Telenet will become 100% owned by Liberty Global. Telenet

shares delisted at close of trade on 13 October 2023

Liberty Global plc (Liberty Global) (NASDAQ: LBTYA, LBTYB

and LBTYK) is pleased to announce today that, during the mandatory

reopening period of its voluntary public takeover bid for all the

shares of Telenet Group Holding NV (Telenet) (the

Offer) by its indirect wholly-owned subsidiary, Liberty

Global Belgium Holding B.V. (the Offeror), which closed on

13 September 2023, it received acceptances for 3,164,944 Telenet

shares1. These acceptances, together with the Telenet shares

already held by the Offeror and Telenet, represent 96.26% of the

total shares issued by Telenet.

Payment of the offer price for the Telenet shares tendered

during the mandatory reopening period (EUR 21.00 per share after

deduction of the EUR 1.00 gross dividend approved by Telenet’s

ordinary general meeting of 26 April 2023 and paid on 5 May 2023)

will take place on the payment date, 21 September 2023.

Following the payment date, the Offeror will reopen the Offer as

a simplified squeeze-out bid2 (the Simplified Squeeze-Out),

subject to the same financial conditions as the Offer.

The Simplified Squeeze-Out will open at 9:00am CET on 22

September 2023 and will close at 4.00pm CET on 13 October 2023 (the

Simplified Squeeze-Out Period). Shareholders who have not

yet accepted the Offer will be able to accept the Offer during the

Simplified Squeeze-Out Period.

The results of the Simplified Squeeze-Out will be announced on

or before 20 October 2023. Shares not tendered by the end of the

Simplified Squeeze-Out Period will be deemed to have automatically

transferred to the Offeror at the end of the Simplified Squeeze-Out

Period, and the funds required to pay the bid price for such

non-tendered shares will be deposited with the Deposit and

Consignment Office.

On 13 October 2023, at the end of the Simplified Squeeze-Out

Period, all Telenet shares will be delisted from Euronext

Brussels.

The prospectus, approved in English and translated into Dutch

and French, the response memorandum, approved in Dutch and

translated into English and French, the independent expert report,

available in English, and the acceptance forms, available in

English, Dutch and French, are available on the following

websites:

- https://shareholder-offer.be/en/, a microsite dedicated to the

Offer which is also accessible via (www.telenetgroup.be) and LG plc

(https://www.libertyglobal.com/investors/telenet/)

- www.bnpparibasfortis.be/epargneretplacer (in French and in

English) and www.bnpparibasfortis.be/sparenenbeleggen (in Dutch and

in English)

- U.S. shareholders may email ir@libertyglobal.com to request a

copy of the prospectus.

ABOUT LIBERTY GLOBAL

Liberty Global (NASDAQ: LBTYA, LBTYB and LBTYK) is a world

leader in converged broadband, video and mobile communications

services. We deliver next-generation products through advanced

fiber and 5G networks, and currently provide over 85 million*

connections across Europe and the United Kingdom. Our businesses

operate under some of the best-known consumer brands, including

Virgin Media-O2 in the United Kingdom, VodafoneZiggo in The

Netherlands, Telenet in Belgium, Sunrise in Switzerland, Virgin

Media in Ireland and UPC in Slovakia. Through our substantial scale

and commitment to innovation, we are building Tomorrow’s

Connections Today, investing in the infrastructure and platforms

that empower our customers to make the most of the digital

revolution, while deploying the advanced technologies that nations

and economies need to thrive.

Liberty Global’s consolidated businesses generate annual revenue

of more than $7 billion, while the VodafoneZiggo JV and the VMO2 JV

generate combined annual revenue of more than $17 billion.**

Liberty Global Ventures, our global investment arm, has a

portfolio of more than 75 companies across content, technology and

infrastructure, including strategic stakes in companies like ITV,

Televisa Univision, Plume, AtlasEdge and the Formula E racing

series.

* Represents aggregate consolidated and 50% owned

non-consolidated fixed and mobile subscribers. Includes wholesale

mobile connections of the VMO2 JV and B2B fixed subscribers of the

VodafoneZiggo JV.

