Record Revenues and Continued Year-over-Year

Increase in Gross Margin

SkyWater Technology, Inc. (NASDAQ: SKYT), the trusted technology

realization partner, today announced financial results for the

third quarter of 2023, ended October 1, 2023.

Financial Highlights for Q3 2023:

- Revenue increased 37% year-over-year to a record $71.6

million.

- Gross margin increased to 19.8% on a GAAP basis, compared to

15.8% in Q3 2022, and increased to 20.4% on a non-GAAP basis,

compared to 16.9% in Q3 2022.

- Net loss to shareholders of $7.6 million, or $(0.16) per share

on a GAAP basis, and net loss to shareholders of $2.2 million, or

$(0.05) per share on a non-GAAP basis, compared to net loss to

shareholders of $6.9 million, or $(0.17) per share on a GAAP basis,

and net loss to shareholders $5.1 million, or $(0.13) per share on

a non-GAAP basis in Q3 2022.

- Adjusted EBITDA of $8.3 million, or 11.6% of revenue, compared

to $3.8 million, or 7.3% of revenue in Q3 2022.

“SkyWater again achieved revenue upside and sequential growth in

what was a very strong third quarter for our ATS business,”

commented Thomas Sonderman, SkyWater chief executive officer. “The

outperformance we’ve achieved in 2023 to date is largely driven by

increased demand – and strong operational execution – as we

continue to drive improvements in fab efficiency, velocity,

linearity, and output. We are also starting to see an increasing

contribution of customer-funded capital expenditures, which is a

trend we expect to continue, as our customers are significantly

increasing their investments in SkyWater. The transformative

process currently underway is proceeding well and is accelerating,

especially now that John Sakamoto is on board as our new president

and COO. We anticipate another year of revenue growth and continued

strong financial results ahead for 2024.”

Recent Business Highlights:

- Year-to-date revenues of $208 million, up 40% compared to the

first nine months of 2022, are ahead of our long-term annual

revenue growth objectives due to strong demand and improved

operational execution for our Advanced Technology Services (ATS)

business, which has also driven strong improvement in gross margin

and adjusted EBITDA in 2023.

- Increased size and scope of multiple strategic aerospace and

defense programs; continued progress on the productization and

qualification of SkyWater’s RadHard 90nm platform during Q3 ahead

of the planned production ramp in 2025.

- Increased tool revenues in Q3 mark the beginning of a period of

significant increases in customer-funded capital expenditures

expected in the quarters ahead, which we believe is a strong

indicator of our customers’ desires to make increased investments

in SkyWater to enable the growth ramp for multiple products and

platforms currently under development.

- Electronic systems design leader Cadence Design Systems, Inc.

is now offering a full SKY130 process design kit (PDK) to their

broad subscribed user base, encouraging and facilitating design

work and subsequent tapeouts on one of SkyWater’s key CMOS

technology platforms.

- Continued momentum for our CHIPS Act funding applications, in

particular for our planned expansion in Bloomington MN, and we look

forward to the continued due diligence process with the Department

of Commerce for mature node fabrication facilities.

Q3 2023 Summary:

GAAP

In millions, except per share data

Q3 2023

Q3 2022

Y/Y

Q2 2023

Q/Q

ATS revenue

$57.1

$35.2

62%

$53.0

8%

Wafer Services revenue

$14.5

$17.2

(16)%

$16.8

(14)%

Total revenue

$71.6

$52.3

37%

$69.8

3%

Gross profit

$14.1

$8.3

71%

$16.7

(15)%

Gross margin

19.8%

15.8%

400 bps

23.9%

(410) bps

Net loss to shareholders

$(7.6)

$(6.9)

(9)%

$(8.6)

NM

Basic loss per share

$(0.16)

$(0.17)

NM

$(0.19)

NM

Net loss margin to shareholders

(10.6)%

(13.3)%

270 bps

(12.3)%

170 bps

Non-GAAP

In millions, except per share data

Q3 2023

Q3 2022

Y/Y

Q2 2023

Q/Q

Non-GAAP gross profit

$14.6

$8.8

65%

$17.7

(17)%

Non-GAAP gross margin

20.4%

16.9%

350 bps

25.3%

(490) bps

Non-GAAP net loss to shareholders

$(2.2)

$(5.1)

