NCR Corporation (NYSE: NCR), a leading enterprise technology

provider, will conduct two virtual Investor Days today, which will

highlight each of the two companies, NCR Voyix ("Voyix") and NCR

Atleos ("Atleos"), that will result from its planned separation,

expected in the fourth quarter of 2023.

The Investor Day for the digital commerce business, Voyix, will

take place from 9:00 a.m. – 11:00 a.m. Eastern Time. Executives

presenting during the event include Chief Executive Officer David

Wilkinson, Chief Financial Officer Brian Webb-Walsh, and other

senior leaders.

The Investor Day for the ATM business, Atleos, will take place

from 1:00 p.m. to 3:00 p.m. Eastern Time. Executives presenting

during the event include Atleos Chief Executive Officer Tim Oliver,

Chief Financial Officer Paul Campbell, and other senior

leaders.

Both events will include formal presentations followed by a

question-and-answer session with senior leadership.

Voyix Event Detail:

Tuesday, September 5, 2023

9:00 a.m. – 11:00 a.m. ET

Register here

Atleos Event Detail:

Tuesday, September 5, 2023

1:00 p.m. – 3:00 p.m. ET

Register here

Registration for each event is required at the links above, and

a live webcast and replay of the events will be available at the

same links following the event.

About NCR Corporation

NCR Corporation (NYSE: NCR) is a leader in transforming,

connecting, and running technology platforms for self-directed

banking, stores, and restaurants. NCR is headquartered in Atlanta,

Georgia, with 35,000 employees globally. NCR is a trademark of NCR

Corporation in the United States and other countries.

Web site: www.ncr.com Twitter: @NCRCorporation Facebook:

www.facebook.com/ncrcorp LinkedIn:

www.linkedin.com/company/ncr-corporation YouTube:

www.youtube.com/user/ncrcorporation

Cautionary Statements

This release contains “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended,

pursuant to the safe harbor provisions of the Private Securities

Litigation Reform Act of 1995 (the “Act”). Forward-looking

statements use words such as “expect,” “anticipate,” “outlook,”

“intend,” “plan,” “confident,” “believe,” “will,” “should,”

“would,” “potential,” “positioning,” “proposed,” , “planned, ”

“objective,” “likely,” “could,” “may,” and words of similar

meaning, as well as other words or expressions referencing future

events, conditions or circumstances. We intend these

forward-looking statements to be covered by the safe harbor

provisions for forward-looking statements contained in the Act.

Statements that describe or relate to NCR’s plans, goals,

intentions, strategies, or financial outlook, and statements that

do not relate to historical or current fact, are examples of

forward-looking statements. Examples of forward-looking statements

in this release include, without limitation, statements regarding

the proposed separation of NCR into two separate companies,

including, but not limited to, statements regarding the anticipated

timing and structure of such proposed transaction, the future

commercial performance of NCR Voyix or NCR Atleos (or their

respective businesses) following such proposed transaction, and

value creation and ability to innovate and drive growth generally

as a result of such transaction as well as statements regarding the

intended future executive management teams of both companies.

Forward-looking statements are based on our current beliefs,

expectations and assumptions, which may not prove to be accurate,

and involve a number of known and unknown risks and uncertainties,

many of which are out of NCR’s control. Forward-looking statements

are not guarantees of future performance, and there are a number of

important factors that could cause actual outcomes and results to

differ materially from the results contemplated by such

forward-looking statements, including those factors relating

to:

- Strategy and Technology: transforming our business model;

development and introduction of new solutions; competition in the

technology industry; integration of acquisitions and management of

alliance activities; our multinational operations

- Business Operations: domestic and global economic and credit

conditions; risks and uncertainties from the payments-related

business and industry; disruptions in our data center hosting and

public cloud facilities; retention and attraction of key employees;

defects, errors, installation difficulties or development delays;

failure of third-party suppliers; , a major natural disaster or

catastrophic event, including the impact of the coronavirus

(COVID-19) pandemic and geopolitical and macroeconomic challenges;

environmental exposures from historical and ongoing manufacturing

activities; and climate change

- Data Privacy & Security: impact of data protection,

cybersecurity and data privacy including any related issues,

including the April 2023 ransomware incident;

