- Cash position of €2.8 million, including €1 million of

Research Tax Credit pre-financing implemented in early January

2024

- Capital increase designed to secure funding for completion

of Post-COVID Phase 2 trial, with results expected in June 2024,

and to extend the Company’s financial runway

- Offering of an indicative amount of €5 million, composed of

a reserved offering for specialized and strategic investors and a

public offering for retail investors, in France only via the

PrimaryBid platform

- Issue price of 1.05 euro per new share, a 17% discount from

closing price of January 31, 2024

- Subscription commitments of minimum 60% by historical

shareholders, Institut Mérieux and Servier

- Closing of the offering conducted through the PrimaryBid

platform on February 1, 2024 at 10 p.m. (CET) and of the Reserved

Offering on February 2, 2024 before market open (subject to early

closing)

Regulatory News:

NOT FOR PUBLICATION, DISTRIBUTION OR RELEASE, IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED STATES,

AUSTRALIA, CANADA, JAPAN, SOUTH AFRICA OR ANY OTHER JURISDICTION IN

WHICH IT WOULD BE UNLAWFUL TO DO SO

GeNeuro (Euronext Paris: CH0308403085 - GNRO), a

biopharmaceutical company focused on stopping the progression of

neurodegenerative and autoimmune diseases such as multiple

sclerosis (MS), amyotrophic lateral sclerosis (ALS) and Post-Acute

Sequelae of COVID-19 (PASC, long-COVID or post-COVID), today

announces the launch of a private placement of ordinary shares to

be issued by the Company, in connection with a share capital

increase without preferential subscription rights of an indicative

amount of €5 million by way of a private placement reserved to

certain qualified investors, with an accelerated book-building; the

offering will also include a public offering for retail investors,

in France only through the PrimaryBid platform. The Company also

announces its 2023 year-end cash position.

Cash position at December 31, 2023

At December 31, 2023, GeNeuro had €1.8 million in cash and cash

equivalents. In addition, the Company implemented a non-recourse

bank pre-financing of €1 million for its 2022 Research Tax Credit,

which was received in cash in January 2024; taking this into

account, the said cash and cash equivalent unaudited position as at

31 December 2023 would amount to €2.8 million.

As announced in November 2023, the Company completed the

recruitment of its Phase 2 trial evaluating temelimab against

Post-COVID and expects topline results in June 2024. The trial

“Temelimab as a Disease Modifying Therapy in Patients With

Neuropsychiatric Symptoms in Post-COVID 19 or PASC Syndrome” is a

randomized, placebo-controlled, biomarker-based, Phase 2 clinical

trial assessing the effect of the treatment with temelimab on the

clinical course of these symptoms. The trial has recruited 203

patients across 14 clinical centers in Switzerland, Spain and

Italy. All enrolled patients receive 6 intravenous infusions of

temelimab or placebo (1 to 1 randomization) over 24 weeks. The

clinical endpoints will assess the efficacy and the safety of the

treatment with temelimab on the improvement in fatigue as well as a

large panel of cognitive impairment measures.

Cash burn from operating and investing activities in the second

half of 2023 was €5.6 million, compared to €4.7 million in the

first half of 2023; the increase is due to the trial’s longer

recruitment period and to increased working capital needs. As a

result, the Company’s financial resources at year-end 2023

(including the Research Tax Credit pre-financing received in

January 2024) are not sufficient to cover its upcoming deadlines

and operational expenses and the Company will use the net proceeds

from the Offering to secure the completion of the Post-COVID study

and to extend its financial runway into early third quarter of

2024.

Reasons for the Offering

The proceeds of the Offering, combined with the Company's

existing cash position, are intended primarily to (i) cover the net

costs of €6.8 million for the completion of the ongoing Phase 2

trial in Post-COVID, with results expected in June 2024, (ii)

extend the company’s runway, which had been reduced, before the

Offering, from theQ3 2024 to mid Q2 2024, to early Q3 quarter of

2024 and (iii) for the Company’s general corporate needs.

Terms of the Offering

Pursuant to applicable Swiss law and Section 5bis of the

Company’s bylaws, as adopted by the Ordinary Shareholders’ Meeting

of June 14, 2023, the Board of Directors of the Company has

decided, at the date of this press release, to launch a capital

increase with waiver of shareholders’ subscription rights by way of

a book-built private placement reserved for qualified investors

(the “Private Placement”) and a public offering for retail

investors in France only through the PrimaryBid platform (the

“PrimaryBid Offer” and, together with the Private Placement,

the “Offering”). The Offering will be carried out by issuing

new ordinary shares at a fixed price of €1.05 per new share in

connection with the Private Placement (the "Private Placement

New Shares") and the PrimaryBid Offer (the "PrimaryBid New

Shares" and, together with the Private Placement Shares, the

"New Shares").

