ATS Corporation (TSX and NYSE: ATS) (“ATS” or the “Company”)

today reported its financial results for the three and twelve

months ended March 31, 2024. All references to "$" or "dollars" in

this news release are to Canadian dollars unless otherwise

indicated.

Fourth quarter highlights:

- Revenues increased 8.3% year over year to $791.5 million.

- Net Income was $48.5 million compared to $29.6 million a year

ago.

- Basic earnings per share were 49 cents, compared to 32 cents a

year ago.

- Adjusted EBITDA1 was $115.8 million, 2.0% lower compared to

$118.2 million a year ago.

- Adjusted basic earnings per share1 were 65 cents compared to 73

cents a year ago.

- Order Bookings1 were $791 million, 7.3% higher compared to $737

million a year ago.

- Order Backlog1 was $1,793 million at the end of the

quarter.

"Today ATS reported record fourth quarter revenues and strong

Order Bookings," said Andrew Hider, Chief Executive Officer. "Our

Order Backlog positions us well for fiscal '25 , and we look

forward to the addition of Paxiom Group to ATS' portfolio, as we

maintain our focus on long-term value creation."

Year-to-date highlights:

- Revenues increased 17.7% year over year to $3,032.9

million.

- Net Income increased 52.1% year over year to $194.2

million.

- Basic earnings per share increased 42.4% year over year to

$1.98.

- Adjusted EBITDA1 increased 17.3% year over year to $470.6

million.

- Adjusted basic earnings per share1 increased 10.1% year over

year to $2.61.

- Order Bookings1 were $2,891 million, compared to $3,256 million

a year ago.

Mr. Hider added: “In fiscal 2024 we delivered profitable growth

on revenues of over $3 billion, the highest in company history,

along with record adjusted earnings. Our global team of over 7,000

employees continues to execute across our strategic markets, and

drive improvement in the business through ongoing application of

our ATS Business Model."

1 Non-IFRS measure: see “Notice to Reader:

Non-IFRS and Other Financial Measures”.

Financial results

(In millions of dollars, except per share

and margin data)

Q4 2024

Q4 2023

Variance

Fiscal 2024

Fiscal 2023

Variance

Revenues

$

791.5

$

730.8

8.3

%

$

3,032.9

$

2,577.4

17.7

%

Net income

$

48.5

$

29.6

63.9

%

$

194.2

$

127.7

52.1

%

Adjusted earnings from

operations1

$

95.9

$

101.9

(5.9

)%

$

397.5

$

343.4

15.8

%

Adjusted earnings from operations

margin1

12.1

%

13.9

%

(183)bps

13.1

%

13.3

%

(22)bps

Adjusted EBITDA1

$

115.8

$

118.2

(2.0

)%

$

470.6

$

401.2

17.3

%

Adjusted EBITDA margin1

14.6

%

16.2

%

(154)bps

15.5

%

15.6

%

(5)bps

Basic earnings per share

$

0.49

$

0.32

53.1

%

$

1.98

$

1.39

42.4

%

Adjusted basic earnings per

share

$

0.65

$

0.73

(11.0

)%

$

2.61

$

2.37

10.1

%

Order Bookings1

$

791.0

$

737.0

7.3

%

$

2,891.0

$

3,256.0

(11.2

)%

As At

March 31 2024

March 31 2023

Variance

Order Backlog1

$

1,793

$

2,153

(16.7

)%

1 Non-IFRS financial measure - See

“Non-IFRS and Other Financial Measures."

Recent Acquisitions

On May 15, 2024, the Company announced it had entered into a

definitive agreement to acquire Paxiom Group (“Paxiom”). With

headquarters in Montreal, Quebec, Paxiom is a provider of primary,

secondary, and end-of-line packaging machines in the food and

beverage, cannabis, and pharmaceutical industries. Paxiom provides

a vast product line that includes precision weight filling,

bagging, wrapping, labeling, conveyors, case forming, robotic case

packing and end of line palletizing equipment that will complement

ATS’ businesses CFT S.p.A, Raytec Vision S.p.A, Marco Limited, IWK

Verpackungstechnik GmbH, and NCC Automated Systems, Inc. and allow

ATS to offer complete packaging and end-of-line solutions. The

transaction is expected to close in the third calendar quarter of

2024, subject to customary closing conditions.

On January 1, 2024, the Company acquired IT.ACA. Engineering

S.r.l ("IT.ACA"), an Italian automation system integrator. IT.ACA

strengthens process automation solutions business ("PA") market

position in southern Europe, while also adding strong capabilities

aligned with PA's in automation integration, digitalization, and

production process optimization.

Fourth quarter summary

Fiscal 2024 fourth quarter revenues were 8.3% or $60.7 million

higher than in the corresponding period a year ago. This

performance primarily reflected year-over-year organic revenue

growth (growth excluding contributions from acquired companies and

foreign exchange translation) of $25.3 million or 3.5%, and

revenues earned by acquired companies of $34.0 million, which

included $24.8 million from Avidity. Revenues generated from

construction contracts increased 6.0% or $28.3 million due to

organic revenue growth. Revenues from services increased 23.9% or

$32.9 million due to organic revenue growth in addition to revenues

earned by acquired companies of $12.9 million. Revenues from the

sale of goods decreased 0.4% or $0.5 million primarily due to lower

Order Backlog entering the quarter, partially offset by revenues

earned by acquired companies of $20.6 million, primarily from

Avidity.

By market, revenues generated in life sciences increased $50.7

million or 15.6% year over year. This was primarily due to

contributions from acquisitions totalling $28.3 million and organic

revenue growth on higher Order Backlog entering the quarter.

Revenues in transportation increased $23.1 million or 11.6%, due to

timing of program execution. Revenues generated in food &

beverage increased $0.6 million or 0.6% due to revenues earned by

acquired companies. Revenues generated in consumer products

decreased $12.1 million or 14.7% due to timing of program

execution. Revenues in energy decreased $1.6 million or 6.2% due to

timing of program execution.

Net income for the fourth quarter of fiscal 2024 was $48.5

million (49 cents per share basic), compared to $29.6 million (32

cents per share basic) for the fourth quarter of fiscal 2023. The

increase primarily reflected higher revenues, lower stock-based

compensation expenses and lower restructuring charges, partially

offset by higher cost of revenues and selling, general and

administrative ("SG&A") expenses. Adjusted basic earnings per

share were 65 cents compared to 73 cents in the fourth quarter of

fiscal 2023 (see “Reconciliation of Non-IFRS Measures to IFRS

Measures”).

Depreciation and amortization expense was $36.3 million in the

fourth quarter of fiscal 2024, compared to $33.9 million a year

ago; the increase was primarily related to incremental depreciation

and amortization expense from recently acquired companies.

