Lucas Haldeman Steps Down as CEO and Resigns

from Board

Board of Directors Forms Operating Committee to

Oversee Company’s Operations

Management Committee of Current SmartRent

Executives to Guide Company on Interim Basis

Company Suspends Full-Year 2024 Outlook

SmartRent, Inc. (NYSE: SMRT) (“SmartRent” or the “Company”), a

leading provider of smart communities and smart operations

solutions for the rental housing industry, today announced a CEO

transition plan under which Lucas Haldeman has stepped down from

his position as Chief Executive Officer and resigned from the Board

of Directors, effective July 29, 2024. John Dorman, the Board’s

lead independent director, has been appointed Chairman of the

Board, and the Board has formed a Management Committee of current

executives to guide the Company through the transition period. The

Board has initiated a search to identify the next CEO of SmartRent

and is working with a leading executive search firm to assist in

the process of identifying and evaluating candidates.

“SmartRent is a market leader with an outstanding suite of

products, technology and services that provide enormous value to

our customers,” said Dorman. “The Company successfully developed

and deployed a range of products and services that customers love

and depend on because of the way they streamline operations, reduce

costs, protect assets, and provide convenience and an overall

improved resident experience.”

Dorman continued, “SmartRent has a leading market position in a

large addressable market, proven product quality, deep customer

loyalty, and significant growth potential in penetrating our

existing customer base, which owns and/or manages over seven

million rental units. The Board is working with the talented team

at the Company to capitalize on these unique strengths and create

long-term value for our shareholders. On behalf of the full Board,

I want to thank Lucas for his dedication to SmartRent, which he

founded, took public, and built into the innovator and leader in

smart home technology it is today. As we scale and mature the

Company into a new phase of growth, the Board decided that

SmartRent will benefit from a CEO with a different skill set and

fresh perspective.”

The Management Committee is composed of Chief Financial Officer

Daryl Stemm, Executive Vice President of Human Resources Heather

Auer, Executive Vice President of Operations Wyron Bobis,

Co-Founder and Chief Technology Officer Isaiah DeRose-Wilson, Chief

Legal Officer Kristen Lee and Chief Marketing Officer Robyn Young.

Daryl Stemm will act as Principal Executive Officer of SmartRent on

an interim basis. The Management Committee will report to John

Dorman as Chairman of the Board. Additionally, the Board has formed

an Operating Committee of the Board chaired by Frank Martell and

composed of Alison Dean, Ann Sperling, and Fred Tuomi. The

Operating Committee will serve under the direction of the Board and

oversee the Company’s operations. The Board is also working with

Morgan Stanley & Co. LLC as part of an ongoing financial review

focusing on shareholder value. Additionally, the Company is

recruiting a new head of sales to reinvigorate and refocus the

sales strategy and drive further growth across existing and new

customers.

Preliminary Second Quarter 2024 Results

On a preliminary basis, the Company expects second quarter 2024

Total Revenue of $48.5 million, a decrease of 9% from the same

period last year and slightly below the guidance range of $49

million to $55 million. The Company expects a Net Loss in the

second quarter of $4.6 million, a 55% improvement year over year.

Adjusted EBITDA is expected to be $0.9 million for the quarter,

above the guidance range of $(0.5) million to $0.5 million. SaaS

Revenue is expected to be $12.8 million for the quarter, an

increase of 32% over the same period last year.

Full-Year 2024 Outlook

In light of the pending CEO transition, the scaling back of

SmartRent’s channel partner program and continued, increasing

market headwinds, including known and anticipated customer capital

spending delays, the Company is suspending its previous guidance

for full-year 2024. The Company advises investors they should not

rely on the outlook previously provided by management.

The Company will hold a conference call on August 7, 2024, to

discuss second quarter 2024 financial results (details below).

Date: Wednesday, August 7, 2024 Time: 11:30 a.m.

ET Dial-in: To access the conference call via telephone,

please register here to be provided with dial-in details. To avoid

delays, participants are encouraged to dial into the conference

call 15 minutes ahead of the scheduled start time.

Webcast: A live and archived webcast of the conference

call will be accessible from the Events and Presentations section

of the Company’s Investor Relations website at

https://investors.smartrent.com.

About SmartRent

Founded in 2017, SmartRent, Inc. (NYSE: SMRT) is a leading

provider of smart communities solutions and smart operations

solutions to the rental housing industry. SmartRent’s end-to-end

ecosystem powers smarter living and working in rental housing by

automating operations, protecting assets, reducing energy

consumption and more. The company’s differentiators – purpose-built

software and hardware, and end-to-end implementation and support –

create an exceptional experience, with 15 of the top 20 multifamily

operators and millions of users leveraging SMRT solutions daily.

For more information, please visit smartrent.com.

