In Q3 2023, Mainstreet Equity Corp. (“Mainstreet”, TSX:MEQ)

achieved double-digit, year-over-year growth across all key

operating metrics for the seventh consecutive quarter. Funds from

operations (“FFO”) increased 32%, net operating income (“NOI”) grew

22% and rental revenues rose 18%. Same-asset revenue and NOI also

accelerated, increasing 10% and 13%, respectively. Despite

inflationary pressures, operating margins improved to 63%, up from

61% in 2022.

Bob Dhillon, Founder and Chief Executive Officer of Mainstreet,

said, “Once again, the mid-market rental space has proven itself a

safe and reliable investment haven during this time of widespread

economic disruption.” He added, “At a time when supply shortages

and inflationary pressures have sharply increased the costs of home

ownership, Mainstreet prides itself in being a crucial provider of

affordable living in Western Canada.”

We believe these highly positive results reflect the proven

success of Mainstreet’s value-add business model. By strictly

adhering to our 100% organic, non-dilutive growth strategy,

Mainstreet has continued to create shareholder value throughout the

economic cycle, including in periods of high volatility. Under this

model, we leverage our sizeable liquidity position ($307 million)

and historically low-cost financing to acquire underperforming

apartment buildings. Once acquired, we rapidly reposition units

through renovations to optimize operating income. Since Mainstreet

began trading on the TSX in 2000, we have expanded our portfolio

from a handful of rental units to over 17,000, and reached $3

billion in assets while avoiding any equity dilution (excluding

small volumes of exercised share options). During that same period,

our stock value has increased more than 3,500%.

Magnifying the success of Mainstreet’s countercyclical strategy

is the strong macro fundamentals of the broader rental market,

where a structural supply-demand imbalance has persisted. Canada’s

population is growing fast—the country expected to accept a

record-high 1.5 million new comers in 2022 ( including 431,645 new

permanent residents, 608,420 work permits under the Temporary

Foreign Worker Program and International Mobility Program, and

551,405 study permits, based on Immigration, Refugees and

Citizenship Canada) —at a time when new rental market supply is

flat (the number of purpose-built rental units in the country

increased by just 400,000 in the last decade, up to a total 2.2

million). As a result, vacancy rates have fallen to an all-time low

of 1.9% in 2022, according to CMHC data. Those figures are

particularly low in the provinces where Mainstreet operates: In

Vancouver, rental vacancies remain among the lowest in the country

at 0.9%, while vacancies in Calgary and Edmonton are expected to

fall between 2023 and 2025, down to 1.2% and 1.3%, respectively

(Statistics Canada).

We believe this core trend is evident in our Q3 performance,

both on an overall and same-asset basis. Combined with high rates

of in-migration into Western provinces and the steep cost of home

ownership, we believe such trends further establish the rental

market as an inherently reliable and resilient asset class. With

Mainstreet’s current average rental rates are among the most

affordable in the mid-market sector, Mainstreet remains well

positioned to meet this high demand while continuing our role as a

crucial provider of affordable living in Western Canada. As we

enter the final quarter of 2023, our management team sees ample

opportunity to continue building on this advantaged position as we

pursue acquisitions and boost NOI through our stabilization

process.

CHALLENGES

Despite major opportunities for growth, rising costs continue to

pose a challenge to Mainstreet. Primarily, higher interest rates

raise the cost of any new debt. Mainstreet has spent years

establishing a long-term debt position to fortify itself against

eventual rate increases. By securing early finance pre-matured

debts and agreeing to pay higher up-front borrowing costs on

certain mortgages, we extended our obligations over longer periods

(10 years instead of the typical five). Mainstreet has in turn

locked in 99% of our debt into fixed-term debt with an average

maturity and interest rate of 6.2 years and 2.69%, respectively.

Recognizing that inflationary periods are often transitory in

nature, we have strategically negotiated for shorter-term open

mortgages that provide flexibility for early renewal when and if

interest rates fall.

Inflationary pressures also increase the cost of everything from

labour to materials. Canadian job vacancies have come down from

their peak in Q2 2022, according to Statistics Canada, but

competition for talent remains fierce. This has raised Mainstreet’s

labour costs and made hiring more challenging. That said,

Mainstreet has managed to limit its exposure to shortages through

various avenues including foreign worker programs.

