Bernstein Litowitz Berger & Grossmann Secures a Historic $1 Billion Settlement for Shareholders in Wells Fargo Securities Class Action

16 Maio 2023 - 8:30AM

Business Wire

Among Top Securities Class Action Settlements of All Time

In one of the largest securities class action settlements in

recent years, Bernstein Litowitz Berger & Grossmann (BLB&G)

announced today that it has reached a settlement agreement on

behalf of its clients and a class of investors with Wells Fargo

& Co (NYSE: WFC), which has agreed to pay $1 billion in cash to

resolve a federal securities class action lawsuit in the United

States.

The action, In re Wells Fargo & Company Securities

Litigation, No. 20-CV-04494 (GHW), is pending in the U.S. District

Court for the Southern District of New York before Judge Gregory

Woods. The action alleges that Wells Fargo issued false and

misleading statements to investors regarding the status of Wells

Fargo’s compliance with regulatory Consent Orders requiring the

bank to remedy serious risk management deficiencies. Wells Fargo’s

investors were harmed after a series of disclosures revealed that

Wells Fargo had misrepresented its compliance with those orders,

causing a decline in Wells Fargo’s stock price.

The $1 billion settlement was reached after three years of

hard-fought litigation and was achieved with the assistance of a

respected mediator, former U.S. District Judge Layn R. Phillips. If

approved by Judge Woods, the settlement will be among the top six

U.S. securities class action settlements in the past decade and

among the top 17 of all time.

“This is an outstanding result for Wells Fargo investors,” said

John C. Browne, partner at BLB&G. “This precedent-setting

settlement reflects our clients’ commitment to take appropriate

action to protect the interests of their stakeholders and the

broader investment community.”

“We are pleased that Wells Fargo’s new management is moving

forward by resolving this significant litigation related to the

bank’s past actions and that we were able to achieve an excellent

settlement for investors,” said BLB&G Founding Partner Max

Berger. “This case further underscores the critical role that

institutional investors can play to help protect and maintain trust

in the financial markets, which is crucial for global stability and

economic growth.”

Lead Plaintiffs include institutional investors Handelsbanken

Fonder AB, the Public Employees’ Retirement System of Mississippi,

and the State of Rhode Island, Office of the General Treasurer, on

behalf of the Employees’ Retirement System of Rhode Island.

Investors were represented by a team of attorneys, financial

analysts, and private investigators at Bernstein Litowitz Berger

& Grossmann LLP (BLB&G), led by partners Max Berger, John

C. Browne, Jeroen van Kwawegen, Hannah Ross, and Jonathan Uslaner,

and senior associate Lauren Cruz. The law firm of Cohen Milstein

Sellers & Toll PLLC served as co-lead counsel.

About BLB&G

BLB&G (www.blbglaw.com) is widely recognized as a leading

law firm worldwide, advising clients on securities litigation and

prosecuting class and private actions on behalf of individual and

institutional clients. Since its founding in 1983, BLB&G’s

distinguished group of trial-tested litigators have obtained many

of the largest monetary recoveries in history – securing over $37

billion on behalf of investors.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230516005521/en/

Name: Kristin Coda Phone: 212-554-1509 Email:

Kristin.coda@blbglaw.com

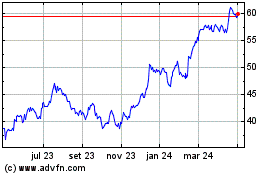

Wells Fargo (NYSE:WFC)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

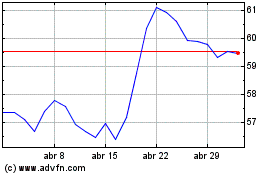

Wells Fargo (NYSE:WFC)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024