- Service revenue of $173 million and total revenue of $179

million

- Delivered 16th consecutive quarter of positive cash flow from

operations

- Continued strong growth in new products

8x8, Inc. (NASDAQ: EGHT), the industry's most integrated

Platform for CX that combines Contact Center, Unified

Communication, and CPaaS APIs, today reported financial results for

the third quarter of fiscal year 2025 ended December 31, 2024.

"Our third quarter results highlight further progress and

continued momentum in our transformation journey. We delivered

solid financial performance, with record cash flow from operations

and strong adoption of our AI-powered customer experience

solutions, driving a 60% year-over-year increase in new products.

As we move forward, our focus remains on enhancing customer value,

accelerating growth, and driving long-term profitability. With a

clear strategy and a strong team, I believe we are well-positioned

to capitalize on the opportunities ahead," said Samuel Wilson,

Chief Executive Officer at 8x8, Inc.

Third Quarter Fiscal Year 2025

Financial Results:

- Total revenue of $178.9 million, compared to $181.0 million in

the third quarter of fiscal 2024.

- Service revenue of $173.5 million, compared to $175.1 million

in the third quarter of fiscal 2024.

- GAAP operating income was $9.0 million, compared to GAAP

operating loss of $9.4 million in the third quarter of fiscal

2024.

- Non-GAAP operating profit was $19.1 million, compared to

non-GAAP operating profit of $24.3 million in the third quarter of

fiscal 2024.

- GAAP net income was $3.0 million, compared to GAAP net loss of

$21.2 million in the third quarter of fiscal 2024.

- Non-GAAP net income was $14.5 million, compared to non-GAAP net

income of $14.8 million in the third quarter of fiscal 2024.

- Adjusted EBITDA was $23.9 million, compared to Adjusted EBITDA

of $30.7 million in the third quarter of fiscal 2024.

- Cash flow from operations of $27.2 million, compared to cash

flow from operations of $22.4 million in the third quarter of

fiscal 2024.

- Ending cash and equivalents, including restricted cash, of

$104.6 million reflected the repayment of $33.0 million of

principal payments made on the 2024 Term Loan during the third

quarter.

"We delivered solid service and total revenue performance

relative to our guidance, despite unfavorable foreign exchange

rates compared to the rates prevailing when we established our

outlook for the quarter. Additionally, record cash flow from

operations further reinforced our confidence in our ability to

consistently generate cash. As a result, we were comfortable making

an additional $15 million term loan prepayment in January, further

strengthening our balance sheet and positioning us for long-term

financial flexibility," said Kevin Kraus, Chief Financial Officer

at 8x8, Inc.

A reconciliation of the non-GAAP measures to the most directly

comparable GAAP measures and other information relating to non-GAAP

measures is included in the supplemental reconciliation at the end

of this release.

Recent Business

Highlights:

8x8 Platform for CX innovation

The latest innovations leverage AI-driven automation, advanced

security, and seamless integrations to simplify complex operations

and enhance efficiency for customers. Key enhancements include:

- Effortless Secure Payments - Anywhere, Anytime: Expanded

8x8 Secure Pay to enable secure and compliant payments across

voice, touch-tone, SMS and email, through a fully automated

customer experience via interactive voice response (IVR) or with an

agent’s assistance.

- Secure, AI-powered Payments through 8x8 Intelligent Customer

Assistant: Organizations can now enable 8x8 Secure Pay to allow

customers to pay through 8x8 Intelligent Customer Assistant for a

fully automated path to process payments, rather than waiting to

speak with an agent, by either speaking payment details or entering

the information via the phone's keypad. The new functionality

enables customers to make payments quickly and securely, while

increasing payment capture for businesses by allowing 24/7

payment.

- Voice Intelligent Directory for 8x8 Intelligent Customer

Assistant: 8x8 Intelligent Customer Assistant now delivers a

faster, natural sounding service with the newly introduced Voice

Intelligent Directory. Callers simply speak their request and the

AI matches it to a comprehensive directory, ensuring seamless

connections in seconds for improved CX through integration with 8x8

Contact Center and 8x8 Work.

- Faster Customer Support: 8x8 Knowledge Base Shortcuts

help agents quickly access and share relevant information,

improving response times.

