Metals Acquisition Limited (NYSE:MTAL; ASX:MAC)

Highlights

- MAC launches institutional Placement of approximately 7.8

million New CDIs at an issue price of A$18.00 per New CDI to raise

~A$140.0 million (~US$96.2 million1) (before costs)

- Offer Price of A$18.00 per New CDI, which represents a 13.0%

discount to both the last closing price of CDIs on the ASX and the

5-day VWAP of CDIs on the ASX

- Placement proceeds will be used to optimise MAC’s balance sheet

and de-lever by retiring its existing US$145 million Mezzanine Debt

Facility at the earliest practicable date while also providing

additional flexibility to pursue strategic inorganic growth

opportunities

- Upon settlement of the Placement, MAC will be well capitalised

with a pro-forma 30 September 2024 cash balance of ~US$177 million1

(before costs) (in addition to a US$25 million revolving credit

facility which remains undrawn) and pro-forma net debt of ~US$134

million2 (before costs)

- Operations continue to perform strongly at the CSA Copper Mine

(“CSA”) with Q3 2024 copper production of 10,159 tonnes at

an average grade of 4% copper and C1 cash costs expected to be in

the range of US$1.90-2.002 per pound. The Company remains on track

to deliver at the mid-point of the full-year 2024 copper production

guidance of between 38,000-43,000 tonnes

Commentary

Metals Acquisition Limited (“MAC” or the

“Company”) is pleased to announce the launch of an

institutional placement of approximately 7.8 million new Chess

Depositary Interests (“New CDIs”) to raise ~A$140.0 million

(~US$96.2 million1) (before costs) (the “Placement”). The

New CDIs are to be issued under the Placement at an offer price of

A$18.00 per New CDI (“Offer Price”).

Proceeds of the Placement, together with existing cash, enable

MAC to better optimise its balance sheet and de-lever following the

acquisition of CSA from Glencore plc in mid-2023, while also

providing additional flexibility to pursue strategic inorganic

growth opportunities.

Commenting on the Placement, MAC CEO, Mick McMullen, said:

“Following the acquisition of CSA in mid-2023

and listing on the ASX in early 2024, MAC has placed greater focus

on optimising its balance sheet and determining an appropriate

capital structure more reflective of the strong asset quality and

the markedly improved credit proposition that MAC today represents

compared to mid-2023.

Feedback from investors has been strong that

moving to a more typical long-term capital structure is desired.

While work around MAC’s long-term capital structure remains

ongoing, it is clear that the existing Mezzanine Debt Facility will

not form part of this. As such, MAC has determined that it is in

the best interests of shareholders to retire this facility at the

earliest possible date and further de-lever, building on the

significant progress that MAC has already made to date reducing its

net debt position from US$455 million following the acquisition of

CSA to ~US$134 million upon completion of the Placement.

Importantly, by raising equity today, MAC has full flexibility to

do so once the opportunity permits, while also preserving its

balance sheet strength and ensuring it can pursue any strategic

inorganic growth opportunities that may present.

Today’s Placement is testament to the

high-quality nature of CSA and the significant work that has been

undertaken by management to deliver on a range of operational

improvements over the past year. Q3 2024 delivered another strong

operational result for the Company with copper production of 10,159

tonnes at an average grade of 4% copper and C1 cash costs expected

to be in the range of US$1.90-2.002 per pound. We remain on track

to deliver around the mid-point of our full-year 2024 copper

production guidance of between 38,000-43,000 tonnes and will

provide a more fulsome update on the status of operations as part

of our quarterly report later this month.

On behalf of the MAC Board and management, I

wish a warm welcome to our new shareholders that participated in

the Placement and thank all of our existing shareholders for their

continued support as we move MAC to the long-term capital structure

that they have indicated they would like to see.”

Operational Update

MAC is pleased to confirm that operations continue to perform

strongly at CSA and the Company remains on track to deliver at the

mid-point of the full-year 2024 copper production guidance of

between 38,000-43,000 tonnes.

In the September quarter, MAC achieved copper production of

10,159 tonnes with C1 cash costs expected to be in the range of

US$1.90-2.002 per pound. Capital development metres also

accelerated in the quarter, increasing by 64% on Q2 2024 to 736

metres.