Forward-Looking Statements

This press release contains forward-looking statements which

address the Company's expected future business and financial

performance, statements regarding the Company’s executive

transition, expected growth, prospects and strategies, expected

Total Revenue, Adjusted EBITDA, Net Loss and SaaS Revenue for the

second quarter, and other future events. Forward-looking statements

may contain words such as "goal," "target," "future," "estimate,"

"expect," "anticipate," "intend," "plan," "believe," "seek,"

"project," "may," "should," "will" or similar expressions. Examples

of forward-looking statements include, among others, statements

regarding the expected financial results, the Company’s executive

transition, expected growth, prospects, strategies and

opportunities and earnings guidance related to financial and

operational metrics. Forward-looking statements involve risks and

uncertainties that could cause actual results to differ materially

from those currently anticipated. Some of the factors that could

cause actual results to differ materially from those expressed or

implied by the forward-looking statements include, among other

things, our ability to: (1) accelerate adoption of our products and

services; (2) anticipate the uncertainties inherent in the

development of new business lines and business strategies; (3)

manage risks associated with our third-party suppliers and

manufacturers and partners for our products; (4) manage risks

associated with adverse macroeconomic conditions, including

inflation, slower growth or recession, barriers to trade, changes

to fiscal and monetary policy, tighter credit, higher interest

rates, high unemployment, and currency fluctuations; (5) attract,

train, and retain effective officers, key employees and directors;

(6) develop, design, manufacture, and sell products and services

that are differentiated from those of competitors; (7) realize the

benefits expected from our acquisitions; (8) acquire or make

investments in other businesses, patents, technologies, products or

services to grow the business; (9) successfully pursue, defend,

resolve or anticipate the outcome of pending or future litigation

matters; (10) comply with laws and regulations applicable to our

business, including privacy regulations; (11) realize the benefits

expected from our stock repurchase program; and (12) maintain key

strategic relationships with partners and distributors. The

forward-looking statements herein represent the judgment of the

Company, as of the date of this release, and SmartRent disclaims

any intent or obligation to update forward-looking statements. This

press release should be read in conjunction with the information

included in the Company's other press releases, reports and other

filings with the SEC. Understanding the information contained in

these filings is important in order to fully understand the

Company's reported financial results and our business outlook for

future periods.

Use of Non-GAAP Financial Measures

In addition to disclosing financial results that are determined

in accordance with GAAP, SmartRent also discloses certain non-GAAP

financial measures in this press release, including EBITDA and

Adjusted EBITDA. These financial measures are not recognized

measures under GAAP and should not be considered in isolation or as

a substitute for, or superior to, the financial information

prepared and presented in accordance with GAAP.

We define Adjusted EBITDA as EBITDA before the following items:

stock-based compensation expense, non-employee warrant expense,

non-recurring warranty provisions, asset impairment, loss on

extinguishment of debt, non-recurring expenses in connection with

acquisitions, severance charges, and other expenses caused by

non-recurring, or unusual, events that are not indicative of our

ongoing business. We define EBITDA as net income or loss computed

in accordance with GAAP before interest income/expense, income tax

expense and depreciation and amortization.

EBITDA and Adjusted EBITDA may be determined or calculated

differently by other companies. Reconciliations of these non-GAAP

measures to the most directly comparable GAAP financial measures

have been provided in the financial statement tables included in

this press release, and investors are encouraged to review the

reconciliations.

EBITDA and Adjusted EBITDA are not used as measures of

SmartRent’s liquidity and should not be considered alternatives to

net income or loss or any other measure of financial performance

presented in accordance with GAAP.

SmartRent’s management uses EBITDA and Adjusted EBITDA in a

number of ways to assess the Company’s financial and operating

performance and believes that these measures provide useful

information to investors regarding financial and business trends

related to SmartRent’s results of operations. EBITDA and Adjusted

EBITDA are also used to identify certain expenses and make

decisions designed to help SmartRent meet its current financial

goals and optimize its financial performance, while neutralizing

the impact of expenses included in its operating results which

could otherwise mask underlying trends in its business. SmartRent’s

management believes that investors are provided with a more

meaningful understanding of SmartRent’s ongoing operating

performance when non-GAAP financial information is viewed with GAAP

financial information.

SMARTRENT, INC.

RECONCILIATION OF NON-GAAP

MEASURES

PRELIMINARY UNAUDITED

For the three months ended

June 30, 2024

(dollars

in thousands)

Net loss

$

(4,605

)

Interest income, net

(2,290

)

Income tax expense

68

Depreciation and amortization

1,585

EBITDA

(5,242

)

Stock-based compensation

3,284

Impairment of investment in

non-affiliate

2,250

Non-recurring warranty provision

463

Other acquisition expenses

117

Other non-operating expenses

30

Adjusted EBITDA

$

902

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240730774755/en/

Investor Contact Kelly Reisdorf Head of Investor

Relations investors@smartrent.com

Media Contact Amanda Chavez Senior Director, Corporate

Communications media@smartrent.com

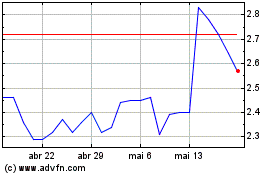

SmartRent (NYSE:SMRT)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

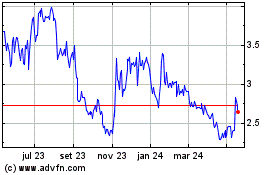

SmartRent (NYSE:SMRT)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024