57%

$(2.0)

(11)%

Non-GAAP basic loss per share

$(0.05)

$(0.13)

62%

$(0.04)

(25)%

Adjusted EBITDA

$8.3

$3.8

117%

$10.3

(19)%

Adjusted EBITDA margin

11.6%

7.3%

430 bps

14.7%

(310) bps

NM - Not meaningful

Q3 2023 Results:

- Revenue: Revenue of $71.6 million increased 37%

year-over-year. ATS revenue of $57.1 million increased 62%

year-over-year. ATS revenue contained $3.2 million of tool revenue

in the third quarter of 2023 and $0.2 million in the third quarter

of 2022. Wafer Services revenue of $14.5 million decreased (16)%

compared to the third quarter of 2022.

- Gross Profit: GAAP gross profit was $14.1 million, or

19.8% of revenue, compared to gross profit of $8.3 million, or

15.8% of revenue, in the third quarter of 2022. Non-GAAP gross

profit was $14.6 million, or 20.4% of revenue, compared to non-GAAP

gross profit of $8.8 million, or 16.9% of revenue, in the third

quarter of 2022.

- Operating Expenses: GAAP operating expenses were $18.3

million, compared to $13.4 million in the third quarter of 2022,

and included $3.5 million of project-based management consulting

transformation fees related to long-term improvement in automation

and operational efficiency that were not a component of operating

expenses in the third quarter of 2022.

- Net Loss: GAAP net loss to shareholders of $7.6 million,

or $(0.16) per share, compared to a net loss to shareholders of

$6.9 million, or $(0.17) per share, in the third quarter of 2022.

Non-GAAP net loss to shareholders of $2.2 million, or $(0.05) per

share, compared to a non-GAAP net loss to shareholders of $5.1

million, or $(0.13) per share, in the third quarter of 2022.

- Adjusted EBITDA: Adjusted EBITDA was $8.3 million, or

11.6% of revenue, compared to $3.8 million, or 7.3% of revenue, in

the third quarter of 2022.

A reconciliation between historical GAAP and non-GAAP

information is contained in the tables below in the section titled,

“Non-GAAP Financial Measures.”

Investor Webcast

SkyWater will host a conference call on Wednesday, November 8,

2023, at 3:30 p.m. CT to discuss its third quarter 2023 financial

results. A live webcast of the call will be available online at

IR.SkyWaterTechnology.com.

About SkyWater Technology

SkyWater (NASDAQ: SKYT) is a U.S.-based semiconductor

manufacturer and a DMEA-accredited Category 1A Trusted Foundry.

SkyWater’s Technology as a Service model streamlines the path to

production for customers with development services, volume

production and heterogeneous integration solutions in its

world-class U.S. facilities. This pioneering model enables

innovators to co-create the next wave of technology with diverse

categories including mixed-signal CMOS, read-out ICs, rad-hard ICs,

power management, MEMS, superconducting ICs, photonics, carbon

nanotubes and interposers. SkyWater serves growing markets

including aerospace & defense, automotive, biomedical, cloud

& computing, consumer, industrial and IoT. For more

information, visit: www.skywatertechnology.com.

Cautionary Statement Regarding Preliminary Results

The Company’s results for the third quarter of 2023 are

preliminary, unaudited and subject to the finalization of the

Company’s third quarter review and full-year audit and should not

be viewed as a substitute for full financial statements prepared in

accordance with GAAP. The Company cautions that actual results may

differ materially from those described in this press release.

SkyWater Technology Forward-Looking Statements

This press release contains “forward-looking” statements within

the meaning of the Private Securities Litigation Reform Act of

1995, including statements that are based on the Company’s current

expectations or forecasts of future events, rather than past events

and outcomes, and such statements are not guarantees of future

performance. Forward-looking statements include all statements

other than statements of historical fact contained in this

presentation, including information or predictions concerning the

Company’s future business, results of operations, financial

performance, plans and objectives, competitive position, market

trends, and potential growth and market opportunities. In some

cases, you can identify forward-looking statements by words such as

“intends,” “estimates,” “predicts,” “potential,” “continues,”

“anticipates,” “plans,” “expects,” “believes,” “should,” “could,”

“may,” “will,” “targets,” “projects,” “seeks” or the negative of

these terms or other comparable terminology.

