– Net Income Per Fully Diluted Share of

$0.10 –

– Core FFO Per Fully Diluted Share of $0.24

–

– Signed 272,000 Rentable Square Feet of

Leases –

– Announces Agreements to Acquire North 6th

Street Williamsburg, Brooklyn Retail –

– 10th Quarter of Positive Leased Absorption

–

– 12th Quarter of Positive Leasing Spreads

–

– Over $1.0B of Liquidity, No Floating Rate

Debt Exposure –

– Reaffirms 2024 FFO Guidance –

Empire State Realty Trust, Inc. (NYSE: ESRT) is a NYC-focused

REIT that owns and operates a portfolio of modernized, amenitized,

and well-located office, retail, and multifamily assets. ESRT’s

flagship Empire State Building, the “World's Most Famous Building,”

features its iconic Observatory that was declared the #1 Attraction

in the World – and the #1 Attraction in the U.S. for the third

consecutive year– in Tripadvisor’s 2024 Travelers’ Choice Awards:

Best of the Best Things to Do. The Company is the recognized leader

in energy efficiency and indoor environmental quality. Today the

Company reported its operational and financial results for the

second quarter 2024. All per share amounts are on a fully diluted

basis, where applicable.

Second Quarter and Recent Highlights

- Net Income of $0.10 per share.

- Core Funds From Operations (“Core FFO”) of $0.24 per

share.

- Same-Store Property Cash Net Operating Income (“NOI”) increased

7.4% year-over-year, excluding lease termination fees, primarily

driven by higher revenues from cash rent commencement, which was

partially offset by increases in operating expenses. Adjusted for

certain nonrecurring items, Same-Store NOI increased by

approximately 6% year-over-year.

- Manhattan office portfolio leased rate increased by 60bps

sequentially and 170bps year-over-year to 93.3%. The total

commercial portfolio is 92.6% leased as June 30, 2024. This is the

10th consecutive quarter of positive commercial leased rate

absorption.

- Signed approximately 272,000 rentable square feet of new,

renewal and expansion leases. In our Manhattan office portfolio,

blended leasing spreads were +2.0%, and this is the 12th

consecutive quarter of positive leasing spreads.

- Empire State Building Observatory generated $41.3 million of

NOI year-to-date, a 5.8% increase year-over-year.

- Subsequent to quarter-end, the Company entered into two

agreements to acquire prime retail assets located on North 6th

Street in Williamsburg, Brooklyn, for $195 million in

aggregate.

Property Operations

As of June 30, 2024, the Company’s property portfolio contained

7.9 million rentable square feet of office space, 0.7 million

rentable square feet of retail space and 727 residential units,

which were occupied and leased as shown below.

June 30,

20241

March

31, 2024

June 30,

2023

Percent occupied:

Total commercial portfolio

88.5%

87.6%

86.8%

Total office

88.2%

87.4%

86.5%

Manhattan office

88.8%

88.9%

87.6%

GNYMA office

70.7%

76.8%

79.2%

Total retail2

92.3%

89.8%

90.7%

Percent leased (includes signed leases

not commenced):

Total commercial portfolio

92.6%

91.1%

90.3%

Total office

92.5%

91.1%

90.2%

Manhattan office

93.3%

92.7%

91.6%

GNYMA office

73.3%

79.5%

80.4%

Total retail2

93.5%

91.0%

91.6%

Total multifamily portfolio

97.9%

97.1%

97.4%

1 Occupancy and leased percentages for

June 30, 2024 exclude First Stamford Place.

2 “Total retail” for the periods ended

June 30 and March 31, 2024 includes the Williamsburg Retail assets

acquired in September 2023.

Leasing

The tables that follow summarize leasing activity for the three

months ended June 30, 2024. During this period, the Company signed

35 leases that totaled 271,981 square feet, inclusive of 54,761

square feet of early renewals3. Within the Manhattan office

portfolio, the Company signed 31 office leases that totaled 261,311

square feet.

