Rubicon Technologies, Inc. (NYSE: RBT) (“Rubicon” or the

“Company”), a leading provider of software-based waste, recycling,

and fleet operations products for businesses and governments

worldwide, today announced that the Company's board of directors

(the “Board”) approved a reverse stock split (the “Reverse Stock

Split”) of Rubicon's Class A common stock, par value $0.0001 per

share (the “Common Stock”), at a ratio of 1-for-8 (the “Reverse

Stock Split Ratio”). The Reverse Stock Split is expected to become

effective immediately after the close of trading on the New York

Stock Exchange (the “NYSE”) on September 26, 2023 (the “Effective

Time”), and Rubicon's Common Stock is expected to begin trading on

the NYSE on a split-adjusted basis at the opening of trading on

September 27, 2023, under the existing ticker symbol “RBT”, new

CUSIP number 78112J208, and new ISIN number US78112J2087. Rubicon's

publicly traded warrants will continue to be traded on the NYSE

under the existing ticker symbol “RBT.WS” and existing CUSIP and

ISIN numbers.

The Reverse Stock Split was approved by Rubicon’s stockholders

at the Company’s 2023 Annual Meeting of Stockholders, held on June

8, 2023, with the final ratio to be determined by the Board. The

Company will file an amendment to its Certificate of Incorporation

(the “Charter”) to implement the Reverse Stock Split as of the

Effective Time. The primary goal of the Reverse Stock Split is to

increase the per share market price of the Common Stock to regain

compliance with the minimum $1.00 average closing price requirement

for continued listing on the NYSE.

At the Effective Time, every eight shares of Common Stock issued

and outstanding or held as treasury stock will be automatically

combined and converted into one share of Common Stock. The total

number of shares of Common Stock authorized for issuance under the

Charter, the par value per share of Common Stock, and the number of

shares of all other classes of stock authorized under the Charter

other than the Common Stock will not change.

As a result of the Reverse Stock Split, equitable adjustments

corresponding to the Reverse Stock Split Ratio will be made to

Rubicon’s outstanding public warrants such that every eight shares

of Common Stock that may be issued upon the exercise of warrants

held immediately prior to the Reverse Stock Split will represent

one share of Common Stock that may be issued upon exercise of such

warrants immediately following the Reverse Stock Split.

Correspondingly, the per share exercise price of public warrants

held immediately prior to the Reverse Stock Split will be

proportionately increased, such that the per share exercise price

of such warrants immediately following the Reverse Stock Split will

be $92.00, which equals the product of eight multiplied by $11.50,

the exercise price per share immediately prior to the Reverse Stock

Split.

In addition, equitable adjustments corresponding to the Reverse

Stock Split Ratio will be made to the number of shares of Common

Stock underlying Rubicon’s outstanding equity awards and the number

of shares issuable under Rubicon's equity incentive plan, as well

as any exercise prices or market-based vesting conditions of such

equity awards, as applicable. Equitable adjustments corresponding

to the Reverse Stock Split Ratio will also be made to issued and

outstanding shares of all other classes of stock of the Company and

to the number of shares of Common Stock underlying Rubicon’s

private warrants, as well as the applicable exercise price.

No fractional shares will be issued in connection with the

Reverse Stock Split. Any stockholder who would otherwise be

entitled to receive a fractional share will instead be entitled to

receive one whole share of Common Stock in lieu of such fractional

share.

Continental Stock Transfer & Trust Company (“Continental”)

is acting as transfer and exchange agent for the Reverse Stock

Split. Registered stockholders who hold shares of Common Stock in

uncertificated form are not required to take any action to receive

post-reverse split shares and holders of certificated shares will

receive instructions from the Continental. Stockholders owning

shares through an account at a brokerage firm, bank, dealer,

custodian or other similar organization acting as nominee will have

their positions automatically adjusted to reflect the Reverse Stock

Split, subject to such broker's particular processes, and will not

be required to take any action in connection with the Reverse Stock

Split.

Additional information about the Reverse Stock Split can be

found in Rubicon’s definitive proxy statement filed with the U.S.

