ProPetro Holding Corp. ("ProPetro" or "the Company") (NYSE:

PUMP) today announced financial and operational results for the

first quarter of 2024.

First Quarter 2024 Results and Highlights

- Total revenue of $406 million increased 17% compared to the

prior quarter.

- Net Income was $20 million ($0.18 income per diluted share) as

compared to a net loss of $17 million in the prior quarter ($0.16

loss per diluted share).

- Adjusted EBITDA(1) of $93 million was 23% of revenue and

increased 45% compared to the prior quarter with 50% incremental

margins.(2)

- Incurred capital expenditures were $40 million.

- Awarded a long-term contract from ExxonMobil for two

FORCESM electric-powered hydraulic fracturing fleets with

the option for a third FORCESM fleet coupled with our

Silvertip wireline and pumpdown services.

- Four FORCESM electric fleets are now under contract with

leading customers with three FORCESM electric fleets

currently operating.

- Increased share repurchase program by $100 million for a total

of $200 million and extended the program to May 2025.

- Effective frac fleet utilization was 15.0 fleets compared to

12.9 fleets in the prior quarter.

- Repurchased and retired 3.0 million shares during the quarter

with total repurchases of 8.8 million shares representing

approximately 8% of outstanding shares since plan inception in May

2023.

- Net cash provided by operating activities was $75 million with

Free Cash Flow(3) of $41 million.

(1)

Adjusted EBITDA is a non-GAAP financial

measure and is described and reconciled to net income (loss) in the

table under “Non-GAAP Financial Measures.”

(2)

Incremental margins represent the

sequential change in Adjusted EBITDA divided by the sequential

change in revenues.

(3)

Free Cash Flow is a non-GAAP financial

measure and is described and reconciled to cash from operating

activities in the table under “Non-GAAP Financial Measures."

Management Comments

Sam Sledge, Chief Executive Officer, commented, “We are excited

to start off 2024 with strong financial results and positive

momentum. Our results reflect a strategy that is working. Thanks to

the dedication and discipline of our teams across our service

lines, we continue to deliver strong performance and advance our

strategic priorities toward industrializing our business. We are

delighted to have entered into an agreement under which ProPetro

will provide electric hydraulic fracturing services to ExxonMobil

in the Permian Basin, including introducing FORCESM electric

fleets to our longstanding partnership. The FORCESM

electric-powered fleets, along with our Tier IV DGB dual-fuel

fleets, are part of our strategy to transition to next-generation

assets, delivering premium value to our customers while lowering

their completions costs and reducing their emissions. The long-term

agreement with ExxonMobil, which includes FORCESM electric

hydraulic fracturing fleets coupled with our Silvertip wireline and

pumpdown services, is a significant milestone for ProPetro and

underscores our dedication to delivering industry-leading services

for customers while accelerating the efficiency and profitability

of our business for shareholders."

Mr. Sledge continued, "We delivered strong financial results

despite market pressures in the first quarter thanks to our

disciplined operating strategy, operational density in the

resilient Permian Basin and prudent investments in next-generation

equipment. The strong free cash flow we generated, and our

confidence in the continued growth and resiliency of our earnings,

facilitates our commitment to returning capital to shareholders

through our share repurchase program. We also recently announced

that our board of directors approved a $100 million increase to our

share repurchase program, bringing that program to $200 million,

and extending the program to May 2025. With the larger capital

requirements behind us following the recent upgrading of our fleet,

we are beginning to showcase the results of our superior assets and

industrialized business model. We’re excited to continue delivering

differentiated services to our customers and strong financial

returns for all our stakeholders.”

David Schorlemer, Chief Financial Officer, said, "ProPetro's

robust first quarter results reflect the strategy yielding results.

As expected, revenues recovered as our customers reinitiated

dedicated fleet operations and the business generated healthy 50%

incremental margins. Additionally, lower capital spending coupled

with our stronger profitability resulted in a dramatic improvement

in free cash flow performance, another theme we've previously

communicated. Another key aspect of our strategy has been selective

M&A to complement our existing businesses and drive incremental

free cash flow available for capital returns. In the last 18 months

since our acquisition of Silvertip, we've now repurchased and

retired nearly 90% of the number of shares we issued to Silvertip

shareholders in the acquisition and we continue to benefit from

this segment's high EBITDA to free cash flow conversion."

First Quarter 2024 Financial Summary

Revenue was $406 million, compared to $348 million for the

fourth quarter of 2023. The 17% increase in revenue was

attributable to increased utilization and job mix in our hydraulic

fracturing and wireline businesses during the quarter.

