate published for a

three-month tenor plus a spread adjustment of 0.26161%. The

replacement of Three-month USD LIBOR with Three-month CME Term SOFR

plus the spread adjustment will be effective for determinations

made under the terms of the Specified Instruments after June 30,

2023. Additional information regarding the Specified Instruments

will be made available through the LIBOR Benchmark Replacement

Index solution through DTCC’s Legal Notice System.

Preferred Stock and Related Depositary Shares

Each series of Wells Fargo’s Fixed-to-Floating Rate

Non-Cumulative Perpetual Class A Preferred Stock is governed by the

terms of a certificate of designation (each, a “Certificate”) and

will not transition to Three-month CME Term SOFR by operation of

law or otherwise. The Certificate for each series specifically

defines Three-month LIBOR to be a set rate (the “Set Rate”), as

shown for each series in the table below, for a dividend period

beginning on the date (the “Commencement Date”), as shown for each

series in the table below, if Three-month LIBOR cannot otherwise be

determined as provided in the applicable Certificate. In accordance

with this definition of Three-month LIBOR, the dividend rate that

will apply to any dividend payment date occurring after the

applicable Commencement Date will be an annual rate equal to the

Set Rate + the spread set forth in the Certificate for each

series.

Fixed-to-Floating Rate Non-Cumulative

Perpetual Class A Preferred Stock

CUSIP*

Set Rate (which is equal to the

dividend rate preceding the Commencement Date)

Commencement Date

Spread

Dividend Rate following Commencement

Date

Series Q

949746556

5.85%

September 15, 2023

3.09%

5.85% + 3.09%

Series R

949746465

6.625%

March 15, 2024

3.69%

6.625% + 3.69%

Series S

949746RG8

5.90%

June 15, 2024

3.11%

5.90% + 3.11%

Series U

949746RN3

5.875%

June 15, 2025

3.99%

5.875% + 3.99%

The cessation of Three-month LIBOR has no further impact on the

terms of the Fixed-to-Floating Rate Non-Cumulative Perpetual Class

A Preferred Stock.

*The CUSIP numbers are included solely for the convenience of

holders. Wells Fargo shall not be responsible for the selection or

use of these CUSIP numbers, nor is any representation made as to

their correctness.

About Wells Fargo

Wells Fargo & Company (NYSE: WFC) is a leading financial

services company that has approximately $1.9 trillion in assets,

proudly serves one in three U.S. households and more than 10% of

small businesses in the U.S., and is a leading middle market

banking provider in the U.S. We provide a diversified set of

banking, investment and mortgage products and services, as well as

consumer and commercial finance, through our four reportable

operating segments: Consumer Banking and Lending, Commercial

Banking, Corporate and Investment Banking, and Wealth &

Investment Management. Wells Fargo ranked No. 41 on Fortune’s 2022

rankings of America’s largest corporations. In the communities we

serve, the company focuses its social impact on building a

sustainable, inclusive future for all by supporting housing

affordability, small business growth, financial health, and a

low-carbon economy. News, insights, and perspectives from Wells

Fargo are also available at Wells Fargo Stories.

Additional information may be found at www.wellsfargo.com |

Twitter: @WellsFargo.

News Release Category: WF-CF

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230512005060/en/

Media Beth Richek, 704-374-2545

beth.richek@wellsfargo.com

Investor Relations Tanya Quinn, 415-396-7495

tanya.quinn@wellsfargo.com

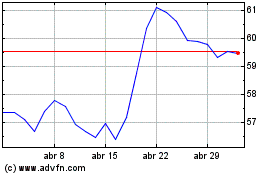

Wells Fargo (NYSE:WFC)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

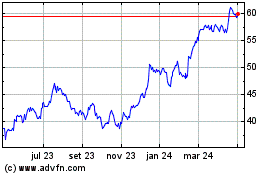

Wells Fargo (NYSE:WFC)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024