Total Portfolio3

Total Portfolio

Total Leases Executed

Total square footage

executed

Average cash rent psf – leases

executed

Previously escalated cash

rents psf

% of new cash rent over/ under

previously escalated rents

Office

32

262,991

$

66.60

$

65.31

2.0

%

Retail

3

8,990

$

91.14

$

75.03

21.5

%

Total Overall

35

271,981

$

67.41

$

65.63

2.7

%

Manhattan Office Portfolio3

Manhattan Office Portfolio

Total Leases Executed

Total square footage

executed

Average cash rent psf – leases

executed

Previously escalated cash

rents psf

% of new cash rent over /

under previously escalated rents

New Office

18

162,655

$

67.44

$

64.36

4.8

%

Renewal Office

13

98,656

$

65.50

$

67.09

-2.4

%

Total Office

31

261,311

$

66.71

$

65.40

2.0

%

3 Beginning in the quarter ended June 30,

2024, we include "Early Renewals", defined as leases which were

signed over two years prior to lease expiration. “Early Renewals”

are included within “Renewal Office” metrics listed above.

Leasing Activity Highlights

- 11-year 40,679 square foot new lease at the Empire State

Building with Pontera Solutions Inc., which represents a relocation

and expansion from its current 10,539 square foot space at 111 West

33rd Street.

- 11-year 27,866 square foot new lease with A.T. Kearney, Inc. at

the Empire State Building.

- 11-year 24,592 square feet new lease with William Carter

Company at 1350 Broadway.

Observatory Results

In the second quarter, Observatory revenue was $34.1 million,

and expenses were $8.9 million. Observatory NOI was $25.2 million,

a 1.6% increase year-over-year. Year-to-date, Observatory NOI was

$41.3 million, a 5.8% increase year-over-year.

Balance Sheet

The Company had $1.0 billion of total liquidity as of June 30,

2024, which was comprised of $536 million of cash, plus $500

million available under its revolving credit facility. At June 30,

2024, the Company had total debt outstanding of approximately $2.3

billion, no floating rate debt exposure, and a weighted average

interest rate of 4.27% per annum. At June 30, 2024, the Company’s

ratio of net debt to adjusted EBITDA was 5.1x.

In July, the Company executed an agreement to refinance the

mortgage for the Metro Center property that was due to mature in

November 2024. Beginning November 2024, the new loan balance of $72

million will be interest-only at the same interest rate of 3.6%,

with a maturity of November 2029, inclusive of a one-year extension

option.

Portfolio Transaction Activity

Subsequent to quarter end, the Company entered into an agreement

to acquire a prime retail portfolio located on North 6th Street in

Williamsburg, Brooklyn for $103 million. The approximately 40,000

square foot retail portfolio comprises five high quality retail

storefronts which are 86% leased for a weighted average lease term

of 7.5 years. Separately, the Company has entered into another

agreement to acquire an additional prime retail portfolio on North

6th Street for $92 million. Due to confidentiality requirements,

more details on this additional portfolio will be disclosed upon

closing. These all-cash transactions are consistent with our

strategy to recycle capital and balance sheet capacity from

non-core suburban assets into strong NYC assets. This further

expands the Company’s presence in Williamsburg, Brooklyn following

its initial acquisition of prime retail on North 6th Street in

September 2023.

Share Repurchase

The stock repurchase program began in March 2020 and through

July 23, 2024, approximately $293.7 million has been repurchased at

a weighted average price of $8.18 per share. There were no share

repurchases during the second quarter.

Dividend

On June 28, 2024, the Company paid a quarterly dividend of

$0.035 per share or unit, as applicable, for the second quarter of

2024 to holders of the Company’s Class A common stock (NYSE: ESRT)

and Class B common stock and to holders of the Series ES, Series

250 and Series 60 partnership units (NYSE Arca: ESBA, FISK and

OGCP, respectively) and Series PR partnership units of Empire State

Realty OP, L.P., the Company’s operating partnership (the

“Operating Partnership”).

On June 28, 2024, the Company paid a quarterly preferred

dividend of $0.15 per unit for the second quarter of 2024 to

holders of the Operating Partnership’s Series 2014 private

perpetual preferred units and a preferred dividend of $0.175 per

unit for the second quarter of 2024 to holders of the Operating

Partnership’s Series 2019 private perpetual preferred units.

