Western Asset Mortgage Capital Corporation (NYSE: WMC) (“WMC”)

announced that its Board of Directors has declared a second interim

fourth quarter dividend of $0.10 per common share in light of the

adjournment of the special meeting of WMC stockholders until

December 5, 2023. The dividend is payable on December 5, 2023 to

stockholders of record as of November 30, 2023.

The second interim fourth quarter dividend is being made in

connection with the previously announced Agreement and Plan of

Merger, dated as of August 8, 2023 (the “Merger Agreement”), by and

among AG Mortgage Investment Trust, Inc. (“MITT”), AGMIT Merger

Sub, LLC (“Merger Sub”), WMC and, solely for the limited purposes

set forth in the Merger Agreement, AG REIT Management, LLC,

pursuant to which, subject to the terms and conditions therein, WMC

will be merged with and into Merger Sub, with Merger Sub continuing

as the surviving company (such transaction, the “Merger”). WMC

previously declared an interim fourth quarter dividend in the

amount of $0.14 to stockholders of record as of November 3, 2023,

which was paid on November 8, 2023. This second interim fourth

quarter dividend payment covers the period following the payment of

the first interim fourth quarter dividend through the day prior to

December 6, 2023, the expected closing date of the Merger. MITT is

also distributing a similar partial payment dividend to its common

stockholders of record.

Additional information regarding the proposed Merger is included

in the joint proxy statement/prospectus relating to the Merger that

was declared effective by the Securities and Exchange Commission

(the “SEC”) on September 29, 2023 and mailed to stockholders on or

about October 3, 2023.

About Western Asset Mortgage Capital Corporation

WMC is a real estate investment trust that invests in, finances,

and manages a diverse portfolio of assets consisting of Residential

Whole Loans, Non-Agency RMBS, and to a lesser extent GSE Risk

Transfer Securities, Commercial Loans, Non-Agency CMBS, Agency

RMBS, Agency CMBS, and ABS. WMC is externally managed and advised

by Western Asset Management Company, LLC, an investment advisor

registered with the SEC and a wholly-owned subsidiary of Franklin

Resources, Inc.

Important Additional Information and Where to Find It

In connection with the proposed Merger, MITT has filed with the

SEC a registration statement on Form S-4 (File No. 333-274319) (the

“Registration Statement”), which was declared effective by the SEC

on September 29, 2023. The Registration Statement includes a

prospectus of MITT and a joint proxy statement of MITT and WMC (the

“joint proxy statement/prospectus”). The joint proxy

statement/prospectus contains important information about MITT,

WMC, the proposed Merger and related matters. MITT and WMC may file

with the SEC other documents regarding the Merger. The definitive

joint proxy statement/prospectus has been sent to the stockholders

of MITT and WMC, and contains important information about MITT,

WMC, the proposed Merger and related matters. This communication is

not a substitute for any proxy statement, registration statement,

tender or exchange offer statement, prospectus or other document

MITT or WMC has filed or may file with the SEC in connection with

the proposed Merger and related matters. INVESTORS AND SECURITY

HOLDERS ARE ADVISED TO READ THE REGISTRATION STATEMENT ON FORM S-4

AND THE RELATED JOINT PROXY STATEMENT/PROSPECTUS (INCLUDING ALL

AMENDMENTS AND SUPPLEMENTS THERETO) AND OTHER RELEVANT DOCUMENTS

THAT ARE FILED OR MAY BE FILED BY MITT AND WMC WITH THE SEC

CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN IMPORTANT

INFORMATION ABOUT MITT, WMC AND THE PROPOSED MERGER. Investors

and security holders may obtain copies of these documents free of

charge through the website maintained by the SEC at www.sec.gov.

Copies of the documents filed by MITT with the SEC are also

available free of charge on MITT’s website at www.agmit.com. Copies

of the documents filed by WMC with the SEC are also available free

of charge on WMC’s website at www.westernassetmcc.com.

Participants in the Solicitation Relating to the

Merger

MITT, WMC and certain of their respective directors and

executive officers and certain other affiliates of MITT and WMC may

be deemed to be participants in the solicitation of proxies from

the common stockholders of WMC in respect of the proposed Merger.

Information regarding WMC and its directors and executive officers

and their ownership of common stock of WMC can be found in WMC’s

Annual Report on Form 10-K for the fiscal year ended December 31,

2022, filed with the SEC on March 13, 2023, and in its definitive

proxy statement relating to its 2023 annual meeting of

stockholders, filed with the SEC on May 2, 2023. Information

regarding MITT and its directors and executive officers and their

ownership of common stock of MITT can be found in MITT’s Annual

Report on Form 10-K for the fiscal year ended December 31, 2022,

filed with the SEC on February 27, 2023, and in its definitive

proxy statement relating to its 2023 annual meeting of

stockholders, filed with the SEC on March 22, 2023. Additional

information regarding the interests of such participants in the

Merger is included in the joint proxy statement/prospectus and

other relevant documents relating to the proposed Merger filed with

the SEC. These documents are available free of charge on the SEC’s

website and from MITT or WMC, as applicable, using the sources

indicated above.