EBITDA was $111.1 million (14.0% EBITDA margin) in the fourth

quarter of fiscal 2024 compared to $85.8 million (11.7% EBITDA

margin) in the fourth quarter of fiscal 2023. EBITDA for the fourth

quarter of fiscal 2024 included $6.6 million of restructuring

charges, $4.6 million of incremental costs related to acquisition

activity, $2.0 million of acquisition-related fair value

adjustments to acquired inventories, and a $8.5 million recovery of

stock-based compensation expenses due to revaluation. EBITDA for

the corresponding period in the prior year included $1.5 million of

incremental costs related to acquisition activity, $15.8 million of

restructuring charges, and $15.1 million of stock-based

compensation revaluation expenses. Excluding these costs, adjusted

EBITDA was $115.8 million (14.6% adjusted EBITDA margin), compared

to $118.2 million (16.2% adjusted EBITDA margin) for the

corresponding period in the prior year. Lower adjusted EBITDA

reflected increased SG&A expenses and cost of revenues,

partially offset by higher revenues. EBITDA is a non-IFRS financial

measure - see “Non-IFRS and Other Financial Measures.”

Order Backlog

Continuity

(In millions of dollars)

Q4 2024

Q4 2023

Fiscal 2024

Fiscal 2023

Opening Order Backlog

$

1,907

$

2,143

$

2,153

$

1,438

Revenues

(792

)

(731

)

(3,033

)

(2,577

)

Order Bookings

791

737

2,891

3,256

Order Backlog adjustments1

(113

)

4

(218

)

36

Total

$

1,793

$

2,153

$

1,793

$

2,153

1. Order Backlog adjustments include

incremental Order Backlog of acquired companies ($4 million

acquired with Avidity Science, LLC ("Avidity" in the twelve months

ended March 31, 2024, and in fiscal 2023, $9 million acquired with

Zi-Argus Australia Pty Ltd. and Zi-Argus Ltd. and $5 million

acquired with Triad Unlimited LLC in the three and twelve months

ended March 31, 2023, $14 million acquired with IPCOS Group N.V. in

the twelve months ended March 31, 2023), as well as foreign

exchange adjustments, scope changes and cancellations.

Order Bookings

Fourth quarter fiscal 2024 Order Bookings were $791 million, a

7.3% year over year increase, reflecting 5.2% growth from acquired

companies, in addition to organic Order Bookings of 2.1%. Order

Bookings from acquired companies totalled $38.7 million. By market,

Order Bookings in life sciences increased compared to the

prior-year period primarily due to organic growth, along with $28.7

million of contributions from acquired companies, including $22.7

million from Avidity. Order Bookings in transportation decreased

compared to the prior-year period, which included Order Bookings of

U.S. $119.9 million (approximately $162.2 million CAD) from a

global automotive customer to move towards fully automated battery

assembly systems for their North American manufacturing operations.

Order Bookings in food & beverage increased primarily due to

timing of customer projects. Order Bookings in consumer products

decreased slightly as a result of the timing of customer projects,

offset by contributions from acquired companies. Order Bookings in

energy increased primarily due to timing of customer projects.

Trailing twelve month book-to-bill ratio at March 31, 2024 was

0.95:1. Book-to-bill ratio is a supplementary financial measure -

see “Non-IFRS and Other Financial Measures.”

Backlog

At March 31, 2024, Order Backlog was $1,793 million, 16.7% lower

than at March 31, 2023 primarily on account of lower Order Backlog

within the transportation market which included several large Order

Bookings a year ago.

Outlook

The life sciences funnel remains strong, with a focus on

strategic submarkets of pharmaceuticals, radiopharmaceuticals, and

medical devices. Management continues to see opportunities with

both new and existing customers, including those who produce

auto-injectors and wearable devices for diabetes and obesity

treatments, contact lenses and pre-filled syringes, as well as

opportunities to provide life science solutions that leverage

integrated capabilities from across ATS. Management expects

revenues from programs related to GLP-1 drugs and associated drug

delivery solutions, such as auto- injectors, to move towards a high

single digit percentage of total revenues over the next several

years. In transportation, the funnel is comprised of smaller

shorter-term opportunities, relative to the larger Order Bookings

received throughout fiscal years 2023 and 2024, and some of those

larger opportunities have also moved further into the future,

reflecting Original Equipment Manufacturers taking a more measured

approach, aligning capacity and platform costs with market demand.

Management believes the Company's automated electric vehicle ("EV")

battery pack and assembly capabilities position ATS well within the

industry as the market continues to evolve. Funnel activity in food

& beverage remains strong, particularly for energy-efficient

solutions. The Company continues to benefit from strong brand

recognition within the global tomato processing industry, and there

is continued interest in automated solutions within the food &

beverage market more broadly. Funnel activity in consumer products

is stable; inflationary pressures continue to have an effect on

discretionary spending by consumers, which may impact timing of

some customer investments. Funnel activity in energy remains strong

and includes longer-term opportunities in the nuclear industry. The

Company is focused on clean energy applications including solutions

for the refurbishment of nuclear power plants, early participation

in the small modular reactor market, and grid battery storage.

Across all markets, customers are exercising normal caution in

their approach to investment and spending. Funnel growth in markets

where environmental, social and governance requirements are an

increasing focus for customers — including grid battery storage, EV

and nuclear, as well as consumer goods packaging — provide ATS with

opportunities to use its capabilities to respond to customer

sustainability standards and goals, including global and regional

requirements to reduce carbon emissions. Customers seeking to

de-risk or enhance the resiliency of their supply chains, address a

shortage of skilled workers or combat higher labour costs also

provide future opportunities for ATS to pursue. Management believes

that the underlying trends driving customer demand for ATS

solutions including rising labour costs, labour shortages,

production onshoring or reshoring and the need for scalable,

high-quality, energy-efficient production remain favourable.

Order Backlog of $1,793 million is expected to help mitigate

some of the impact of quarterly variability in Order Bookings on

revenues in the short term. The Company’s Order Backlog includes

several large enterprise programs that have longer periods of

performance and therefore longer revenue recognition cycles. In the

first quarter of fiscal 2025, management expects the conversion of

Order Backlog to revenues to be in the 36% to 40% range. This

estimate is calculated each quarter based on management’s

assessment of project schedules across all customer contracts,

expectations for faster- turn product and services revenues,

expected delivery timing of third-party equipment and operational

capacity. In the third quarter, management disclosed that

approximately $200 million of Order Backlog with one of the

Company's EV customers was delayed. During the fourth quarter,

approximately $50 million of Order Backlog on this portion of the

program was reduced to reflect scope changes, partially offset by

increased scope changes in other areas of the overall program with

this same customer. Management continues to work with this customer

to support their revised timing as they realign their production

schedules on this portion of the program. This delay is accounted

for in the first-quarter revenue conversion range. Management

expects some pressure on EV revenues in the short-term as ATS

continues to execute on existing EV Order Backlog. For fiscal 2025,

despite expected lower revenues from EV, Management believes that

ATS is well-positioned to drive revenue growth in other markets,

including life sciences and expects this growth, combined with the

addition of Paxiom will largely offset reduced volumes from EV.