GeNeuro’s principal shareholder, GNEH SAS (a subsidiary of

Institut Mérieux), which holds 40% of GeNeuro’s share capital prior

to the Offering, has committed to subscribe at least pro rata to

its shareholding stake in the Company, i.e. for illustrative

purpose, for at least €2 million out of the €5 million expected to

be raised in connection with the Offering, in connection with the

Private Placement, and Servier has committed to subscribe for a

minimum amount of €1 million in connection with the Private

Placement. In accordance with applicable Swiss laws and

regulations, the GNEH’s representative at the Board of directors of

GeNeuro has not participated, and will not participate, in the vote

on the Board of Directors’ decisions relating to the Offering. As a

result, the subscription commitments received by the Company, as

described above, represent a minimum of 60% of the Offering,

corresponding to a total amount of €3 million.

The book building process will begin immediately following the

publication of this press release. The results of the Offering will

be announced after the closing of the accelerated book building

process by way of a press release published before market open on

February 2, 2024.

The Issue Price is expected to be €1.05 per New Share, which

represents a discount of 17% on the closing market price of the

Company’s shares on Euronext Paris on the last trading day

preceding the closing date of the Offering, i.e. €1.26 on January

31, 2024.

The size of the Offering will depend exclusively on the orders

received for the Private Placement and the PrimaryBid Offer, with

no possibility of reallocating the amounts allocated from one to

the other. The PrimaryBid Offer is ancillary to the Private

Placement and will represent a maximum amount corresponding to 20%

of the amount of the Offer and will be limited to 8 million euros.

Allocations of new shares will be proportional to demand, subject

to reduction of allocations if demand exceeds the aforementioned

limits. In any event, the PrimaryBid Offer will not be carried out

if the Private Placement does not take place.

Bryan, Garnier & Co will act as Sole Global Coordinator and

Sole Bookrunner (the “Placement Agent”).

In connection with the Offering, the Company has entered into a

lock-up commitment effective from the date of signature of the

placement agreement entered into between the Company and the

Placement Agent today for a period of 90 days following the

settlement-delivery date of the Offering, subject to customary

exceptions. Certain directors and significant shareholders,

together holding around 70% of the Company's share capital, have

also entered into a lock-up commitment, effective from the date of

signature thereof, with respect to their shares in the Company for

a period of 90 days following the settlement-delivery date of the

Offering, subject to certain customary exceptions.

The settlement-delivery of the New Shares and their admission to

trading on the regulated market of Euronext Paris are scheduled for

February 7, 2024.

Prospectus

The new shares issued under the Private Placement will be

admitted to trading on the regulated market of Euronext in Paris by

virtue of an admission prospectus submitted for approval to the

Autorité des marchés financiers (the "AMF") and comprising the 2022

universal registration document filed with the AMF on April 28,

2023 under number D.23-0385, including the 2022 annual financial

report, as supplemented by an amendment to the 2022 universal

registration document, which will be filed with the AMF on 2

February 2024, and a securities note, including a summary of the

prospectus (the "Prospectus"). As from the filing with the AMF,

copies of the 2022 universal registration document, as amended, and

the listing prospectus will be available free of charge at the

Company's registered office at 3 chemin du Pré-Fleuri - 1228

Plan-les-Ouates - Geneva - Switzerland, on the Company's website

(www.geneuro.com) and on the AMF website (www.amf-france.org).

Risk factors

The Company draws the public's attention to the risk factors

relating to the Company and its activities, presented in section 3

of the Company's 2022 universal registration document, filed with

the AMF on April 28, 2023, under number D.23-0385, available free

of charge on the Company's website (https://www.geneuro.com) and

the AMF website (https://www.amf-france.org). The occurrence of any

or all of these risks could have an adverse effect on the Company's

business, financial situation, results, development or

prospects.

In addition, investors are invited to consider the following

risks specific to the Offer: (i) the volatility of the Company's

shares could fluctuate significantly; (ii) the Company's two main

shareholders will continue to hold a significant percentage of its

share capital; (iii) shareholders cannot benefit from any

change-of-control premium on their shares, as neither French nor

Swiss law on mandatory takeover bids applies to the Company; (iv)

the disposal by the Company's main shareholders of a significant

number of shares in the Company at the end of the lock-up period

could have a negative impact on the market price of the Company's

shares; and (v) the placement agreement between the Company and the

Placement Agent may be terminated at any time.

