Q2 Revenue of $854 million, an increase of

21%

Record 522 million global monthly active users,

an increase of 12%

Pinterest, Inc. (NYSE: PINS) today announced financial results

for the quarter ended June 30, 2024.

- Q2 revenue grew 21% year over year to $854 million.

- Global Monthly Active Users ("MAUs") increased 12% year over

year to 522 million.

- GAAP net income was $9 million for Q2. Adjusted EBITDA was $180

million for Q2.

- Total costs and expenses were $875 million.

“We had another impressive quarter, reporting a 21% increase in

revenue and 12% growth in monthly active users globally,” said Bill

Ready, CEO of Pinterest. “Our monetization efforts are paying off.

Advertisers are seeing improved performance across key objectives

on Pinterest – from brand awareness to conversion – as we continue

to roll out AI-powered products and experiences. As a result, we’re

gaining share of advertising budgets with some of the world’s

largest brands. I’m proud of our pace of innovation as we execute

against the opportunity ahead.”

Q2 2024 Financial Highlights

The following table summarizes our consolidated financial

results (in thousands, except percentages, unaudited):

Three Months Ended June

30,

% Change

2024

2023

Revenue

$

853,680

$

708,025

21

%

Net income (loss)

$

8,887

$

(34,942

)

125

%

Net income (loss) margin

1

%

(5

)%

Non-GAAP net income*

$

207,160

$

142,089

46

%

Adjusted EBITDA*

$

179,912

$

107,019

68

%

Adjusted EBITDA margin*

21

%

15

%

_____________

* For more information on these non-GAAP

financial measures, please see "―About non-GAAP financial measures"

and the tables under "―Reconciliation of GAAP to non-GAAP financial

results" included at the end of this release.

Q2 2024 Other Highlights

The following table sets forth our revenue, MAUs and average

revenue per user ("ARPU") based on the geographic location of our

users (in millions, except ARPU and percentages, unaudited):

Three Months Ended June

30,

% Change

2024

2023

Revenue - Global

$

854

$

708

21

%

Revenue - U.S. and Canada

$

673

$

565

19

%

Revenue - Europe

$

143

$

114

25

%

Revenue - Rest of World

$

38

$

29

32

%

MAUs - Global

522

465

12

%

MAUs - U.S. and Canada

98

95

3

%

MAUs - Europe

136

124

9

%

MAUs - Rest of World

288

246

17

%

ARPU - Global

$

1.64

$

1.53

8

%

ARPU - U.S. and Canada

$

6.85

$

5.92

16

%

ARPU - Europe

$

1.03

$

0.91

14

%

ARPU - Rest of World

$

0.13

$

0.12

13

%

Guidance

For Q3 2024, we expect revenue to be in the range of $885

million to $900 million, representing 16-18% growth year over year.

We expect Q3 2024 Non-GAAP operating expenses* to be in the range

of $485 million to $500 million, representing 17-20% growth year

over year. Please note that our operating expense guidance does not

include cost of revenue.

We intend to provide further details on our outlook during the

conference call.

_____________ *We have not provided the forward-looking GAAP

equivalents for certain forward-looking non-GAAP operating expenses

or a GAAP reconciliation as a result of the uncertainty regarding,

and the potential variability of, reconciling items such as

share-based compensation expense, which is impacted by, among other

things, employee retention and decisions around future equity

grants to employees. Accordingly, a reconciliation of these

non-GAAP guidance metrics to their corresponding GAAP equivalents

is not available without unreasonable effort. However, it is

important to note that material changes to reconciling items could

have a significant effect on future GAAP results and, as such, we

also believe that any reconciliations provided would imply a degree

of precision that could be confusing or misleading to investors.

Webcast and conference call information

A live audio webcast of our second quarter 2024 earnings release

call will be available at investor.pinterestinc.com. The call

begins today at 1:30 PM (PT) / 4:30 PM (ET). This press release,

including the reconciliations of certain non-GAAP measures to their

nearest comparable GAAP measures and slide presentation are also

available. A recording of the webcast will be available at

investor.pinterestinc.com for 90 days.