The timing of customer decisions on larger opportunities is

expected to cause variability in Order Bookings from quarter to

quarter. Revenues in a given period are dependent on a combination

of the volume of outstanding projects the Company is contracted to

perform, the size and duration of those projects, and the timing of

project activities including design, assembly, testing, and

installation. Given the specialized nature of the Company’s

offerings, the size and scope of projects vary based on customer

needs. The Company seeks to achieve revenue growth organically and

by identifying strategic acquisition opportunities that provide

access to attractive end-markets and new products and technologies

and deliver hurdle-rate returns. After-sales revenues and

reoccurring revenues, which ATS defines as revenues from ancillary

products and services associated with equipment sales, and revenues

from customers who purchase non-customized ATS product at regular

intervals, are expected to provide some balance to customers'

capital expenditure cycles. Management estimates that reoccurring

revenues are currently in the range of 25% to 35% of total revenues

on a trailing twelve- month basis.

In the short term, ATS expects it will continue to mitigate

supply chain volatility. Lead times have improved in most key

categories; however, prolonged cost increases, price and lead-time

volatility have and may continue to disrupt the timing and progress

of the Company’s margin expansion efforts and affect revenue

recognition. In addition, short-term revenue pressure related to EV

programs could impact margins. However, Management expects to be

able to manage the Company's cost structure over time through

flexible resourcing, including but not limited to subcontract

labour and redeploying resources to other parts of the business.

Over time, sustaining management's margin target assumes that the

Company will successfully implement its margin expansion

initiatives, and that such initiatives will result in improvements

to its adjusted earnings from operations margin that offset these

shorter- term pressures (see “Forward-Looking Statements” for a

description of the risks underlying the achievement of the margin

target in future periods).

In the short term, the Company expects non-cash working capital

to remain elevated as large enterprise programs progress through

milestones. Over the long-term, the Company expects to continue

investing in non-cash working capital to support growth, with

fluctuations expected on a quarter-over-quarter basis. The

Company’s long-term goal is to maintain its investment in non-cash

working capital as a percentage of annualized revenues below 15%.

However, given the size and timing of milestone payments for

certain large EV programs in Order Backlog, the Company could see

its working capital exceed 15% of annualized revenues in certain

periods as it did throughout fiscal 2024. The Company expects that

continued cash flows from operations, together with cash and cash

equivalents on hand and credit available under operating and

long-term credit facilities will be sufficient to fund its

requirements for investments in non-cash working capital and

capital assets, and to fund strategic investment plans including

some potential acquisitions. Acquisitions could result in

additional debt or equity financing requirements for the Company.

Non-cash working capital as a percentage of revenues is a non-IFRS

ratio - see “Non-IFRS and Other Financial Measures.”

The Company continues to make progress in line with its plans to

integrate acquired companies, and expects to realize cost and

revenue synergies consistent with announced integration plans.

Reorganization Activity

The Company periodically undertakes reviews of its operations to

ensure alignment with strategic market opportunities. As a part of

this review, the Company has identified and previously announced an

opportunity to improve the cost structure of the organization and

reallocate investment to growth areas. Resulting actions started in

the third quarter of fiscal 2024 and continued through fiscal year

end. Restructuring expenses of $6.6 million were recorded in the

fourth quarter, and for the full year, total costs of $22.8 million

were recorded, including actions to address expected lower EV

volumes in fiscal 2025.

Quarterly Conference Call

ATS will host a conference call and webcast at 8:30 a.m. eastern

on Thursday, May 16, 2024 to discuss its quarterly results. The

listen-only webcast can be accessed live at www.atsautomation.com.

The conference call can be accessed live by dialing (888) 660-6652

or (646) 960-0554 five minutes prior. A replay of the conference

will be available on the ATS website following the call.

Alternatively, a telephone recording of the call will be available

for one week (until midnight May 23, 2024) by dialing (800)

770-2030 and using the access code 8782510.

About ATS

ATS Corporation is an industry-leading automation solutions

provider to many of the world's most successful companies. ATS uses

its extensive knowledge base and global capabilities in custom

automation, repeat automation, automation products and value-added

solutions including pre-automation and after-sales services, to

address the sophisticated manufacturing automation systems and

service needs of multinational customers in markets such as life

sciences, transportation, food & beverage, consumer products,

and energy. Founded in 1978, ATS employs over 7,000 people at more

than 65 manufacturing facilities and over 85 offices in North

America, Europe, Southeast Asia and Oceania. The Company's common

shares are traded on the Toronto Stock Exchange ("TSX") and the New

York Stock Exchange ("NYSE") under the symbol ATS. Visit the

Company's website at www.atsautomation.com.

SOURCE: ATS Corporation

Consolidated Revenues

(In millions of dollars)

Revenues by type

Q4 2024

Q4 2023

Fiscal 2024

Fiscal 2023

Revenues from construction

contracts

$

499.0

$

470.7

$

1,972.8

$

1,630.4

Services rendered

170.3

137.4

614.7

492.3

Sale of goods

122.2

122.7

445.4

454.7

Total revenues

$

791.5

$

730.8

$

3,032.9

$

2,577.4

Revenues by market

Q4 2024

Q4 2023

Fiscal 2024

Fiscal 2023

Life Sciences

$

375.2

$

324.5

$

1,268.6

$

1,209.9

Transportation

222.2

199.1

933.3

578.2

Food & Beverage

99.7

99.1

435.0

371.3

Consumer Products

70.1

82.2

287.2

305.1

Energy

24.3

25.9

108.8

112.9

Total revenues

$

791.5

$

730.8

$

3,032.9

$

2,577.4

Revenues by customer

location

Q4 2024

Q4 2023

Fiscal 2024

Fiscal 2023

North America

$

468.0

$

438.1

$

1,766.5

$

1,525.5

Europe

247.1

237.8

990.1

811.7

Asia/Other

76.4

54.9

276.3

240.2

Total revenues

$

791.5

$

730.8

$

3,032.9

$

2,577.4

Additional revenue

disaggregation

Q4 2024

Q4 2023

Fiscal 2024

Fiscal 2023

Custom integration

$

367.7

$

329.0

$

1,422.3

$

1,143.3

Products and equipment

$

197.7

$

209.8

$

783.6

$

747.2

Services including spare

parts

$

226.1

$

192.0

$

827.0

$

686.9

Total revenues

$

791.5

$

730.8

$

3,032.9

$

2,577.4

Consolidated Operating

Results

(In millions of dollars)

Q4 2024

Q4 2023

Fiscal 2024

Fiscal 2023

Earnings from

operations

$

74.8

$

51.9

$

315.4

$

222.5

Amortization of

acquisition-related intangible assets

16.4

17.6

68.1

67.7

Acquisition-related transaction

costs

4.6

1.5

6.8

3.1

Acquisition-related inventory

fair value charges

2.0

—

2.8

9.2

Gain on sale of facilities

—

—

(11.7

)

—

Restructuring charges

6.6

15.8

22.8

27.5

Mark to market portion of

stock-based compensation

(8.5

)

15.1

(6.7

)

