Voya Increases Distribution Rate on 5 Funds

19 Abril 2024 - 7:37AM

Business Wire

Voya Investment Management, the asset management business of

Voya Financial, Inc. (NYSE: VOYA), announced an increase in the

distribution rate on five funds: Voya Global Advantage and Premium

Opportunity Fund (NYSE: IGA), Voya Global Equity Dividend and

Premium Opportunity Fund (NYSE: IGD), Voya Infrastructure,

Industrials and Materials Fund (NYSE: IDE), Voya Asia Pacific High

Dividend Equity Income Fund (NYSE: IAE), and Voya Emerging Markets

High Dividend Equity Fund (NYSE: IHD).

The increase is intended to address demand in the market for

higher distribution rates given the increase in market yields and

competition from alternative sources of regular cashflows. Voya

previously announced a change to the distribution frequency from

quarterly to monthly for four of the funds; therefore, all five

funds will make monthly distributions. The combination of monthly

payments with higher distribution rates, including, potentially,

returning capital to investors at net asset value, aims to have the

funds serve as an attractive regular source of cashflow for

investors.

The changes to distributions are summarized below:

Old

New

Fund

Ticker

Distribution

Frequency

Annualized Amount*

Distribution

Frequency

Annualized Amount*

% Change

Voya Global Advantage and Premium

Opportunity Fund

IGA

$0.197

Quarterly

$0.788

$0.085

Monthly

$1.02

+29%

Voya Global Equity Dividend and Premium

Opportunity Fund

IGD

$0.04

Monthly

$0.48

$0.050

Monthly

$0.60

+25%

Voya Infrastructure, Industrials and

Materials Fund

IDE

$0.229

Quarterly

$0.916

$0.100

Monthly

$1.20

+31%

Voya Emerging Markets High Dividend Equity

Fund

IHD

$0.135

Quarterly

$0.54

$0.055

Monthly

$0.66

+22%

Voya Asia Pacific High Dividend Equity

Income Fund

IAE

$0.16

Quarterly

$0.64

$0.065

Monthly

$0.78

+22%

*Annualized distributions are the product

of the periodic distribution and payment frequency; distributions

are declared monthly and future distributions may differ from the

amount declared today.

The change in distributions will take effect with the payment

made on May 15, 2024. The record date for the distributions is May

2, 2024, and ex-date is May 1, 2024.

The following table sets forth an estimate of the sources of

each Fund’s April distribution and its cumulative distributions

paid this fiscal year to date. Amounts are expressed on a per

common share basis and as a percentage of the distribution

amount.

Data as of 3/31/2024 Estimated Sources Fiscal YTD Estimated

Percentages of Current Distribution Estimated Sources of

Distribution of Distribution Per Share Net Investment LT ST Return

of Per Share Net Investment LT ST Return of Net Investment LT ST

Return of

Distribution Income Gains

Gains Capital Distribution

Income Gains Gains

Capital Income Gains

Gains Capital IGA (FYE 2/28)

0.197

0.057

0.000

0.000

0.140

0.197

0.057

0.000

0.000

0.140

28.8%

0.0%

0.0%

71.2%

IGD (FYE 2/28)

0.040

0.020

0.000

0.000

0.020

0.080

0.021

0.000

0.000

0.059

26.4%

0.0%

0.0%

73.6%

IDE (FYE 2/28)

0.229

0.037

0.000

0.000

0.192

0.229

0.037

0.000

0.000

0.192

16.1%

0.0%

0.0%

83.9%

IHD (FYE 2/28)

0.135

0.000

0.000

0.000

0.135

0.135

0.000

0.000

0.000

0.135

0.0%

0.0%

0.0%

100.0%

IAE (FYE 2/28)

0.160

0.000

0.000

0.000

0.160

0.160

0.000

0.000

0.000

0.160

0.0%

0.0%

0.0%

100.0%

Set forth in the tables below is information relating to each

Fund’s performance based on its net asset value (NAV) for certain

periods.

