Flowserve Completes Acquisition of MOGAS Industries

15 Outubro 2024 - 5:15PM

Business Wire

- Enhances Flowserve’s severe service portfolio targeting key

growth sectors in mining, mineral extraction and process

industries

- Demonstrates company’s commitment to value-creating,

inorganic growth through a disciplined capital allocation

approach

Flowserve Corporation (“Flowserve”) (NYSE: FLS), a leading

provider of flow control products and services for the global

infrastructure markets, today announced that it has completed the

acquisition of MOGAS Industries (“MOGAS”). This transaction helps

strengthen Flowserve’s presence in mission-critical severe service

valves and associated aftermarket services.

“We welcome the MOGAS team to Flowserve and look forward to

leveraging our industry-leading scale to expand the MOGAS severe

service portfolio and aftermarket services to customers around the

world,” said Scott Rowe, President and CEO of Flowserve. “This

acquisition accelerates growth under our 3D strategy and enhances

our valve aftermarket business with MOGAS’ large installed

base.”

Flowserve intends to fully integrate MOGAS into its Flow Control

Division segment.

As previously disclosed, Flowserve used cash to fund the

transaction’s purchase price of approximately $305 million

including the potential earnout.

About Flowserve

Flowserve Corp. is one of the world’s leading providers of fluid

motion and control products and services. Operating in more than 50

countries, Flowserve produces engineered and industrial pumps,

seals and valves as well as a range of related flow management

services. More information about Flowserve can be obtained by

visiting Flowserve’s Web site at www.flowserve.com.

Safe Harbor Statement: This news release includes

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933 and Section 21E of the Securities Exchange

Act of 1934, which are made pursuant to the safe harbor provisions

of the Private Securities Litigation Reform Act of 1995, as

amended. Words or phrases such as, "may," "should," "expects,"

"could," "intends," "plans," "anticipates," "estimates,"

"believes," "forecasts," "predicts" or other similar expressions

are intended to identify forward-looking statements, which include,

without limitation, earnings forecasts, statements relating to our

business strategy and statements of expectations, beliefs, future

plans and strategies and anticipated developments concerning our

industry, business, operations and financial performance and

condition.

The forward-looking statements included in this news release are

based on our current expectations, projections, estimates and

assumptions. These statements are only predictions, not guarantees.

Such forward-looking statements are subject to numerous risks and

uncertainties that are difficult to predict. These risks and

uncertainties may cause actual results to differ materially from

what is forecast in such forward-looking statements, and include,

without limitation, the following: economic, political and other

risks associated with our international operations, including

military actions, trade embargoes, epidemics or pandemics or

changes to tariffs or trade agreements that could affect customer

markets, particularly North African, Latin American, Asian and

Middle Eastern markets and global oil and gas producers, and

non-compliance with U.S. export/re-export control, foreign corrupt

practice laws, economic sanctions and import laws and regulations;

any continued volatile regional and global economic conditions

resulting from the COVID-19 pandemic on our business and

operations; global supply chain disruptions and the current

inflationary environment could adversely affect the efficiency of

our manufacturing and increase the cost of providing our products

to customers; a portion of our bookings may not lead to completed

sales, and our ability to convert bookings into revenues at

acceptable profit margins; changes in global economic conditions

and the potential for unexpected cancellations or delays of

customer orders in our reported backlog; our dependence on our

customers’ ability to make required capital investment and

maintenance expenditures; if we are not able to successfully

execute and realize the expected financial benefits from any

restructuring and realignment initiatives, our business could be

adversely affected; the substantial dependence of our sales on the

success of the oil and gas, chemical, power generation and water

management industries; the adverse impact of volatile raw materials

prices on our products and operating margins; increased aging and

slower collection of receivables, particularly in Latin America and

other emerging markets; our exposure to fluctuations in foreign

currency exchange rates, including in hyperinflationary countries

such as Venezuela and Argentina; potential adverse consequences

resulting from litigation to which we are a party, such as

litigation involving asbestos-containing material claims;

expectations regarding acquisitions and the integration of acquired

businesses; the potential adverse impact of an impairment in the

carrying value of goodwill or other intangible assets; our

dependence upon third-party suppliers whose failure to perform

timely could adversely affect our business operations; the highly

competitive nature of the markets in which we operate;

environmental compliance costs and liabilities; potential work

stoppages and other labor matters; access to public and private

sources of debt financing; our inability to protect our

intellectual property in the U.S., as well as in foreign countries;

obligations under our defined benefit pension plans; our internal

control over financial reporting may not prevent or detect

misstatements because of its inherent limitations, including the

possibility of human error, the circumvention or overriding of

controls, or fraud; the recording of increased deferred tax asset

valuation allowances in the future or the impact of tax law changes

on such deferred tax assets could affect our operating results; our

information technology infrastructure could be subject to service

interruptions, data corruption, cyber-based attacks or network

security breaches, which could disrupt our business operations and

result in the loss of critical and confidential information;

ineffective internal controls could impact the accuracy and timely

reporting of our business and financial results; and other factors

described from time to time in our filings with the Securities and

Exchange Commission.

All forward-looking statements included in this news release are

based on information available to us on the date hereof, and we

assume no obligation to update any forward-looking statement.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241015206344/en/

Investors: Brian Ezzell, Vice President, Investor Relations,

Treasurer & Corporate Finance (972) 443-6560 Tarek Zeni,

Director, Investor Relations (469) 420-4045

Media: Wes Warnock, Vice President, Marketing, Communications

& Public Affairs (972) 443-6900

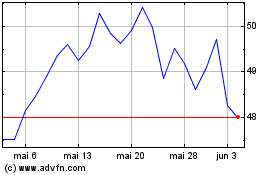

Flowserve (NYSE:FLS)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Flowserve (NYSE:FLS)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025