13.4

Adjusted earnings from

operations1

$

95.9

$

101.9

$

397.5

$

343.4

1 Non-IFRS Financial Measure, See

“Non-IFRS and Other Financial Measures”

Q4 2024

Q4 2023

Fiscal 2024

Fiscal 2023

Earnings from

operations

$

74.8

$

51.9

$

315.4

$

222.5

Depreciation and amortization

36.3

33.9

141.2

125.5

EBITDA1

$

111.1

$

85.8

$

456.6

$

348.0

Restructuring charges

6.6

15.8

22.8

27.5

Acquisition-related transaction

costs

4.6

1.5

6.8

3.1

Acquisition-related inventory

fair value charges

2.0

—

2.8

9.2

Mark to market portion of

stock-based compensation

(8.5

)

15.1

(6.7

)

13.4

Gain on sale of facilities

—

—

(11.7

)

—

Adjusted EBITDA1

$

115.8

$

118.2

$

470.6

$

401.2

1 Non-IFRS Financial Measure, See

“Non-IFRS and Other Financial Measures”

Order Backlog by

Market

(In millions of dollars)

As at

March 31, 2024

March 31, 2023

Life Sciences

$

871

$

761

Transportation

425

939

Food & Beverage

230

215

Consumer Products

156

156

Energy

111

82

Total

$

1,793

$

2,153

Order Bookings by

Quarter

(In millions of dollars)

Fiscal 2024

Fiscal 2023

Q1

$

690

$

736

Q2

742

804

Q3

668

979

Q4

791

737

Total Order Bookings

$

2,891

$

3,256

Reconciliation of Non-IFRS Measures to

IFRS Measures

(In millions of dollars, except per share

data)

The following table reconciles adjusted

EBITDA and EBITDA to the most directly comparable IFRS measure (net

income):

Q4 2024

Q4 2023

Fiscal 2024

Fiscal 2023

Adjusted EBITDA

$

115.8

$

118.2

$

470.6

$

401.2

Less: restructuring charges

6.6

15.8

22.8

27.5

Less: acquisition-related

transaction costs

4.6

1.5

6.8

3.1

Less: acquisition-related

inventory fair value charges

2.0

—

2.8

9.2

Less: mark to market portion of

stock-based compensation

(8.5

)

15.1

(6.7

)

13.4

Less: gain on sale of

facilities

—

—

(11.7

)

—

EBITDA

$

111.1

$

85.8

$

456.6

$

348.0

Less: depreciation and

amortization expense

36.3

33.9

141.2

125.5

Earnings from

operations

$

74.8

$

51.9

$

315.4

$

222.5

Less: net finance costs

18.8

18.8

68.7

62.7

Less: provision for income

taxes

7.5

3.5

52.5

32.1

Net income

$

48.5

$

29.6

$

194.2

$

127.7

The following table reconciles adjusted earnings from

operations, adjusted net income, and adjusted basic earnings per

share to the most directly comparable IFRS measure (net income and

basic earnings per share):

Three Months Ended March 31,

2024

Three Months Ended March 31,

2023

Earnings from

operations

Finance costs

Provision for income

taxes

Net income

Basic EPS

Earnings from operations

Finance costs

Provision for income taxes

Net income

Basic EPS

Reported (IFRS)

$

74.8

$

(18.8

)

$

(7.5

)

$

48.5

$

0.49

$

51.9

$

(18.8

)

$

(3.5

)

$

29.6

$

0.32

Amortization of acquisition-

related intangibles

16.4

—

—

16.4

0.16

17.6

—

—

17.6

0.19

Restructuring charges

6.6

—

—

6.6

0.07

15.8

—

—

15.8

0.17

Acquisition-related inventory

fair value charges

2.0

—

—

2.0

0.02

—

—

—

—

—

Acquisition-related transaction

costs

4.6

—

—

4.6

0.05

1.5

—

—

1.5

0.02

Mark to market portion of

stock-based compensation

(8.5

)

—

—

(8.5

)

(0.09

)

15.1

—

—

15.1

0.17

Tax effect adjustments1

—

—

(5.3

)

(5.3

)

(0.05

)

—

—

(12.9

)

(12.9

)

(0.14

)

Adjusted (non-IFRS)

$

95.9

$

64.3

$

0.65

$

101.9

$

66.7

$

0.73

1 Adjustments to provision for income

taxes relate to the income tax effects of adjustment items that are

excluded for the purposes of calculating non-IFRS based adjusted

net income.

Year Ended March 31,

2024

Year Ended March 31, 2023

Earnings from

operations

Finance costs

Provision for income

taxes

Net income

Basic EPS

Earnings from operations

Finance costs

Provision for income taxes

Net income

Basic EPS

Reported (IFRS)

$

315.4

$ (68.7)

$(52.5

)

$

194.2

$

1.98

$

222.5

$

(62.7

)

$

(32.1

)

$

127.7

$

1.39

Amortization of acquisition-

related intangibles

68.1

—

—

68.1

0.70

67.7

—

—

67.7

0.74

Restructuring charges

22.8

—

—

22.8

0.23

27.5

—

—

27.5

0.30

Acquisition-related fair value

inventory charges

2.8

—

—

2.8

0.03

9.2

—

—

9.2

0.10

Acquisition-related transaction

costs

6.8

—

—

6.8

0.07

3.1

—

—

3.1

0.03

Mark to market portion of

stock-based compensation

(6.7

)

—

—

(6.7

)

(0.07

)

13.4

—

—

13.4

0.14

Gain on sale of facilities

(11.7

)

—

—

(11.7

)

(0.12

)

—

—

—

—

—

Tax effect of the above

adjustments1

—

(21.0

)

(21.0

)

(0.21

)

—

—

(30.7

)

(30.7

)

(0.33

)

Adjusted (non-IFRS)

$

397.5

$

255.3

$

2.61

$

343.4

$

217.9

$

2.37

1 Adjustments to provision for income

taxes relate to the income tax effects of adjustment items that are

excluded for the purposes of calculating non-IFRS based adjusted

net income.