We have used, and intend to continue to use, our investor

relations website at investor.pinterestinc.com as a means of

disclosing material nonpublic information and for complying with

our disclosure obligations under Regulation FD.

Forward-looking statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Exchange Act of 1934, as amended,

about us and our industry that involve substantial risks and

uncertainties. Forward-looking statements can be identified by the

fact that they do not relate strictly to historical or current

facts and are often characterized by the use of words such as

"believes," "estimates," "expects," "projects," "may," "will,"

"can," "intends," "plans," "targets," "forecasts," "anticipates,"

or and similar expressions, or by discussions of strategy, plans or

intentions. Such forward-looking statements involve known and

unknown risks, uncertainties, assumptions and other important

factors that could cause our actual results, performance or

achievements, or industry results, to differ materially from

historical results or any future results, performance or

achievements expressed, suggested or implied by such

forward-looking statements. These risks and uncertainties include,

but are not limited to, statements about: general economic

uncertainty in global markets and a worsening of global economic

conditions or low levels of economic growth, including inflation,

stress in the banking industry, foreign exchange fluctuations and

supply-chain issues; the effect of general economic and political

conditions; our financial performance, including revenue, cost and

expenses and cash flows; our ability to attract, retain and recover

users and maintain and grow their level of engagement; our ability

to provide content that is useful and relevant to users' personal

taste and interests; our ability to develop successful new products

or improve existing ones; our ability to maintain and enhance our

brand and reputation; potential harm caused by compromises in

security, including our cybersecurity protections and resources and

costs required to prevent, detect and remediate potential security

breaches; potential harm caused by changes in online application

stores or internet search engines' methodologies, particularly

search engine optimization methodologies and policies;

discontinuation, disruptions or outages in third-party single

sign-on access; our ability to compete effectively in our industry;

our ability to scale our business, including our monetization

efforts; our ability to attract and retain advertisers and scale

our revenue model; our ability to attract and retain creators and

publishers that create relevant and engaging content; our ability

to develop effective products and tools for advertisers, including

measurement tools; our ability to expand and monetize our platform

internationally; our ability to effectively manage the growth of

our business; our ability to continue to use and develop artificial

intelligence ("AI") as well as managing the challenges and risks

posed by AI; our ability to successfully manage our flexible work

model with a more distributed workforce; our lack of operating

history and ability to sustain profitability; decisions that reduce

short-term revenue or profitability or do not produce the long-term

benefits we expect; fluctuations in our operating results; our

ability to raise additional capital on favorable terms or at all;

our ability to realize anticipated benefits from mergers and

acquisitions, joint ventures, strategic partnerships and other

investments; our ability to protect our intellectual property; our

ability to receive, process, store, use and share data, and

compliance with laws and regulations related to data privacy and

content; current or potential litigation and regulatory actions

involving us; our ability to comply with modified or new laws and

regulations applying to our business, and potential harm to our

business as a result of those laws and regulations; real or

perceived inaccuracies in metrics related to our business;

disruption of, degradation in or interference with our use of

Amazon Web Services and our infrastructure; and our ability to

attract and retain personnel. These and other potential risks and

uncertainties that could cause actual results to differ from the

results predicted are more fully detailed in our Quarterly Report

on Form 10-Q for the fiscal quarter ended June 30, 2024, which is

available on our investor relations website at

investor.pinterestinc.com and on the SEC website at www.sec.gov.

All information provided in this release and in the earnings

materials is as of July 30, 2024. Undue reliance should not be

placed on the forward-looking statements in this press release,

which are based on information available to us on the date hereof.

We undertake no duty to update this information unless required by

law.

About non-GAAP financial measures

To supplement our condensed consolidated financial statements,

which are prepared and presented in accordance with generally

accepted accounting principles in the United States ("GAAP"), we

use the following non-GAAP financial measures: Adjusted EBITDA,

Adjusted EBITDA margin, non-GAAP costs and expenses (including

non-GAAP cost of revenue, research and development, sales and

marketing, and general and administrative), non-GAAP income from

operations, non-GAAP net income, non-GAAP net income per share and

constant currency revenue growth rates. The presentation of these

financial measures is not intended to be considered in isolation,

as a substitute for or superior to the financial information

prepared and presented in accordance with GAAP. Investors are

cautioned that there are material limitations associated with the

use of non-GAAP financial measures as an analytical tool. In

addition, these measures may be different from non-GAAP financial

measures used by other companies, limiting their usefulness for

comparative purposes. We compensate for these limitations by

providing specific information regarding GAAP amounts excluded from

these non-GAAP financial measures.