- Finance and Accounting: our level of indebtedness; the terms

governing our indebtedness; incurrence of additional debt or

similar liabilities or obligations; access or renewal of financing

sources; our cash flow sufficiency to service our indebtedness;

interest rate risks; the terms governing our trade receivables

facility; the impact of certain changes in control relating to

acceleration of our indebtedness, our obligations under other

financing arrangements, or required repurchase of our senior

unsecured notes; any lowering or withdrawal of the ratings assigned

to our debt securities by rating agencies; our pension liabilities;

and write down of the value of certain significant assets

- Law and Compliance: allegations or claims by third parties that

our products or services infringe on intellectual property rights

of others, including claims against our customers and claims by our

customers to defend and indemnify them with

- respect to such claims; protection of our intellectual

property; changes to our tax rates and additional income tax

liabilities; uncertainties regarding regulations, lawsuits and

other related matters; and changes to cryptocurrency

regulations

- Governance: impact of the terms of our Series A Convertible

Preferred (“Series A”) Stock relating to voting power, share

dilution and market price of our common stock; rights, preferences

and privileges of Series A stockholders compared to the rights of

our common stockholders; and actions or proposals from stockholders

that do not align with our business strategies or the interests of

our other stockholders

- Planned Separation: an unexpected failure to complete, or

unexpected delays in completing, the necessary actions for the

planned separation, or to obtain the necessary approvals or third

party consents to complete these actions; that the potential

strategic benefits, synergies or opportunities expected from the

separation may not be realized or may take longer to realize than

expected; costs of implementation of the separation and any changes

to the configuration of businesses included in the separation if

implemented; the potential inability to access or reduced access to

the capital markets or increased cost of borrowings, including as a

result of a credit rating downgrade; the potential adverse

reactions to the planned separation by customers, suppliers,

strategic partners or key personnel and potential difficulties in

maintaining relationships with such persons and risks associated

with third party contracts containing consent, and/or other

provisions that may be triggered by the planned separation and the

ability to obtain such consents; the risk that any newly formed

entity to house the commerce or ATM business would have no credit

rating and may not have access to the capital markets on acceptable

terms; unforeseen tax liabilities or changes in tax law; requests

or requirements of governmental authorities related to certain

existing liabilities; and the ability to obtain or consummate

financing or refinancing related to the transaction upon acceptable

terms or at all.

Should one or more of these risks or uncertainties materialize,

or should underlying assumptions prove incorrect, actual results

may vary materially from those set forth in the forward-looking

statements. There can be no guarantee that the planned separation

will be completed in the expected form or within the expected time

frame or at all. Nor can there be any guarantee that NCR Voyix or

NCR Atleos (or their respective businesses) after a separation will

be able to realize any of the potential strategic benefits,

synergies or opportunities as a result of these actions. Neither

can there be any guarantee that shareholders will achieve any

particular level of shareholder returns. Nor can there be any

guarantee that the planned separation will maximize value for

shareholders, or that NCR or any of its divisions, or separate

commerce and ATM business, will be commercially successful in the

future, or achieve any particular credit rating or financial

results.

Additional information concerning these and other factors can be

found in the Company’s filings with the U.S. Securities and

Exchange Commission, including the Company’s most recent annual

report on Form 10-K, quarterly reports on Form 10-Q and current

reports on Form 8-K. Any forward-looking statement speaks only as

of the date on which it is made. The Company does not undertake any

obligation to publicly update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise, except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230905248225/en/

Investor Contact Michael Nelson NCR Corporation

678-808-6995 michael.nelson@ncr.com

Media Contact Scott Sykes NCR Corporation

scott.sykes@ncr.com

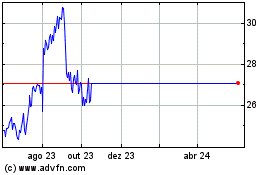

NCR (NYSE:NCR)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

NCR (NYSE:NCR)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025