The following table reconciles organic revenue to the most

directly comparable IFRS measure (revenue):

Q4 2024

Q4 2023

Fiscal 2024

Fiscal 2023

Organic revenue

$

756.1

$

702.7

$

2,852.6

$

2,382.1

Revenues of acquired

companies

34.0

4.8

93.5

201.7

Impact of foreign exchange rate

changes

1.4

23.3

86.8

(6.4

)

Total revenue

$

791.5

$

730.8

$

3,032.9

$

2,577.4

Organic revenue growth

3.5

%

10.7

%

The following table reconciles non-cash working capital as a

percentage of revenues to the most directly comparable IFRS

measures:

As at

March 31 2024

March 31 2023

Accounts receivable

$

471.3

$

399.7

Income tax receivable

13.4

15.2

Contract assets

704.7

527.0

Inventories

295.9

256.9

Deposits, prepaids and other

assets

98.2

93.4

Accounts payable and accrued

liabilities

(604.5

)

(647.6

)

Income tax payable

(44.7

)

(38.9

)

Contract liabilities

(312.2

)

(296.6

)

Provisions

(36.0

)

(30.6

)

Non-cash working

capital

$

586.1

$

278.5

Trailing six-month revenues

annualized

$

3,087.0

$

2,755.6

Working capital %

19.0

%

10.1

%

The following table reconciles net debt to adjusted EBITDA to

the most directly comparable IFRS measures:

As at

March 31

2024

March 31

2023

Cash and cash equivalents

$

170.2

$

159.9

Bank indebtedness

(4.1

)

(5.8

)

Current portion of lease

liabilities

(27.6

)

(24.0

)

Current portion of long-term

debt

(0.2

)

(0.1

)

Long-term lease liabilities

(83.8

)

(73.3

)

Long-term debt

(1,171.8

)

(1,155.7

)

Net Debt

$

(1,117.3

)

$

(1,099.0

)

Adjusted EBITDA (TTM)

$

470.6

$

401.2

Net Debt to Adjusted

EBITDA

2.4x

2.7x

The following table reconciles free cash flow to the most

directly comparable IFRS measures:

(in millions of dollars)

Q4 2024

Q4 2023

Fiscal 2024

Fiscal 2023

Cash flows provided by operating

activities

$

9.6

$

81.4

$

20.8

$

127.8

Acquisition of property, plant

and equipment

(12.3

)

(23.4

)

(58.8

)

(56.1

)

Acquisition of intangible

assets

(13.6

)

(10.1

)

(29.6

)

(24.2

)

Free cash flow

$

(16.3

)

$

47.9

$

(67.6

)

$

47.5

Certain non-IFRS financial measures exclude the impact on

stock-based compensation expense of the revaluation of deferred

stock units and restricted share units resulting specifically from

the change in market price of the Company's common shares between

periods. Management believes the adjustment provides further

insight into the Company's performance.

The following table reconciles total stock-based compensation

expense to its components:

(in millions of dollars)

Q4 2024

Q3 2024

Q2 2024

Q1 2024

Q4 2023

Q3 2023

Q2 2023

Q1 2023

Total stock-based compensation expense

$

(4.3

)

$

4.7

$

3.5

$

10.0

$

19.3

$

9.9

$

5.3

$

(4.0

)

Less: Mark to market portion of

stock-based compensation

(8.5

)

(0.6

)

(2.0

)

4.4

15.1

5.6

1.0

(8.3

)

Base stock-based compensation

expense

$

4.2

$

5.3

$

5.5

$

5.6

$

4.2

$

4.3

$

4.3

$

4.3

INVESTMENTS, LIQUIDITY, CASH FLOW AND FINANCIAL RESOURCES

(In millions of dollars, except

ratios)

As at

March 31, 2024

March 31, 2023

Cash and cash equivalents

$

170.2

$

159.9

Debt-to-equity ratio1

0.79:1

1.18:1

1 Debt is calculated as bank indebtedness,

long-term debt and lease liabilities. Equity is calculated as total

equity less accumulated other comprehensive income.

Q4 2024

Q4 2023

Fiscal 2024

Fiscal 2023

Cash, beginning of period

$

260.9

$

302.1

$

159.9

$

135.3

Total cash provided by (used

in):

Operating activities

9.6

81.4

20.8

127.8

Investing activities

(26.3

)

(66.9

)

(341.8

)

(109.0

)

Financing activities

(75.4

)

(155.9

)

330.7

4.9

Net foreign exchange

difference

1.4

(0.8

)

0.6

0.9

Cash, end of period

$

170.2

$

159.9

$

170.2

$

159.9

ATS CORPORATION

Consolidated Statements of

Financial Position

(in thousands of Canadian

dollars)

As at March 31

2024

2023

ASSETS

Current assets

Cash and cash equivalents

$

170,177

$

159,867

Accounts receivable

471,345

399,741

Income tax receivable

13,428

15,160

Contract assets

704,703

526,990

Inventories

295,880

256,866

Deposits, prepaids and other

assets

98,161

93,350

1,753,694

1,451,974

Non-current assets

Property, plant and equipment

296,977

263,119

Right-of-use assets

105,661

94,212

Other assets

18,416

16,679

Goodwill

1,228,600

1,118,262

Intangible assets

679,547

593,210

Deferred income tax assets

5,904

6,337

2,335,105

2,091,819

Total assets

$

4,088,799

$

3,543,793

LIABILITIES AND EQUITY

Current liabilities

Bank indebtedness

$

4,060

$

5,824

Accounts payable and accrued

liabilities

604,488

647,629

Income tax payable

44,732

38,904

Contract liabilities

312,204

296,555

Provisions

35,978

30,600

Current portion of lease

liabilities

27,571

23,994

Current portion of long-term

debt

176

65

1,029,209

1,043,571

Non-current

liabilities

Employee benefits

24,585

25,486

Long-term lease liabilities

83,808

73,255

Long-term debt

1,171,796

1,155,721

Deferred income tax

liabilities

81,353

104,459

Other long-term liabilities

14,101

10,718

1,375,643

1,369,639

Total liabilities

$

2,404,852

$

2,413,210

EQUITY

Share capital

$

865,897

$

520,633

Contributed surplus

26,119

15,468

Accumulated other comprehensive

income

64,155

60,040

Retained earnings

724,495

530,707

Equity attributable to

shareholders

1,680,666

1,126,848

Non-controlling interests

3,281

3,735

Total equity

1,683,947

1,130,583

Total liabilities and

equity

$

4,088,799

$

3,543,793

Please refer to complete Consolidated Financial Statements for

supplemental notes which can be found on the Company’s profile on

SEDAR+ at www.sedarplus.com, the Company's profile on the U.S.

Securities and Exchange Commission's website at www.sec.gov, and on

the Company’s website at www.atsautomation.com.

ATS CORPORATION

Consolidated Statements of

Income

(in thousands of Canadian

dollars, except per share amounts)

Years ended March 31

2024

2023

Revenues

$

3,032,883

$

2,577,384

Operating costs and expenses

Cost of revenues

2,177,379

1,851,574

Selling, general and

administrative

503,533

445,242

Restructuring costs

22,790

27,487

Stock-based compensation

13,790

30,592

Earnings from

operations

315,391

222,489

Net finance costs

68,704

62,718

Income before income

taxes

246,687

159,771

Income tax expense

52,506

32,070

Net income

$

194,181

$

127,701

Attributable to

Shareholders

$

193,735

$

127,433

Non-controlling interests

446

268

$

194,181

$

127,701

Earnings per share

attributable to shareholders

Basic

$

1.98

$

1.39

Diluted

$

1.97

$

1.38

Please refer to complete Consolidated Financial Statements for

supplemental notes which can be found on the Company’s profile on

SEDAR+ at www.sedarplus.com, the Company's profile on the U.S.

Securities and Exchange Commission's website at www.sec.gov, and on

the Company’s website at www.atsautomation.com.