2024 Earnings Outlook

The Company provides 2024 guidance and key assumptions, as

summarized in the table below. The Company’s guidance does not

include the impact of any significant future lease termination fee

income or any unannounced acquisition, disposition or other capital

markets activity.

Key Assumptions 2024 UpdatedGuidance(July 2024)

2024 InitialGuidance(Feb 2024) Comments

Earnings Core FFO

Per Fully Diluted Share $0.90 to $0.94 $0.90 to $0.94 • 2024

includes $0.04 from multifamily

assets

Commercial Property Drivers

Commercial Occupancy at year-end 87% to 89% 87% to

89% SS Property Cash NOI(excluding lease termination fees)

0% to 3%

-1% to +2%

• Assumes positive revenue growth •

Assumes a 6-7% y/y increase in operating expenses and real estate

taxes, partially offset by higher tenant expense

reimbursements

Observatory Drivers

Observatory NOI $94M to $102M $94M to $102M •

Reflects average quarterly expenses of ~$9M

Low

High

Net Income (Loss) Attributable to Common Stockholders and the

Operating Partnership

$0.21

$0.25

Add: Impairment Charge

0.00

0.00

Real Estate Depreciation & Amortization

0.67

0.67

Less: Private Perpetual Distributions

0.02

0.02

Gain on Disposal of Real Estate, net

0.00

0.00

FFO Attributable to Common Stockholders and the Operating

Partnership

$0.87

$0.91

Add: Amortization of Below Market Ground Lease

0.03

0.03

Core FFO Attributable to Common Stockholders and the Operating

Partnership

$0.90

$0.94

The estimates set forth above may be subject to fluctuations as

a result of several factors, including continued impacts of changes

in the use of office space and remote work on our business and our

market, our ability to complete planned capital improvements in

line with budget, costs of integration of completed acquisitions,

costs associated with future acquisitions or other transactions,

straight-line rent adjustments and the amortization of above and

below-market leases. There can be no assurance that the Company’s

actual results will not differ materially from the estimates set

forth above.

Investor Presentation Update

The Company has posted on the “Investors” section of ESRT’s

website the latest investor presentation, which contains additional

information on its businesses, financial condition and results of

operations.

Webcast and Conference Call Details

Empire State Realty Trust, Inc. will host a webcast and

conference call, open to the general public, on Thursday, July 25,

2024 at 12:00 pm Eastern time.

The webcast will be accessible on the “Investors” section of

ESRT’s website. To listen to the live webcast, go to the site at

least five minutes prior to the scheduled start time in order to

register and download and install any necessary audio software. The

conference call can also be accessed by dialing 1-877-407-3982 for

domestic callers or 1-201-493-6780 for international callers.

Starting shortly after the call until August 1, 2024, a replay

of the webcast will be available on the Company’s website, and a

dial-in replay will be available by dialing 1-844-512-2921 for

domestic callers or 1-412-317-6671 for international callers. The

passcode for this dial-in replay is 13741462.

The Supplemental Report and Investor Presentation are additional

components of the quarterly earnings announcement and are now

available on the “Investors” section of ESRT’s website.

The Company uses, and intends to continue to use, the

“Investors” page of its website, which can be found at

www.esrtreit.com, as a means to disclose material nonpublic

information and to comply with its disclosure obligations under

Regulation FD, including, without limitation, through the posting

of investor presentations that may include material nonpublic

information. Accordingly, investors should monitor the “Investors”

page, in addition to following our press releases, SEC filings,

public conference calls, presentations and webcasts. The

information contained on, or that may be accessed through, our

website is not incorporated by reference into, and is not a part

of, this document.

About Empire State Realty Trust

Empire State Realty Trust, Inc. (NYSE: ESRT) is a NYC-focused

REIT that owns and operates a portfolio of modernized, amenitized,

and well-located office, retail, and multifamily assets. ESRT’s

flagship Empire State Building, the “World's Most Famous Building,”

features its iconic Observatory that was declared the #1 Attraction

in the World – and the #1 Attraction in the U.S. for the third

consecutive year – in Tripadvisor’s 2024 Travelers’ Choice Awards:

Best of the Best Things to Do. The Company is the recognized leader

in energy efficiency and indoor environmental quality. As of June

30, 2024, ESRT’s portfolio is comprised of approximately 7.9

million rentable square feet of office space, 0.7 million rentable

square feet of retail space and 727 residential units. More

information about Empire State Realty Trust can be found at

esrtreit.com and by following ESRT

on Facebook, Instagram,

TikTok, X, and LinkedIn.

