AM Best has affirmed the Financial Strength Rating (FSR)

of A (Excellent) and the Long-Term Issuer Credit Ratings (Long-Term

ICRs) of “a+” (Excellent) of the key U.S. life/health subsidiaries

and Europe-based insurance companies of The Cigna Group (Cigna)

(headquartered in Bloomfield, CT) [NYSE: CI]. In addition, AM Best

has affirmed the Long-Term ICR of “bbb+” (Good) and the Long-Term

Issue Credit Ratings (Long-Term IRs) of Cigna. AM Best also has

affirmed the Short-Term Issue Credit Rating (Short-Term IR) of

Cigna. The outlook of these Credit Ratings (ratings) is stable.

(Please see below for a detailed listing of the companies and

ratings.) The majority of Cigna’s core U.S. health insurance

entities are collectively referred to as Cigna Life & Health

Group.

The ratings of Cigna Life & Health Group reflect its balance

sheet strength, which AM Best assesses as strong, as well as its

strong operating performance, favorable business profile and

appropriate enterprise risk management (ERM).

Cigna Life & Health Group’s balance sheet strength

assessment of strong is supported by its risk-adjusted

capitalization, which is at the strongest level, as measured by

Best’s Capital Adequacy Ratio (BCAR). Cigna Life & Health

Group’s risk-adjusted capitalization has remained at the strongest

level over the past few years, driven by capital expansion

supported by favorable earnings, despite sizeable annual dividends.

The group also has been strengthened by sources of contingent

liquidity, which contributes to the fungibility of capital, with

strong and stable metrics, as well as diverse operating cash flows

across its businesses. Additional sources of liquidity for the

insurance entities include parent company cash and a commercial

paper program supported by an unsecured revolving credit facility

and access to the debt market, as well as non-regulated cash flows

from Cigna's Evernorth business segment. Cigna’s insurance

subsidiaries consistently have provided cash flow from operations

upstream in the form of sizeable dividends, which have been growing

given its ongoing favorable results.

Furthermore, the ratings of Cigna Life & Health Group also

consider the high level of goodwill/intangibles at Cigna, the

ultimate parent, largely relating to acquisitions. While financial

leverage has fluctuated, management remains committed to managing

it at approximately 40%. Cigna’s debt service is supported by its

strong earnings and dividends from the group’s insurance entities,

as well as solid non-regulated earnings from its Evernorth segment.

Cigna’s earnings before interest and taxes interest coverage

remains good at close to five times for 2023.

Cigna Life & Health Group has a track record of strong

operating performance, demonstrated by a five-year weighted average

return-on-equity ratio exceeding 28%. Earnings from the insurance

operations have been driven largely by the group’s core commercial

segment. AM Best also notes that Cigna Life & Health Group

continues to operate under a lower risk model as a majority of its

commercial business is operated under self-funded/administrative

services only employer group contracts, versus fully insured.

Underwriting and net income each has remained strong over the past

five years. AM Best expects prospective earnings to remain

positive, underpinned by profitable underwriting results. Cigna’s

insurance operations are less exposed to government programs

compared with its peers, resulting in higher margins, and the

organization has demonstrated profitable growth in the commercial

segment over the past several years. Cigna has reported premium

growth in its core businesses and looking forward, growth is

projected for 2024. On Jan. 31, 2024, it was announced that Cigna

entered into an agreement to sell its Medicare business to Health

Care Service Corporation. The transaction is expected to close in

the first quarter of 2025.

Cigna Life & Health Group’s business profile is viewed as

favorable, driven by a strong position in the competitive health

care market. Cigna has been increasing its penetration into the

U.S. commercial health market through organic growth. Cigna

maintains a diverse product portfolio of health care products. The

organization also offers specialty health care products and

services that include medical management, disease management and

other health advocacy services to employers and other plan

sponsors. The growth of Evernorth health services business, as well

as the parent’s retained international core medical business,

provide Cigna an expanded customer base, earnings diversification

and medical cost management capabilities.

The organization has a comprehensive ERM program with mature

governance. The program is integrated into day-to-day operations

and strategic business planning. Each business unit has its own

heat map, which rolls up to an enterprise-level heat map.

The organization also employs a formal risk appetite statement

that includes key principles and key tolerances and limits. Cigna

utilizes economic capital modeling and stress testing.

The ratings of CIGNA Life Insurance Company of Europe S.A.- N.V.

reflects its balance sheet strength, which AM Best assesses as very

strong, as well as its adequate operating performance, neutral

business profile and appropriate ERM. Additionally, the company

benefits from rating enhancement from Cigna.

The ratings of CIGNA Global Insurance Company Limited (Guernsey)

reflect its balance sheet strength, which AM Best assesses as very

strong as well as its adequate operating performance, limited

business profile and appropriate ERM. The company also benefits

from rating enhancement from Cigna.

The FSR of A (Excellent) and the Long-Term ICRs of “a+”

(Excellent) have been affirmed with stable outlooks for the

following key U.S. life/health subsidiaries of The Cigna Group:

- Connecticut General Life Insurance Company

- Cigna Health and Life Insurance Company

- Cigna Worldwide Insurance Company

- Cigna HealthCare of Indiana, Inc.

- Cigna HealthCare of North Carolina, Inc.

- Cigna HealthCare of South Carolina, Inc.

- Cigna HealthCare of Arizona, Inc.

- Cigna HealthCare of Georgia, Inc.

- Cigna HealthCare of Texas, Inc.

- Cigna HealthCare of Florida, Inc.

