- Order intake growth of 31% vs. H1 2022 due to favorable

seasonality commitment orders with Linde Material Handling

- Delay in direct sales orders which represent 24% of orders

in H1 2023 vs. 36% in H1 2022

- Q2 2023 sales at €7.6m, +73% vs. Q2 2022

- Order book1 at €10.3m at June 30, 2023, down slightly vs. H1

2022 leading to a request for an extraordinary drawdown under the

interim financing agreement with Softbank Group

- Proposed tender offer by SoftBank Group to acquire Balyo

shares at €0.85 per ordinary share

Regulatory News:

BALYO (FR0013258399, Mnemonic: BALYO, PEA-PME eligible),

(Paris:BALYO) technology leader in the design and development of

innovative robotic solutions for industrial trucks, announces its

sales for the 1st half of 2023.

Pascal Rialland, Chairman and CEO of BALYO, comments:

"The first half of 2023 was marked by strong growth in our sales,

up 79% to €14.9 million. Our business is growing in all our

markets. However, even if order intake for the past six months was

up +31% on the previous year, direct sales did not reach the

expected level in part because of client delays. As a result, Balyo

will need to request an extraordinary drawdown under the interim

financing agreement with Softbank in order for the Company to meet

ongoing operating expenses. Finally, SoftBank Group's proposed

takeover bid for Balyo shares marked the end of the first half of

2023. We believe this combination provides a secure platform to

meet our short term financial obligations alongside a unique

opportunity to drive long-term growth.".

In thousands of euros

Q1 2022

Q2 2022

H1 2022

Q1 2023

Q2 2023

H1 2023

Change Q2 23/ Q2 22

Change H1 23/ H1 22

EMEA Region

3,380

3,863

7,243

5,736

5,064

10,800

+31%

+49%

Region Americas

382

465

847

1,388

1,871

3,259

+302%

+285%

APAC Region

111

88

199

104

707

811

+703%

+307%

Sales published*

3,873

4,416

8,289

7,228

7,642

14,870

+73%

+79%

* Unaudited data

Sales for the 2nd quarter and 1st half of 2023

BALYO recorded sales of €14.9 million in the first half of 2023,

up 79% on the first half of 2022. In the second quarter of 2023,

the Group recorded sales of €7.6 million, up 73% on the second

quarter of 2022.

Evolution of order book

After integrating new orders of €3.3 million in the second

quarter of 2023, BALYO's order book1 stood at €10.3 million at June

30, 2023, compared with €11.0 million for the same period last

year. This represents a decline of -6% compared with the first half

of 2022, due to a slowdown in business in the United States.

Over the period, BALYO generated 24% of its sales directly,

compared with 36% in 2022, a lower level of performance than the

Company's ambitions, due in part to client delays.

Highlight: proposed takeover bid by SoftBank Group

At the beginning of June, SoftBank Group initiated a proposed

takeover bid to acquire the shares of BALYO. This friendly offer is

priced at €0.85 per ordinary share. BALYO complements SoftBank's

existing investments in the transport and logistics sectors. The

investment will enable SoftBank Group to expand its business in the

transportation and mobility sectors, while BALYO will gain access

to its partner's global network of over 470 technology-driven

companies to develop new business relationships. As part of the

SoftBank Group ecosystem, it is expected that BALYO will have the

long term security and support to deliver on its direct sales

strategy.

In connection with the Offer, SoftBank has agreed to provide

interim financing of up to €5 million to BALYO to meet its working

capital requirements. This financing will be paid in several

drawdowns and structured in the form of convertible bonds issued by

BALYO to SoftBank, maturing on October 31, 2024. As a result of

softer than expected orders in H1, Balyo requested the issuance of

the first tranche of financing on 19 July 2023 for an amount of

€1.5 million.

The amount drawn down by BALYO under the financing is

convertible at SoftBank' selection, at the following price:

(i) at the Offer price per ordinary share, if the conversion is

on or after the filing of the Offer but before the earlier of the

closing of the Offer and the termination of the Offer (meaning the

tender offer agreement being terminated in accordance with its

terms for any reason whatsoever) ;

(ii) at the lower of (a) the Offer price, and (b) a 20% discount

to Balyo’s ordinary share price at the date of the conversion

notice, based on the last thirty (30) day VWAP, if the conversion

is on or after the earlier of the closing of the Offer and the

termination of the Offer and BALYO's shares are still listed on

Euronext Paris; and

(iii) at the lower of (a) the Offer price per ordinary share,

and (b) a 20% discount to the fair market value of Balyo’s shares,

if the conversion is on or after the earlier of the closing of the

Offer and the termination of the Offer and Balyo’s shares have

ceased to listed on Euronext Paris following successful completion

of a mandatory squeeze-out on the remaining outstanding shares of

Balyo.

Upon termination of the Offer (as the case may be), the

Financing will remain in place but the amount available to Balyo

shall be reduced to EUR 3,000,000 less any amounts that have

previously been drawn2.

BALYO's Board of Directors welcomed the Offer in principle on

June 13, 2023, pending the independent expert's conclusions on its

financial terms. BALYO's Economic and Social Council issued also a

favorable opinion on the Offer on July 5. All the documents

relating to the Offer will be filed with the AMF during the third

quarter of 2023, following the Board of Directors' reasoned opinion

on the Offer, with completion of the Offer scheduled for the fourth

quarter of 2023.

Strategy and outlook

BALYO remains confident to recover the delay of direct sales

order during H2 2023.

Next BALYO financial announcement: half-year results

2023, on September 28, 2023.

About BALYO

Humans around the World deserve enriching and creative jobs. At

BALYO, we believe that pallet movements in DC and manufacturing

sites should be left to fully autonomous robots. To execute this

ambition, BALYO transforms standard forklifts into intelligent

robots thanks to its breakthrough Driven by Balyo™ technology. Our

leading geo guidance navigation system enables robots to locate

their position and navigate autonomously inside buildings - without

the need for any additional infrastructure. To accelerate the

material handling market conversion to autonomy, BALYO has entered

into two global partnerships with KION (Fenwick-Linde's parent

company) and Hyster-Yale Group. A full range of globally available

robots has been developed for virtually all traditional warehousing

applications; Tractor, Pallet, Stackers, Reach and VNA-robots.

BALYO and its subsidiaries in Boston and Singapore serve clients in

the Americas, Europe and Asia-Pacific. The company has been listed

on EURONEXT since 2017 and its sales revenue reached €24.1 million

in 2022. For more information, visit www.balyo.com.

1 The order book refers to all project orders received but not

yet delivered. The order backlog changes every quarter, taking into

account new orders, sales generated by projects during the period,

and any order cancellations. 2 Without any early repayment for any

amount in excess of EUR 3,000,000.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230717143976/en/

BALYO Frank Chuffart investors@balyo.com

NewCap Financial Communication and Investor Relations Thomas

Grojean / Aurélie Manavarere Phone: +33 1 44 71 94 94

balyo@newcap.eu

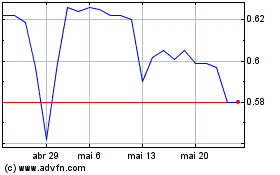

Balyo (EU:BALYO)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

Balyo (EU:BALYO)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024