We define Adjusted EBITDA as net income (loss) adjusted to

exclude depreciation and amortization expense, share-based

compensation expense, interest income (expense), net, other income

(expense), net, benefit from income taxes and restructuring

charges. Adjusted EBITDA margin is calculated by dividing Adjusted

EBITDA by revenue. Non-GAAP costs and expenses (including non-GAAP

cost of revenue, research and development, sales and marketing, and

general and administrative) and non-GAAP net income exclude

amortization of acquired intangible assets, share-based

compensation expense and restructuring charges. Non-GAAP income

from operations is calculated by subtracting non-GAAP costs and

expenses from revenue. Non-GAAP net income per share is calculated

by dividing non-GAAP net income by diluted weighted-average shares

outstanding. We use these measures to evaluate our operating

results and for financial and operational decision-making purposes.

We believe these non-GAAP financial measures help identify

underlying trends in our business that could otherwise be masked by

the effect of the income and expenses they exclude. We also believe

these measures provide useful information about our operating

results, enhance the overall understanding of our past performance

and future prospects and allow for greater transparency with

respect to key metrics we use for financial and operational

decision-making. We present these non-GAAP measures to assist

potential investors in seeing our operating results through the

eyes of management and because we believe these measures provide an

additional tool for investors to use in comparing our operating

results over multiple periods with other companies in our industry.

There are a number of limitations related to the use of non-GAAP

financial measures rather than the nearest GAAP equivalents. For

example, Adjusted EBITDA excludes certain recurring, non-cash

charges such as depreciation of fixed assets and amortization of

acquired intangible assets, although these assets may have to be

replaced in the future, and share-based compensation expense, which

has been, and will continue to be for the foreseeable future, a

significant recurring expense and an important part of our

compensation strategy.

For a reconciliation of these non-GAAP financial measures to the

most directly comparable GAAP financial measures, please see the

tables under "―Reconciliation of GAAP to non-GAAP financial

results" included at the end of this release.

Limitation of key metrics and other data

The numbers for our key metrics, which include our MAUs and

ARPU, are calculated using internal company data based on the

activity of user accounts. We define a MAU as an authenticated

Pinterest user who visits our website, opens our mobile application

or interacts with Pinterest through one of our browser or site

extensions, such as the Save button, at least once during the

30-day period ending on the date of measurement. The number of MAUs

do not include Shuffles users unless they would otherwise qualify

as MAUs. Unless otherwise indicated, we present MAUs based on the

number of MAUs measured on the last day of the current period. We

measure monetization of our platform through our ARPU metric. We

define ARPU as our total revenue in a given geography during a

period divided by the average of the number of MAUs in that

geography during the period. We calculate average MAUs based on the

average of the number of MAUs measured on the last day of the

current period and the last day prior to the beginning of the

current period. We calculate ARPU by geography based on our

estimate of the geography in which revenue-generating activities

occur. We use these metrics to assess the growth and health of the

overall business and believe that MAUs and ARPU best reflect our

ability to attract, retain, engage and monetize our users, and

thereby drive revenue. While these numbers are based on what we

believe to be reasonable estimates of our user base for the

applicable period of measurement, there are inherent challenges in

measuring usage of our products across large online and mobile

populations around the world. In addition, we are continually

seeking to improve our estimates of our user base, and such

estimates may change due to improvements or changes in technology

or our methodology.