- Cigna HealthCare of New Jersey, Inc.

- Cigna HealthCare of Connecticut, Inc.

- Cigna HealthCare of Illinois, Inc.

- Cigna HealthCare of St. Louis, Inc.

- Cigna HealthCare of Tennessee, Inc.

- Cigna HealthCare of California, Inc.

- Cigna Dental Health Plan of Arizona, Inc.

- Cigna Dental Health of California, Inc.

- Cigna Dental Health of Florida, Inc.

- Cigna Dental Health of Maryland, Inc.

- Cigna Dental Health of Ohio, Inc.

- Cigna Dental Health of Pennsylvania, Inc.

- Cigna Dental Health of Texas, Inc.

- Cigna Dental Health of New Jersey, Inc.

- Cigna Dental Health of Missouri, Inc.

- Cigna Dental Health of Virginia, Inc.

The FSR of A (Excellent) and the Long-Term ICRs of “a+”

(Excellent) have been affirmed with stable outlooks for the

following Europe-based subsidiaries of The Cigna Group:

- CIGNA Life Insurance Company of Europe S.A. – N.V.

- CIGNA Europe Insurance Company S.A. – N.V.

- CIGNA Global Insurance Company Limited

The following Long-Term IRs have been affirmed with stable

outlooks for The Cigna Group:

The Cigna Group— -- “bbb+” (Good) on $700 million of 5.685%

senior unsecured notes, due 2026 -- “bbb+” (Good) on $800 million

of 1.25% senior unsecured notes, due 2026 -- “bbb+” (Good) on $1

billion of 5% senior unsecured notes, due 2029 -- “bbb+” (Good) on

$1.5 billion of 2.4% senior unsecured notes, due 2030 -- “bbb+”

(Good) on $1.5 billion of 2.375% senior unsecured notes, due 2031

-- “bbb+” (Good) on $750 million of 5.125% senior unsecured notes,

due 2031 -- “bbb+” (Good) on $800 million of 5.4% senior unsecured

notes, due 2033 -- “bbb+” (Good) on $1.25 billion of 5.25% senior

unsecured notes, due 2034 -- “bbb+” (Good) on $750 million of 3.2%

senior unsecured notes, due 2040 -- “bbb+” (Good) on $1.25 billion

of 3.4% senior unsecured notes, due 2050 -- “bbb+” (Good) on $1.5

billion of 3.4% senior unsecured notes, due 2051 -- “bbb+” (Good)

on $1.5 billion of 5.6% senior unsecured notes, due 2054

The following Short-Term IR has been affirmed:

The Cigna Group— -- AMB-2 (Satisfactory) on commercial paper

program

The following indicative Long-Term IRs have been affirmed with

stable outlooks for The Cigna Group:

The Cigna Group— -- “bbb+” (Good) on senior unsecured debt --

“bbb-” (Good) on preferred stock

The following Long-Term IRs have been affirmed with stable

outlooks for Cigna Holding Company:

Cigna Holding Company— -- “bbb+” (Good) on $900 million of 3.25%

senior unsecured notes, due 2025 -- “bbb+” (Good) on $300 million

of 7.875% of senior unsecured debentures, due 2027 -- “bbb+” (Good)

on $600 million of 3.05% senior unsecured notes, due 2027 -- “bbb+”

(Good) on $83 million of 8.3% senior unsecured step-down notes, due

2033 -- “bbb+” (Good) on $500 million of 6.15% senior unsecured

notes, due 2036 -- “bbb+” (Good) on $300 million of 5.875% senior

unsecured notes, due 2041 -- “bbb+” (Good) on $750 million of

5.375% senior unsecured notes, due 2042 -- “bbb+” (Good) on $1

billion of 3.875% senior unsecured notes, due 2047

This press release relates to Credit Ratings that have been

published on AM Best’s website. For all rating information relating

to the release and pertinent disclosures, including details of the

office responsible for issuing each of the individual ratings

referenced in this release, please see AM Best’s Recent

Rating Activity web page. For additional information

regarding the use and limitations of Credit Rating opinions, please

view Guide to Best's Credit Ratings. For information

on the proper use of Best’s Credit Ratings, Best’s

Performance Assessments, Best’s Preliminary Credit Assessments and

AM Best press releases, please view Guide to Proper Use of

Best’s Ratings & Assessments.

AM Best is a global credit rating agency, news publisher and

data analytics provider specializing in the insurance industry.

Headquartered in the United States, the company does business in

over 100 countries with regional offices in London, Amsterdam,

Dubai, Hong Kong, Singapore and Mexico City. For more information,

visit www.ambest.com.

Copyright © 2024 by A.M. Best Rating

Services, Inc. and/or its affiliates. ALL RIGHTS RESERVED.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240425476812/en/

Jennifer Asamoah Senior Financial Analyst +1

908 882 1637 jennifer.asamoah@ambest.com

Christopher Sharkey Associate Director, Public

Relations +1 908 882 2310

christopher.sharkey@ambest.com

Bridget Maehr Director +1 908 882 2080

bridget.maehr@ambest.com

Al Slavin Senior Public Relations Specialist +1

908 882 2318 al.slavin@ambest.com

Konstantin Langowski Senior Financial Analyst

+31 20 808 2994 konstantin.langowski@ambest.com

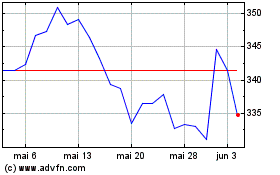

Cigna (NYSE:CI)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Cigna (NYSE:CI)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025