Forward-looking statements are subject to risks, uncertainties

and assumptions, which may cause the Company’s actual results,

performance or achievements to be materially different from those

expressed or implied by such forward-looking statements. Key

factors that could cause the Company’s actual results to be

different than expected or anticipated include, but are not limited

to: our goals and strategies; our future business development,

financial condition and results of operations; our ability to

continue operating our sole semiconductor foundry at full capacity;

our ability to appropriately respond to changing technologies on a

timely and cost-effective basis; our customer relationships and our

ability to retain and expand our customer relationships; our

ability to accurately predict our future revenues for the purpose

of appropriately budgeting and adjusting our expenses; our

expectations regarding dependence on our largest customers; our

ability to diversify our customer base and develop relationships in

new markets; the performance and reliability of our third-party

suppliers and manufacturers; our ability to procure tools,

materials, and chemicals; our ability to control costs, including

our operating and capital expenses; the size and growth potential

of the markets for our solutions, and our ability to serve and

expand our presence in those markets; the level of demand in our

customers’ end markets; our ability to attract, train and retain

key qualified personnel in a competitive labor market; adverse

litigation judgments, settlements or other litigation-related

costs; changes in trade policies, including the imposition of

tariffs; our ability to raise additional capital or financing; our

ability to accurately forecast demand; the level and timing of U.S.

government program funding; our ability to maintain compliance with

certain U.S. government contracting requirements; regulatory

developments in the United States and foreign countries; our

ability to protect our intellectual property rights; our ability to

meet our long-term growth targets; and other factors discussed in

the “Risk Factors” section of the annual report on Form 10-K the

Company filed with the SEC on March 15, 2023 and in other documents

that the Company files with the SEC, which are available at

http://www.sec.gov. The Company assumes no obligation to update any

forward-looking statements, which speak only as of the date of this

press release.

SKYWATER TECHNOLOGY,

INC.

Consolidated Balance

Sheets

(Unaudited)

October 1, 2023

January 1, 2023

(in thousands, except share

data)

Assets

Current assets

Cash and cash equivalents

$

17,346

$

30,025

Accounts receivable (net of allowance for

credit losses of $4,699 and $1,638, respectively)

43,492

28,045

Contract assets (net of allowance for

credit losses of $227 and $0, respectively)

37,733

34,625

Inventory

16,648

13,397

Prepaid expenses and other current

assets

8,654

10,290

Income tax receivable

122

169

Total current assets

123,995

116,551

Property and equipment, net

165,818

179,915

Intangible assets, net

4,843

5,608

Other assets

5,053

3,690

Total assets

$

299,709

$

305,764

Liabilities and shareholders'

equity

Current liabilities

Current portion of long-term debt

$

4,241

$

1,855

Accounts payable

14,378

21,102

Accrued expenses

39,381

25,212

Short-term financing, net of unamortized

debt issuance costs

45,253

55,817

Contract liabilities

24,674

28,186

Total current liabilities

127,927

132,172

Long-term liabilities

Long-term debt, less current portion and

net of unamortized debt issuance costs

37,729

35,181

Long-term incentive plan

—

1,643

Long-term contract liabilities

55,636

67,967

Deferred income tax liability, net

1,121

1,239

Other long-term liabilities

9,466

13,585

Total long-term liabilities

103,952

119,615

Total liabilities

231,879

251,787

Shareholders' equity

Preferred stock, $0.01 par value per share

(80,000,000 shares authorized, zero shares issued and

outstanding)

—

—

Common stock, $0.01 par value per share

(200,000,000 shares authorized; 47,006,694 and 43,704,876 shares

issued and outstanding)

470

437

Additional paid-in capital

177,286

147,304

Accumulated deficit

(114,878

)

(94,072

)

Total shareholders' equity, SkyWater

Technology, Inc.

62,878

53,669

Noncontrolling interests

4,952

308

Total shareholders' equity

67,830

53,977

Total liabilities and shareholders'

equity

$

299,709

$

305,764

SKYWATER TECHNOLOGY,

INC.

