- Transaction value of approximately $570 million on a cash-free,

debt-free basis, subject to certain assumptions and purchase price

adjustments

- Acquisition to provide CWT customers with more choice and

value

- Transaction projected to create greater capacity for investment

in software and services

- Expected to deliver significant shareholder value through

synergy opportunity and efficiency gains from the combination, with

approximately $155 million of synergies identified

- Investor conference call scheduled for today at 08:30 A.M.

Eastern Time

American Express Global Business Travel (“Amex GBT”), which is

operated by Global Business Travel Group, Inc. (NYSE: GBTG) (“Amex

GBT” or the “Company”), a leading B2B software and services company

for travel and expense, has today announced it entered into a

definitive agreement to acquire CWT, a global business travel and

meetings solutions provider, in a transaction that values CWT at

approximately $570 million on a cash-free, debt-free basis, subject

to certain assumptions and purchase price adjustments. The

transaction will be funded by a combination of stock and cash and

is expected to close in the second half of 2024, subject to the

satisfaction of customary closing conditions, including the receipt

of certain regulatory approvals.

CWT serves 4,000 customers and is expected to generate

approximately $850 million of revenues and $70 million–$80 million

of Adjusted EBITDA in 2024.

Paul Abbott, Amex GBT’s CEO, said: “Bringing CWT onto the proven

Amex GBT software and services model will create more choice for

customers, more opportunities for people and more value for

shareholders.”

After the acquisition closes, CWT customers would have access to

Amex GBT’s proprietary software and services for travel and

expense, including Neo1, Neo and Egencia, in addition to Select,

which enables customers to integrate with leading technology

partners. Customers would have access to the broadest portfolio of

professional services, including meetings and events, consulting

and sustainability solutions and Amex GBT’s marketplace would

provide access to the most comprehensive and competitive content in

the industry.

CWT CEO, Patrick Andersen, said: “Joining forces with Amex GBT

helps accelerate our vision of a tech-enabled future for business

travel, where people and technology combine to deliver an

exceptional customer experience. We are highly confident in the

value creation of the combined company.”

Significant Shareholder Value

- Highly attractive valuation and financial return: Based

on CWT estimated 2024 Adjusted EBITDA of $70 million–$80 million

and $155 million of identified synergies, Amex GBT acquiring CWT

for pre-synergy multiple of 7.6x and post-synergy multiple of 2.5x

Adjusted EBITDA. Based on CWT estimated 2024 revenue of

approximately $850 million, Amex GBT acquiring CWT for 0.7x revenue

multiple.

- Synergy opportunity: Identified approximately $155

million of annual run-rate synergies within three years, with

approximately 35% expected to be realized in 2025. Amex GBT has a

proven track record of delivering significant synergies through

acquisitions. A dedicated integration team will execute the synergy

plan.

- Strong balance sheet and leverage profile: Amex GBT

maintains a strong balance sheet and post-deal leverage stays

within Amex GBT’s target range of 1.5x–2.5x.

- Accretive transaction: Expected to be break-even to

earnings per share in the first year of transaction close and

accretive thereafter.

Transaction Overview

- The transaction values CWT at approximately $570 million on a

cash-free and debt-free basis, subject to certain assumptions and

purchase price adjustments. At the closing of the transaction Amex

GBT expects to issue approximately 71.7 million shares of its

common stock at a fixed price of $6.00 per share and to use cash on

hand to fund the retirement of CWT debt and the remaining

transaction consideration. The CWT shareholders, which are

primarily investment funds, are subject to a 90-day lockup for 50%

of their shares and a 270-day lockup for the remainder of their

shares. Both companies’ boards of directors have approved the

transaction, which is expected to be completed in the second half

of 2024, subject to the satisfaction of customary closing

conditions, including the receipt of certain regulatory

approvals.

- Amex GBT acquiring CWT for pre-synergy multiple of 7.6x and

post-synergy multiple of 2.5x Adjusted EBITDA, based on CWT

estimated 2024 Adjusted EBITDA of $70 million –$80 million and $155

million identified synergies.

- Amex GBT acquiring CWT for 0.7x revenue

multiple, based on CWT estimated 2024 revenue of approximately $850

million.

Investor Conference Call Information

Amex GBT will hold a live investor conference call on March 25,

2024, at 8:30 AM ET. The live investor conference call and

accompanying slide presentation can be accessed on the Amex GBT

Investor Relations website at

investors.amexglobalbusinesstravel.com. A replay of the event will

be available on the website for at least 90 days following the

event.

About Amex GBT

American Express Global Business Travel (Amex GBT) is a leading

software and services company for travel, expense, and meetings

& events. We have built the most valuable marketplace in travel

with the most comprehensive and competitive content. A choice of

solutions brought to you through a powerful combination of

technology and people, delivering the best experiences, proven at

scale. With travel professionals and business partners in more than

140 countries, our solutions deliver savings, flexibility, and

service from a brand you can trust – Amex GBT.

About CWT

CWT is a global business travel and meetings solutions provider,

with whom companies and governments partner to keep their people

connected, in traditional business locations and some of the most

remote and inaccessible parts of the globe. A private company

majority owned by funds affiliated to Redwood Capital Management

and Monarch Alternative Capital amongst others, CWT provides its

customers’ employees with innovative technology and an efficient,

safe, and sustainable travel experience.

