Experian Consumer Credit Reports to Now Include Apple Pay Later Loan Information

28 Fevereiro 2024 - 10:00AM

Business Wire

In a move towards greater transparency and responsible credit

reporting in the buy now, pay later (BNPL) industry, Experian®

today announced it will now include “pay-in-4” BNPL loan

information from Apple Pay Later on consumers’ credit reports,

making Apple the first major BNPL provider to fully furnish

“pay-in-4” loan information and payment history directly to the

credit reporting agency.

Experian is committed to driving transparency in the BNPL

industry and doing so in a way that doesn’t inadvertently

negatively impact consumers. Given this, Apple Pay Later loans

borrowed today onward will appear on a consumer’s Experian credit

report with a BNPL designation starting March 1. While consumers

will be able to see their Apple Pay Later loan information on their

Experian credit report, the information won’t be factored into

existing traditional credit scores but may in the future as new

credit scoring models are developed.

When BNPL account information becomes more widely reported to

Experian by additional BNPL providers, a consumer’s BNPL history

will be visible to lenders who request an Experian credit report —

enabling lenders to make more informed decisions when determining

whether to extend credit offers.

“We designed Apple Pay Later with our users’ financial health in

mind, and an important part of this is ensuring that their loans

are reflected in their overall financial profiles,” said Jennifer

Bailey, Apple’s vice president of Apple Pay and Apple Wallet. “By

reporting Apple Pay Later loans to Experian, we aim to help promote

greater transparency and responsible lending for both the borrower

and the lender, while providing users with the opportunity to

further build their credit.”

Experian’s role as the first credit bureau receiving Apple Pay

Later loan information underscores the company’s commitment to

drive industry transparency while protecting consumers. Experian

has a longstanding history of working with leading BNPL providers

and is in active conversations to expand the reporting of BNPL

information on consumer credit reports.

“Experian has long supported the use of expanded data sources,

including BNPL information, to help consumers build their credit

profile and improve their financial health,” said Jennifer Schulz,

CEO of Experian North America. "We applaud Apple for taking this

meaningful first step and look forward to working with other

leading BNPL providers to drive greater transparency that will

benefit lenders and consumers alike."

To learn more, visit

https://www.experian.com/consumer-education-content/buy-now-pay-later-faq.

About Experian

Experian is the world’s leading global information services

company. During life’s big moments – from buying a home or a car,

to sending a child to college, to growing a business by connecting

with new customers – we empower consumers and our clients to manage

their data with confidence. We help individuals to take financial

control and access financial services, businesses to make smarter

decisions and thrive, lenders to lend more responsibly, and

organisations to prevent identity fraud and crime.

We have 22,000 people operating across 32 countries and every

day we’re investing in new technologies, talented people, and

innovation to help all our clients maximise every opportunity. With

corporate headquarters in Dublin, Ireland, we are listed on the

London Stock Exchange (EXPN) and are a constituent of the FTSE 100

Index.

Learn more at www.experianplc.com or visit our global content

hub at our global news blog for the latest news and insights from

the Group.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240228033473/en/

Amanda Garofalo Experian Public Relations 1 714 460 3739

amanda.garofalo@experian.com

Experian (LSE:EXPN)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

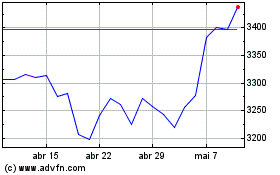

Experian (LSE:EXPN)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024