Consolidated Statements of

Operations

(Unaudited)

Three-Month Period

Ended

Nine-Month Period

Ended

October 1, 2023

July 2, 2023

October 2, 2022

October 1, 2023

October 2, 2022

(in thousands, except share

data)

Revenue

$

71,624

$

69,811

$

52,326

$

207,529

$

147,854

Cost of revenue

57,477

53,144

44,049

160,247

138,437

Gross profit

14,147

16,667

8,277

47,282

9,417

Research and development expense

2,233

2,396

2,580

7,296

7,223

Selling, general, and administrative

expense

16,105

17,820

10,778

48,821

33,263

Operating loss

(4,191

)

(3,549

)

(5,081

)

(8,835

)

(31,069

)

Interest expense

(2,507

)

(2,950

)

(1,331

)

(7,928

)

(3,400

)

Loss before income taxes

(6,698

)

(6,499

)

(6,412

)

(16,763

)

(34,469

)

Income tax (benefit) expense

(96

)

25

87

(71

)

(44

)

Net loss

(6,602

)

(6,524

)

(6,499

)

(16,692

)

(34,425

)

Less: net income attributable to

noncontrolling interests

966

2,066

440

3,739

2,125

Net loss attributable to SkyWater

Technology, Inc.

$

(7,568

)

$

(8,590

)

$

(6,939

)

$

(20,431

)

$

(36,550

)

Net loss per share attributable to common

shareholders, basic and diluted

$

(0.16

)

$

(0.19

)

$

(0.17

)

$

(0.45

)

$

(0.91

)

Weighted average shares used in computing

net loss per common share, basic and diluted

46,445,309

44,743,269

40,669,322

45,001,998

40,245,736

SKYWATER TECHNOLOGY,

INC.

Consolidated Statements of

Cash Flows

(Unaudited)

Nine-Month Period

Ended

October 1, 2023

October 2, 2022

(in thousands)

Cash flows from operating activities

Net loss

$

(16,692

)

$

(34,425

)

Adjustments to reconcile net loss to net

cash flows used in operating activities

Depreciation and amortization

21,651

20,740

Amortization of debt issuance costs

included in interest expense

1,349

521

Long-term incentive and equity-based

compensation

5,673

7,033

Cash paid for contingent consideration in

excess of initial valuation

—

(816

)

Deferred income taxes

(118

)

(30

)

Cash paid for operating leases

(37

)

—

Cash paid for interest on finance

leases

(649

)

—

Provision for credit losses

4,133

—

Changes in operating assets and

liabilities

Accounts receivable and contract

assets

(23,063

)

773

Inventory

(3,251

)

(4,686

)

Prepaid expenses and other assets

270

(1,212

)

Accounts payable and accrued expenses

4,868

16,705

Contract liabilities, current and

long-term

(15,843

)

(10,612

)

Income tax receivable and payable

47

1

Net cash used in operating activities

(21,662

)

(6,008

)

Cash flows from investing activities

Purchase of software and licenses

(612

)

(400

)

Purchases of property and equipment

(3,864

)

(11,325

)

Net cash used in investing activities

(4,476

)

(11,725

)

Cash flows from financing activities

Draws on revolving line of credit

182,763

—

Paydowns of revolving line of credit

(194,396

)

—

Net proceeds on Revolver

—

14,522

Proceeds from tool financings

6,492

—

Repayment of VIE financing

(1,839

)

(765

)

Cash paid for principal on finance

leases

(818

)

(1,158

)

Proceeds from the issuance of common stock

pursuant to the employee stock purchase plan

2,305

1,800

Proceeds from the issuance of common

stock, net of commissions

20,397

2,186

Cash paid on license technology

obligations

(2,350

)

(1,150

)

Net contributions (distributions) from

(to) noncontrolling interest

905

(1,297

)

Net cash provided by financing

activities

13,459

14,138

Net uses of cash and cash equivalents

(12,679

)

(3,595

)

Cash and cash equivalents - beginning of

period

30,025

12,917

Cash and cash equivalents - end of

period

$

17,346

$

9,322

Supplemental Financial Information by Quarter

Q3 2023

Q2 2023

Q1 2023

Q4 2022

Q3 2022

Q2 2022

Q1 2022

(in thousands)

ATS revenue

$

57,134

$

53,009

$

48,306

$

47,876

$

35,172

$

29,823

$

26,575

Wafer Services revenue

14,490

16,802

17,788

17,211

17,154

17,584

21,546

Total revenue

$

71,624

$

69,811

$

66,094

$

65,087

$

52,326

$

47,407

$

48,121

Tool revenue (1)