Forward-Looking Statements

This communication contains statements that are forward-looking

and as such are not historical facts. This includes, without

limitation, statements regarding our financial position, business

strategy, and the plans and objectives of management for future

operations and full-year guidance. These statements constitute

projections, forecasts and forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995.

The words “anticipate,” “believe,” “continue,” “could,” “estimate,”

“expect,” “intend,” “may,” “might,” “plan,” “possible,”

“potential,” “predict,” “project,” “should,” “will,” “would” and

similar expressions may identify forward-looking statements, but

the absence of these words does not mean that a statement is not

forward-looking.

The forward-looking statements contained in this communication

are based on our current expectations and beliefs concerning future

developments and their potential effects on us. There can be no

assurance that future developments affecting us, including as a

result of the transaction, will be those that we have anticipated.

These forward-looking statements involve a number of risks,

uncertainties (some of which are beyond our control) or other

assumptions that may cause actual results or performance to be

materially different from those expressed or implied by these

forward-looking statements. These risks and uncertainties include,

but are not limited to, the following risks, uncertainties and

other factors: (1) changes to projected financial information or

our ability to achieve our anticipated growth rate and execute on

industry opportunities; (2) our ability to maintain our existing

relationships with customers and suppliers and to compete with

existing and new competitors; (3) various conflicts of interest

that could arise among us, affiliates and investors; (4) our

success in retaining or recruiting, or changes required in, our

officers, key employees or directors; (5) factors relating to our

business, operations and financial performance, including market

conditions and global and economic factors beyond our control; (6)

the impact of geopolitical conflicts, including the war in Ukraine

and the conflicts in the Middle East, as well as related changes in

base interest rates, inflation and significant market volatility on

our business, the travel industry, travel trends and the global

economy generally; (7) the sufficiency of our cash, cash

equivalents and investments to meet our liquidity needs; (8) the

effect of a prolonged or substantial decrease in global travel on

the global travel industry; (9) political, social and macroeconomic

conditions (including the widespread adoption of teleconference and

virtual meeting technologies which could reduce the number of

in-person business meetings and demand for travel and our

services); (10) the effect of legal, tax and regulatory changes;

(11) the decisions of market data providers, indices and individual

investors; (12) the outcome of any legal proceedings that may be

instituted against Amex GBT or CWT following the announcement of

the transaction; (13) the inability to complete the transaction;

(14) delays in obtaining, adverse conditions contained in, or the

inability to obtain necessary regulatory approvals or complete

regulatory reviews required to complete the transaction; (15) the

risk that the transaction disrupts current plans and operations as

a result of the announcement and consummation of the transaction;

(16) the inability to recognize the anticipated benefits of the

transaction, which may be affected by, among other things,

competition, the ability of the combined company to grow and manage

growth profitably, maintain relationships with customers and

suppliers and retain key employees; (17) costs related to the

transaction; (18) risks related to the business of Cape or

unexpected liabilities that arise in connection with the

transaction or the integration with Cape; (19) the risk that the

assumptions, estimates and estimated adjustments described in this

communication may prove to be inaccurate; and (20) other risks and

uncertainties described in the Company’s Form 10-K, filed with the

SEC on March 13, 2024, and in the Company’s other SEC filings.

Should one or more of these risks or uncertainties materialize, or

should any of our assumptions prove incorrect, actual results may

vary in material respects from those projected in these

forward-looking statements. We undertake no obligation to update or

revise any forward-looking statements, whether as a result of new

information, future events or otherwise, except as may be required

under applicable securities laws.

Non-GAAP Financial Measures

Adjusted EBITDA is defined as net income (loss) before interest

income, interest expense, gain (loss) on early extinguishment of

debt, benefit from (provision for) income taxes and depreciation

and amortization and as further adjusted to exclude costs that

management believes are non-core to the underlying business of the

Company, consisting of restructuring, exit and related charges,

integration costs, costs related to mergers and acquisitions,

non-cash equity-based compensation, fair value movements on earnout

and warrant derivative liabilities, long-term incentive plan costs,

certain corporate costs, foreign currency gains (losses),

non-service components of net periodic pension benefit (costs) and

gains (losses) on disposal of businesses.

This communication contains non-GAAP financial measures related

to the anticipated acquisition. Amex GBT believes these

forward-looking non-GAAP measures are of interest to investors. We

have not reconciled these forward-looking non-GAAP measures to

their corresponding GAAP measures because certain items that impact

these measures are unavailable without unreasonable efforts, out of

Amex GBT’s control and/or cannot be reasonably predicted without

unreasonable efforts.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240325881910/en/

Media: AmexGBT@SloanePR.com Investors: Jennifer Thorington Vice

President Investor Relations investor@amexgbt.com

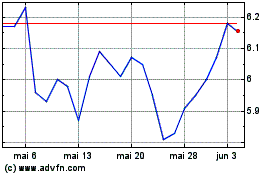

Global Business Travel (NYSE:GBTG)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Global Business Travel (NYSE:GBTG)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025