Permianville Royalty Trust Announces Record Date and Meeting Date for Special Unitholder Meeting

14 Junho 2023 - 5:15PM

Business Wire

Permianville Royalty Trust (NYSE: PVL) (the “Trust”) today

announced that it has established a record date of June 6, 2023 and

a meeting date of July 19, 2023 for a special meeting of its

unitholders to be held at 10:00 a.m., Central Daylight Time,

virtually by live webcast at https://web.lumiagm.com/295009374,

password “permianville2023” (case-sensitive). At the special

meeting, the Trust’s unitholders will consider and act upon

proposals to approve:

- A transaction pursuant to which (a) COERT Holdings 1 LLC (the

“Sponsor”) will sell its interests in certain oil and natural gas

properties that constitute part of the oil and natural gas

properties burdened by the net profits interest held by the Trust,

(b) the Trust will release the related net profits interest

associated with such oil and natural gas properties, and (c) the

net proceeds received by the Trust with respect to each such sale

will be distributed to the Trust unitholders;

- Amendments to the Amended and Restated Trust Agreement of the

Trust (the “Trust Agreement”) to raise certain threshold

requirements for a vote of unitholders in connection with similar

future transactions;

- Amendments to the Conveyance of Net Profits Interest (the

“Conveyance”) to raise certain threshold requirements for a vote of

unitholders in connection with similar future transactions;

and

- An adjournment of the special meeting, if necessary or

appropriate, to permit solicitation of additional proxies in favor

of the above proposals.

The special meeting has been called by the Sponsor. As described

in the definitive proxy statement for the special meeting, the

Sponsor estimates the net proceeds from the sale of the oil and

natural gas properties (which represent less than 5% of the total

PV-10 of the oil and natural gas properties underlying the Trust at

December 31, 2022) to be distributed to Trust unitholders will be

$0.15000 per Trust unit. Additionally, the Sponsor believes that

its proposals to amend the Trust Agreement and the Conveyance are

advantageous to the Trust unitholders because they will reduce

future transaction and proxy expense burdens with respect to

potential asset sales and increase the potential amounts payable

under the Trust’s net profits interests to Trust unitholders for

such transactions.

The Trust also announced that it has filed a definitive proxy

statement with the Securities and Exchange Commission on June 14,

2023 for the special meeting. Holders of record of Trust units as

of the close of business on June 6, 2023 will be entitled to

receive notice of the special meeting and to vote at the special

meeting.

About Permianville Royalty Trust

Permianville Royalty Trust is a Delaware statutory trust formed

to own a net profits interest representing the right to receive 80%

of the net profits from the sale of oil and natural gas production

from certain, predominantly non-operated, oil and gas properties in

the states of Texas, Louisiana and New Mexico. As described in the

Trust’s filings with the Securities and Exchange Commission (the

“SEC”), the amount of the periodic distributions is expected to

fluctuate, depending on the proceeds received by the Trust as a

result of actual production volumes, oil and gas prices, the amount

and timing of capital expenditures, and the Trust’s administrative

expenses, among other factors. Future distributions are expected to

be made on a monthly basis. For additional information on the

Trust, please visit www.permianvilleroyaltytrust.com.

Forward-Looking Statements and Cautionary Statements

This press release contains statements that are “forward-looking

statements” within the meaning of Section 21E of the Securities

Exchange Act of 1934, as amended. All statements contained in this

press release, other than statements of historical facts, are

“forward-looking statements” for purposes of these provisions.

These forward-looking statements include the amount of any

anticipated distribution to unitholders as a result of the proposed

disposition of certain properties and expected expenses, including

capital expenditures. The anticipated distribution is based, in

large part, on the amount of cash received or expected to be

received by the Trust from the Sponsor as a result of the sale of

the underlying properties. Other important factors that could cause

actual results to differ materially include expenses of the Trust

and reserves for anticipated future expenses. Statements made in

this press release are qualified by the cautionary statements made

in this press release. Neither the Sponsor nor the Trustee intends,

and neither assumes any obligation, to update any of the statements

included in this press release. An investment in units issued by

the Trust is subject to the risks described in the Trust’s filings

with the SEC, including the risks described in the Trust’s Annual

Report on Form 10-K for the year ended December 31, 2022, filed

with the SEC on March 23, 2023. The Trust’s quarterly and other

filed reports are or will be available over the Internet at the

SEC’s website at http://www.sec.gov.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230614372388/en/

Permianville Royalty Trust The Bank of New York Mellon Trust

Company, N.A., as Trustee Sarah Newell, 1 (512) 236-6555

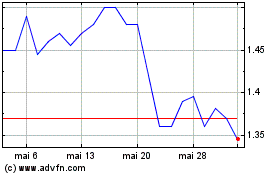

Permianville Royalty (NYSE:PVL)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Permianville Royalty (NYSE:PVL)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025