Forward-Looking Statements

This press release includes “forward-looking statements” within

the meaning of Section 27A of the Securities Act of 1933, as

amended (the “Securities Act"), and Section 21E of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”). We intend

these forward-looking statements to be covered by the safe harbor

provisions for forward-looking statements contained in the Private

Securities Litigation Reform Act of 1995 and are including this

statement for purposes of complying with those safe harbor

provisions. You can identify forward-looking statements by the use

of forward-looking terminology such as “aims," "anticipates,"

"approximately," "believes," "contemplates," "continues,"

"estimates," "expects," "forecasts," "hope," "intends," "may,"

"plans," "seeks," "should," "thinks," "will," "would" or the

negative of these words and phrases or similar words or phrases.

For the avoidance of doubt, any projection, guidance, or similar

estimation about the future or future results, performance or

achievements is a forward-looking statement.

Forward-looking statements are subject to substantial risks and

uncertainties, many of which are difficult to predict and are

generally beyond our control, and you should not rely on them as

predictions of future events. Forward-looking statements depend on

assumptions, data or methods which may be incorrect or imprecise,

and we may not be able to realize them. We do not guarantee that

the transactions and events described will happen as described (or

that they will happen at all).

Many important factors could cause our actual results,

performance, achievements, and future events to differ materially

from those set forth, implied, anticipated, expected, projected,

assumed or contemplated in our forward-looking statements,

including, among other things: (i) economic, market, political and

social impact of, and uncertainty relating to, any catastrophic

events, including pandemics, epidemics or other outbreaks of

disease, climate-related risks such as natural disasters and

extreme weather events, terrorism and other armed hostilities, as

well as cybersecurity threats and technology disruptions; (ii) a

failure of conditions or performance regarding any event or

transaction described herein; (iii) resolution of legal proceedings

involving the Company; (iv) reduced demand for office, multifamily

or retail space, including as a result of the changes in the use of

office space and remote work; (v) changes in our business strategy;

(vi) a decline in Observatory visitors due to changes in domestic

or international tourism, including due to health crises,

geopolitical events, currency exchange rates, and/or competition

from other observatories; (vii) defaults on, early terminations of,

or non-renewal of, leases by tenants; (viii) increases in the

Company’s borrowing costs as a result of changes in interest rates

and other factors; (ix) declining real estate valuations and

impairment charges; (x) termination of our ground leases; (xi)

limitations on our ability to pay down, refinance, restructure or

extend our indebtedness or borrow additional funds; (xii) decreased

rental rates or increased vacancy rates; (xiii) difficulties in

executing capital projects or development projects successfully or

on the anticipated timeline or budget; (xiv) difficulties in

identifying and completing acquisitions; (xv) impact of changes in

governmental regulations, tax laws and rates and similar matters;

(xvi) our failure to qualify as a REIT; (xvii) incurrence of

taxable capital gain on disposition of an asset due to failure of

compliance with a 1031 exchange program; and (xviii) failure to

achieve sustainability metrics and goals, including as a result of

tenant collaboration, and impact of governmental regulation on our

sustainability efforts. For a further discussion of these and other

factors that could impact the company's future results,

performance, or transactions, see the section entitled “Risk

Factors” of our annual report on Form 10-K for the year ended

December 31, 2023 and any additional factors that may be contained

in any filing we make with the SEC.

While forward-looking statements reflect the Company's good

faith beliefs, they do not guarantee future performance. Any

forward-looking statement contained in this press release speaks

only as of the date on which it was made, and we assume no

obligation to update or revise publicly any forward-looking

statement to reflect changes in underlying assumptions or factors,

new information, data or methods, future events, or other changes

after the date of this press release, except as required by

applicable law. Prospective investors should not place undue

reliance on any forward-looking statements, which are based only on

information currently available to the Company (or to third parties

making the forward-looking statements).

Empire State Realty Trust,

Inc.