** Revenue figures above are provided based on full year 2022

Liberty Global consolidated results (excluding revenue from Poland)

and the combined as reported full year 2022 results for the

VodafoneZiggo JV and full year 2022 U.S. GAAP results for the VMO2

JV.

Telenet, the VMO2 JV, the VodafoneZiggo JV and Sunrise UPC

deliver mobile services as mobile network operators. Virgin Media

Ireland delivers mobile services as a mobile virtual network

operator through third-party networks.

Liberty Global plc is listed on the Nasdaq Global Select Market

under the symbols “LBTYA”, “LBTYB” and “LBTYK”.

Liberty Global Belgium Holding is an indirect wholly-owned

subsidiary of Liberty Global plc, and is a private limited

liability company incorporated under the laws of the

Netherlands.

For more information, please visit www.libertyglobal.com or

contact:

Investor Relations:

Corporate Communications:

Michael Bishop +44 20 8483 6246

Matt Beake +44 20 8483 6215

WARNINGS:

This communication is for informational purposes only and does

not constitute or form part of an offer to purchase or invitation

to sell or issue, securities of Telenet, nor is it a solicitation

by anyone in any jurisdiction in respect of such securities, a vote

or an approval.

This press release may not be published, distributed or

disseminated in any country or territory where its publication or

content would be illegal or may require registration or any other

filing of documents. Anyone in possession of this press release

must refrain from publishing, distributing or disseminating it in

the countries and territories concerned.

The Offer will not be made, directly or indirectly, in any

country or jurisdiction in which it would be considered unlawful or

otherwise violate any applicable laws or regulations, or which

would require Liberty Global or any of its subsidiaries to change

or amend the terms or conditions of the Offer in any material way,

to make an additional filing with any governmental, regulatory or

other authority or take additional action in relation to the Offer.

It is not intended that the Offer extend to any such country or

jurisdiction. Any such documents relating to the Offer must neither

be distributed in any such country or jurisdiction nor be sent into

such country or jurisdiction and must not be used for the purpose

of soliciting the purchase of securities of Telenet by any person

or entity resident or incorporated in any such country or

jurisdiction.

Notice for US Shareholders

The Offer is made in the U.S. in reliance on, and in compliance

with, Section 14(e) of, and Regulation 14E under, the U.S.

Securities Exchange Act of 1934, as amended (the U.S. Exchange

Act), and the “Tier II” exemption provided by Rule 14d-1(d)

under the U.S. Exchange Act, and otherwise in accordance with the

requirements of Belgian law. Accordingly, the Offer is subject to

disclosure and other procedural requirements, including with

respect to withdrawal rights, settlement procedures and timing of

payments that are different from those applicable under U.S.

procedures and laws. U.S. Shareholders should note that Telenet is

not listed on a U.S. securities exchange, subject to the periodic

reporting requirements of the U.S. Exchange Act or required to, and

does not, file any reports with the U.S. Securities and Exchange

Commission (the SEC) thereunder.

It may be difficult for U.S. Shareholders to enforce certain

rights and claims arising in connection with the Offer under US

federal securities laws since Telenet and Offeror are located

outside the U.S. and most of its officers and directors may reside

outside the U.S. It may not be possible to sue a non-U.S. company

or its officers or directors in a non-U.S. court for violations of

U.S. securities laws. It also may not be possible to compel a

non-U.S. company or its affiliates to subject themselves to a U.S.

court’s judgment.

To the extent permissible under applicable laws and regulations

(including Rule 14e-5 under the U.S. Exchange Act and any exemptive

relief granted by the SEC therefrom), and in accordance with

customary Belgian practice, Offeror, its nominees or brokers

(acting as agents), or any of its or their affiliates, may make

certain purchases of, or arrangements to purchase, shares outside

the U.S. during the period in which the Offer remains open for

acceptance, including sales and purchases of shares effected by any

investment bank acting as market maker in the shares. These

purchases, or other arrangements, may occur either in the open

market at prevailing prices or in private transactions at

negotiated prices. In order to be excepted from the requirements of

Rule 14e-5 under the U.S. Exchange Act by virtue of Rule 14e-5(b)

thereunder, such purchases, or arrangements to purchase must comply

with applicable Belgian law and regulation and the relevant

provisions of the U.S. Exchange Act. Any information about such

purchases will be disclosed as required in Belgium and the U.S.