- Enhanced Interaction Retrieval Widget for Proactive

Monitoring: The Interaction Retrieval widget in 8x8 Supervisor

Workspace empowers supervisors to quickly locate all contact center

interactions, including voice calls, digital messages,

transcriptions from 8x8 Speech Analytics, and voicemails. With

enhanced functionality, supervisors can now download multiple

interactions in bulk and effortlessly retrieve archived

interactions, saving valuable time.

- 8x8 Meetings Assets Sharing: Meeting assets, such as

participant list, recording, screenshots, chat, transcriptions,

summaries, action items, and links to shared files can be easily

shared to streamline post-meeting follow-ups and keep everyone

informed.

- Mobile Device Management Support for Retail: Mobile

Device Management (MDM) support and streamlined, credential-free

authentication for shared devices for retail operations. This new,

configurable user experience ensures secure and effortless access,

tailored specifically for retail scenarios with retail staff in

shared-device environments, such as stores with multiple

departments or locations.

- Desk Phones Multicast Paging: Multicast paging is now

available on supported Yealink phones and the Algo 8180, allowing

quick and easy broadcasting of instant audio announcements. In

addition to Yealink-to-Yealink or Poly-to-Poly paging, customers

can configure paging groups with supported Yealink, Poly, and Algo

devices, allowing cross-vendor paging.

- Connect Multi-Channel Sender: Users can now launch

text-to-speech messaging campaigns directly on 8x8 Connect

multi-channel sender. This powerful new feature enables

organizations to add voice to their communication strategy,

enhancing accessibility and connecting with customers like never

before.

8x8 Technology Partner Ecosystem

Expansion

- CallCabinet, a leader in compliant call recording,

joined the 8x8 Technology Partner Ecosystem. This partnership

provides Microsoft-certified compliance call recording to customers

using 8x8 for Microsoft Teams, further strengthening the value

delivered to organizations looking to enhance compliance within

Microsoft Teams. This partnership expands 8x8 for Microsoft Teams

portfolio, reinforcing 8x8's commitment to provide customers with

seamless, Microsoft-certified solutions for their business

communications and contact center needs.

New Brand and Messaging Reflects CX

Transformation

- Launched a new, modern brand that captures the energy

and ambition of the Company's CX transformation and mission of

empowering CX leaders. Learn more about the new 8x8 brand by

reading the blog post from 8x8 CMO, Bruno Bertini.

Recognition for the 8x8 Platform for CX,

Contact Center, Customer Service and Sustainable Business

Practices

- Included in the Newsweek Excellence 1000 Index, a list

of the top 1000 US companies that have demonstrated best practices

across a range of metrics, including R&D investment in

innovation, financial responsibility, stakeholder ratings, and

social responsibility ratings.

- Awarded 43 badges in the G2 Winter 2025 Awards for 8x8

Contact Center and 8x8 Work, including "Leader in Enterprise" and

"Users Most Likely to Recommend for Enterprise" badges.

- Received TrustRadius Tech Cares and TrustRadius "Top Rated"

Awards for Unified Communications as a Service and Contact

Center. The Trust Radius Tech Cares Award highlights companies that

have excelled in their Corporate Social Responsibility (CSR)

initiatives, while the TrustRadius 2024 Top Rated awards are driven

by customer sentiment in reviews on TrustRadius.

- Michelle Paitich, 8x8's Channel Chief and Global Vice

President, Channel Sales, was named in the 2025 CRN® Channel Chiefs

List, which recognizes the IT vendor and distribution

executives who are driving strategy and setting the channel agenda

for their companies.

Corporate and Leadership

Updates

- Appointed Joel Neeb as Chief Transformation and Business

Operations Officer to drive alignment and accelerate transformation

across the company. Mr. Neeb will be responsible for aligning 8x8’s

strategic initiatives with operational outcomes, driving

organizational excellence and fostering a culture of accountability

and innovation.

- Appointed Darren Remblence as Chief Information Security

Officer to oversee the company’s cybersecurity strategy. This

appointment underscores 8x8’s commitment to cybersecurity, data

protection, and maintaining trust with customers and partners.

- Expanded the Board of Directors to eight members with the

appointment of John Pagliuca, President and Chief Executive Officer

of N-able.

- Established a new Employee Resource Group (ERG) for Parents and

Caregivers of Neurodivergent Children and supported the Company's

Women in Tech ERG with an expanded calendar of activities.

