Abcam plc (Nasdaq: ABCM) (‘Abcam’, the ‘Group’ or the

‘Company’), a global leader in the supply of life science research

tools, announced today that it has entered into a definitive

agreement pursuant to which Danaher Corporation (NYSE: DHR)

(‘Danaher’) will acquire all of the outstanding shares of Abcam for

$24.00 per share in cash (the ‘Transaction’).

The Transaction has been unanimously approved and recommended by

the Abcam Board of Directors and unanimously approved by the

Danaher Board of Directors.

Founded in 1998 and headquartered in Cambridge, UK, Abcam offers

the scientific community highly validated antibodies, reagents,

biomarkers and assays to address targets in biological pathways

that are critical for advancing drug discovery, life sciences

research, and diagnostics. The Company’s technologies are used by

approximately 750,000 researchers.

Abcam is expected to operate as a standalone operating company

and brand within Danaher's Life Sciences segment, furthering

Danaher’s strategy to help map complex diseases and accelerate the

drug discovery process.

The Transaction brings to a conclusion the review of strategic

alternatives initiated by the Abcam Board of Directors in June

2023, following strategic inquiries from multiple parties. The

comprehensive process, assisted by Lazard and Morgan Stanley as

financial advisors and Latham & Watkins as legal advisor,

engaged with over 30 potential counterparties, including more than

20 potential strategic acquirers before entering into a definitive

agreement with Danaher.

Peter Allen, Chairman of Abcam, said: “Following a rigorous

process, I’m confident this combination with Danaher maximizes

value for shareholders while delivering an excellent outcome for

our employees and customers.”

Alan Hirzel, Chief Executive Officer of Abcam, said: “Our

strategy has transformed Abcam to become a scale innovator and

important catalyst in the global life science community. Danaher

shares our passion to help life science researchers achieve their

mission faster and their operating company model allows us to

continue to pursue our strategy, while harnessing the power of the

Danaher Business System to ensure we remain the partner of choice

for our customers.”

Rainer M. Blair, President and Chief Executive Officer, Danaher,

said: “We couldn’t be more excited to have Abcam join Danaher.

Abcam’s long track record of innovation, outstanding product

quality and breadth of antibody portfolio positions them as a key

partner for the scientific community. We look forward to welcoming

Abcam’s innovative and talented team to Danaher as we continue to

help our customers solve some of the world’s biggest healthcare

challenges."

The Transaction is intended to be effected by way of a court

sanctioned scheme of arrangement under English law, subject to the

approval of Abcam shareholders, the receipt of certain regulatory

approvals, the sanction of the High Court of Justice of England and

Wales and other customary closing conditions. A circular containing

further information and setting out the timing and process for

shareholder approval will be issued to Abcam shareholders in the

coming weeks. The Transaction is expected to close mid-2024,

subject to satisfaction of these conditions.

Danaher expects to fund the acquisition using cash on hand and

proceeds from the issuance of commercial paper.

The Company will announce its half-year 2023 results on August

31, 2023. Due to the Transaction, the Company will not be hosting

an earnings conference call.

About Abcam plc

As an innovator in reagents and tools, Abcam's purpose is to

serve life science researchers globally to achieve their mission

faster. Providing the research and clinical communities with tools

and scientific support, the Company offers highly validated

antibodies, assays, and other research tools to address important

targets in critical biological pathways.

Already a pioneer in data sharing and ecommerce in the life

sciences, Abcam's ambition is to be the most influential company in

life sciences by helping advance global understanding of biology

and causes of disease, which, in turn, will drive new treatments

and improved health.

Abcam's worldwide customer base of approximately 750,000 life

science researchers’ uses Abcam's antibodies, reagents, biomarkers,

and assays. By actively listening to and collaborating with these

researchers, the Company continuously advances its portfolio to

address their needs. A transparent program of customer reviews and

datasheets, combined with industry-leading validation initiatives,

gives researchers increased confidence in their results.