ATS CORPORATION

Consolidated Statements of

Cash Flows

(in thousands of Canadian

dollars)

Years ended March 31

2024

2023

Operating activities

Net income

$

194,181

$

127,701

Items not involving cash

Depreciation of property, plant

and equipment

28,455

25,590

Amortization of right-of-use

assets

29,656

24,060

Amortization of intangible

assets

83,063

75,839

Deferred income taxes

(29,915

)

(37,542

)

Other items not involving

cash

(20,277

)

16,470

Stock-based compensation

11,253

5,088

Change in non-cash operating

working capital

(275,636

)

(109,406

)

Cash flows provided by

operating activities

$

20,780

$

127,800

Investing activities

Acquisition of property, plant

and equipment

$

(58,830

)

$

(56,104

)

Acquisition of intangible

assets

(29,628

)

(24,192

)

Business acquisitions, net of

cash acquired

(276,538

)

(51,679

)

Settlement of cross-currency

interest rate swap instrument

—

21,493

Proceeds from disposal of

property, plant and equipment

23,211

1,460

Cash flows used in investing

activities

$

(341,785

)

$

(109,022

)

Financing activities

Bank indebtedness

$

(1,527

)

$

3,399

Repayment of long-term debt

(798,378

)

(344,169

)

Proceeds from long-term debt

816,514

395,559

Proceeds from exercise of stock

options

2,152

4,964

Proceeds from U.S. initial public

offering, net of issuance fees

362,072

—

Purchase of non-controlling

interest

(195

)

(452

)

Repurchase of common shares

(14

)

(21,071

)

Acquisition of shares held in

trust

(23,820

)

(12,365

)

Principal lease payments

(26,080

)

(20,983

)

Cash flows provided by

financing activities

$

330,724

$

4,882

Effect of exchange rate changes

on cash and cash equivalents

591

925

Increase in cash and cash

equivalents

10,310

24,585

Cash and cash equivalents,

beginning of year

159,867

135,282

Cash and cash equivalents, end

of year

$

170,177

$

159,867

Supplemental

information

Cash income taxes paid

$

49,511

$

58,398

Cash interest paid

$

68,526

$

58,452

Please refer to complete Consolidated Financial Statements for

supplemental notes which can be found on the Company’s profile on

SEDAR+ at www.sedarplus.com, the Company's profile on the U.S.

Securities and Exchange Commission's website at www.sec.gov, and on

the Company’s website at www.atsautomation.com.

Notice to Readers: Non-IFRS and Other Financial

Measures

Throughout this document, management uses certain non-IFRS

financial measures, non-IFRS ratios and supplementary financial

measures to evaluate the performance of the Company.

The terms “EBITDA”, "organic revenue", “adjusted net income”,

“adjusted earnings from operations”, “adjusted EBITDA”, “adjusted

basic earnings per share”, and “free cash flow”, are non-IFRS

financial measures, “EBITDA margin”, “adjusted earnings from

operations margin”, “adjusted EBITDA margin”, "organic revenue

growth", “non-cash working capital as a percentage of revenues”,

and “net debt to adjusted EBITDA” are non-IFRS ratios, and

"operating margin", "reoccurring revenues", "custom integration

revenues", "products and equipment revenues", "service including

spare parts revenues", “Order Bookings”, "organic Order Bookings",

"organic Order Bookings growth", “Order Backlog”, and “book-to-bill

ratio” are supplementary financial measures, all of which do not

have any standardized meaning prescribed within IFRS and therefore

may not be comparable to similar measures presented by other

companies. Such measures should not be considered in isolation or

as a substitute for measures of performance prepared in accordance

with IFRS. In addition, management uses “earnings from operations”,

which is an additional IFRS measure, to evaluate the performance of

the Company. Earnings from operations is presented on the Company’s

consolidated statements of income as net income excluding income

tax expense and net finance costs. Operating margin is an

expression of the Company’s earnings from operations as a

percentage of revenues. EBITDA is defined as earnings from

operations excluding depreciation and amortization. EBITDA margin

is an expression of the Company’s EBITDA as a percentage of

revenues. Organic revenue is defined as revenues in the stated

period excluding revenues from acquired companies for which the

acquired company was not a part of the consolidated group in the

comparable period. Organic revenue growth compares the stated

period organic revenue with the reported revenue of the comparable

prior period. Adjusted earnings from operations is defined as

earnings from operations before items excluded from management’s

internal analysis of operating results, such as amortization

expense of acquisition-related intangible assets,

acquisition-related transaction and integration costs,

restructuring charges, the mark-to-market adjustment on stock-based

compensation and certain other adjustments which would be

non-recurring in nature (“adjustment items”). Adjusted earnings

from operations margin is an expression of the Company’s adjusted

earnings from operations as a percentage of revenues. Adjusted

EBITDA is defined as adjusted earnings from operations excluding

depreciation and amortization. Adjusted EBITDA margin is an

expression of the entity’s adjusted EBITDA as a percentage of

revenues. Adjusted basic earnings per share is defined as adjusted

net income on a basic per share basis, where adjusted net income is

defined as adjusted earnings from operations less net finance costs

and income tax expense, plus tax effects of adjustment items and

adjusted for other significant items of a non- recurring nature.

Non-cash working capital as a percentage of revenues is defined as

the sum of accounts receivable, contract assets, inventories,

deposits, prepaids and other assets, less accounts payable, accrued

liabilities, provisions and contract liabilities divided by the

trailing two fiscal quarter revenues annualized. Free cash flow is

defined as cash provided by operating activities less property,

plant and equipment and intangible asset expenditures. Net debt to

adjusted EBITDA is the ratio of the net debt of the Company (cash

and cash equivalents less bank indebtedness, long-term debt, and

lease liabilities) to adjusted EBITDA. Reoccurring revenue for ATS

is defined as revenue from ancillary products and services

associated with equipment sales and revenue from customers who

purchase non-customized ATS products at regular intervals. Custom

integration revenues are defined as revenues from end-to-end

manufacturing solutions customized to customer needs. Products and

equipment revenues are defined as revenues from modular or

standardized equipment and other products. Services including spare

parts revenues are defined as revenues from consulting, digital and

other services, including aftermarket services and spares. Order

Bookings represent new orders for the supply of automation systems,

services and products that management believes are firm. Organic

Order Bookings are defined as Order Bookings in the stated period

excluding Order Bookings from acquired companies for which the

acquired company was not a part of the consolidated group in the

comparable period. Organic Order Bookings growth compares the

stated period organic Order Bookings with the reported Order

Bookings of the comparable prior period. Order Backlog is the

estimated unearned portion of revenues on customer contracts that

are in process and have not been completed at the specified date.

Book to bill ratio is a measure of Order Bookings compared to

revenue.

Following amendments to ATS’ Restricted Stock Unit Plan in 2022

to provide the Company with the option for settlement in shares

purchased in the open market and the creation of the employee

benefit trust to facilitate such settlement, ATS began to account

for equity-settled restricted share units using the equity method

of accounting. However, prior restricted share unit grants which

will be cash-settled and deferred stock unit grants which will be

cash-settled are accounted for as described in the Company's annual

consolidated financial statements and have volatility period over

period based on the fluctuating price of ATS’ common shares.