Fourth Quarter and Updated Fiscal Year

2025 Financial Outlook:

Management provides expected ranges for total revenue, service

revenue, non-GAAP operating margin, and non-GAAP net income per

share, diluted, based on its evaluation of the current business

environment. The Company emphasizes that these expectations are

subject to various important cautionary factors referenced in the

section entitled "Forward-Looking Statements" below.

Fourth Quarter Fiscal Year 2025 Ending March 31, 2025

- Service revenue in the range of $170.0 million to $175.0

million.

- Total revenue in the range of $175.0 million to $181.0

million.

- Non-GAAP operating margin in the range of approximately 9% to

10%.

Fiscal Year 2025 Ending March 31, 2025

- Service revenue in the range of $691.3 million to $696.3

million.

- Total revenue in the range of $713.0 million to $719.0

million.

- Non-GAAP operating margin is projected between 10.7% and

11.0%.

- Non-GAAP net income per share, diluted, in the range of $0.35

to $0.37.

The Company does not reconcile its forward-looking estimates of

non-GAAP operating margin to the corresponding GAAP measure of GAAP

operating margin or non-GAAP net income per share, basic and

diluted, to the corresponding GAAP measure of GAAP net income

(loss) per share due to the significant variability of, and

difficulty in making accurate forecasts and projections with

regards to, the various expenses excluded by these metrics. For

example, future hiring and employee turnover may not be reasonably

predictable, stock-based compensation expense depends on variables

that are largely not within the control of nor predictable by

management, such as the market price of 8x8 common stock, and may

also be significantly impacted by events like acquisitions, the

timing and nature of which are difficult to predict with accuracy.

The actual amounts of these excluded items could have a significant

impact on the Company's GAAP operating margin and GAAP net income

per share, basic and diluted. Accordingly, management believes that

reconciliations of these forward-looking non-GAAP financial

measures to their corresponding GAAP measures are not available

without unreasonable effort. See the "Explanation of GAAP to

Non-GAAP Reconciliation" below for the definition of non-GAAP

operating margin and non-GAAP net income per share, basic and

diluted.

All projections are on a non-GAAP basis. Additionally, our

increased emphasis on profitability and cash flow generation may

not be successful. The reduction in our total costs as a percentage

of revenue may negatively impact our revenue and our business in

ways we don't anticipate and may not achieve the desired

outcome.

Conference Call Information:

Management will host a conference call to discuss earnings

results on February 4, 2025 at 2:00 p.m. Pacific Time (5:00 p.m.

Eastern Time). The conference call will last approximately 60

minutes. Participants may:

- Register to participate in the live call at:

https://register.vevent.com/register/BIf6409dc6cc484dc787a96317e8bb0d4f

- Access the live webcast directly at

https://edge.media-server.com/mmc/p/vgcdunvx

The live webcast and replay will be available from the Company’s

investor relations events page at

https://8x8.gcs-web.com/news-events/events-presentations.

Participants should plan to dial in or log on 10 minutes prior to

the start time. The webcast will be archived on 8x8's website for a

period of at least 30 days. For additional information, visit

https://8x8.gcs-web.com/.

About 8x8. Inc.

8x8, Inc. (NASDAQ: EGHT) connects people and organizations

through seamless communication on the industry's most integrated

platform for Customer Experience—combining Contact Center, Unified

Communication, and CPaaS APIs. The 8x8® Platform for CX integrates

AI at every level to enable personalized customer journeys, drive

operational excellence and insights, and facilitate team

collaboration. We help customer experience and IT leaders become

the heartbeat of their organizations, empowering them to unlock the

potential of every interaction. For additional information, visit

www.8x8.com, or follow 8x8 on LinkedIn, X, and Facebook.

8x8® is a trademark of 8x8, Inc.