Founded in 1998 and headquartered in Cambridge, UK, the Company

has served customers in more than 130 countries. Abcam's American

Depositary Shares (ADSs) trade on the Nasdaq Global Select Market

(Nasdaq: ABCM).

Important Notices

UK Takeover Code does not apply

Abcam is not a company subject to regulation under the City Code

on Takeovers and Mergers (the ‘UK Takeover Code’), therefore no

dealing disclosures are required to be made under Rule 8 of the UK

Takeover Code by shareholders of Abcam or Danaher.

Forward-Looking Statements

This announcement contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995. In

some cases, you can identify forward-looking statements by the

following words: “may,” “might,” “will,” “could,” “would,”

“should,” “expect,” “plan,” “anticipate,” “intend,” “seek,”

“believe,” “estimate,” “predict,” “potential,” “continue,”

“contemplate,” “possible” or the negative of these terms or other

comparable terminology, although not all forward-looking statements

contain these words. They are not historical facts, nor are they

guarantees of future performance. Any express or implied statements

contained in this announcement that are not statements of

historical fact may be deemed to be forward-looking statements,

including, without limitation, statements regarding Danaher’s and

Abcam’s ability to complete the Transaction on the proposed terms

or on the anticipated timeline, or at all, including risks and

uncertainties related to securing the necessary regulatory

approvals and Abcam shareholder approval, the sanction of the High

Court of Justice of England and Wales and satisfaction of other

closing conditions to consummate the Transaction; the occurrence of

any event, change or other circumstance that could give rise to the

termination of the definitive transaction agreement relating to the

Transaction; risks related to diverting the attention of Danaher’s

and Abcam’s management from ongoing business operations; failure to

realize the expected benefits of the Transaction; significant

Transaction costs and/or unknown or inestimable liabilities; the

risk of shareholder litigation in connection with the Transaction,

including resulting expense or delay; the risk that Abcam’s

business will not be integrated successfully or that such

integration may be more difficult, time-consuming or costly than

expected; Danaher’s ability to fund the cash consideration for the

Transaction; risks related to future opportunities and plans for

the combined company, including the uncertainty of expected future

regulatory filings, financial performance and results of the

combined company following completion of the acquisition;

disruption from the Transaction, making it more difficult to

conduct business as usual or maintain relationships with customers,

employees or suppliers; effects relating to the announcement of the

Transaction or any further announcements or the consummation of the

acquisition on the market price of Abcam’s American depositary

shares; regulatory initiatives and changes in tax laws; market

volatility; and other risks and uncertainties affecting Danaher and

Abcam, including those described from time to time under the

caption “Risk Factors” and elsewhere in Abcam’s Annual Report on

Form 20-F for the year ended December 31, 2022 and in any

subsequent reports on Form 6-K, each of which is on file with or

furnished to the U.S. Securities and Exchange Commission

(“SEC” and available at the SEC’s website at www.sec.gov.

Moreover, other risks and uncertainties of which Abcam are not

currently aware may also affect each of the companies’

forward-looking statements and may cause actual results and the

timing of events to differ materially from those anticipated.

Investors are cautioned that forward-looking statements are not

guarantees of future performance. SEC filings for the Company are

available in the Investor Relations section of the Company’s

website at https://corporate.abcam.com/investors/. The information

contained on, or that can be accessed through, the Company’s

website is not a part of, and shall not be incorporated by

reference into, this Form 6-K.

The forward-looking statements made in this announcement are

made only as of the date hereof or as of the dates indicated in the

forward-looking statements and reflect the views stated therein

with respect to future events as at such dates, even if they are

subsequently made available by Abcam on its website or otherwise.

Abcam does not undertake any obligation to update or supplement any

forward-looking statements to reflect actual results, new

information, future events, changes in its expectations or other

circumstances that exist after the date as of which the

forward-looking statements were made other than to the extent

required by applicable law.