About GeNeuro

GeNeuro‘s mission is to develop safe and effective treatments

against neurological disorders and autoimmune diseases, such as

multiple sclerosis, by neutralizing causal factors encoded by

HERVs, which represent 8% of human DNA. GeNeuro is based in Geneva,

Switzerland and has R&D facilities in Lyon, France and owns

rights to 17 patent families protecting its technology.

For more information, visit: https://www.geneuro.com

More information about the Company, and in particular on its

activities, results and corresponding risk factors, can be found in

the 2022 Universal Registration Document filed with the French

Autorité des marchés financiers under number D.23-0385. The 2022

Registration Document of the Company is available, together with

other regulated information of the Company and with its press

releases on its website (www.geneuro.com).

Forward Looking Statements

This press release contains certain forward-looking statements

and estimates concerning GeNeuro’s financial condition, operating

results, strategy, projects and future performance and the market

in which it operates. Such forward-looking statements and estimates

may be identified by words, such as “anticipate,” “believe,” “can,”

“could,” “estimate,” “expect,” “intend,” “is designed to,” “may,”

“might,” “plan,” “potential,” “predict,” “objective,” “should,” or

the negative of these and similar expressions. They incorporate all

topics that are not historical facts. Forward-looking statements,

forecasts and estimates are based on management’s current

assumptions and assessment of risks, uncertainties and other

factors, known and unknown, which were deemed to be reasonable at

the time they were made but which may turn out to be incorrect.

Events and outcomes are difficult to predict and depend on factors

beyond the Company’s control. Consequently, the actual results,

financial condition, performances and/or achievements of GeNeuro or

of the industry results may turn out to differ materially from the

future results, performances or achievements expressed or implied

by these statements, forecasts and estimates. Owing to these

uncertainties, no representation is made as to the correctness or

fairness of these forward-looking statements, forecasts and

estimates. Furthermore, forward-looking statements, forecasts and

estimates speak only as of the date on which they are made, and

GeNeuro undertakes no obligation to update or revise any of them,

whether as a result of new information, future events or otherwise,

except as required by law.

Legal notice

This announcement and the information contained herein do not

constitute either an offer to sell or purchase, or the solicitation

of an offer to sell or purchase, securities of GeNeuro S.A. (the

“Company”).

No communication or information in respect of the issuance by

the Company of the New Shares may be distributed to the public in

any jurisdiction where registration or approval is required. No

steps have been taken or will be taken in any jurisdiction where

such steps would be required. The offering or subscription of

shares may be subject to specific legal or regulatory restrictions

in certain jurisdictions. The Company takes no responsibility for

any violation of any such restrictions by any person.

This announcement does not, and shall not, in any circumstances,

constitute a public offering, an offer to purchase nor an

invitation to the public in connection with any public offer

transaction. The distribution of this document may be restricted by

law in certain jurisdictions. Persons into whose possession this

document comes are required to inform themselves about and to

observe any such restrictions.

This announcement is an advertisement, and not a prospectus

within the meaning of Regulation (EU) 2017/1129 of the European

Parliament and of the Council of 14 June 2017, as amended, (the

“Prospectus Regulation“), as implemented in each member State of

the European Economic Area.

France

The offering of GeNeuro shares described above will be carried

out as part of a capital increase by way of (i) a private placement

reserved for qualified investors and (ii) a public offering to

retail investors in France only via the PrimaryBid platform, which

benefits from an exemption from the prospectus requirement pursuant

to the provisions of article 211-3 of the Autorité des marchés

financiers (“AMF”)'s General Regulations and articles 1(4) and 3 of

the Prospectus Regulation.

The New Shares of the Company's Private Placement issued in

connection with the capital increase will not be offered or sold,

directly or indirectly, to the public in France to persons other

than qualified investors within the meaning of Article 2(e) of the

Prospectus Regulation in connection with the Private Placement. The

New PrimaryBid Shares will only be offered to the public via the

PrimaryBid platform in France as part of the PrimaryBid

Offering.

Any offer or sale of the Company's shares or distribution of

offering documents has been, and will be made, in France only to

qualified investors as defined by Article 2(e) of the Prospectus

Regulation and in accordance with Articles L. 411-1 and L. 411-2 of

the French Monetary and Financial Code.

In connection with the admission of the new shares issued under

the Private Placement, the Company will submit an admission

prospectus to the AMF for approval. The PrimaryBid Offering does

not give rise to a prospectus subject to approval by the AMF.

