Blackwells Capital Issues Presentation Highlighting Compelling Combination of Global Net Lease and The Necessity Retail REIT

12 Junho 2023 - 9:00AM

Business Wire

Blackwells Capital LLC (together with its affiliates,

“Blackwells”), an alternative investment management firm that is a

shareholder of both Global Net Lease Inc. (NYSE: GNL) (“Global Net

Lease,” “GNL” or the “Company") and The Necessity Retail REIT Inc.

(NASDAQ: RTL) (“Necessity Retail REIT” or “RTL”), today issued a

presentation that describes Blackwells’ rationale for supporting

the proposed merger of GNL and RTL. The compelling combination will

result in a pro forma entity with nearly $10 billion in real estate

assets, making GNL one of the largest publicly traded net lease

REITs. Blackwells expects that the increased scale, diversity and

efficiency, combined with internalization of management and

impressive governance enhancements, will position the Company to

create immediate and long-term value for all shareholders.

Blackwells’ full presentation is available at

https://www.blackwellscap.com/wp-content/uploads/2023/06/Blackwells-GNL-RTL-Merger-Presentation-v06.pdf.

Jason Aintabi, Chief Investment Officer of Blackwells, said,

“Blackwells has been engaged in extensive discussions with both GNL

and RTL, and has had the opportunity to examine the proposed

transaction and its potential benefits to shareholders. We have

reviewed the portfolios in detail, as well as the proposed and

possible cost savings, the benefits of internalization and the

details of the governance enhancements, and have signed a

non-disclosure agreement in order to continue to pursue this

important collaboration.”

Mr. Aintabi continued, “After this review, we are confident in

the merits of the transaction and believe the scale and diverse

portfolio of the combined company, along with the enhancements to

management and board accountability, will lead to meaningful value

creation and genuine accountability for the Board. We were also

pleased that the management team and Board have asked for our

continued involvement and advice as the Company plots the best

course forward.”

Mr. Aintabi concluded, “We applaud the internalization and

significant governance enhancements that will be in effect as a

result of the merger, which will bring the Company’s governance

in-line with best practices across the REIT industry. This enhanced

accountability and receptivity to shareholder perspectives marks a

significant change from past practice and one which, in our view,

will underpin long-term value creation. We strongly believe that

the new configuration of the Company will cause the stock to

re-rate in value, better reflecting the quality of the assets and

potential of the business.”

Blackwells will vote in favor of the merger and related

proposals at the Special Meetings of both GNL and RTL, as

previously announced.

About Blackwells Capital

Blackwells Capital was founded in 2016 by Jason Aintabi, its

Chief Investment Officer. Since that time, it has made investments

in public securities, engaging with management and boards, both

publicly and privately, to help unlock value for stakeholders,

including shareholders, employees and communities. Throughout their

careers, Blackwells’ principals have invested globally on behalf of

leading public and private equity firms and have held operating

roles and served on the boards of media, energy, technology,

insurance and real estate enterprises. For more information, please

visit www.blackwellscap.com

The views stated, analysis presented and materials referenced

herein have been prepared by Blackwells alone based on its

independent analysis and have not been independently verified by,

and are not necessarily the views of, RTL or GNL.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230612412460/en/

Gagnier Communications Dan Gagnier (646) 569-5897

blackwells@gagnierfc.com

Longacre Square Partners (646) 386-0091

blackwells@longacresquare.com

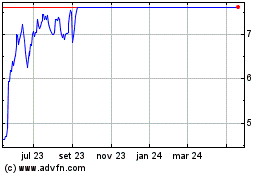

Necessity Retail REIT (NASDAQ:RTL)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

Necessity Retail REIT (NASDAQ:RTL)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024