With $3.3 billion in deposits and 8 million customers, Mexico already stands out among Nu's operations

19 Agosto 2024 - 5:52PM

Business Wire

High GDP per capita coupled with low financial

inclusion make the Latin American country a significant opportunity

for the company's strategy; Cristina Junqueira details plans on the

new episode of Nu Videocast

Standing as the number one business priority for Nu in 2024,

Mexico has proven to be a savvy choice in the company's

international expansion strategy: one year after the launch of

Cuenta, the company has already surpassed 8 million customers in

the country and $3.3 billion in deposits. These figures exceed

those of Brazil at the same stage of operations: in the company’s

home country, there were 7.7 million customers and less than $1

billion in deposits in Q1’19.

With the highest GDP per capita in Latin America (over 30%

higher than Brazil's) but low financial inclusion, Mexico has a

unique combination in the region, making it a significant

opportunity.

This assessment comes from Cristina Junqueira, Co-founder and

Chief Growth Officer (CGO) at Nubank: "There is a lot of room for

growth due to the low reach of financial services in Mexico. In

such a large and even wealthier country than Brazil, we see that,

in certain scenarios, it could be (a market) even bigger than what

we have experienced here."

Cristina made the statement during her participation in the

latest episode of the Nu Videocast, a corporate series that

discusses strategic themes at Nubank with the company's senior

leadership.

"We are very proud of this. When we went to Mexico, we had no

idea what would happen. Part of us was thinking: ‘Could any other

country be as big or as successful as what we have done in Brazil?’

And when we compare (the operation in Mexico) with Brazil at the

same stage, we see that Mexico is really ahead."

The phenomenon is mirrored in Colombia, where over 500,000

Colombians opened a Cuenta within two months of the product's

official launch, and deposits have already surpassed $500 million

as of August. At the close of Q2'24, deposits were at $220

million.

The same philosophy; A different profile

The successful experience in Brazil has facilitated different

aspects of implementing the operation in Mexico, especially in

terms of technology infrastructure. At the same time, Cristina

emphasizes that success in Mexico owes a lot to the continuous

effort to adapt to the Mexican customer's profile.

"Our biggest competitor (in Mexico) is cash. Over 40% of

payments in Mexico are still made in cash; half of our customers

have never had a credit card. So, there is strong work in financial

education underway, so they can start using the products

responsibly."

The company's strategy of offering attractive returns on

deposits has also been effective, as it encourages customers to

keep their money with the institution, which helps finance the

growing credit portfolio.

Currently, Nu offers various returns in Mexico, depending on the

liquidity of the investment in the Cajitas – the local 'Money

Boxes'. This strategy, which promotes good financial habits,

enables the company to provide one of the most competitive returns

in the market, adapting to Mexico's macroeconomic and competitive

factors.

For Cristina, offering a digital and secure option that

remunerates deposits above inflation and enables customers' capital

growth is transformative: "It's something that can change these

customers' lives. It's the gateway to a financial life," she

highlights.

The future in Mexico

Nubank's total investment in Mexico has already exceeded US $1.4

billion, reflecting its long-term commitment to the country and

making it one of the most important foreign investors in the

Mexican financial sector.

In this context, Nu has previously filed a formal application

with the regulator to obtain a local banking license, which would

allow it to offer more services.

Cristina's expectations are positive: "We are optimistic about

the feedback we have received on the pace things are moving, on the

level of information, and with the level of exchange we have had

with the different regulators involved in the banking license

process. We are very excited to see this happen in the future," she

concludes.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240819761268/en/

Investors Relations: J�rg Friedemann investors@nubank.com.br

Media Relations: Leila Suwwan press@nubank.com.br

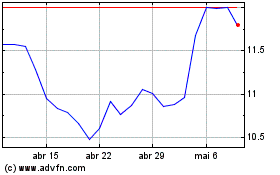

Nu (NYSE:NU)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

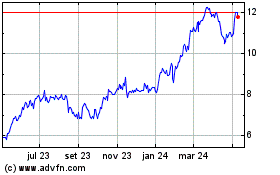

Nu (NYSE:NU)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024