European Economic Area and United Kingdom

With respect to the member States of the European Economic Area,

other than France and the United Kingdom, (each, a “Relevant

State”), no action has been undertaken or will be undertaken to

make an offer to the public of the shares requiring a publication

of a prospectus in any Relevant State. Consequently, the securities

cannot be offered and will not be offered in any Relevant State

(other than France), (i) to qualified investors within the meaning

of the Prospectus Regulation, for any investor in a Member State of

the European Economic Area, or Regulation (EU) 2017/1129 as part of

national law under the European Union (Withdrawal) Act 2018 (the

“UK Prospectus Regulation”), for any investor in the United

Kingdom, (ii) to fewer than 150 individuals or legal entities

(other than qualified investors as defined in the Prospectus

Regulation or the UK Prospectus Regulation, as the case may be), or

(iii) in accordance with the exemptions set out in Article 1(4) of

the Prospectus Regulation, or in the other case which does not

require the publication by GeNeuro of a prospectus pursuant to the

Prospectus Regulation, the UK Prospectus Regulation and/or

applicable regulation in this Member States.

No action has been undertaken or will be undertaken to make

available the New Shares of the Company to any retail investor in

the European Economic Area. For the purposes of this press release,

the expression “retail investor” means a person who is one (or

more) of the following:

- a retail client as defined in point (11) of

Article 4(1) of Directive 2014/65/EU (as amended, “MiFID II“);

or

- a customer within the meaning of Directive

2016/97/EU, as amended, where that customer would not qualify as a

professional client as defined in point (10) of Article 4(1) of

MiFID II; or not a “qualified investor” as defined in the

Prospectus Regulation; and

- the expression “offer” includes the

communication in any form and by any means of sufficient

information on the terms of the offer and the shares to be offered

so as to enable an investor to decide to purchase or subscribe the

shares.

United States

This document may not be distributed, directly or indirectly, in

or into the United States. This document does not constitute an

offer of securities for sale nor the solicitation of an offer to

purchase securities in the United States or any other jurisdiction

where such offer may be restricted. Securities may not be offered

or sold in the United States absent registration under the U.S.

Securities Act of 1933, as amended (the “Securities Act”) except

pursuant to an exemption from, or in a transaction not subject to,

the registration requirements thereof. The securities of the

Company have not been and will not be registered under the

Securities Act, and the Company does not intend to make a public

offering of its securities in the United States. Copies of this

document are not being, and should not be, distributed in or sent

into the United States.

United Kingdom

This press release does not constitute an offer of the

securities to the public in the United Kingdom. The distribution of

this press release is not made, and has not been approved, by an

authorized person (“authorized person”) within the meaning of

Article 21(1) of the Financial Services and Markets Act 2000. As a

consequence, this press release is directed only at persons who (i)

are located outside the United Kingdom, (ii) have professional

experience in matters relating to investments and fall within

Article 19(5) of the Financial Services and Markets Act 2000

(Financial Promotions) Order 2005, as amended and (iii) are persons

falling within Article 49(2)(a) to (d) (high net worth companies,

unincorporated associations, etc.) of the Financial Services and

Markets Act 2000 (Financial Promotion) Order 2005 (the persons

mentioned under (i), (ii) and (iii) together “Relevant Persons”).

The securities of GeNeuro are directed only at Relevant Persons and

no invitation, offer or agreements to subscribe, purchase or

otherwise acquire the securities of GeNeuro may be proposed or made

other than with Relevant Persons. Any person other than a Relevant

Person may not act or rely on this document or any provision

thereof. This press release is not a prospectus which has been

approved by the Financial Conduct Authority or any other United

Kingdom regulatory authority for the purposes of Section 85 of the

Financial Services and Markets Act 2000.

This document may not be distributed, directly or indirectly, in

or into the United States, Canada, Australia, Japan, South Africa

or any other jurisdiction in which it would be unlawful to do

so.

Any decision to subscribe for or purchase GeNeuro shares should

be made solely on the basis of publicly available information about

GeNeuro. This information is not the responsibility of Bryan,

Garnier & Co. and has not been independently verified by Bryan,

Garnier & Co.

The distribution of this press release may be subject to

specific regulations in certain countries. Persons in possession of

this press release comes should inform themselves about and observe

any local restrictions.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240201723063/en/

GeNeuro Jesús Martin-Garcia Chairman and CEO +41 22 552

48 00 investors@geneuro.com

NewCap (France) Investor Relations – Mathilde Bohin /

Louis-Victor Delouvrier +33 1 44 71 98 52

Media Relations – Arthur Rouillé +33 1 44 71 94 98 geneuro@newcap.eu

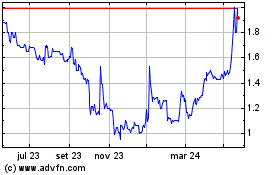

GeNeuro (EU:GNRO)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

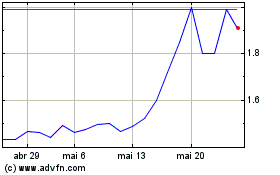

GeNeuro (EU:GNRO)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025