Leading Proxy Advisory Firms Uniformly Agree

that One-Share, One-Vote Represents Best-in-Class Corporate

Governance

Starboard Urges All Shareholders to Vote the

BLUE Proxy Card “FOR” Proposal

4, The Dual-Class Elimination Proposal, TODAY

Starboard Value LP (together with its affiliates, “Starboard” or

“we”), one of the largest shareholders of News Corporation (Nasdaq:

NWSA, NWS) ("News Corp" or the "Company"), today announced that

Institutional Shareholder Services Inc. (“ISS”), Glass, Lewis &

Co. (“Glass Lewis”), and Egan-Jones Proxy Services (“Egan-Jones”),

three leading U.S. proxy advisory firms, recommend shareholders

vote FOR Starboard’s proposal to collapse the dual-class

share structure at the Company’s upcoming 2024 Annual Meeting of

Shareholders. Additionally, Ownership Matters Governance Advisors

(“Ownership Matters”), a leading proxy advisory firm in the

Australian market, recommends shareholders vote FOR this

same proposal.

Summary of Proxy Advisory Firm Recommendations:

- ISS recommends that shareholders vote

FOR the Dual-Class Elimination Proposal

- Glass Lewis recommends that

shareholders vote FOR the Dual-Class Elimination

Proposal

- Egan-Jones recommends that

shareholders vote FOR the Dual-Class Elimination

Proposal

- Ownership Matters recommends that

shareholders vote FOR the Dual-Class Elimination

Proposal

We appreciate the support from shareholders who have already

voted FOR Starboard’s Dual-Class Elimination Proposal

and urge all remaining fellow shareholders to vote FOR the Dual-Class Elimination Proposal

TODAY.

Excerpts from ISS’ Analysis &

Recommendation1

On ISS' Conclusion that News Corp Shareholders Should Vote

Starboard's BLUE Proxy Card to Approve Recapitalization Plan for

all Stock to Have One-vote per Share:

“ISS supports a

one-share, one-vote capital structure. Multi-class capital

structures with unequal voting rights create a misalignment between

economic interest and voting rights, which can disenfranchise

shareholders holding stock with inferior voting

rights.”

“A vote FOR this

proposal is warranted…shareholders not affiliated with the Murdoch

Family Trust may benefit from a capital structure in which the

voting power is dispersed in proportion to economic exposure, and

less voting power is concentrated among those who do not have

commensurate economic exposure.”

Excerpts from Glass Lewis’ Analysis &

Recommendation2

On Glass Lewis' Conclusion that News Corp Shareholders Should

Vote to Approve Shareholder Proposal Regarding

Recapitalization:

“Glass Lewis

believes that allowing one vote per share generally operates as a

safeguard for common shareholders by ensuring that those who hold a

significant minority of shares are able to weigh in on issues set

forth by the board…we believe that the economic stake of each

shareholder should match their voting power and that no small group

of shareholders, family or otherwise, should have voting rights

different from those of other shareholders. On that basis alone, we

believe shareholders should support the Starboard

proposal.”

“…On matters of

governance and shareholder rights, we believe shareholders should

have the power to speak and the opportunity to effect change. That

power should not be concentrated in the hands of a few for reasons

other than an economic stake.”

Excerpts from Egan-Jones’ Analysis &

Recommendation3

On Egan-Jones’ Conclusion that News Corp Shareholders Should

Vote for Item 4 - Adopt a Recapitalization Plan that would

Eliminate the Company’s Dual-Class Capital Structure:

“For our reasons stated below,

we oppose a differential voting power as

it may have the effect of denying shareholders the opportunity to

vote on matters of critical economic importance to them. We believe

that eliminating the Company’s dual class capital structures to

provide equal voting rights to all shareholders [is]

warranted. We recommend a vote

FOR this Proposal.”

“In the ideal world of corporate governance,

a dual capital structure has no room in

the corporate world due to the known disadvantages it

poses. The difference in voting power and economic

interests stirs a major concern which includes super voting power,

increase of conflict of interest and unequal voice for the

unaffiliated or inferior shareholders.”

“We strongly believe

that one of the fundamental rights as a shareholder is the right to

vote the shares of the companies they invest

in…In our view, a one vote per

share principle would provide an equitable approach to ensure that

shareholders are given a fair voice that is proportionate to their

stake in the Company and would be able to hold the management

accountable of their actions through casting a

vote.”

Excerpts from Ownership Matters’ Analysis

& Recommendation4

On Ownership Matters’ Conclusion that News Corp Shareholders

Should Vote for Starboard’s Dual-Class Elimination

Proposal:

“The dual share

class structure at NWS divorces economic ownership and control and

reduces shareholders’ capacity to hold management

accountable.”

“Removing the dual

class structure may however lead to a positive re-rating of News

Corporation shares, which is the rationale behind Starboard’s

proposal.”

* * *

STARBOARD URGES ALL STOCKHOLDERS TO VOTE

FOR THE DUAL-CLASS ELIMINATIONAL

PROPOSAL

RESTORE AND ENHANCE THE VALUE OF YOUR NEWS

CORP INVESTMENT

PLEASE SIGN, DATE, AND MAIL THE BLUE PROXY CARD TODAY

If you have any questions or need further assistance with voting

your News Corp shares, please contact Okapi Partners LLC at the

phone numbers or email listed below.

Shareholders may call toll-free: (877)

629-6356

Banks and brokers call: (212) 297-0720

E-mail: info@okapipartners.com

Starboard encourages all News Corp. shareholders to read its

definitive proxy statement as it contains important information

relating to Starboard’s proxy solicitation, including with respect

to Starboard’s non-binding business proposal to eliminate the

Company’s dual-class share structure. Starboard’s definitive proxy

materials can be obtained free of charge at the SEC’s website,

www.sec.gov.

About Starboard Value LP

Starboard Value LP is an investment adviser with a focused and

differentiated fundamental approach to investing in publicly traded

companies. Starboard invests in deeply undervalued companies and

actively engages with management teams and boards of directors to

identify and execute on opportunities to unlock value for the

benefit of all shareholders.

_________________________ 1 Permission to quote from the ISS

report was neither sought nor obtained. Quotes bolded and

underlined for emphasis. 2 Permission to quote from the Glass Lewis

report was neither sought nor obtained. Quotes bolded and

underlined for emphasis. 3 Permission to quote from the Egan-Jones

report was neither sought nor obtained. Quotes bolded and

underlined for emphasis. 4 Permission to quote from the Ownership

Matters report was neither sought nor obtained. Quotes bolded and

underlined for emphasis.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241106620881/en/

Investor Contacts: Peter Feld, (212) 201-4878 Gavin

Molinelli, (212) 201-4828 www.starboardvalue.com

Okapi Partners LLC Bruce Goldfarb/Chuck Garske (212) 297-0720

info@okapipartners.com

Media Contacts: Longacre Square Partners Greg Marose /

Charlotte Kiaie, (646) 386-0091 starboard@longacresquare.com

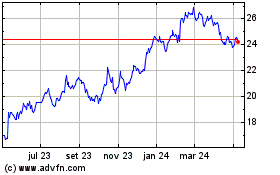

News (NASDAQ:NWSA)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

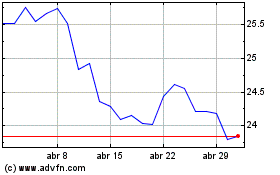

News (NASDAQ:NWSA)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025