Franklin BSP Realty Trust, Inc. Announces Closing of a $80 Million Loan on the Alexan Waterloo, a Luxury High-Rise Multifamily Property

07 Agosto 2023 - 7:00AM

Business Wire

Franklin BSP Realty Trust, Inc. (NYSE: FBRT) (“FBRT” or the

“Company”) today announced the closing of a $80 million loan

facilitating the refinancing of the Alexan Waterloo (“the Alexan”),

a 272-unit, 30-story, 2021-vintage luxury high-rise multifamily

property located in downtown Austin, Texas, centrally located to

the medical district. Crow Holdings Capital (the “Borrower”,

“Crow”) is the property developer and is a subsidiary of Crow

Holdings, a privately owned real estate investment and development

firm with more than 70 years of history and approximately $24

billion of assets under management.

An initial advance of $78.0 million was funded at closing with

future advances of $2.0 million available to the borrower. The loan

was structured with a two-year initial term and three one-year

extension options, subject to the borrower meeting certain

requirements.

Michael Comparato, President of FBRT, commented: “We are excited

to provide financing to Crow, a leading developer with a proven

track record in commercial real estate. The Alexan property is one

of the highest quality physical assets in our portfolio. FBRT

continues to focus on expanding its multifamily presence. This loan

is representative of exactly the type of credit we are looking for

– a great property with a great borrower in a great location.”

About Franklin BSP Realty Trust, Inc.

Franklin BSP Realty Trust, Inc. (NYSE: FBRT) is a real estate

investment trust that originates, acquires and manages a

diversified portfolio of commercial real estate debt secured by

properties located in the United States. As of June 30, 2023, FBRT

had approximately $6.0 billion of assets. FBRT is externally

managed by Benefit Street Partners L.L.C., a wholly owned

subsidiary of Franklin Resources, Inc. For further information,

please visit www.fbrtreit.com.

Forward-Looking Statements

Certain statements included in this press release are

forward-looking statements. Those statements include statements

regarding the intent, belief or current expectations of the Company

and members of our management team, as well as the assumptions on

which such statements are based, and generally are identified by

the use of words such as "may," "will," "seeks," "anticipates,"

"believes," "estimates," "expects," "plans," "intends," "should" or

similar expressions. Actual results may differ materially from

those contemplated by such forward-looking statements. Further,

forward-looking statements speak only as of the date they are made,

and we undertake no obligation to update or revise forward-looking

statements to reflect changed assumptions, the occurrence of

unanticipated events or changes to future operating results over

time, unless required by law.

The Company's forward-looking statements are subject to various

risks and uncertainties. Factors that could cause actual outcomes

to differ materially from our forward-looking statements include

macroeconomic factors in the United States including inflation,

changing interest rates and economic contraction, the extent of any

recoveries on delinquent loans, the financial stability of our

borrowers and the other, risks and important factors contained and

identified in the Company’s filings with the Securities and

Exchange Commission (“SEC”), including its Annual Report on Form

10-K for the fiscal year ended December 31, 2022 and its subsequent

filings with the SEC, any of which could cause actual results to

differ materially from the forward-looking statements. The

forward-looking statements included in this communication are made

only as of the date hereof.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230807277310/en/

Investor Relations Contact: Lindsey Crabbe

l.crabbe@benefitstreetpartners.com (214) 874-2339

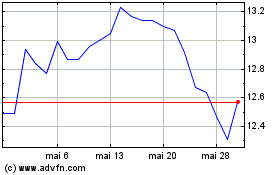

Franklin BSP Realty (NYSE:FBRT)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

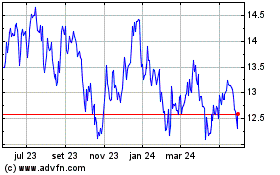

Franklin BSP Realty (NYSE:FBRT)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025