Forward Looking Statements:

This news release contains "forward-looking statements" within

the meaning of the Private Securities Litigation Reform Act of 1995

and Section 21E of the Securities Exchange Act of 1934. Any

statements that are not statements of historical fact may be deemed

to be forward-looking statements. For example, words such as "may,"

"will," "should," "estimates," "predicts," "potential," "continue,"

"strategy," "believes," "anticipates," "plans," "expects,"

"intends," and similar expressions are intended to identify

forward-looking statements. These forward-looking statements

include, but are not limited to: changing industry trends; the size

of our market opportunity; the potential success and impact of our

investments in artificial intelligence technologies; our strategic

transformation initiatives; our ability to drive increased platform

and multi product adoption; our ability to increase profitability

and cash flow; deleverage our balance sheet and fund investment in

innovation; whether our unified communication and contact center

traffic will increase; whether we can increase customer retention;

our future revenue and growth (including platform usage revenue);

whether we can sustain an increasing pace of innovation; the

success of our go-to-market engine; our ability to improve general

and administrative synergies; our ability to enhance shareholder

value; and our financial outlook, revenue growth, and

profitability, including whether we will achieve sustainable growth

and profitability.

You should not place undue reliance on such forward-looking

statements. Actual results could differ materially from those

projected in forward-looking statements depending on a variety of

factors, including, but not limited to: a reduction in our total

costs as a percentage of revenue may negatively impact our revenues

and our business; customer adoption and demand for our products may

be lower than we anticipate; the impact of economic downturns on us

and our customers; ongoing volatility and conflict in the political

environment; inflationary pressures and rising interest rates;

competitive dynamics of the cloud communication and collaboration

markets, including voice, contact center, video, messaging, and

communication application programming interfaces, as well as our

competitors' use of AI, in which we compete, may change in ways we

are not anticipating; third parties may assert ownership rights in

our IP, which may limit or prevent our continued use of the core

technologies behind our solutions; our customer churn rate may be

higher than we anticipate; our investments in marketing, channel

and value-added resellers, new products, and our acquisition of

Fuze, Inc. may not result in meeting our revenue or operating

margin targets we forecast in our guidance, for a particular

quarter or for the full fiscal year. Our increased emphasis on

profitability and cash flow generation may not be successful. The

reduction in our total costs as a percentage of revenue may

negatively impact our revenue and our business in ways we do not

anticipate and may not achieve the desired outcome.

For a discussion of such risks and uncertainties, which could

cause actual results to differ from those contained in the

forward-looking statements, see "Risk Factors" in the Company's

reports on Forms 10-K and 10-Q, as well as other reports that 8x8,

Inc. files from time to time with the Securities and Exchange

Commission. All forward-looking statements are qualified in their

entirety by this cautionary statement, and 8x8, Inc. undertakes no

obligation to update publicly any forward-looking statement for any

reason, except as required by law, even as new information becomes

available or other events occur in the future.

Explanation of GAAP to Non-GAAP Reconciliation

The Company has provided in this release financial information

that has not been prepared in accordance with Generally Accepted

Accounting Principles (GAAP). Management uses these Non-GAAP

financial measures internally to understand, manage, and evaluate

the business, and to make operating decisions. Management believes

they are useful to investors, as a supplement to GAAP measures, in

evaluating the Company's ongoing operational performance.

Management also believes that some of 8x8’s investors use these

Non-GAAP financial measures as an additional tool in evaluating

8x8's "core operating performance" in the ordinary, ongoing, and

customary course of the Company's operations. Core operating

performance excludes items that are non-cash, not expected to

recur, or not reflective of ongoing financial results. Management

also believes that looking at the Company’s core operating

performance provides consistency in period-to-period comparisons

and trends.

These Non-GAAP financial measures may be calculated differently

from, and therefore may not be comparable to, similarly titled

measures used by other companies, which limits the usefulness of

these measures for comparative purposes. Management recognizes that

these Non-GAAP financial measures have limitations as analytical

tools, including the fact that management must exercise judgment in

determining which types of items to exclude from the Non-GAAP

financial information. Non-GAAP financial measures should not be

considered in isolation from, or as a substitute for, financial

information prepared in accordance with GAAP. Investors are

encouraged to review the reconciliation of these Non-GAAP financial

measures to their most directly comparable GAAP financial measures

in the table titled "Reconciliation of GAAP to Non-GAAP Financial

Measures". Detailed explanations of the adjustments from comparable

GAAP to Non-GAAP financial measures are as follows:

Non-GAAP Costs of Revenue, Costs of Service Revenue and Costs of

Other Revenue

Non-GAAP Costs of Revenue includes: (i) Non-GAAP Cost of Service

Revenue, which is Cost of Service Revenue excluding amortization of

acquired intangible assets, stock-based compensation expense and

related employer payroll taxes, and certain severance, transition

and contract exit costs; and (ii) Non-GAAP Cost of Other Revenue,

which is Cost of Other Revenue excluding stock-based compensation

expense and related employer payroll taxes, and certain severance,

transition and contract exit costs.