Important Additional Information and Where to Find It

Abcam intends to furnish to the SEC under cover of a Report of

Foreign Private Issuer on Form 6-K and mail or otherwise provide to

its shareholders a circular containing information on the Scheme

vote regarding the Transaction (the ‘Scheme Circular’). This

announcement is not a substitute for the Scheme Circular or any

other document that may be filed or furnished by Abcam with the

SEC. Investors and security holders are urged to carefully read the

entire Scheme Circular (which will include an explanatory statement

in respect of the Scheme in accordance with the requirements of the

UK Companies Act 2006) and other relevant documents as and when

they become available because they will contain important

information. You may obtain copies of all documents filed with or

furnished to the SEC regarding this transaction, free of charge, at

the SEC’s website (www.sec.gov).

In addition, investors and shareholders will be able to obtain

free copies of the Scheme Circular and other documents filed with

or furnished to the SEC by the Company on its Investors website

(https://corporate.abcam.com/investors/) or by writing to the

Company, at 152 Grove Street, Building 1100 Waltham, MA 02453,

United States of America.

Neither this announcement nor any copy of it may be taken or

transmitted directly or indirectly into or from any jurisdiction

where to do so would constitute a violation of the relevant laws or

regulations of such jurisdiction. Any failure to comply with this

restriction may constitute a violation of such laws or regulations.

Persons in possession of this announcement or other information

referred to herein should inform themselves about, and observe, any

restrictions in such laws or regulations.

This announcement has been prepared for the purpose of complying

with the applicable law and regulation of the United Kingdom and

the United States and information disclosed may not be the same as

that which would have been disclosed if this announcement had been

prepared in accordance with the laws and regulations of

jurisdictions outside the United Kingdom or the United States.

No Offer or Solicitation

This announcement is not intended to and does not constitute an

offer to sell or the solicitation of an offer to subscribe for or

buy or an invitation to purchase or subscribe for any securities or

the solicitation of any vote or approval in any jurisdiction, nor

shall there be any sale, issuance or transfer of securities in any

jurisdiction in contravention of applicable law.

The Transaction will be implemented solely pursuant to the

Scheme, subject to the terms and conditions of the definitive

transaction agreement, which contains the terms and conditions of

the Transaction.

Morgan Stanley & Co. International plc (“Morgan Stanley”)

which is authorised by the Prudential Regulation Authority and

regulated in the UK by the Financial Conduct Authority and the

Prudential Regulation Authority, is acting exclusively as financial

adviser to Abcam and no one else in connection with the Acquisition

and Morgan Stanley, its affiliates and its respective officers,

employees, agents, representatives and/or associates will not

regard any other person as their client, nor will they be

responsible to anyone other than Abcam for providing the

protections afforded to clients of Morgan Stanley nor for providing

advice in connection with the Acquisition or any matter or

arrangement referred to herein.

Lazard & Co., Limited , which is authorised and regulated in

the UK by the Financial Conduct Authority, and Lazard Freres &

Co. LLC (together, “Lazard”) are acting exclusively as financial

adviser to Abcam and no one else in connection with the matters set

out in this announcement and will not be responsible to anyone

other than Abcam for providing any protections afforded to clients

of Lazard nor for providing advice in relation to the matters set

out in this announcement. Neither Lazard nor any of its affiliates

(nor their respective directors, officers, employees or agents)

owes or accepts any duty, liability or responsibility whatsoever

(whether direct or indirect, whether in contract, in tort, under

statute or otherwise) to any person who is not a client of Lazard

in connection with this announcement, any statement contained

herein or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230828718642/en/

Abcam plc Tommy Thomas, CPA Vice President, Investor

Relations +1 617-577-4205 152 Grove Street, Building 1100 Waltham,

MA 02453 Media enquiries FTI Consulting +44 (0)20-3727-1000

Abcam@fticonsulting.com

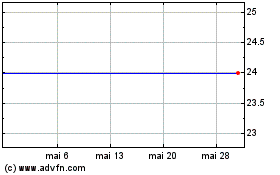

Abcam (NASDAQ:ABCM)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Abcam (NASDAQ:ABCM)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025