Cost of services, excluding depreciation and amortization of

approximately $51 million relating to cost of services, increased

to $289 million from $261 million during the fourth quarter of

2023. The 11% increase was attributable to the increased

operational activity levels across our hydraulic fracturing and

wireline operating segments.

General and administrative expense of $28 million was unchanged

from $28 million in the fourth quarter of 2023. G&A expense

excluding nonrecurring and noncash items (stock-based compensation

and other items) of $4 million, was $24 million, or 6% of

revenue.

Net income totaled $20 million, or $0.18 per diluted share,

compared to net loss of $17 million, or $0.16 per diluted share,

for the fourth quarter of 2023.

Adjusted EBITDA increased to $93 million from $64 million for

the fourth quarter of 2023. The increase in Adjusted EBITDA was

primarily attributable to higher activity and stable pricing during

the quarter.

Net cash provided by operating activities was $75 million as

compared to $70 million in the prior quarter. Free Cash Flow was

approximately $41 million as compared to negative Free Cash Flow of

approximately $2 million in the prior quarter.

Share Repurchase Program

On April 24, 2024, the Company announced a $100 million increase

to its share repurchase program increasing it to a total of $200

million while extending the plan to May 2025. During the quarter,

the Company repurchased and retired 3.0 million shares for $23

million. Since inception, the Company has acquired and retired 8.8

million shares representing approximately 8% of its outstanding

shares as of the date of plan inception.

Liquidity and Capital Spending

As of March 31, 2024, total cash was $46 million and our

borrowings under the ABL Credit Facility were $45 million. Total

liquidity at the end of the first quarter of 2024 was $202 million

including cash and $156 million of available capacity under the ABL

Credit Facility.

Capital expenditures incurred during the first quarter of 2024

were $40 million, the majority of which related to maintenance and

support equipment for our FORCESM electric hydraulic

fracturing fleet deployments. Net cash used in investing activities

during the first quarter of 2024 was $34 million.

Guidance

The Company now expects to be on the low end of our prior

guidance range for full-year 2024 incurred capital expenditures of

$200 million to $250 million. Frac fleet effective utilization is

expected to be between 14 to 15 fleets during the second quarter

2024.

Outlook

Mr. Sledge added, “Looking ahead, we expect demand for our

differentiated service quality and next generation equipment to

remain strong. We believe the recent transition and investment in

our fleet will contribute to industry-leading efficiencies and high

customer satisfaction, as evidenced by our recently announced

multi-year agreement to advance our partnership with ExxonMobil.

Additionally, with our strong balance sheet and steady free cash

flow generation, we continue to make excellent progress on our

strategic priorities, and we will continue to evaluate

opportunities to further enhance financial returns.”

Mr. Sledge concluded, “We are entering the second quarter with

exciting momentum with our industrialization strategy, which is

designed for the future of our sector and industry. In light of the

market pressures that we and our peers face in a slow-to-no-growth

environment, continued focus on our execution is paramount. With

our strategic initiatives largely in place, we believe ProPetro is

well-positioned to provide the reliable completion services,

next-generation technologies and competitive costs that customers

seek in the consolidating E&P space. As we further

industrialize our business, optimize operations, modernize our

fleet and remain opportunistic in value-accretive transactions and

capital returns, aligned with our disciplined capital allocation

framework, we are confident in ProPetro's ability to deliver

increased shareholder value.”

Conference Call Information

The Company will host a conference call at 8:00 AM Central Time

on Wednesday, May 1, 2024, to discuss financial and operating

results for the first quarter of 2024. The call will also be

webcast on ProPetro’s website at www.propetroservices.com. To

access the conference call, U.S. callers may dial toll free

1-844-340-9046 and international callers may dial 1-412-858-5205.

Please call ten minutes ahead of the scheduled start time to ensure

a proper connection. A replay of the conference call will be

available for one week following the call and can be accessed toll

free by dialing 1-877-344-7529 for U.S. callers, 1-855-669-9658 for

Canadian callers, as well as 1-412-317-0088 for international

callers. The access code for the replay is 7906080. The Company

also posted the scripted remarks on its website.

About ProPetro

ProPetro Holding Corp. is a Midland, Texas-based provider of

premium completion services to leading upstream oil and gas

companies engaged in the exploration and production of North

American unconventional oil and natural gas resources. We help

bring reliable energy to the world. For more information visit

www.propetroservices.com.