Non-GAAP Service Revenue Gross Margin, Other Revenue Gross

Margin, and Total Revenue Gross Margin

Non-GAAP Service Revenue Gross Profit and Margin as a percentage

of Service Revenue and Non-GAAP Other Revenue Gross Profit and

Margin as a percentage of Other Revenue are computed as Service

Revenue less Non-GAAP Cost of Service Revenue divided by Service

Revenue and Other Revenue less Non-GAAP Cost of Other Revenue

divided by Other Revenue, respectively. Non-GAAP Total Revenue

Gross Profit and Margin as a percentage of Total Revenue is

computed as Total Revenue less Non-GAAP Cost of Service Revenue and

Non-GAAP Cost of Other Revenue divided by Total Revenue. Management

believes the Company’s investors benefit from understanding these

adjustments and from an alternative view of the Company’s Cost of

Service Revenue and Cost of Other Revenue, as well as the Company's

Service, Other and Total Revenue Gross Margin performance compared

to prior periods and trends.

Non-GAAP Operating Profit and Non-GAAP Operating Margin

Non-GAAP Operating Profit excludes: amortization of acquired

intangible assets, stock-based compensation expense and related

employer payroll taxes, acquisition and integration expenses,

certain legal and regulatory costs, certain severance, transition

and contract exit costs, and impairment of long-lived assets from

Operating Profit (Loss). Non-GAAP Operating Margin is Non-GAAP

Operating Profit divided by Revenue. Management believes that these

exclusions provide investors with a supplemental view of the

Company’s ongoing operating performance.

Non-GAAP Net Income and Adjusted EBITDA

Non-GAAP Net Income excludes: amortization of acquired

intangible assets, stock-based compensation expense and related

employer payroll taxes, acquisition and integration expenses,

certain legal and regulatory costs, certain severance, transition

and contract exit costs, impairment of long-lived assets,

amortization of debt discount and issuance cost, loss on debt

extinguishment, gain on remeasurement of warrants, and other

income. Adjusted EBITDA excludes interest expense, provision

(benefit) for income taxes, depreciation, amortization of

capitalized internal-use software costs, and other income

(expense), net from non-GAAP net income. Management believes the

Company’s investors benefit from understanding these adjustments

and an alternative view of our net income performance as compared

to prior periods and trends.

Non-GAAP Net Income Per Share – Basic and Non-GAAP Net Income

Per Share - Diluted

Non-GAAP Net Income Per Share – Basic is Non-GAAP Net Income

divided by the weighted-average basic shares outstanding. Non-GAAP

Net Income Per Share – Diluted is Non-GAAP Net Income divided by

the weighted-average diluted shares outstanding. Diluted shares

outstanding include the effect of potentially dilutive securities

from stock-based benefit plans and convertible senior notes. These

potentially dilutive securities are excluded from the computation

of net loss per share attributable to common stockholders on a GAAP

basis because the effect would have been anti-dilutive. They are

added for the computation of diluted net income per share on a

non-GAAP basis in periods when 8x8 has net profit on a non-GAAP

basis as their inclusion provides a better indication of 8x8’s

underlying business performance. Management believes the Company’s

investors benefit by understanding our Non-GAAP net income

performance as reflected in a per share calculation as ways of

measuring performance by ownership in the Company. Management

believes these adjustments offer investors a useful view of the

Company’s diluted net income per share as compared to prior periods

and trends.

Management evaluates and makes decisions about its business

operations based on Non-GAAP financial information by excluding

items management does not consider to be “core costs” or “core

proceeds.” Management believes some of its investors also evaluate

our "core operating performance" as a means of evaluating our

performance in the ordinary, ongoing, and customary course of our

operations. Management excludes the amortization of acquired

intangible assets, which primarily represents a non-cash expense of

technology and/or customer relationships already developed, to

provide a supplemental way for investors to compare the Company’s

operations pre-acquisition to those post-acquisition and to those

of our competitors that have pursued internal growth strategies.