Furthermore, this press release does not constitute or form part

of an offer to sell, nor does it constitute a solicitation of an

order to buy financial instruments in the United States or in any

other jurisdiction.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the U.S. federal securities laws, including the safe

harbour provisions of the U.S. Private Securities Litigation Reform

Act of 1995. In this context, forward-looking statements often

address expected future business and financial performance and

financial condition, and often contain words such as “expect,”

“anticipate,” “intend,” “plan,” “believe,” “seek,” “see,” “will,”

“would,” “may,” “target,” and similar expressions and variations or

negatives of these words. These forward-looking statements may

include, among other things, statements relating to the outlook of

Telenet and Liberty Global; operational expectations, including

with respect to the development, launch and benefits of innovative

and advanced products and services, including gigabit speeds, new

technology and next generation platform rollouts or launches;

future growth prospects and opportunities, results of operations,

uses of cash, tax rates, and other measures that may impact the

financial performance of the companies; anticipated benefits and

synergies and estimated costs of the proposed transaction; the

expected timing of completion of any initial or subsequent offer

period and the proposed transaction; and other information and

statements that are not historical facts. These forward-looking

statements involve certain risks and uncertainties that could cause

actual results to differ materially from those expressed or implied

by these statements. These risks and uncertainties include events

that are outside of the control of the parties, such as: (i)

Telenet, Liberty Global, and our respective operating companies’

ability to meet challenges from competition and to achieve

forecasted financial and operating targets; (ii) the effects of

changes in laws or regulations; (iii) general economic,

legislative, political and regulatory factors, and the impact of

weather conditions, natural disasters, or any epidemic, pandemic or

disease outbreak (including COVID-19); (iv) Telenet, Liberty

Global, and our respective affiliates’ ability to satisfy the

conditions to the consummation of the proposed transaction; (v)

whether the proposed transaction can be completed on the

anticipated terms and timing or completed at all; (vi) the outcome

of any potential litigation that may be instituted with respect to

the proposed transaction; (vii) the potential impact of unforeseen

liabilities, future capital expenditures, revenues, expenses,

economic performance, indebtedness, financial condition on the

future prospects and business of Telenet and Liberty Global’s

Belgium business after the consummation of the proposed

transaction; (viii) any negative effects of the announcement,

pendency or consummation of the proposed transaction; and (ix)

management’s response to any of the aforementioned factors. For

additional information on identifying factors that may cause actual

results to vary materially from those stated in forward-looking

statements, please see Liberty Global’s filings with the SEC,

including Liberty Global’s most recently filed Form 10-K and Form

10-Qs, as well as the regulated information filed by Telenet before

the Belgium Financial Services and Markets Authority. These

forward-looking statements speak only as of the date of this

release. Telenet, Offeror and Liberty Global expressly disclaim any

obligation or undertaking to disseminate any updates or revisions

to any forward-looking statement contained herein to reflect any

change in expectations with regard thereto or any change in events,

conditions or circumstances on which any such statement is

based.

____________________

1

Including for 380,691 Telenet shares that

are subject to lock-up provisions, with settlement only upon

completion of the simplified squeeze-out.

2

Squeeze-out pursuant to article 42 and 43

of the Royal Decree on public takeovers, i.e. following the Offer,

the Offeror owning together with Telenet at least 95% of the shares

of Telenet and acquiring, by acceptance of the Offer, at least 90%

of the shares that are the subject of the Offer.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230919767528/en/

Investor Relations: Michael Bishop +44 20 8483 6246

Corporate Communications: Matt Beake +44 20 8483 6215

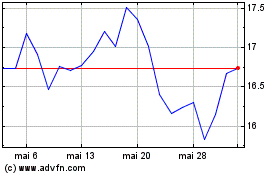

Liberty Global (NASDAQ:LBTYA)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

Liberty Global (NASDAQ:LBTYA)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025