$

3,243

$

936

$

536

$

30

$

219

$

313

$

984

Tool cost of revenue (1)

2,861

290

484

46

152

200

984

Tool gross profit (loss)

$

382

$

646

$

52

$

(16

)

$

67

$

113

$

—

Revenue impact of modified customer

contracts

$

—

$

3,601

$

—

$

4,685

$

—

$

—

$

8,230

Cost of revenue impact of modified

customer contracts

—

—

—

—

—

—

10,887

Gross profit (loss) impact of modified

customer contracts

$

—

$

3,601

$

—

$

4,685

$

—

$

—

$

(2,657

)

__________________

(1)

Tool revenue and cost of tool revenue

arise from the purchase, installation, and qualification of

equipment for our customers. This equipment is used to complete ATS

customer programs. Tool revenue is recorded in ATS revenue.

Non-GAAP Financial Measures

We provide supplemental, non-GAAP financial information that our

management regularly evaluates to provide additional insight to

investors as supplemental information to our results reported using

U.S. generally accepted accounting principles (GAAP). We provide

non-GAAP gross profit, non-GAAP gross margin, non-GAAP net loss to

shareholders, and non-GAAP net loss to shareholders per share. Our

management uses these non-GAAP financial measures to make informed

operating decisions, complete strategic planning, prepare annual

budgets, and evaluate Company and management performance. We

believe these non-GAAP financial measures are useful performance

measures to our investors because they provide a baseline for

analyzing trends in our business and exclude certain items that may

not be indicative of our core operating results. The non-GAAP

financial measures disclosed in this earnings press release should

not be viewed as an alternative to, or more meaningful than, the

reported results prepared in accordance with GAAP. In addition,

because these non-GAAP financial measures are not determined in

accordance with GAAP, other companies, including our peers, may

calculate their non-GAAP financial measures differently than we do.

As a result, the non-GAAP financial measures presented in this

earnings press release may not be directly comparable to similarly

titled measures presented by other companies.

We also provide adjusted earnings before interest, income taxes,

depreciation and amortization (EBITDA) and adjusted EBITDA margin

as supplemental non-GAAP measures. We define adjusted EBITDA as net

(loss) income before net interest expense, income tax (benefit)

expense, depreciation and amortization, equity-based compensation

and certain other items that we do not view as indicative of our

ongoing performance, including net income attributable to

noncontrolling interests, certain management consulting fees, CHIPS

Act specialist fees, management transition expense, and SkyWater

Florida start-up costs. Our management uses adjusted EBITDA and

adjusted EBITDA margin to make informed operating decisions,

complete strategic planning, prepare annual budgets, and evaluate

Company and management performance. We believe adjusted EBITDA is a

useful performance measure to our investors because it allows for

an effective evaluation of our operating performance when compared

to other companies, including our peers, without regard to

financing methods or capital structures. We exclude the items

listed above from net income or loss in arriving at adjusted EBITDA

because the amounts of these items can vary substantially within

our industry depending on the accounting methods and policies used,

book values of assets, capital structures, and the methods by which

assets were acquired. Adjusted EBITDA should not be considered as

an alternative to, or more meaningful than, net (loss) income

determined in accordance with GAAP. Certain items excluded from

adjusted EBITDA are significant components in understanding and

assessing a company’s financial performance, such as a company’s

cost of capital and tax structure, as well as the historic cost

bases of depreciable assets, none of which are reflected in

adjusted EBITDA. Our presentation of adjusted EBITDA should not be

construed as an indication that our results will be unaffected by

the items excluded from adjusted EBITDA. In future fiscal periods,

we may exclude such items and may incur income and expenses similar

to these excluded items. Accordingly, the exclusion of these items

and other similar items in our non-GAAP financial measures should

not be interpreted as implying that these items are non-recurring,

infrequent or unusual, unless otherwise expressly indicated.

We continuously evaluate the non-GAAP financial measures we use,

the manner in which non-GAAP financial measures are calculated, and

the adjustments we make to GAAP results to derive our non-GAAP

financial measures. In the third quarter of 2023, we made the

following changes to our non-GAAP financial measures and revised

prior period non-GAAP financial measures to conform the calculation

of non-GAAP financial measures across all periods and provide

comparability:

- Tool sales have historically been infrequent and viewed by

management as secondary to ATS development programs. Accordingly,

we previously excluded the margin on tool sales when calculating

non-GAAP gross profit, non-GAAP gross margin, non-GAAP earnings to

shareholders and non-GAAP earnings to shareholders per basic share.

