Granite Real Estate Investment Trust and Granite REIT Inc.

(TSX: GRT.UN / NYSE: GRP.U) (“Granite REIT” and

“Granite GP”, and collectively, “Granite”) today

announced the acceptance by the Toronto Stock Exchange (the

“TSX”) of Granite’s Notice of Intention to Make a Normal

Course Issuer Bid (“NCIB”). Pursuant to the NCIB, Granite

proposes to purchase through the facilities of the TSX and any

alternative trading system in Canada, from time to time over the

next 12 months, if considered advisable, up to an aggregate of

6,273,168 of Granite’s issued and outstanding stapled units (the

“Stapled Units”) (each Stapled Unit consisting of one trust

unit of Granite REIT and one common share of Granite GP), being

approximately 10% of Granite’s public float of Stapled Units as of

May 15, 2024. Pursuant to a previous notice of intention to conduct

a NCIB, under which Granite sought and received approval from the

TSX to purchase up to 6,349,296 Stapled Units for the period of May

24, 2023 to May 23, 2024, Granite has purchased, as of May 15,

2024, 768,300 Stapled Units on the open market at a weighted

average purchase price of $69.0523 per Stapled Unit. As of May 15,

2024, Granite had 63,008,797 Stapled Units issued and outstanding

and a public float of 62,731,680 Stapled Units.

The NCIB will commence on May 24, 2024 and will conclude on the

earlier of the date on which purchases under the bid have been

completed and May 23, 2025. Daily purchases made by Granite through

the TSX may not exceed 23,113 Stapled Units, being 25% of the

average daily trading volume of 92,454 Stapled Units on the TSX for

the six-month period ended April 30, 2024. These daily maximums are

subject to certain exceptions prescribed by the TSX, including the

“block purchase exemption”.

Granite intends to enter into an automatic securities purchase

plan with a broker as of the date on which the NCIB commences in

order to facilitate repurchases of the Stapled Units under the NCIB

during Granite’s scheduled blackout periods. Under the automatic

securities purchase plan, Granite’s broker may repurchase Stapled

Units under the NCIB in accordance with any advance instructions

that Granite may elect to deliver, including without limitation

repurchases made at times when Granite would ordinarily not be

permitted to repurchase Stapled Units due to regulatory

restrictions or self-imposed blackout periods. Purchases will be

made by Granite’s broker based upon the parameters under the NCIB

and the terms of the parties’ written agreement.

The Board of Trustees of Granite REIT and the Board of Directors

of Granite GP believe that the potential purchases at prices below

Granite’s view of intrinsic value are in the best interests of

Granite and are a desirable use of Granite’s funds. All Stapled

Units that are purchased under the NCIB will be cancelled.

ABOUT GRANITE

Granite is a Canadian-based REIT engaged in the acquisition,

development, ownership and management of logistics, warehouse and

industrial properties in North America and Europe. Granite owns 143

investment properties representing approximately 63.3 million

square feet of leasable area.

OTHER INFORMATION

Copies of financial data and other publicly filed documents

about Granite are available through the internet on the Canadian

Securities Administrators’ Systems for Electronic Data Analysis and

Retrieval+ (SEDAR+) which can be accessed at www.sedarplus.ca and

on the United States Securities and Exchange Commission’s

Electronic Data Gathering, Analysis and Retrieval System (EDGAR)

which can be accessed at www.sec.gov. For further information,

please see our website at www.granitereit.com or contact Teresa

Neto, Chief Financial Officer, at 647-925-7560 or Andrea Sanelli,

Associate Director, Legal & Investor Services, at

647-925-7504.

FORWARD LOOKING STATEMENTS

This press release may contain statements that, to the extent

they are not recitations of historical fact, constitute

“forward-looking statements” or “forward-looking information”

within the meaning of applicable securities legislation, including

the United States Securities Act of 1933, as amended, the United

States Securities Exchange Act of 1934, as amended, and applicable

Canadian securities legislation. Forward-looking statements and

forward-looking information may include, among others, statements

regarding Granite’s future distributions, Stapled Unit repurchases,

plans, goals, strategies, intentions, beliefs, estimates, costs,

objectives, economic performance, expectations, or foresight or the

assumptions underlying any of the foregoing. Words such as “may”,

“would”, “could”, “will”, “likely”, “expect”, “anticipate”,

“believe”, “intend”, “plan”, “forecast”, “project”, “estimate”,

“seek”, “objective” and similar expressions are used to identify

forward-looking statements and forward-looking information.

Forward-looking statements and forward-looking information should

not be read as guarantees of future Stapled Unit repurchases,

events, performance or results and will not necessarily be accurate

indications of whether or the times at or by which such future

Stapled Unit repurchases, events or performance will be achieved.

Undue reliance should not be placed on such statements.

Forward-looking statements and forward-looking information are

based on information available at the time and/or management’s good

faith assumptions and analyses made in light of its perception of

historical trends, current conditions and expected future

developments, as well as other factors management believes are

appropriate in the circumstances, and are subject to known and

unknown risks, uncertainties and other unpredictable factors, many

of which are beyond Granite’s control, that could cause actual

events or results to differ materially from such forward-looking

statements and forward-looking information. Important factors that

could cause such differences include, but are not limited to, the

risks set forth in the annual information form of Granite REIT and

Granite GP dated February 28, 2024 (the “Annual Information

Form”). The “Risk Factors” section of the Annual Information

Form also contains information about the material factors or

assumptions underlying such forward-looking statements and

forward-looking information. Forward-looking statements and

forward-looking information speak only as of the date the

statements and information were made and unless otherwise required

by applicable securities laws, Granite expressly disclaims any

intention and undertakes no obligation to update or revise any

forward-looking statements or forward-looking information contained

in this press release to reflect subsequent information, events or

circumstances or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240521845957/en/

Teresa Neto Chief Financial Officer 647-925-7560

Andrea Sanelli Associate Director, Legal & Investor Services

647-925-7504

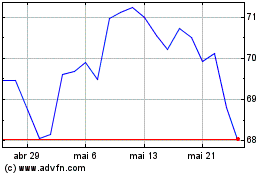

Granite Real Estate Inve... (TSX:GRT.UN)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

Granite Real Estate Inve... (TSX:GRT.UN)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024