Condensed Consolidated

Statements of Operations

(unaudited and amounts in

thousands, except per share data)

Three Months Ended June

30,

2024

2023

Revenues

Rental revenue

$

152,470

$

154,603

Observatory revenue

34,124

33,433

Lease termination fees

-

-

Third-party management and other fees

376

381

Other revenue and fees

2,573

2,125

Total revenues

189,543

190,542

Operating expenses

Property operating expenses

41,516

39,519

Ground rent expenses

2,332

2,332

General and administrative expenses

18,020

16,075

Observatory expenses

8,958

8,657

Real estate taxes

31,883

31,490

Depreciation and amortization

47,473

46,280

Total operating expenses

150,182

144,353

Total operating income

39,361

46,189

Other income (expense):

Interest income

5,092

3,339

Interest expense

(25,323

)

(25,405

)

Interest expense associated with property

in receivership

(628

)

-

Gain on disposition of properties

10,803

13,565

Income before income taxes

29,305

37,688

Income tax expense

(750

)

(733

)

Net income

28,555

36,955

Net income attributable to non-controlling

interests:

Non-controlling interest in the Operating

Partnership

(10,433

)

(14,049

)

Non-controlling interests in other

partnerships

-

(1

)

Preferred unit distributions

(1,051

)

(1,051

)

Net income attributable to common

stockholders

$

17,071

$

21,854

Total weighted average shares

Basic

164,277

160,028

Diluted

268,716

264,196

Earnings per share attributable to

common stockholders

Basic

$

0.10

$

0.14

Diluted

$

0.10

$

0.14

Empire State Realty Trust,

Inc.

Condensed Consolidated

Statements of Operations

(unaudited and amounts in

thousands, except per share data)

Six Months Ended June

30,

2024

2023

Revenues

Rental revenue

$

306,352

$

294,694

Observatory revenue

58,720

55,587

Lease termination fees

-

-

Third-party management and other fees

641

808

Other revenue and fees

5,009

4,075

Total revenues

370,722

355,164

Operating expenses

Property operating expenses

86,576

81,563

Ground rent expenses

4,663

4,663

General and administrative expenses

33,992

31,783

Observatory expenses

17,389

16,512

Real estate taxes

64,124

63,278

Depreciation and amortization

93,554

93,688

Total operating expenses

300,298

291,487

Total operating income

70,424

63,677

Other income (expense):

Interest income

9,270

5,934

Interest expense

(50,451

)

(50,709

)

Interest expense associated with property

in receivership

(628

)

-

Loss on early extinguishment of debt

(553

)

-

Gain on disposition of properties

10,803

29,261

Income before income taxes

38,865

48,163

Income tax benefit (expense)

(95

)

486

Net income

38,770

48,649

Net (income) loss attributable to

noncontrolling interests:

Noncontrolling interest in the Operating

Partnership

(13,933

)

(18,217

)

Noncontrolling interests in other

partnerships

(4

)

42

Preferred unit distributions

(2,101

)

(2,101

)

Net income attributable to common

stockholders

$

22,732

$

28,373

Total weighted average shares

Basic

163,988

160,669

Diluted

268,105

264,736

Earnings per share attributable to

common stockholders

Basic

$

0.14

$

0.18

Diluted

$

0.14

$

0.18

Empire State Realty Trust,

Inc.

Reconciliation of Net Income

to Funds From Operations (“FFO”),

Modified Funds From Operations

(“Modified FFO”) and Core Funds From Operations (“Core

FFO”)

(unaudited and amounts in

thousands, except per share data)

Three Months Ended June

30,

2024

2023

Net income

$

28,555

$

36,955

Non-controlling interests in other

partnerships

-

(1

)

Preferred unit distributions

(1,051

)

(1,051

)

Real estate depreciation and

amortization

46,398

44,887

Gain on disposition of properties

(10,803

)

(13,565

)

FFO attributable to common stockholders

and Operating Partnership units

63,099

67,225

Amortization of below-market ground

leases

1,958

1,958

Modified FFO attributable to common

stockholders and Operating Partnership units

65,057

69,183

Interest expense associated with property

in receivership

628

-

Core FFO attributable to common

stockholders and Operating Partnership units

$

65,685

$

69,183

Total weighted average shares and

Operating Partnership units

Basic

264,676

262,903

Diluted

268,716

264,196

FFO per share

Basic

$

0.24

$

0.26

Diluted

$

0.23

$

0.25

Modified FFO per share

Basic

$

0.25

$

0.26

Diluted

$

0.24

$

0.26

Core FFO per share

Basic

$

0.25

$

0.26

Diluted

$

0.24

$

0.26

Empire State Realty Trust,

Inc.

