Empire State Realty Trust Announces Private Placement of $225 Million of Green Senior Unsecured Notes

10 Abril 2024 - 5:15PM

Business Wire

Empire State Realty Trust, Inc. (NYSE: ESRT) (the “Company”),

today announced that it and its operating partnership, Empire State

Realty OP, L.P. (the “Operating Partnership”), entered into a note

purchase agreement to issue $225 million aggregate principal amount

of green senior unsecured notes in a private placement

transaction.

The issuance consists of $155 million of 7.20% notes due in June

2029, $45 million of 7.32% notes due in June 2031, and $25 million

of 7.41% notes due in June 2034. The notes were issued pursuant to

the Company’s Green Financing Framework, and pending the allocation

of an amount equal to the net proceeds from the private placement

to eligible green projects, the Operating Partnership intends to

apply the net proceeds from the private placement (i) to repay

existing indebtedness, including to repay certain amounts drawn on

the Company's revolving credit facility, and (ii) the remainder (if

any) for general corporate purposes.

“This transaction demonstrates strong support by high quality,

existing and new institutional investors who understand and want to

invest in ESRT’s differentiated NYC-focused portfolio,

well-positioned balance sheet and leadership in sustainability,”

said Christina Chiu, President of Empire State Realty Trust.

The Company commissioned S&P Global to conduct an external

review of its Green Financing Framework, and S&P issued a

Second Party Opinion (SPO) on the Framework’s environmental

credentials and its alignment with the Green Bond Principles

2021.

The private placement is scheduled to fund on June 17, 2024,

subject to customary closing conditions. The notes are

unconditionally guaranteed by each of the Company’s subsidiaries

that guarantees indebtedness under the Operating Partnership’s

senior credit facility.

The notes have not been and will not be registered under the

Securities Act of 1933, as amended (the “Securities Act”), and are

being offered and sold in reliance on an exemption from

registration provided by Section 4(a)(2) of the Securities Act. The

notes may not be offered or sold in the United States except

pursuant to an exemption from, or in a transaction not subject to,

the registration requirements of the Securities Act and applicable

state securities laws.

This press release is neither an offer to sell nor a

solicitation of an offer to buy the notes or any other securities

and shall not constitute an offer to sell or a solicitation of an

offer to buy, or a sale of, the notes or any other securities in

any jurisdiction in which such offer, solicitation or sale is

unlawful.

About Empire State Realty Trust

Empire State Realty Trust, Inc. (NYSE: ESRT) is a NYC-focused

REIT that owns and operates a portfolio of modernized, amenitized,

and well-located office, retail, and multifamily assets. The

Company is the recognized leader in energy efficiency and indoor

environmental quality. ESRT’s flagship Empire State Building – the

“World’s Most Famous Building” – includes its Observatory, the #1

attraction in the U.S. in Tripadvisor’s Travelers’ Choice Awards:

Best of the Best for two consecutive years. As of December 31,

2023, ESRT's portfolio is comprised of approximately 8.6 million

rentable square feet of office space, 0.7 million rentable square

feet of retail space and 727 residential units.

Forward-Looking Statements

This press release includes "forward-looking statements" within

the meaning of the federal securities laws. We intend these

forward-looking statements to be covered by the safe harbor

provisions for forward-looking statements contained in the Private

Securities Litigation Reform Act of 1995 and are including this

statement for purposes of complying with those safe harbor

provisions. You can identify these statements by use of words such

as "aims," "anticipates," "approximately," "believes,"

"contemplates," "continues," "estimates," "expects," "forecasts,"

"hope," "intends," "may," "plans," "seeks," "should," "thinks,"

"will," "would" or the negative of these words and phrases or

similar words or expressions that do not relate to historical

matters. You should exercise caution in interpreting and relying on

forward-looking statements, because they involve known and unknown

risks, uncertainties and other factors which are, in some cases,

beyond the Company's control and could materially affect actual

results, performance or achievements. These factors include,

without limitation, the risks and uncertainties detailed from time

to time in the Company's filings with the SEC, including those set

forth in the Company's Annual Report on Form 10-K for the year

ended December 31, 2023 under the headings "Risk Factors" and any

failure of the conditions or events cited in this release. Except

as may be required by law, the Company does not undertake a duty to

update any forward-looking statement, whether as a result of new

information, future events or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240410126004/en/

Investors Empire State

Realty Trust Investor Relations IR@esrtreit.com

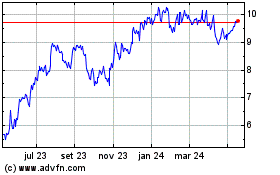

Empire State Realty (NYSE:ESRT)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Empire State Realty (NYSE:ESRT)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024