Forward-Looking Statements

Except for historical information contained herein, the

statements and information in this news release and discussion in

the scripted remarks described above are forward-looking statements

that are made pursuant to the Safe Harbor Provisions of the Private

Securities Litigation Reform Act of 1995. Statements that are

predictive in nature, that depend upon or refer to future events or

conditions or that include the words “may,” “could,” “plan,”

“project,” “budget,” “predict,” “pursue,” “target,” “seek,”

“objective,” “believe,” “expect,” “anticipate,” “intend,”

“estimate,” “will,” “should,” and other expressions that are

predictions of, or indicate, future events and trends or that do

not relate to historical matters generally identify forward‑looking

statements. Our forward‑looking statements include, among other

matters, statements about the supply of and demand for

hydrocarbons, our business strategy, industry, projected financial

results and future financial performance, expected fleet

utilization, sustainability efforts, the future performance of

newly improved technology, expected capital expenditures, the

impact of such expenditures on our performance and capital

programs, our fleet conversion strategy and our share repurchase

program. A forward‑looking statement may include a statement of the

assumptions or bases underlying the forward‑looking statement. We

believe that we have chosen these assumptions or bases in good

faith and that they are reasonable.

Although forward‑looking statements reflect our good faith

beliefs at the time they are made, forward-looking statements are

subject to a number of risks and uncertainties that may cause

actual events and results to differ materially from the

forward-looking statements. Such risks and uncertainties include

the volatility of oil prices, the global macroeconomic uncertainty

related to the conflict in the Israel-Gaza region and continued

hostilities in the Middle East, including rising tensions with

Iran, and the Russia-Ukraine war, general economic conditions,

including the impact of continued inflation, central bank policy

actions, bank failures, and the risk of a global recession, and

other factors described in the Company's Annual Report on Form 10-K

and Quarterly Reports on Form 10-Q, particularly the “Risk Factors”

sections of such filings, and other filings with the Securities and

Exchange Commission (the “SEC”). In addition, the Company may be

subject to currently unforeseen risks that may have a materially

adverse impact on it. Accordingly, no assurances can be given that

the actual events and results will not be materially different than

the anticipated results described in the forward-looking

statements. Readers are cautioned not to place undue reliance on

such forward-looking statements and are urged to carefully review

and consider the various disclosures made in the Company’s Annual

Report on Form 10-K, Quarterly Reports on Form 10-Q and other

filings made with the SEC from time to time that disclose risks and

uncertainties that may affect the Company’s business. The

forward-looking statements in this news release are made as of the

date of this news release. ProPetro does not undertake, and

expressly disclaims, any duty to publicly update these statements,

whether as a result of new information, new developments or

otherwise, except to the extent that disclosure is required by

law.

PROPETRO HOLDING CORP.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(In thousands, except per

share data)

(Unaudited)

Three Months Ended

March 31, 2024

December 31, 2023

March 31, 2023

REVENUE - Service revenue

$

405,843

$

347,776

$

423,570

COSTS AND EXPENSES

Cost of services (exclusive of

depreciation and amortization)

288,641

261,034

280,486

General and administrative (inclusive of

stock-based compensation)

28,226

27,990

28,746

Depreciation and amortization

52,206

56,137

38,271

Loss on disposal of assets

6,458

10,898

34,607

Total costs and expenses

375,531

356,059

382,110

OPERATING INCOME (LOSS)

30,312

(8,283

)

41,460

OTHER INCOME (EXPENSE):

Interest expense

(2,029

)

(2,292

)

(667

)

Other income (expense), net

1,405

(7,784

)

(3,704

)

Total other (expense) income, net

(624

)

(10,076

)

(4,371

)

INCOME (LOSS) BEFORE INCOME TAXES

29,688

(18,359

)

37,089

INCOME TAX (EXPENSE) BENEFIT

(9,758

)

1,250

(8,356

)

NET INCOME (LOSS)

$

19,930

$

(17,109

)

$

28,733

NET INCOME (LOSS) PER COMMON SHARE:

Basic

$

0.18

$

(0.16

)

$

0.25

Diluted

$

0.18

$

(0.16

)

$

0.25

WEIGHTED AVERAGE COMMON SHARES

OUTSTANDING:

Basic

108,540

110,164

114,881

Diluted

108,989

110,164

115,331

NOTE:

Certain reclassifications to loss on

disposal of assets and depreciation and amortization have been made

to the statement of operations and the statement of cash flows for

the periods prior to 2024 to conform to the current period

presentation.