Securities and Exchange Commission (the "SEC") on May 1, 2023,

which is available free of charge at the SEC's website at

www.sec.gov, and on Rubicon's Investor Relations website at

investors.rubicon.com.

About Rubicon Technologies, Inc.

Rubicon is a leading provider of software-based waste,

recycling, and fleet operations products for businesses and

governments worldwide. Striving to create a new industry standard

by using technology to drive environmental innovation, the Company

helps turn businesses into more sustainable enterprises, and

neighborhoods into greener and smarter places to live and work.

Rubicon’s mission is to end waste. It helps its partners find

economic value in their waste streams and confidently execute on

their sustainability goals. To learn more, visit rubicon.com.

Forward-Looking Statements

This press release includes “forward-looking statements” within

the meaning of the “safe harbor” provisions of the United States

Private Securities Litigation Reform Act of 1995 and within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended.

All statements, other than statements of present or historical fact

included in this press release, are forward-looking statements.

When used in this press release, the words “could,” “should,”

“will,” “may,” “believe,” “anticipate,” “intend,” “estimate,”

“expect,” “project,” the negative of such terms and other similar

expressions are intended to identify forward-looking statements,

although not all forward-looking statements contain such

identifying words. Such forward-looking statements are subject to

risks, uncertainties, and other factors which could cause actual

results to differ materially from those expressed or implied by

such forward-looking statements.

These forward-looking statements are based upon current

expectations, estimates, projections, and assumptions that, while

considered reasonable by Rubicon and its management, are inherently

uncertain; factors that may cause actual results to differ

materially from current expectations include, but are not limited

to: 1) the outcome of any legal proceedings that may be instituted

against Rubicon or others following the closing of the business

combination; 2) Rubicon’s ability to meet the New York Stock

Exchange’s listing standards following the consummation of the

business combination; 3) the risk that the business combination

disrupts current plans and operations of Rubicon as a result of

consummation of the business combination; 4) the ability to

recognize the anticipated benefits of the business combination,

which may be affected by, among other things, the ability of the

combined company to grow and manage growth profitably, maintain

relationships with customers and suppliers and retain its

management and key employees; 5) costs related to the business

combination; 6) changes in applicable laws or regulations; 7) the

possibility that Rubicon may be adversely affected by other

economic, business and/or competitive factors, including the

impacts of the COVID-19 pandemic, geopolitical conflicts, such as

the conflict between Russia and Ukraine, the effects of inflation

and potential recessionary conditions; 8) Rubicon’s execution of

anticipated operational efficiency initiatives, cost reduction

measures and financing arrangements; and 9) other risks and

uncertainties set forth in the sections entitled “Risk Factors” and

“Cautionary Note Regarding Forward-Looking Statements” in the

Company’s Annual Report on Form 10-K and other documents Rubicon

has filed with the SEC. Although Rubicon believes the expectations

reflected in the forward-looking statements are reasonable, nothing

in this press release should be regarded as a representation by any

person that the forward-looking statements set forth herein will be

achieved or that any of the contemplated results of such forward

looking statements will be achieved. There may be additional risks

that Rubicon presently does not know of or that Rubicon currently

believes are immaterial that could also cause actual results to

differ from those contained in the forward-looking statements, many

of which are beyond Rubicon’s control. You should not place undue

reliance on forward-looking statements, which speak only as of the

date they are made. Rubicon does not undertake, and expressly

disclaims, any duty to update these forward-looking statements,

except as otherwise required by applicable law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230915996079/en/

Investor Contact: Alexandra Clark

Director of Finance & Investor Relations

alexandra.clark@rubicon.com

Media Contact: Dan Sampson Chief

Marketing & Corporate Communications Officer

dan.sampson@rubicon.com

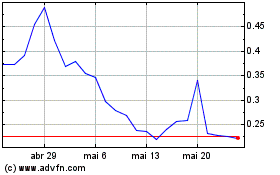

Rubicon Technologies (NYSE:RBT)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Rubicon Technologies (NYSE:RBT)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025