PINTEREST, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(in thousands, except par

value)

(unaudited)

June 30,

December 31,

2024

2023

ASSETS

Current assets:

Cash and cash equivalents

$

1,376,681

$

1,361,936

Marketable securities

1,358,502

1,149,148

Accounts receivable, net of allowances of

$8,729 and $10,635 as of June 30, 2024 and December 31, 2023,

respectively

664,293

763,159

Prepaid expenses and other current

assets

93,270

64,316

Total current assets

3,492,746

3,338,559

Property and equipment, net

40,036

32,225

Operating lease right-of-use assets

83,941

92,119

Goodwill and intangible assets, net

113,783

117,462

Other assets

17,010

14,040

Total assets

$

3,747,516

$

3,594,405

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities:

Accounts payable

$

73,924

$

79,058

Accrued expenses and other current

liabilities

293,779

238,032

Total current liabilities

367,703

317,090

Operating lease liabilities

151,750

160,616

Other liabilities

30,010

26,019

Total liabilities

549,463

503,725

Commitments and contingencies

Stockholders’ equity:

Class A common stock, $0.00001 par value,

6,666,667 shares authorized, 603,564 and 591,663 shares issued and

outstanding as of June 30, 2024 and December 31, 2023,

respectively; Class B common stock, $0.00001 par value, 1,333,333

shares authorized, 82,629 and 86,355 shares issued and outstanding

as of June 30, 2024 and December 31, 2023, respectively

7

7

Additional paid-in capital

5,366,284

5,241,954

Accumulated other comprehensive loss

(2,045

)

(1,013

)

Accumulated deficit

(2,166,193

)

(2,150,268

)

Total stockholders’ equity

3,198,053

3,090,680

Total liabilities and stockholders’

equity

$

3,747,516

$

3,594,405

PINTEREST, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(in thousands, except per share

amounts)

(unaudited)

Three Months Ended June

30,

2024

2023

Revenue

$

853,680

$

708,025

Costs and expenses:

Cost of revenue

184,856

168,740

Research and development

312,837

269,391

Sales and marketing

265,354

243,239

General and administrative

112,074

99,898

Total costs and expenses

875,121

781,268

Loss from operations

(21,441

)

(73,243

)

Interest income (expense), net

34,680

24,888

Other income (expense), net

(4,596

)

2,180

Income (loss) before benefit from income

taxes

8,643

(46,175

)

Benefit from income taxes

(244

)

(11,233

)

Net income (loss)

$

8,887

$

(34,942

)

Net income (loss) per share:

Basic

$

0.01

$

(0.05

)

Diluted

$

0.01

$

(0.05

)

Weighted-average shares used in computing

net income (loss) per share:

Basic

683,171

674,280

Diluted

708,258

674,280

PINTEREST, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(in thousands)

(unaudited)

Six Months Ended June

30,

2024

2023

Operating activities

Net loss

$

(15,925

)

$

(243,521

)

Adjustments to reconcile net loss to net

cash provided by operating activities:

Depreciation and amortization

9,781

11,283

Share-based compensation

358,906

312,752

Impairment and abandonment charges for

leases and leasehold improvements

—

117,315

Net amortization of investment premium and

discount

(13,092

)

(8,986

)

Other

3,629

4,485

Changes in assets and liabilities:

Accounts receivable

102,767

136,827

Prepaid expenses and other assets

(35,722

)

(23,048

)

Operating lease right-of-use assets

16,618

34,595

Accounts payable

(4,968

)

(24,295

)

Accrued expenses and other liabilities

60,681

(31,663

)

Operating lease liabilities

(20,103

)

(39,568

)

Net cash provided by operating

activities

462,572

246,176

Investing activities

Purchases of property and equipment

(16,897

)

(2,800

)

Purchases of marketable securities

(811,693

)

(654,349

)

Sales of marketable securities

7,749

29,271

Maturities of marketable securities

606,566

609,402

Net cash used in investing activities

(214,275

)

(18,476

)

Financing activities

Proceeds from exercise of stock

options

19,255

3,216

Repurchases of Class A common stock

(33,336

)

(500,000

)

Shares repurchased for tax withholdings on

release of restricted stock units and restricted stock awards

(219,461

)

(163,203

)

Net cash used in financing activities

(233,542

)

(659,987

)

Effect of exchange rate changes on cash,

cash equivalents and restricted cash

(1,484

)