PROPETRO HOLDING CORP.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(In thousands, except share

data)

(Unaudited)

March 31, 2024

December 31, 2023

ASSETS

CURRENT ASSETS:

Cash and cash equivalents

$

46,458

$

33,354

Accounts receivable - net of allowance for

credit losses of $236 and $236, respectively

273,709

237,012

Inventories

19,447

17,705

Prepaid expenses

13,124

14,640

Short-term investment, net

7,143

7,745

Other current assets

155

353

Total current assets

360,036

310,809

PROPERTY AND EQUIPMENT - net of

accumulated depreciation

947,138

967,116

OPERATING LEASE RIGHT-OF-USE ASSETS

109,362

78,583

FINANCE LEASE RIGHT-OF-USE ASSETS

42,923

47,449

OTHER NONCURRENT ASSETS:

Goodwill

23,624

23,624

Intangible assets - net of

amortization

49,183

50,615

Other noncurrent assets

1,994

2,116

Total other noncurrent assets

74,801

76,355

TOTAL ASSETS

$

1,534,260

$

1,480,312

LIABILITIES AND SHAREHOLDERS’

EQUITY

CURRENT LIABILITIES:

Accounts payable

$

189,216

$

161,441

Accrued and other current liabilities

70,855

75,616

Operating lease liabilities

26,534

17,029

Finance lease liabilities

17,379

17,063

Total current liabilities

303,984

271,149

DEFERRED INCOME TAXES

101,045

93,105

LONG-TERM DEBT

45,000

45,000

NONCURRENT OPERATING LEASE LIABILITIES

56,481

38,600

NONCURRENT FINANCE LEASE LIABILITIES

26,416

30,886

OTHER LONG-TERM LIABILITIES

3,180

3,180

Total liabilities

536,106

481,920

COMMITMENTS AND CONTINGENCIES

SHAREHOLDERS’ EQUITY:

Preferred stock, $0.001 par value,

30,000,000 shares authorized, none issued, respectively

—

—

Common stock, $0.001 par value,

200,000,000 shares authorized, 106,891,337 and 109,483,281 shares

issued, respectively

107

109

Additional paid-in capital

909,083

929,249

Retained earnings

88,964

69,034

Total shareholders’ equity

998,154

998,392

TOTAL LIABILITIES AND SHAREHOLDERS’

EQUITY

$

1,534,260

$

1,480,312

PROPETRO HOLDING CORP.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

Three Months Ended March

31,

2024

2023

CASH FLOWS FROM OPERATING ACTIVITIES:

Net income

$

19,930

$

28,733

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

52,206

38,271

Deferred income tax expense

7,940

7,807

Amortization of deferred debt issuance

costs

108

64

Stock-based compensation

3,742

3,536

Loss on disposal of assets

6,458

34,607

Unrealized loss on short-term

investment

602

3,794

Changes in operating assets and

liabilities:

Accounts receivable

(36,697

)

(74,199

)

Other current assets

430

(468

)

Inventories

(1,742

)

(6,366

)

Prepaid expenses

1,530

(548

)

Accounts payable

21,191

29,823

Accrued and other current liabilities

(876

)

8,006

Net cash provided by operating

activities

74,822

73,060

CASH FLOWS FROM INVESTING ACTIVITIES:

Capital expenditures

(34,585

)

(114,839

)

Proceeds from sale of assets

738

1,089

Net cash used in investing activities

(33,847

)

(113,750

)

CASH FLOWS FROM FINANCING ACTIVITIES:

Payments on finance lease obligations

(4,154

)

—

Tax withholdings paid for net settlement

of equity awards

(1,209

)

(3,379

)

Share repurchases

(22,508

)

—

Net cash used in financing activities

(27,871

)

(3,379

)

NET INCREASE (DECREASE) IN CASH, CASH

EQUIVALENTS AND RESTRICTED CASH

13,104

(44,069

)

CASH, CASH EQUIVALENTS AND RESTRICTED CASH

- Beginning of period

33,354

88,862

CASH, CASH EQUIVALENTS AND RESTRICTED CASH

- End of period

$

46,458

$

44,793

Reportable Segment Information

Three Months Ended March 31,

2024

(in thousands)

Hydraulic Fracturing

Wireline

All Other

Reconciling Items

Total

Service revenue

$

309,300

$

60,805

$

35,738

$

—

$

405,843

Adjusted EBITDA

$

86,119

$

16,786

$

4,861

$

(14,371

)

$

93,395

Depreciation and amortization

$

44,995

$

4,915

$

2,271

$

25

$

52,206

Operating lease expense on FORCESM fleets

(1)

$

8,592

$

—

$

—

$

—

$

8,592

Capital expenditures incurred

$

35,988

$

2,386

$

1,466

$

—

$

39,840

Three Months Ended December

31, 2023

(in thousands)

Hydraulic Fracturing

Wireline

All Other

Reconciling Items

Total

Service revenue

$

262,448

$

50,417

$

34,911

$

—

$

347,776

Adjusted EBITDA

$

58,360

$

11,261

$

7,805

$

(13,158

)

$

64,268

Depreciation and amortization (2)

$

49,471

$

4,900

$

1,741

$

25

$

56,137

Operating lease expense on FORCESM fleets

(1)

$

4,310

$

—

$

—

$

—

$

4,310

Capital expenditures incurred

$

37,020

$

1,316

$

200

$

—

$

38,536

(1)

Represents lease cost related to operating

leases on our FORCESM electric-powered hydraulic fracturing fleets.