Further details of MAC’s production and operational results for

the September quarter will be released in MAC’s quarterly report

which is expected to be released later this month.

Use of Proceeds and Rationale

MAC entered into a Mezzanine Debt Facility on 10 March 2023 and

subsequently fully drew down on the facility on 15 June 2023 to

help fund, in part, the acquisition of CSA. Under the terms of the

facility and subject to obtaining requisite consents from other

secured lenders, full prepayment of the facility may be initiated

by MAC after the second anniversary date from draw down. As such,

the earliest date that MAC may elect to repay the facility,

provided all necessary third-party consents are obtained, is 16

June 2025, unless the Mezzanine Debt provider consents to allow MAC

to do so earlier.

MAC is focused on continuing to optimise its balance sheet and

de-levering following the acquisition of CSA in mid-2023 and

believes that this Placement will enable MAC to put in place a more

typical balance sheet commensurate with the asset quality and

maturity of the business. Provided that necessary consents are

obtained, the proceeds of the Placement and MAC’s existing cash on

hand will allow MAC to retire the Mezzanine Debt Facility at the

earliest possible date.

The proceeds of the Placement also enhance MAC’s balance sheet

strength and provide additional financial flexibility to pursue

strategic inorganic growth opportunities.

Placement Details

The Company will issue approximately 7.8 million New CDIs under

the Placement at an Offer Price of A$18.00 per New CDI, which

represents a:

- 13.0% discount to the last closing price of A$20.70 per CDI on

the ASX on Tuesday, 8 October 2024; and

- 13.0% discount to the 5-day volume weighted average price of

A$20.70 per CDI traded on the ASX up to and including Tuesday, 8

October 2024.

The Placement will take place in a single tranche pursuant to

the Company’s available placement capacity under ASX Listing Rule

7.1.

Settlement of New CDIs is expected to occur on Monday, 14

October 2024, with allotment to occur shortly thereafter on

Tuesday, 15 October 2024.

Barrenjoey Markets Pty Limited is acting as Sole Lead Manager

and Bookrunner to the Placement. Sternship Advisers Pty Ltd is

acting as Co-Manager to the Placement. Gilbert + Tobin is acting as

Legal Adviser to the Company.

New CDIs issued under the Placement will rank equally with the

Company’s existing CDIs on issue.

Indicative Timetable*

Event

Date

ASX trading halt and launch of Offer

Wednesday, 9 October 2024

ASX trading halt lifted and announcement

of completion of Placement

Thursday, 10 October 2024

Settlement of New CDIs under the

Placement

Monday, 14 October 2024

Allotment, quotation and trading of New

CDIs under the Placement

Tuesday, 15 October 2024

*The above timetable is indicative only and subject to change.

MAC reserves the right to amend these dates at its absolute

discretion, subject to the Corporations Act (2001) (Cth), the ASX

Listing Rules and other applicable laws. The quotation of New CDIs

is subject to confirmation from the ASX.

Additional Information

Additional information in relation to the Placement, and the

Company can be found in the ASX announcements and Investor

Presentation released to the ASX simultaneously with this

announcement, which contain important information, including a

breakdown of sources and uses of funds, the key risks and foreign

selling restrictions with respect to the Placement.

An Appendix 3B for the proposed issue of New CDIs will follow

this announcement. Further details of the fees payable to the Lead

Manager are set out in the Appendix 3B.

Nothing contained in this announcement constitutes investment,

legal, tax or other advice. Investors should seek appropriate

professional advice before making any investment decision.

This announcement is authorised for release by the Board of

Directors.

About Metals Acquisition Limited

Metals Acquisition Limited (NYSE: MTAL; ASX:MAC) is a company

focused on operating and acquiring metals and mining businesses in

high quality, stable jurisdictions that are critical in the

electrification and decarbonization of the global economy.

Not an offer in the United States

This announcement does not constitute an offer to sell, or the

solicitation of an offer to buy, any securities in the United

States or any other jurisdiction in which such an offer would be

unlawful. Any securities described in this announcement have not

been, and will not be, registered under the US Securities Act of

1933, as amended (U.S. Securities Act), or the securities

laws of any state or other jurisdiction of the United States. No

securities described in this announcement may be offered or sold in

the United States or to, or for the account or benefit of, any U.S.