Major fixed expenses like property taxes (up 2%), insurance, and

utilities (up 13%) also remain high. Carbon taxes, which place the

financial burden on property owners, are scheduled to rise

annually, from $65 per tonne today to $170 by 2030. We have

addressed higher energy costs by securing various longer-term

natural gas contracts, pursuant to which Mainstreet currently pays

well below current spot prices. We also managed to reduce our

insurance costs more than 13% for fiscal 2023 by obtaining improved

premium rates and coverage.

Mainstreet continues our efforts to counteract inflation and

rising interest rates. Although higher costs erode our operating

margins and negatively impact our bottom line, some of the

financial burden will ultimately be passed onto tenants through

soft rent increases.

OUTLOOK

Rental market continues to tighten

We expect average rental rates across Canada to rise as demand

continues to outpace supply. However, we believe supply shortages

in the real estate market, combined with inflation and rising

interest rate, will continue to deter first-time home buyers and

incentivize renters. High immigration rates will also underpin

those market fundamentals, a trend we view as unlikely to change

given the federal government’s indication that immigration and

international students are a bedrock of its plan to grow the

economy.

Accelerated acquisitions

Our team continues to see risk-adjusted opportunities for growth

supported by our large liquidity position, as higher interest rates

could force more distressed sellers onto the market. Such dynamics

create growth potential through opportunistic acquisitions. As

ever, we will maintain our strategy of countercyclical growth by

acquiring assets only when it prioritizes true value creation. As

in past quarters, our acquisition efforts will continue to

emphasize portfolio diversification, evidenced by our recent

expansion into the Winnipeg market.

BC remains a standout

We expect Vancouver/Lower Mainland will continue to drive growth

and performance. Vacancies in the region remain among the lowest in

the country while rental rates are among the highest. British

Columbia has become central to Mainstreet’s portfolio, accounting

for approximately 42% of our estimated net asset value (“NAV”)

based on IFRS value. With an average monthly mark-to-market gap of

$638 per suite per month, 98% of our customers in the region are

below the average market rent. According to our estimates, that

translates into approximately $26 million in NOI growth potential

after accounting for tenancy turnover and gradual rent

increases.

Western bound

Alberta had an in-migration rate of 51,700 in Q1 2023, as

improved economic prospects and relatively affordable housing drew

a near-record number of newcomers to the province. The figure is

comparable to the last two quarters of 2022, when Alberta had the

largest influx of international and interprovincial migrants in its

history. We believe high in-migration rates will in turn continue

to push housing prices upward. Benchmark home prices rose 1.5% in

Calgary and 1.6% in Edmonton in June as a flood of people entered

Alberta. Saskatchewan’s provincial in-migration also grew sharply,

with 5,700 people coming to the province in Q4, compared with 2,500

the year prior.

Closing the NOI gap

Current market conditions create a rare opportunity for

Mainstreet. Our stabilization rates are higher than average due to

our high rate of acquisitions in recent quarters, while our vacancy

rates are lower than average (4.7%, including our unstabilized

properties which accounted for 14% of our portfolio). This

discrepancy provides substantial opportunity for Mainstreet to

continue extracting value from existing assets by aggressively

repositioning units.

Turning intangibles to tangibles

Over our 23-year history, Mainstreet has strategically built up

an extensive portfolio of 800+ buildings in desirable neighborhoods

that we believe offers significant intangible value. Management is

in the early stages of exploring a three-pronged plan to

potentially capitalize on adding more value to our existing assets

at low cost. This strategy involves three key pillars: turning

unused/residual space within existing buildings into new units;

exploring zoning and density relaxations to assess the excess

‘capacity/density’ to expand/build new within the existing land

footprint; or subdividing residual lands to maximize useable space.

While the plan is currently conceptual in nature, we view it as yet

another aspect of Mainstreet’s inherent value proposition over the

long term. Given the ongoing housing shortage in Canada, our

management team believes now is the ideal time for Mainstreet to

explore such possibilities, particularly as we aim to align our

goals with policymakers, who are increasingly seeking densification

options in order to reduce housing costs.

RUNWAY ON EXISTING PORTFOLIO

- Pursuing our 100% organic, non-dilutive growth model: Using our

strong potential liquidity position, estimated at $307 million, we

believe there is significant opportunity to continue acquiring

underperforming assets at attractive valuations.