Certain non-IFRS financial measures (adjusted EBITDA, net debt to

adjusted EBITDA, adjusted earnings from operations and adjusted

basic earnings per share) exclude the impact on stock-based

compensation expense of the revaluation of deferred stock units and

restricted share units resulting specifically from the change in

market price of the Company's common shares between periods.

Management believes that this adjustment provides insight into the

Company's performance, as share price volatility drives variability

in the Company's stock-based compensation expense.

Operating margin, adjusted earnings from operations, EBITDA,

EBITDA margin, adjusted EBITDA, and adjusted EBITDA margin are used

by the Company to evaluate the performance of its operations.

Management believes that earnings from operations is an important

indicator in measuring the performance of the Company’s operations

on a pre-tax basis and without consideration as to how the Company

finances its operations. Management believes that organic revenue

and organic revenue growth, when considered with IFRS measures,

allow the Company to better measure the Company's performance and

evaluate long-term performance trends. Organic revenue growth also

facilitates easier comparisons of the Company's performance with

prior and future periods and relative comparisons to its peers.

Management believes that EBITDA and adjusted EBITDA are important

indicators of the Company’s ability to generate operating cash

flows to fund continued investment in its operations. Management

believes that adjusted earnings from operations, adjusted earnings

from operations margin, adjusted EBITDA, adjusted net income and

adjusted basic earnings per share are important measures to

increase comparability of performance between periods. The

adjustment items used by management to arrive at these metrics are

not considered to be indicative of the business’ ongoing operating

performance. Management uses the measure “non-cash working capital

as a percentage of revenues” to assess overall liquidity. Free cash

flow is used by the Company to measure cash flow from operations

after investment in property, plant and equipment and intangible

assets. Management uses net debt to adjusted EBITDA as a

measurement of leverage of the Company. Reoccurring revenues,

custom integration revenues, products and equipment revenues and

service including spare parts revenues are used by the Company to

understand the revenue portfolio of the Company. Order Bookings

provide an indication of the Company’s ability to secure new orders

for work during a specified period, while Order Backlog provides a

measure of the value of Order Bookings that have not been completed

at a specified point in time. Both Order Bookings and Order Backlog

are indicators of future revenues that the Company expects to

generate based on contracts that management believes to be firm.

Organic Order Bookings and organic Order Bookings growth allow the

Company to better measure the Company's performance and evaluate

long-term performance trends. Organic Order Bookings growth also

facilitates easier comparisons of the Company's performance with

prior and future periods and relative comparisons to its peers.

Book to bill ratio is used to measure the Company’s ability and

timeliness to convert Order Bookings into revenues. Management

believes that ATS shareholders and potential investors in ATS use

these additional IFRS measures and non-IFRS financial measures in

making investment decisions and measuring operational results.

A reconciliation of (i) adjusted EBITDA and EBITDA to net

income, (ii) adjusted net income to net income, (iii) adjusted

basic earnings per share to basic earnings per share (iv) free cash

flow to its IFRS measure components and (vi) organic revenue to

revenue, in each case for the three- and twelve- months ended March

31, 2024 and March 31, 2023, is contained in this document (see

“Reconciliation of Non-IFRS Measures to IFRS Measures”). This

document also contains a reconciliation of (i) non-cash working

capital as a percentage of revenues and (ii) net debt to their IFRS

measure components, in each case at both March 31, 2024 and March

31, 2023 (see “Reconciliation of Non-IFRS Measures to IFRS

Measures”). A reconciliation of adjusted earnings from operations

to earnings from operations for the three- and twelve-months ended

March 31, 2024 and March 31, 2023 is also contained in this

document (see “Consolidated Operating Results"). A reconciliation

of Order Bookings and Order Backlog to total Company revenues for

the three- and twelve-months ended March 31, 2024 and March 31,

2023 is also contained in this document (see “Order Backlog

Continuity”).

Note to Readers: Forward-Looking Statements

This news release contains certain statements that may

constitute forward-looking information and forward-looking

statements within the meaning of applicable Canadian and United

States securities laws ("forward-looking statements"). All such

statements are made pursuant to the “safe harbour” provisions of

Canadian provincial and territorial securities laws and the U.S.

Private Securities Litigation Reform Act of 1995. Forward-looking

statements include all statements that are not historical facts

regarding possible events, conditions or results of operations that

ATS believes, expects or anticipates will or may occur in the

future, including, but not limited to: the value creation strategy;

the Company’s strategy to expand organically and through

acquisition, and the expected benefits to be derived; the ABM;

disciplined acquisitions; various market opportunities for ATS;

expanding in emerging markets; conversion of opportunities into

Order Bookings; the Company’s Order Backlog partially mitigating

the impact of variable Order Bookings; rate of Order Backlog

conversion to revenue; the expected benefits where the Company

engages with customers on enterprise-type solutions and the

potential impact of the Company’s approach to market and timing of

customer decisions on Order Bookings, performance period, and

timing of revenue recognition; the announcement of new Order

Bookings and the anticipated timeline for delivery; potential

impacts on the time to convert opportunities into Order Bookings;

expected benefits with respect to the Company’s efforts to grow its

product portfolio and after-sale service revenues; initiatives in

furtherance of the Company’s goal of expanding its adjusted

earnings from operations margin over the long term and potential

impact of supply chain disruptions; the ability of after-sales

revenues and reoccurring revenues to provide some balance to

customers’ capital expenditure cycles; the range of reoccurring

revenues as a percentage of total revenues; the impact of

developing the Company’s digitalization capabilities, including the

collection and interpretation of data, as a key area of growth, and

to drive meaningful change to optimize performance for customers;

expectation of synergies from integration of acquired businesses;

the closing and completion of any planned acquisitions as

anticipated; the timing and amount of restructuring costs; non-cash

working capital levels as a percentage of revenues in the

short-term and the long-term; reorganization activity, and its

ability to improve the cost structure of the Company, and to be

reallocated to growth areas, and the expected timing and cost of

this reorganization activity; expectation in relation to meeting

liquidity and funding requirements for investments; potential to

use debt or equity financing to support strategic opportunities and

growth strategy; underlying trends driving customer demand;

potential impacts of variability in bookings caused by the

strategic nature and size of electric vehicle programs; revenue

growth in other markets and due to acquisitions to offset any

reduced volumes from the electric vehicle program in fiscal 2025;

expected capital expenditures for fiscal 2025; the uncertainty and

potential impact on the Company’s business and operations due to

the current macroeconomic environment including the impacts of

infectious diseases or any epidemic or pandemic outbreak or

resurgence, inflation, supply chain disruptions, interest rate

changes, energy shortages, global price increases, events involving

limited liquidity, defaults, non-performance or other adverse

developments that affect financial institutions, transactional

counterparties or other companies in the financial services

industry generally, or concerns or rumours about any events of

these kinds or other similar risks that have in the past and may in

the future lead to market-wide liquidity problems, and regional

conflicts; the Company’s belief with respect to the outcome of

certain lawsuits, claims and contingencies; and the expectation

that changes in accounting standards will not have a material

effect on the Company's financial statements.