1,075

Net increase (decrease) in cash, cash

equivalents and restricted cash

13,271

(431,212

)

Cash, cash equivalents and restricted

cash, beginning of period

1,368,532

1,617,660

Cash, cash equivalents and restricted

cash, end of period

$

1,381,803

$

1,186,448

Supplemental cash flow

information

Cash paid for income taxes, net

$

15,178

$

6,006

Non-cash investing and financing

activities:

Repurchases of Class A common stock in

accrued expenses and other current liabilities

$

1,042

$

—

Operating lease right-of-use assets

obtained in exchange for operating lease liabilities

$

9,778

$

13,809

Reconciliation of cash, cash

equivalents and restricted cash to condensed consolidated balance

sheets

Cash and cash equivalents

$

1,376,681

$

1,179,852

Restricted cash included in prepaid

expenses and other current assets

1,068

2,243

Restricted cash included in other

assets

4,054

4,353

Total cash, cash equivalents and

restricted cash

$

1,381,803

$

1,186,448

PINTEREST, INC.

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL RESULTS

(in thousands)

(unaudited)

Three Months Ended June

30,

2024

2023

Share-based compensation by

function:

Cost of revenue

$

3,777

$

2,740

Research and development

128,481

108,580

Sales and marketing

30,906

26,398

General and administrative

33,269

31,912

Total share-based compensation

$

196,433

$

169,630

Amortization of acquired intangible

assets by function:

Cost of revenue

$

1,508

$

1,508

Sales and marketing

135

135

General and administrative

197

197

Total amortization of acquired intangible

assets

$

1,840

$

1,840

Restructuring charges by

function:

Research and development

$

—

$

603

Sales and marketing

—

72

General and administrative

—

4,886

Total restructuring charges

$

—

$

5,561

Reconciliation of total costs and

expenses to non-GAAP costs and expenses:

Total costs and expenses

$

875,121

$

781,268

Share-based compensation

(196,433

)

(169,630

)

Amortization of acquired intangible

assets

(1,840

)

(1,840

)

Restructuring charges

—

(5,561

)

Total non-GAAP costs and expenses

$

676,848

$

604,237

Reconciliation of net income (loss) to

Adjusted EBITDA:

Net income (loss)

$

8,887

$

(34,942

)

Depreciation and amortization

4,920

5,071

Share-based compensation

196,433

169,630

Interest (income) expense, net

(34,680

)

(24,888

)

Other (income) expense, net

4,596

(2,180

)

Benefit from income taxes

(244

)

(11,233

)

Restructuring charges

—

5,561

Adjusted EBITDA

$

179,912

$

107,019

PINTEREST, INC.

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL RESULTS

(in thousands, except per share

amounts)

(unaudited)

Three Months Ended June

30,

2024

2023

Reconciliation of net income (loss) to

non-GAAP net income:

Net income (loss)

$

8,887

$

(34,942

)

Share-based compensation

196,433

169,630

Amortization of acquired intangible

assets

1,840

1,840

Restructuring charges

—

5,561

Non-GAAP net income

$

207,160

$

142,089

Basic weighted-average shares used in

computing net income (loss) per share

683,171

674,280

Weighted-average dilutive

securities(1)

25,087

18,107

Diluted weighted-average shares used in

computing non-GAAP net income per share

708,258

692,387

Non-GAAP net income per share

$

0.29

$

0.21

_____________

(1)

Gives effect to potential common stock instruments such as stock

options, unvested restricted stock units and unvested restricted

stock awards.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240730039688/en/

Press: Tessa Chen press@pinterest.com

Investor relations: Andrew Somberg ir@pinterest.com

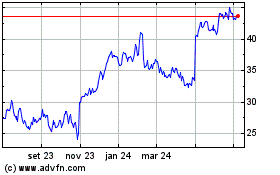

Pinterest (NYSE:PINS)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

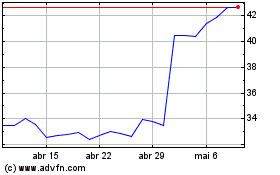

Pinterest (NYSE:PINS)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025