This cost is recorded within cost of services in our condensed

consolidated statements of operations.

(2)

The write-offs of remaining book value of

prematurely failed power ends are recorded as loss on disposal of

assets for the three months ended March 31, 2024. In order to

conform to current period presentation, we have reclassified the

corresponding amount of $6.0 million from depreciation to loss on

disposal of assets for the three months ended December 31,

2023.

Non-GAAP Financial Measures

Adjusted EBITDA and Free Cash Flow are not financial measures

presented in accordance with GAAP. We define EBITDA as net income

(loss) plus (i) interest expense, (ii) income tax expense (benefit)

and (iii) depreciation and amortization. We define Adjusted EBITDA

as EBITDA plus (i) loss (gain) on disposal of assets, (ii)

stock-based compensation, (iii) other expense (income), (iv) other

unusual or nonrecurring (income) expenses such as costs related to

asset acquisitions, insurance recoveries, one-time professional

fees and legal settlements and (v) retention bonus and severance

expense. We define Free Cash Flow as net cash provided by operating

activities less net cash used in investing activities.

We believe that the presentation of these non-GAAP financial

measures provide useful information to investors in assessing our

financial condition and results of operations. Net income (loss) is

the GAAP measure most directly comparable to Adjusted EBITDA, and

net cash from operating activities is the GAAP measure most

directly comparable to Free Cash Flow. Non-GAAP financial measures

should not be considered as alternatives to the most directly

comparable GAAP financial measures. Non-GAAP financial measures

have important limitations as analytical tools because they exclude

some, but not all, items that affect the most directly comparable

GAAP financial measures. You should not consider Adjusted EBITDA or

Free Cash Flow in isolation or as a substitute for an analysis of

our results as reported under GAAP. Because Adjusted EBITDA and

Free Cash Flow may be defined differently by other companies in our

industry, our definitions of these non-GAAP financial measures may

not be comparable to similarly titled measures of other companies,

thereby diminishing their utility.

Reconciliation of Net Income (Loss) to

Adjusted EBITDA

Three Months Ended

(in thousands)

March 31, 2024

December 31, 2023

Net income (loss)

$

19,930

$

(17,109

)

Depreciation and amortization (1)

52,206

56,137

Interest expense

2,029

2,292

Income tax expense (benefit)

9,758

(1,250

)

Loss on disposal of assets (1)

6,458

10,898

Stock-based compensation

3,742

3,846

Other (income) expense, net (2)

(1,405

)

7,784

Other general and administrative expense,

net

59

1,310

Retention bonus and severance expense

618

360

Adjusted EBITDA

$

93,395

$

64,268

(1)

The write-offs of remaining book value of

prematurely failed power ends are recorded as loss on disposal of

assets for the three months ended March 31, 2024. In order to

conform to current period presentation, we have reclassified the

corresponding amount of $6.0 million from depreciation to loss on

disposal of assets for the three months ended December 31,

2023.

(2)

Other income for the three months ended

March 31, 2024 is primarily comprised of insurance reimbursements

of $2.0 million, partially offset by a $0.6 million unrealized loss

on short-term investment. Other expense for the three months ended

December 31, 2023 includes settlement expenses resulting from

routine audits and true-up health insurance costs of totaling

approximately $7.4 million.

Reconciliation of Cash from Operating

Activities to Free Cash Flow

Three Months Ended

(in thousands)

March 31, 2024

December 31, 2023

Cash from Operating Activities

$

74,822

$

69,671

Cash used in Investing Activities

(33,847

)

(71,356

)

Free Cash Flow

$

40,975

$

(1,685

)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240501694892/en/

Investor Contacts:

David Schorlemer Chief Financial Officer

david.schorlemer@propetroservices.com 432-227-0864

Matt Augustine Director, Corporate Development and Investor

Relations matt.augustine@propetroservices.com 432-219-7620

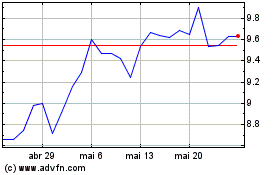

ProPetro (NYSE:PUMP)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

ProPetro (NYSE:PUMP)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025