Forward-looking statements are inherently subject to significant

known and unknown risks, uncertainties, and other factors that may

cause the actual results, performance, or achievements of ATS, or

developments in ATS’ business or in its industry, to differ

materially from the anticipated results, performance, achievements,

or developments expressed or implied by such forward-looking

statements. Important risks, uncertainties, and factors that could

cause actual results to differ materially from expectations

expressed in the forward-looking statements include, but are not

limited to: the impact of regional or global conflicts; general

market performance including capital market conditions and

availability and cost of credit; performance of the markets that

ATS serves; industry challenges in securing the supply of labour,

materials, and, in certain jurisdictions, energy sources such as

natural gas; impact of inflation; interest rate changes; foreign

currency and exchange risk; the relative strength of the Canadian

dollar; risks related to customer concentration; risks related to a

recession, slowdown, and/or sustained downturn in the economy;

impact of factors such as increased pricing pressure, increased

cost of energy and supplies, and delays in relation thereto, and

possible margin compression; the regulatory and tax environment;

the emergence of new infectious diseases or any epidemic or

pandemic outbreak or resurgence, and collateral consequences

thereof, including the disruption of economic activity, volatility

in capital and credit markets, and legislative and regulatory

responses; the effect of events involving limited liquidity,

defaults, non-performance or other adverse developments that affect

financial institutions, transaction counterparties, or other

companies in the financial services industry generally, or concerns

or rumours about any events of these kinds or other similar risks,

that have in the past and may in the future lead to market-wide

liquidity problems; energy shortages and global prices increases;

inability to successfully expand organically or through

acquisition, due to an inability to grow expertise, personnel,

and/or facilities at required rates or to identify, negotiate and

conclude one or more acquisitions; or to raise, through debt or

equity, or otherwise have available, required capital; that the ABM

is not effective in accomplishing its goals; that ATS is unable to

expand in emerging markets, or is delayed in relation thereto, due

to any number of reasons, including inability to effectively

execute organic or inorganic expansion plans, focus on other

business priorities, or local government regulations or delays;

that the timing of completion of new Order Bookings is other than

as expected due to various reasons, including schedule changes or

the customer exercising any right to withdraw the Order Booking or

to terminate the program in whole or in part prior to its

completion, thereby preventing ATS from realizing on the full

benefit of the program; that some or all of the sales funnel is not

converted to Order Bookings due to competitive factors or failure

to meet customer needs; that the market opportunities ATS

anticipates do not materialize or that ATS is unable to exploit

such opportunities; failure to convert Order Backlog to revenue

and/or variations in the amount of Order Backlog completed in any

given quarter; timing of customer decisions related to large

enterprise programs and potential for negative impact associated

with any cancellations or non-performance in relation thereto; that

the Company is not successful in growing its product portfolio

and/or service offering or that expected benefits are not realized;

that efforts to expand adjusted earnings from operations margin

over long-term are unsuccessful, due to any number of reasons,

including less than anticipated increase in after-sales service

revenues or reduced margins attached to those revenues, inability

to achieve lower costs through supply chain management, failure to

develop, adopt internally, or have customers adopt, standardized

platforms and technologies, inability to maintain current cost

structure if revenues were to grow, and failure of ABM to impact

margins; that after-sales or reoccurring revenues do not provide

the expected balance to customers’ expenditure cycles; that

reoccurring revenues are not in the expected range; the development

of the Company’s digitalization capabilities fails to achieve the

growth or change expected; that planned acquisitions are not closed

as anticipated or at all; that acquisitions made are not integrated

as quickly or effectively as planned or expected and, as a result,

anticipated benefits and synergies are not realized; non-cash

working capital as a percentage of revenues operating at a level

other than as expected due to reasons, including, the timing and

nature of Order Bookings, the timing of payment milestones and

payment terms in customer contracts, and delays in customer

programs; that planned reorganization activity does not succeed in

improving the cost structure of the Company or that the investment

is not reallocated to growth areas, or is not completed at the cost

or within the timelines expected, or at all; underlying trends

driving customer demand will not materialize or have the impact

expected; that capital expenditure targets are increased in the

future or the Company experiences cost increases in relation

thereto; risk that the ultimate outcome of lawsuits, claims, and

contingencies give rise to material liabilities for which no

provisions have been recorded; the impact on the Company’s

financial statements of changes in accounting standards; the

consequence of activist initiatives on the business performance,

results, or share price of the Company; the impact of analyst

reports on price and trading volume of ATS’ shares; and other risks

and uncertainties detailed from time to time in ATS' filings with

securities regulators, including, without limitation, the risk

factors described in ATS’ annual information form for the fiscal

year ended March 31, 2024, which are available on the System for

Electronic Data Analysis and Retrieval + ("SEDAR+") at

www.sedarplus.com and on the U.S. Securities Exchange Commission’s

Electronic Data Gatherin, Analysis and Retrieval System ("EDGAR")

at www.sec.gov. ATS has attempted to identify important factors

that could cause actual results to materially differ from current

expectations, however, there may be other factors that cause actual

results to differ materially from such expectations.

Forward-looking statements are necessarily based on a number of

estimates, factors, and assumptions regarding, among others,

management's current plans, estimates, projections, beliefs and

opinions, the future performance and results of the Company’s

business and operations; the ability of ATS to execute on its

business objectives; and general economic and political conditions,

and global events, including any epidemic or pandemic outbreak or

resurgence.

Forward-looking statements included in this news release are

only provided to understand management’s current expectations

relating to future periods and, as such, are not appropriate for

any other purpose. Although ATS believes that the expectations

reflected in such forward-looking statements are reasonable, such

statements involve risks and uncertainties, and ATS cautions you

not to place undue reliance upon any such forward-looking

statements, which speak only as of the date they are made. ATS does

not undertake any obligation to update forward-looking statements

contained herein other than as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240516233307/en/

For more information, contact: David Galison Head of

Investor Relations ATS Corporation 730 Fountain Street North

Cambridge, ON, N3H 4R7 (519) 653-6500 dgalison@atsautomation.com

For general media inquiries, contact: Matthew Robinson

Director, Corporate Communications ATS Corporation 730 Fountain

Street North Cambridge, ON, N3H 4R7 (519) 653-6500

mrobinson@atsautomation.com

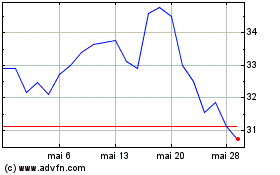

ATS (NYSE:ATS)

Gráfico Histórico do Ativo

De Mar 2025 até Abr 2025

ATS (NYSE:ATS)

Gráfico Histórico do Ativo

De Abr 2024 até Abr 2025