Person (as defined in Regulation S under the U.S. Securities Act)

unless they have been registered under the U.S. Securities Act or

are offered and sold in a transaction exempt from, or not subject

to, the registration requirements of the U.S. Securities Act and

any other applicable U.S. state securities laws.

Forward Looking Statements

This press release includes “forward-looking statements.” MAC’s

actual results may differ from expectations, estimates, and

projections and, consequently, you should not rely on these

forward-looking statements as predictions of future events. Words

such as “expect,” “estimate,” “project,” “budget,” “forecast,”

“anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,”

“believes,” “predicts,” “potential,” “continue,” and similar

expressions (or the negative versions of such words or expressions)

are intended to identify such forward- looking statements. These

forward-looking statements include, without limitation, MAC’s

expectations with respect to future performance of the CSA Mine and

anticipated financial impacts and other effects of the proposed

business combination, the satisfaction of the closing conditions to

the proposed transaction and the timing of the completion of the

proposed transaction. These forward-looking statements involve

significant risks and uncertainties that could cause the actual

results to differ materially from those discussed in the

forward-looking statements. Most of these factors are outside MAC’s

control and are difficult to predict. Factors that may cause such

differences include, but are not limited to: the ability to

recognize the anticipated benefits of the business combination,

which may be affected by, among other things; the supply and demand

for copper; the future price of copper; the timing and amount of

estimated future production, costs of production, capital

expenditures and requirements for additional capital; cash flow

provided by operating activities; unanticipated reclamation

expenses; claims and limitations on insurance coverage; the

uncertainty in mineral resource estimates; the uncertainty in

geological, metallurgical and geotechnical studies and opinions;

infrastructure risks; and dependence on key management personnel

and executive officers; and other risks and uncertainties indicated

from time to time in the definitive proxy statement/prospectus

relating to the business combination that MAC filed with the SEC,

including those under “Risk Factors” therein, and in MAC’s other

filings with the SEC. MAC cautions that the foregoing list of

factors is not exclusive. MAC cautions readers not to place undue

reliance upon any forward-looking statements, which speak only as

of the date made. MAC does not undertake or accept any obligation

or undertaking to release publicly any updates or revisions to any

forward-looking statements to reflect any change in its

expectations or any change in events, conditions, or circumstances

on which any such statement is based.

More information on potential factors that could affect MAC’s or

CSA Mine’s financial results is included from time to time in MAC’s

public reports filed with the SEC. If any of these risks

materialize or MAC’s assumptions prove incorrect, actual results

could differ materially from the results implied by these

forward-looking statements. There may be additional risks that MAC

does not presently know, or that MAC currently believes are

immaterial, that could also cause actual results to differ from

those contained in the forward-looking statements. In addition,

forward-looking statements reflect MAC’s expectations, plans or

forecasts of future events and views as of the date of this

communication. MAC anticipates that subsequent events and

developments will cause its assessments to change. However, while

MAC may elect to update these forward-looking statements at some

point in the future, MAC specifically disclaims any obligation to

do so, except as required by law. These forward- looking statements

should not be relied upon as representing MAC’s assessment as of

any date subsequent to the date of this communication. Accordingly,

undue reliance should not be placed upon the forward-looking

statements.

1 Placement proceeds converted into US$ based on an A$:US$

exchange rate of 0.6869, which represents the average exchange rate

for the week from 30 September 2024 to 4 October 2024

(inclusive).

2 Unaudited.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241008291816/en/

Mick McMullen Chief Executive Officer & Director Metals

Acquisition Limited investors@metalsacqcorp.com

Morne Engelbrecht Chief Financial Officer Metals Acquisition

Limited

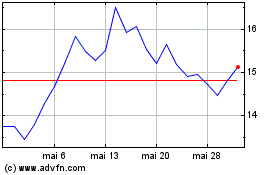

Macerich (NYSE:MAC)

Gráfico Histórico do Ativo

De Nov 2024 até Dez 2024

Macerich (NYSE:MAC)

Gráfico Histórico do Ativo

De Dez 2023 até Dez 2024