Recently, our ATS customers have increasingly sought us to purchase

tools on their behalf and we expect this trend to continue going

forward. Accordingly, we no longer believe tool sales are

infrequent and therefore do not exclude the impact of tool revenue

and tool cost of revenue in the calculation of our non-GAAP

financial measures.

- Since the second quarter of 2023, we have incurred

project-based, management consulting fees related to long-term

transformation activities focused on improvement in automation and

operational efficiency. Similarly, we have also incurred

project-based specialist fees associated with our CHIPS Act

application. Neither of these types of fees are required to run our

business and, therefore, are incremental to our ongoing operations

and are not a normal operating expense. Beginning in the third

quarter of 2023, we began excluding these fees in the calculation

of non-GAAP earnings, non-GAAP earnings to shareholders per share,

and adjusted EBITDA.

The following tables present a reconciliation of the most

directly comparable financial measures, calculated and presented in

accordance with GAAP, to our non-GAAP financial measures.

SKYWATER TECHNOLOGY,

INC.

Reconciliation of GAAP to

Non-GAAP Financial Measures

(Unaudited)

Three-Month Period

Ended

October 1, 2023

July 2, 2023

(Revised)

October 2, 2022

(Revised)

(in thousands)

GAAP revenue

$

71,624

$

69,811

$

52,326

GAAP cost of revenue

$

57,477

$

53,144

$

44,049

Equity-based compensation (1)

(438

)

(291

)

(456

)

Management transition expense (2)

—

(705

)

—

SkyWater Florida start-up costs (3)

—

—

(114

)

Non-GAAP cost of revenue

$

57,039

$

52,148

$

43,479

GAAP gross profit

$

14,147

$

16,667

$

8,277

GAAP gross margin

19.8

%

23.9

%

15.8

%

Equity-based compensation (1)

$

438

$

291

$

456

Management transition expense (2)

—

705

—

SkyWater Florida start-up costs (3)

—

—

114

Non-GAAP gross profit

$

14,585

$

17,663

$

8,847

Non-GAAP gross margin

20.4

%

25.3

%

16.9

%

GAAP research and development expense

$

2,233

$

2,396

$

2,580

Equity-based compensation (1)

(218

)

(217

)

(115

)

Non-GAAP research and development

expense

$

2,015

$

2,179

$

2,465

GAAP selling, general, and administrative

expense

$

16,105

$

17,820

$

10,778

Equity-based compensation (1)

(1,197

)

(1,459

)

(1,128

)

Management transition expense (2)

—

(130

)

—

Management consulting fees (4)

(3,522

)

(2,500

)

—

CHIPS Act specialist fees (5)

—

(1,320

)

—

Non-GAAP selling, general, and

administrative expense

$

11,386

$

12,411

$

9,650

Three-Month Period

Ended

October 1, 2023

July 2, 2023

(Revised)

October 2, 2022

(Revised)

(in thousands)

GAAP net loss to shareholders

$

(7,568

)

$

(8,590

)

$

(6,939

)

Equity-based compensation (1)

1,853

1,967

1,699

Management transition expense (2)

—

835

—

SkyWater Florida start-up costs (3)

—

—

114

Management consulting fees (4)

3,522

2,500

—

CHIPS Act specialist fees (5)

—

1,320

—

Non-GAAP net loss to shareholders

$

(2,193

)

$

(1,968

)

$

(5,126

)

Equity-based compensation allocation in

the consolidated statements of operations (1):

Cost of revenue

$

438

$

291

$

456

Research and development expense

218

217

115

Selling, general, and administrative

expense

1,197

1,459

1,128

$

1,853

$

1,967

$

1,699

Management transition expense allocation

in the consolidated statements of operations (2):

Cost of revenue

$

—

$

705

$

—

Selling, general, and administrative

expense

—

130

—

$

—

$

835

$

—

Three-Month Period Ended

October 1, 2023

GAAP

Non-GAAP

Computation of net loss per common share,

basic and diluted:

(in thousands, except per

share data)

Numerator:

Net loss attributable to SkyWater

Technology, Inc.