Stock-based compensation expense has been excluded because it is a

non-cash expense and relies on valuations based on future

conditions and events, such as the market price of 8x8 common

stock, that are difficult to predict and/or largely not within the

control of management. The related employer payroll taxes for

stock-based compensation are excluded since they are incurred only

due to the associated stock-based compensation expense. Acquisition

and integration expenses consist of external and incremental costs

resulting directly from merger and acquisition and strategic

investment activities such as legal and other professional

services, due diligence, integration, and other closing costs,

which are costs that vary significantly in amount and timing. Legal

and regulatory costs include litigation and other professional

services, as well as certain tax and regulatory liabilities.

Severance, transition and contract exit costs include employee

termination benefits, executive severance agreements, and

cancellation of certain contracts and lease impairments. Debt

amortization expenses relate to the non-cash accretion of the debt

discount.

8x8, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(Unaudited, in thousands, except

per share amounts)

Three Months Ended December

31,

Nine Months Ended December

31,

2024

2023

2024

2023

Service revenue

$

173,459

$

175,069

$

521,335

$

528,089

Other revenue

5,423

5,937

16,692

21,203

Total revenue

178,882

181,006

538,027

549,292

Cost of service revenue

50,529

48,983

150,276

144,403

Cost of other revenue

7,268

7,177

22,531

23,533

Total cost of revenue

57,797

56,160

172,807

167,936

Gross profit

121,085

124,846

365,220

381,356

Operating expenses:

Research and development

29,833

32,787

93,261

102,286

Sales and marketing

65,644

66,997

197,617

204,189

General and administrative

16,629

23,419

59,568

77,231

Impairment of long-lived assets

—

11,034

—

11,034

Total operating expenses

112,106

134,237

350,446

394,740

Income (loss) from operations

8,979

(9,391

)

14,774

(13,384

)

Interest expense

(5,842

)

(10,035

)

(23,703

)

(30,174

)

Other income (expense), net

793

(1,275

)

(10,200

)

1,133

Income (loss) before provision for income

taxes

3,930

(20,701

)

(19,129

)

(42,425

)

Provision for income taxes

908

521

2,682

1,576

Net income (loss)

$

3,022

$

(21,222

)

$

(21,811

)

$

(44,001

)

Net income (loss) per share:

Basic

$

0.02

$

(0.17

)

$

(0.17

)

$

(0.37

)

Diluted

$

0.02

$

(0.17

)

$

(0.17

)

$

(0.37

)

Weighted average number of shares:

Basic

130,970

122,556

128,750

120,042

Diluted

135,742

122,556

128,750

120,042

Comprehensive loss

Net income (loss)

$

3,022

$

(21,222

)

$

(21,811

)

$

(44,001

)

Unrealized gain (loss) on investments in

securities

—

(16

)

(5

)

281

Foreign currency translation

adjustment

(9,321

)

5,987

(1,312

)

3,108

Comprehensive loss

$

(6,299

)

$

(15,251

)

$

(23,128

)

$

(40,612

)

8x8, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Unaudited, in thousands)

December 31, 2024

March 31, 2024

ASSETS

Current assets:

Cash and cash equivalents

$

104,165

$

116,262

Restricted cash

462

356

Short-term investments

—

1,048

Accounts receivable, net

52,312

58,979

Deferred sales commission costs

32,046

35,933

Other current assets

30,105

35,258

Total current assets

219,090

247,836

Property and equipment, net

49,228

53,181

Operating lease, right-of-use assets

32,777

35,924

Intangible assets, net

71,420

86,717

Goodwill

266,217

266,574

Restricted cash, non-current

—

105

Deferred sales commission costs,

non-current

45,154

52,859

Other assets, non-current

14,325

12,783

Total assets

$

698,211

$

755,979

LIABILITIES AND STOCKHOLDERS'

EQUITY

Current liabilities:

Accounts payable

$

53,072

$

48,862

Accrued and other liabilities

61,601

78,102

Operating lease liabilities

11,386

11,295

Deferred revenue

33,394

34,325

Term loan, current

16,524

—

Total current liabilities

175,977

172,584

Operating lease liabilities,

non-current

49,842

56,647

Deferred revenue, non-current

5,960

7,810

Convertible senior notes, non-current

198,569

197,796

Term loan

149,437

211,894

Other liabilities, non-current

5,413

7,290

Total liabilities

585,198

654,021

Stockholders' equity:

Preferred stock: $0.001 par value,

5,000,000 shares authorized, none issued and outstanding as of

December 31, 2024 and March 31, 2024

—

—

Common stock: $0.001 par value,

300,000,000 shares authorized, 131,472,684 shares and 125,193,573

shares issued and outstanding as of December 31, 2024 and March 31,

2024, respectively

131

125

Additional paid-in capital

1,008,072

973,895

Accumulated other comprehensive loss

(12,870

)

(11,553

)

Accumulated deficit

(882,320

)

(860,509

)

Total stockholders' equity

113,013

101,958

Total liabilities and stockholders'

equity

$

698,211

$

755,979

8x8, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(Unaudited, in thousands)

Nine Months Ended December

31,

2024

2023

Cash flows from operating

activities:

Net loss

$

(21,811

)

$

(44,001

)

Adjustments to reconcile net loss to net

cash provided by operating activities:

Depreciation

5,622

6,133

Amortization of intangible assets

15,296

15,296

Amortization of capitalized internal-use

software costs

9,981

14,418

Amortization of debt discount and issuance

costs

2,145

3,397

Amortization of deferred sales commission

costs

28,981

30,150

Allowance for credit losses

1,425

1,663

Operating lease expense, net of

accretion

8,907

8,057

Impairment of right-of-use assets

—

11,034

Stock-based compensation expense

31,710

46,835

Loss on debt extinguishment

12,212

1,766

Gain on remeasurement of warrants

(1,197

)

(1,234

)

Other

855

(570

)

Changes in assets and liabilities:

Accounts receivable, net

5,146

(2,188

)

Deferred sales commission costs

(17,581

)

(17,095

)

Other current and non-current assets

(1,943

)

(586

)

Accounts payable and accruals

(19,181

)

(4,471

)

Deferred revenue

(2,886

)

(2,272

)

Net cash provided by operating

activities

57,681

66,332

Cash flows from investing

activities:

Purchases of property and equipment

(2,045

)

(2,341

)

Capitalized internal-use software

costs

(8,462

)

(10,913

)

Purchase of investments

—

(6,174

)

Purchase of cost investment

(771

)

—

Maturities of investments

1,048

31,659

Net cash (used in) provided by

investing activities

(10,230

)

12,231

Cash flows from financing

activities:

Proceeds from issuance of common stock

under employee stock plans

1,681

2,365

Payments for debt issuance costs

(1,517

)

—

Repayment of principal on term loan

(258,000

)

(25,000

)

Gross proceeds from term loan

200,000

—

Other financing activities

(1,261

)

—

Net cash used in financing

activities

(59,097

)

(22,635

)

Effect of exchange rate changes on

cash

(450

)

674

Net increase (decrease) in cash and cash

equivalents

(12,096

)

56,602

Cash, cash equivalents and restricted

cash, beginning of year

116,723

112,729

Cash, cash equivalents and restricted

cash, end of period

$

104,627

$

169,331

Supplemental disclosures of cash flow

information:

Interest paid

$

19,517

$

24,663

Income taxes paid

$

3,094

$

5,444

Payables and accruals for property and

equipment

$

2,861

$

3,861

8x8, INC.

RECONCILIATION OF GAAP TO

NON-GAAP FINANCIAL MEASURES

(Unaudited, in thousands, except

per share amounts)

Three Months Ended December

31,

Nine Months Ended December

31,

2024

2023

2024

2023

Cost of Revenue:

GAAP cost of service revenue (as a

percentage of service revenue)

$

50,529

29.1

%

$

48,983

28.0

%

$

150,276

28.8

%

$

144,403

27.3

%

Amortization of acquired intangible

assets

(2,117

)

(2,118

)

(6,352

)

(6,354

)

Stock-based compensation expense and

related employer payroll taxes

(857

)

(1,694

)

(3,695

)

(5,661

)

Legal and regulatory costs

55

—

55

—

Severance, transition and contract exit

costs

3

(444

)

(574

)

(732

)

Non-GAAP cost of service revenue (as a

percentage of service revenue)