No Offer or Solicitation

This communication and the information contained herein shall

not constitute an offer to sell or the solicitation of an offer to

buy any securities, nor shall there be any sale of securities in

any jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of any such jurisdiction. No offering of securities

shall be made except by means of a prospectus meeting the

requirements of Section 10 of the Securities Act of 1933, as

amended (the “Securities Act”). This communication may be deemed to

be solicitation material in respect of the proposed Merger.

Forward-Looking Statements

This document contains certain “forward-looking” statements

within the meaning of Section 27A of the Securities Act and Section

21E of the Securities Exchange Act of 1934, as amended. MITT and

WMC intend such forward-looking statements to be covered by the

safe harbor provisions for forward-looking statements contained in

the Private Securities Litigation Reform Act of 1995 and include

this statement for purposes of complying with the safe harbor

provisions. Words such as “expects,” “anticipates,” “intends,”

“plans,” “believes,” “seeks,” “estimates,” “will,” “should,” “may,”

“projects,” “could,” “estimates” or variations of such words and

other similar expressions are intended to identify such

forward-looking statements, which generally are not historical in

nature, but not all forward-looking statements include such

identifying words. Forward-looking statements regarding MITT and

WMC include, but are not limited to, statements related to the

proposed Merger, including the anticipated timing, benefits and

financial and operational impact thereof; other statements of

management’s belief, intentions or goals; and other statements that

are not historical facts. These forward-looking statements are

based on each of the companies’ current plans, objectives,

estimates, expectations and intentions and inherently involve

significant risks and uncertainties. Actual results and the timing

of events could differ materially from those anticipated in such

forward-looking statements as a result of these risks and

uncertainties, which include, without limitation, risks and

uncertainties associated with: MITT’s and WMC’s ability to complete

the proposed Merger on the proposed terms or on the anticipated

timeline, or at all, including risks and uncertainties related to

securing the necessary stockholder approval from WMC’s stockholders

and satisfaction of other closing conditions to consummate the

proposed Merger; the occurrence of any event, change or other

circumstance that could give rise to the termination of the Merger

Agreement; risks related to diverting the attention of MITT and WMC

management from ongoing business operations; failure to realize the

expected benefits of the proposed Merger; significant transaction

costs and/or unknown or inestimable liabilities; the risk of

stockholder litigation in connection with the proposed Merger,

including resulting expense or delay; the risk that MITT’s and

WMC’s respective businesses will not be integrated successfully or

that such integration may be more difficult, time-consuming or

costly than expected; the amount and timing of MITT’s remaining

fourth quarter dividend; and effects relating to the announcement

of the proposed Merger or any further announcements or the

consummation of the proposed Merger on the market price of MITT’s

or WMC’s common stock. Additional risks and uncertainties related

to MITT’s and WMC’s business are included under the headings

“Forward-Looking Statements” and “Risk Factors” in MITT’s and WMC’s

Annual Report on Form 10-K for the year ended December 31, 2022,

MITT’s and WMC’s Quarterly Reports on Form 10-Q for the quarter

ended June 30, 2023 and September 30, 2023, the joint proxy

statement/prospectus and in other reports and documents filed by

either company with the SEC from time to time. Moreover, other

risks and uncertainties of which MITT or WMC are not currently

aware may also affect each of the companies’ forward-looking

statements and may cause actual results and the timing of events to

differ materially from those anticipated. The forward-looking

statements made in this communication are made only as of the date

hereof or as of the dates indicated in the forward-looking

statements, even if they are subsequently made available by MITT or

WMC on their respective websites or otherwise. Neither MITT nor WMC

undertakes any obligation to update or supplement any

forward-looking statements to reflect actual results, new

information, future events, changes in its expectations or other

circumstances that exist after the date as of which the

forward-looking statements were made, except as required by

law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20231117439311/en/

Investors Western Asset Mortgage Capital Corporation

Larry Clark Financial Profiles, Inc. (310) 622-8223

lclark@finprofiles.com

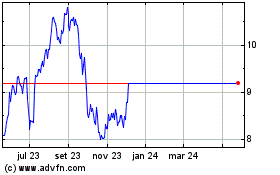

Western Asset Mortgage C... (NYSE:WMC)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Western Asset Mortgage C... (NYSE:WMC)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024