Data as of 3/31/2024 Annualized Cumulative Fiscal

Fiscal YTD Fiscal YTD Distribution YTD 5-Year Distribution Rate

Fiscal YTD Distribution Rate Rate Distribution NAV Return on NAV on

NAV1 Return on NAV on NAV1 IGA (FYE 2/28)

0.197

0.197

10.35

5.20%

7.61%

5.48%

1.90%

IGD (FYE 2/28)

0.040

0.080

6.05

5.11%

7.93%

4.72%

1.32%

IDE (FYE 2/28)

0.229

0.229

12.16

5.35%

7.53%

4.78%

1.88%

IHD (FYE 2/28)

0.135

0.135

6.14

2.35%

8.79%

1.93%

2.20%

IAE (FYE 2/28)

0.160

0.160

7.21

2.84%

8.88%

4.11%

2.22%

1 As a percentage of 3/28/2024 NAV

You should not draw any conclusions about the Funds’ investment

performance from the amount of this distribution or from the terms

of the Funds’ Plan. The Funds’ estimate that it has distributed

more than its income and net realized capital gains; therefore, a

portion of your distribution may be a return of capital. A return

of capital may occur, for example, when some or all of the money

that you invested in the Funds’ is paid back to you. A return of

capital distribution does not necessarily reflect the Funds’

investment performance and should not be confused with ‘yield’ or

‘income.’ The amounts and sources of distributions reported in this

Section 19(a) Notice are only estimates and are not being provided

for tax reporting purposes. The actual amounts and sources of the

amounts for tax reporting purposes will depend upon the Funds’

investment experience during the remainder of its fiscal year and

may be subject to changes based on tax regulations. The Funds’ will

send you a Form 1099-DIV for the calendar year that will tell you

how to report these distributions for federal income tax

purposes.

Past performance is no guarantee of future results.

Investment return and principal value of an investment will

fluctuate, and shares, when redeemed, may be worth more or less

than their original cost. Current performance may be lower or

higher than the performance data quoted.

Shares of closed-end funds often trade at a discount from their

net asset value. The market price of Fund shares may vary from net

asset value based on factors affecting the supply and demand for

shares, such as Fund distribution rates relative to similar

investments, investors' expectations for future distribution

changes, the clarity of the Fund's investment strategy and future

return expectations, and investors' confidence in the underlying

markets in which the Fund invests. Fund shares are subject to

investment risk, including possible loss of principal invested. No

Fund is a complete investment program and you may lose money

investing in a Fund. An investment in a Fund may not be appropriate

for all investors. Before investing, prospective investors should

consider carefully the Fund's investment objective, risks, charges

and expenses.

Certain statements made on behalf of the Funds in this release

are forward-looking statements. The Funds actual future results may

differ significantly from those anticipated in any forward-looking

statements due to numerous factors, including but not limited to a

decline in value in equity markets in general or the Funds'

investments specifically. Neither the Funds nor Voya Investment

Management undertake any responsibility to update publicly or

revise any forward-looking statement.

This information should not be used as a basis for legal and/or

tax advice. In any specific case, the parties involved should seek

the guidance and advice of their own legal and tax counsel.

About Voya® Investment Management

Voya Investment Management manages approximately $322 billion as

of December 31, 2023 in assets across public and private fixed

income, equities, multi-asset solutions and alternative strategies

for institutions, financial intermediaries and individual

investors, drawing on a 50-year legacy of active investing and the

expertise of 300+ investment professionals. Voya IM has cultivated

a culture grounded in a commitment to understanding and

anticipating clients’ needs, producing strong investment

performance, and embedding diversity, equity and inclusion in its

business.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240419126104/en/

SHAREHOLDER INQUIRIES: Shareholder Services at (800) 992-0180;

voyainvestments.com CONTACT: Kris Kagel, (800) 992-0180

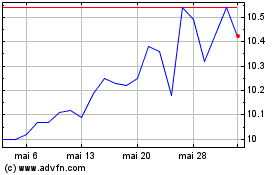

Voya Infrastructure Indu... (NYSE:IDE)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Voya Infrastructure Indu... (NYSE:IDE)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024