Reconciliation of Net Income

to Funds From Operations (“FFO”),

Modified Funds From Operations

(“Modified FFO”) and Core Funds From Operations (“Core

FFO”)

(unaudited and amounts in

thousands, except per share data)

Six Months Ended June

30,

2024

2023

Net income

$

38,770

$

48,649

Noncontrolling interests in other

partnerships

(4

)

42

Preferred unit distributions

(2,101

)

(2,101

)

Real estate depreciation and

amortization

91,255

90,911

Gain on disposition of properties

(10,803

)

(29,261

)

FFO attributable to common stockholders

and Operating Partnership units

117,117

108,240

Amortization of below-market ground

leases

3,916

3,916

Modified FFO attributable to common

stockholders and Operating Partnership units

121,033

112,156

Interest expense associated with property

in receivership

628

-

Loss on early extinguishment of debt

553

-

Core FFO attributable to common

stockholders and Operating Partnership units

$

122,214

$

112,156

Total weighted average shares and

Operating Partnership units

Basic

264,619

263,694

Diluted

268,105

264,736

FFO per share

Basic

$

0.44

$

0.41

Diluted

$

0.44

$

0.41

Modified FFO per share

Basic

$

0.46

$

0.43

Diluted

$

0.45

$

0.42

Core FFO per share

Basic

$

0.46

$

0.43

Diluted

$

0.46

$

0.42

Empire State Realty Trust,

Inc.

Condensed Consolidated Balance

Sheets

(unaudited and amounts in

thousands)

June 30,

2024

December 31, 2023

Assets

Commercial real estate properties, at

cost

$

3,503,302

$

3,655,192

Less: accumulated depreciation

(1,206,039

)

(1,250,062

)

Commercial real estate properties, net

2,297,263

2,405,130

Contract asset4

166,955

-

Cash and cash equivalents

535,533

346,620

Restricted cash

41,015

60,336

Tenant and other receivables

34,665

39,836

Deferred rent receivables

242,940

255,628

Prepaid expenses and other assets

105,438

98,167

Deferred costs, net

172,318

172,457

Acquired below market ground leases,

net

317,326

321,241

Right of use assets

28,318

28,439

Goodwill

491,479

491,479

Total assets

$

4,433,250

$

4,219,333

Liabilities and equity

Mortgage notes payable, net

$

700,348

$

877,388

Senior unsecured notes, net

1,196,831

973,872

Unsecured term loan facility, net

268,580

389,286

Unsecured revolving credit facility

120,000

-

Debt associated with property in

receivership

177,667

-

Accrued interest associated with property

in receivership

1,589

-

Accounts payable and accrued expenses

90,908

99,756

Acquired below market leases, net

11,872

13,750

Ground lease liabilities

28,318

28,439

Deferred revenue and other liabilities

61,890

70,298

Tenants’ security deposits

24,031

35,499

Total liabilities

2,682,034

2,488,288

Total equity

1,751,216

1,731,045

Total liabilities and equity

$

4,433,250

$

4,219,333

4 As of June 30, 2024, we have recorded a

contract asset that represents our right to debt extinguishment

once the foreclosure process on First Stamford Place is

completed.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240724237218/en/

Investors and Media

Empire State Realty Trust Investor Relations (212) 850-2678

IR@esrtreit.com

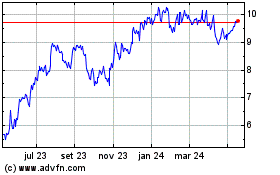

Empire State Realty (NYSE:ESRT)

Gráfico Histórico do Ativo

De Dez 2024 até Jan 2025

Empire State Realty (NYSE:ESRT)

Gráfico Histórico do Ativo

De Jan 2024 até Jan 2025