$

(7,568

)

$

(2,193

)

Denominator:

Weighted-average common shares

outstanding, basic and diluted

46,445

46,445

Net loss per common share, basic and

diluted

$

(0.16

)

$

(0.05

)

Three-Month Period Ended

July 2, 2023 (Revised)

GAAP

Non-GAAP

Computation of net loss per common share,

basic and diluted:

(in thousands, except per

share data)

Numerator:

Net loss attributable to SkyWater

Technology, Inc.

$

(8,590

)

$

(1,968

)

Denominator:

Weighted-average common shares

outstanding, basic and diluted

44,743

44,743

Net loss per common share, basic and

diluted

$

(0.19

)

$

(0.04

)

Three-Month Period Ended

October 2, 2022

GAAP

Non-GAAP

Computation of net loss per common share,

basic and diluted:

(in thousands, except per

share data)

Numerator:

Net loss attributable to SkyWater

Technology, Inc.

$

(6,939

)

$

(5,126

)

Denominator:

Weighted-average common shares

outstanding, basic and diluted

40,669

40,669

Net loss per common share, basic and

diluted

$

(0.17

)

$

(0.13

)

Three-Month Period

Ended

Nine-Month Period

Ended

October 1, 2023

July 2, 2023 (Revised)

October 2, 2022

October 1, 2023

October 2, 2022

(in thousands)

Net loss to shareholders (GAAP)

$

(7,568

)

$

(8,590

)

$

(6,939

)

$

(20,431

)

$

(36,550

)

Net loss margin to shareholders

(10.6

)%

(12.3

)%

(13.3

)%

(9.8

)%

(24.7

)%

Interest expense (6)

$

2,507

$

2,950

$

1,331

$

7,928

$

3,400

Income tax (benefit) expense

(96

)

25

87

(71

)

(44

)

Depreciation and amortization

7,092

7,207

7,083

21,651

20,740

EBITDA

1,935

1,592

1,562

9,077

(12,454

)

Equity-based compensation (1)

1,853

1,967

1,699

5,673

7,033

Management transition expense (2)

—

835

—

835

—

SkyWater Florida start-up costs (3)

—

—

114

—

674

Management consulting fees (4)

3,522

2,500

—

6,022

—

CHIPS Act specialist fees (5)

—

1,320

—

1,320

—

Net income attributable to noncontrolling

interests (7)

966

2,066

440

3,739

2,125

Adjusted EBITDA

$

8,276

$

10,280

$

3,815

$

26,666

$

(2,622

)

Adjusted EBITDA margin

11.6

%

14.7

%

7.3

%

12.8

%

(1.8

)%

__________________

(1)

Represents non-cash equity-based

compensation expense.

(2)

Represents severance and other costs

related to the reorganization of the manufacturing and operations

leadership team.

(3)

Represents start-up costs associated with

our 200 mm heterogeneous integration facility in Kissimmee,

Florida, which includes legal fees, recruiting expenses, retention

awards and facility start-up expenses. These expenses are not

representative of our expected ongoing costs. Effective 2023, our

Kissimmee, Florida plant is up and running and no longer in its

start-up phase.

(4)

Represents project-based management

consulting fees related to long-term transformation activities

focused on improvement in automation and operational

efficiency.

(5)

Represents project-based specialist fees

related to our CHIPS Act application process.

(6)

Includes losses related to the

extinguishment of our revolving credit agreement in 2022.

(7)

Represents net income attributable to our

VIE, which was formed for the purpose of purchasing the land and

building of our primary operating facility in Bloomington,

Minnesota. Since depreciation and interest expense are excluded

from net loss in our adjusted EBITDA financial measure, we also

exclude the net income attributable to the VIE.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231108444761/en/

SkyWater Investor Contact: Claire McAdams |

claire@headgatepartners.com

SkyWater Media Contact: Lauri Julian |

Media@SkyWaterTechnology.com

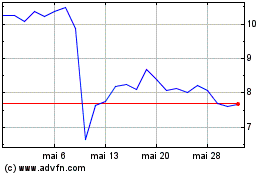

SkyWater Technology (NASDAQ:SKYT)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

SkyWater Technology (NASDAQ:SKYT)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025