Clean Harbors to Acquire HEPACO for $400 Million

06 Fevereiro 2024 - 10:30AM

Business Wire

- Leading Provider of Specialized Environmental and Emergency

Response Services in Eastern U.S. Will Accelerate Growth

Opportunities in Environmental Services Segment

- Significant Margin Improvement to be Achieved Through Projected

$20 Million in Cost Synergies and Efficiency Gains

- HEPACO Adds Complementary Emergency Response Rail Assets

- Transaction Expected to Close in the First Half of 2024

Clean Harbors, Inc. (“Clean Harbors”) (NYSE: CLH) today

announced it has entered into a definitive agreement with Gryphon

Investors (“Gryphon”) to acquire HEPACO (“HEPACO”), a leading

provider of specialized environmental and emergency response

services in the Eastern United States, for $400 million in cash.

The acquisition is expected to close in the first half of 2024,

subject to regulatory approval and other customary closing

conditions.

“HEPACO is a recognized leader in Field Services and its

addition will accelerate the growth of our Environmental Services

segment,” said Eric Gerstenberg, Co-Chief Executive Officer of

Clean Harbors. “When providing emergency services, scale and rapid

response capabilities are critical. HEPACO’s geographic footprint,

trained personnel and equipment fleet will enhance our existing

business, enabling us to gain efficiencies and offer an even

broader range of solutions. Field Services and emergency response

have been a hallmark of Clean Harbors since our founding in 1980.

We are confident that we can deliver strong shareholder value

through this transaction in the years ahead.”

Headquartered in Charlotte, North Carolina, HEPACO has more than

2,000 customers, which it services through more than 40 regional

locations in 17 states. Its primary offerings include field

services, environmental remediation and emergency response

services.

On an adjusted basis, HEPACO is expected to generate full-year

2023 EBITDA of approximately $36 million on $270 million of

revenues. Clean Harbors expects the acquisition to generate cost

synergies of approximately $20 million after the first full year of

operations, which equates to a post-synergy acquisition multiple of

7.1 times. Clean Harbors expects to fund the acquisition through

available cash and the issuance of some additional debt

financing.

Mike Battles, Co-Chief Executive Officer of Clean Harbors, said,

“The acquisition of HEPACO aligns with our Vision 2027 long-term

strategic plan for driving growth through a continued focus on

value creation across all areas of our business. We see an

excellent cultural fit with our two organizations that should help

ensure the success of this acquisition. HEPACO has demonstrated a

commitment to safety, environmental compliance and service

excellence that matches our principles in these areas. We look

forward to welcoming HEPACO’s talented team to the Clean Harbors

family.”

Key strategic benefits of the transaction for Clean Harbors

include:

- Complementary product offerings that increase the scale and

capabilities of Clean Harbors’ Field Services business;

- Synergies in areas such as subcontracting, branch network,

asset rentals, transportation and procurement;

- Expansion of its rail and marine service capabilities through

the addition of HEPACO’s highly trained people and specialized

equipment;

- The opportunity to drive additional volumes of waste to Clean

Harbors’ network of disposal and recycling facilities;

- Meaningful cross-selling opportunities, particularly for

industrial services and hazardous waste disposal; and

- The opportunity to introduce new customers to the Clean Harbors

and Safety-Kleen brands, and to deepen relationships with existing

customers.

HEPACO employs approximately 1,000 people, operates a fleet of

more than 900 vehicles and serves a diverse set of industry

verticals. In addition to the company’s regional operations

spanning 17 states, HEPACO’s National Operations center provides

24-hour coverage across the continental U.S. through a network of

contractors.

Robb Schreck, Chief Executive Officer of HEPACO, said, “Given

its leading position in environmental and field services, as well

as a 40-year history in emergency response, Clean Harbors is an

ideal fit for HEPACO. Clean Harbors will provide HEPACO’s customers

with far greater resources and access to North America’s largest

network of permitted disposal and recycling assets. This

transaction also will offer enhanced career opportunities for

HEPACO employees.”

For this acquisition, Davis, Malm & D’Agostine is serving as

legal counsel to Clean Harbors. For HEPACO, Piper Sandler Companies

and Houlihan Lokey, Inc. are serving as financial advisors and

Kirkland & Ellis LLP and Moore & Van Allen PLLC are serving

as legal counsel.

About Clean Harbors

Clean Harbors (NYSE: CLH) is North America’s leading provider of

environmental and industrial services. The Company serves a diverse

customer base, including a majority of Fortune 500 companies. Its

customer base spans a number of industries, including chemical,

manufacturing and refining, as well as numerous government

agencies. These customers rely on Clean Harbors to deliver a broad

range of services such as end-to-end hazardous waste management,

emergency spill response, industrial cleaning and maintenance, and

recycling services. Through its Safety-Kleen subsidiary, Clean

Harbors also is North America’s largest re-refiner and recycler of

used oil and a leading provider of parts washers and environmental

services to commercial, industrial and automotive customers.

Founded in 1980 and based in Massachusetts, Clean Harbors operates

in the United States, Canada, Mexico, Puerto Rico and India. For

more information, visit www.cleanharbors.com.

Safe Harbor Statement

Any statements contained herein that are not historical facts

are forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. These forward-looking

statements are generally identifiable by use of the words

“believes,” “expects,” “intends,” “anticipates,” “plans to,”

“seeks,” “should,” “estimates,” “projects,” “may,” “likely,” or

similar expressions. Such statements may include, but are not

limited to, statements about future financial and operating

results, and other statements that are not historical facts. Such

statements are based upon the beliefs and expectations of Clean

Harbors’ management as of this date only and are subject to certain

risks and uncertainties that could cause actual results to differ

materially, including, without limitation, the risks and

uncertainties surrounding the proposed Clean Harbors and HEPACO

transaction, and those items identified as “Risk Factors” in Clean

Harbors’ most recently filed Form 10-K and Form 10-Q.

Forward-looking statements are neither historical facts nor

assurances of future performance. Therefore, readers are cautioned

not to place undue reliance on these forward-looking statements.

Clean Harbors undertakes no obligation to revise or publicly

release the results of any revision to these forward-looking

statements other than through its filings with the Securities and

Exchange Commission, which may be viewed in the “Investors” section

of Clean Harbors’ website at www.cleanharbors.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240206126978/en/

Eric J. Dugas EVP and Chief Financial Officer Clean Harbors,

Inc. 781.792.5100 InvestorRelations@cleanharbors.com

Jim Buckley SVP Investor Relations Clean Harbors, Inc.

781.792.5100 Buckley.James@cleanharbors.com

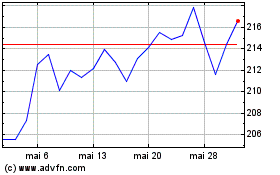

Clean Harbors (NYSE:CLH)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Clean Harbors (NYSE:CLH)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025