- Boosting NOI: As of Q3 2023, 14% of Mainstreet’s portfolio was

going through the stabilization process. Once stabilized, we remain

confident same-asset revenue, vacancy rates, NOI and FFO will be

meaningfully improved. We are cautiously optimistic that we can

boost cash flow in coming quarters. In the BC market alone, we

estimate that the potential upside based on mark-to-market gaps for

NOI growth is approximately $26 million. The Calgary market in

particular also has substantial room for rent-to-market catch

up.

- Buying back shares at a discount: We believe MEQ shares

continue to trade below their true NAV, and that ongoing

macroeconomic volatility could intensify that trend.

Forward-Looking Information

Certain statements contained herein constitute "forward-looking

statements" as such term is used in applicable Canadian securities

laws. These statements relate to analysis and other information

based on forecasts of future results, estimates of amounts not yet

determinable and assumptions of management. In particular,

statements concerning estimates related to future acquisitions,

dispositions and capital expenditures, increase or reduction of

vacancy rates, increase or decrease of rental rates and rental

revenue, future income and profitability, timing of refinancing of

debt and completion, timing and costs of renovations, increased or

decreased funds from operations and cash flow, the Corporation's

liquidity and financial capacity, improved rental conditions,

future environmental impact the Corporation's goals and the steps

it will take to achieve them the Corporation's anticipated funding

sources to meet various operating and capital obligations and other

factors and events described in this document should be viewed as

forward-looking statements to the extent that they involve

estimates thereof. Any statements that express or involve

discussions with respect to predictions, expectations, beliefs,

plans, projections, objectives, assumptions of future events or

performance (often, but not always, using such words or phrases as

"expects" or "does not expect", "is expected", "anticipates" or

"does not anticipate", "plans", "estimates" or "intends", or

stating that certain actions, events or results "may", "could",

"would", "might" or "will" be taken, occur or be achieved) are not

statements of historical fact and should be viewed as

forward-looking statements.

Such forward-looking statements are not guarantees of future

events or performance and by their nature involve known and unknown

risks, uncertainties and other factors, including those risks

described in this Annual Information Form under the heading "Risk

Factors", that may cause the actual results, performance or

achievements of the Corporation to be materially different from any

future results, performance or achievements expressed or implied by

such forward-looking statements. Such risks and other factors

include, among others, costs and timing of the development of

existing properties, availability of capital to fund stabilization

programs, other issues associated with the real estate industry

including availability but without limitation of labour and costs

of renovations, fluctuations in vacancy rates, unoccupied units

during renovations, rent control, fluctuations in utility and

energy costs, credit risks of tenants, fluctuations in interest

rates and availability of capital, and other such business risks as

discussed herein. Material factors or assumptions that were applied

in drawing a conclusion or making an estimate set out in the

forward-looking statements include, among others, the rental

environment compared to several years ago, relatively stable

interest costs, access to equity and debt capital markets to fund

(at acceptable costs) and the availability of purchase

opportunities for growth in Canada. Although the Corporation has

attempted to identify important factors that could cause actual

actions, events or results to differ materially from those

described in forward-looking statements, other factors may cause

actions, events or results to be different than anticipated,

estimated or intended. There can be no assurance that such

statements will prove to be accurate as actual results and future

events could vary or differ materially from those anticipated in

such forward-looking statements. Accordingly, readers should not

place undue reliance on forward-looking statements contained

herein.

Forward-looking statements are based on Management's beliefs,

estimates and opinions on the date the statements are made, and the

Corporation undertakes no obligation to update forward-looking

statements if these beliefs, estimates and opinions should change

except as required by applicable securities laws or as otherwise

described therein.

Certain information set out herein may be considered as

"financial outlook" within the meaning of applicable securities

laws. The purpose of this financial outlook is to provide readers

with disclosure regarding the Corporations reasonable expectations

as to the anticipated results of its proposed business activities

for the periods indicated. Readers are cautioned that the financial

outlook may not be appropriate for other purposes.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230725557440/en/

For further information: Bob Dhillon, Founder, President

& CEO D: +1 (403) 215-6063 Executive Assistant: +1 (825)

945-4823 100, 305 10 Avenue SE, Calgary, AB T2G 0W2 Canada TSX: MEQ

https://www.mainst.biz/ https://www.sedar.com

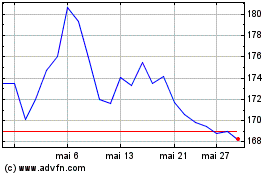

Mainstreet Equity (TSX:MEQ)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Mainstreet Equity (TSX:MEQ)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024