$

47,613

27.4

%

$

44,727

25.5

%

$

139,710

26.8

%

$

131,656

24.9

%

GAAP service revenue margin (as a

percentage of service revenue)

$

122,930

70.9

%

$

126,086

72.0

%

$

371,059

71.2

%

$

383,686

72.7

%

Non-GAAP service revenue margin (as a

percentage of service revenue)

$

125,846

72.6

%

$

130,342

74.5

%

$

381,625

73.2

%

$

396,433

75.1

%

GAAP cost of other revenue (as a

percentage of other revenue)

$

7,268

134.0

%

$

7,177

120.9

%

$

22,531

135.0

%

$

23,533

111.0

%

Stock-based compensation expense and

related employer payroll taxes

(272

)

(459

)

(995

)

(1,578

)

Legal and regulatory costs

62

—

62

—

Severance, transition and contract exit

costs

(130

)

(74

)

(386

)

(124

)

Non-GAAP cost of other revenue (as a

percentage of other revenue)

$

6,928

127.8

%

$

6,644

111.9

%

$

21,212

127.1

%

$

21,831

103.0

%

GAAP other revenue margin (as a percentage

of other revenue)

$

(1,845

)

(34.0

)%

$

(1,240

)

(20.9

)%

$

(5,839

)

(35.0

)%

$

(2,330

)

(11.0

)%

Non-GAAP other revenue margin (as a

percentage of other revenue)

$

(1,505

)

(27.8

)%

$

(707

)

(11.9

)%

$

(4,520

)

(27.1

)%

$

(628

)

(3.0

)%

GAAP gross margin (as a percentage of

total revenue)

$

121,085

67.7

%

$

124,846

69.0

%

$

365,220

67.9

%

$

381,356

69.4

%

Non-GAAP gross margin (as a percentage of

total revenue)

$

124,341

69.5

%

$

129,635

71.6

%

$

377,105

70.1

%

$

395,805

72.1

%

Operating Profit (Loss):

GAAP income (loss) from operations (as a

percentage of total revenue)

$

8,979

5.0

%

$

(9,391

)

(5.2

)%

$

14,774

2.7

%

$

(13,384

)

(2.4

)%

Amortization of acquired intangible

assets

5,098

5,100

15,296

15,300

Stock-based compensation expense and

related employer payroll taxes

9,769

14,890

33,207

49,992

Acquisition and integration costs

244

102

560

752

Legal and regulatory costs(1)

(6,849

)

98

(9,467

)

5,445

Severance, transition and contract exit

costs

1,847

2,423

6,366

5,311

Impairment of long-lived assets

—

11,034

—

11,034

Non-GAAP operating profit (as a percentage

of total revenue)

$

19,088

10.7

%

$

24,256

13.4

%

$

60,736

11.3

%

$

74,450

13.6

%

Three Months Ended December

31,

Nine Months Ended December

31,

2024

2023

2024

2023

Net Income (Loss):

GAAP net income (loss) (as a percentage of

total revenue)

$

3,022

1.7

%

$

(21,222

)

(11.7

)%

$

(21,811

)

(4.1

)%

$

(44,001

)

(8.0

)%

Amortization of acquired intangible

assets

5,098

5,100

15,296

15,300

Stock-based compensation expense and

related employer payroll taxes

9,769

14,890

33,207

49,992

Acquisition and integration costs

244

102

560

752

Legal and regulatory costs(1)

(6,849

)

98

(9,467

)

5,445

Severance, transition and contract exit

costs

1,847

2,423

6,366

5,311

Impairment of long-lived assets

—

11,034

—

11,034

Amortization of debt discount and issuance

cost

427

1,157

2,145

3,398

Loss on debt extinguishment

216

—

12,212

1,766

Gain on warrants remeasurement

813

1,297

(1,197

)

(1,234

)

Other income

(116

)

(120

)

(348

)

(351

)

Income tax expense effects, net (2)

—

—

—

—

Non-GAAP net income (as a percentage of

total revenue)

$

14,471

8.1

%

$

14,759

8.2

%

$

36,963

6.9

%

$

47,412

8.6

%

Interest expense(3)

5,415

8,878

21,558

26,777

Provision (benefit) for income taxes

908

521

2,682

1,576

Depreciation

1,866

2,043

5,622

6,132

Amortization of capitalized internal-use

software costs

2,959

4,358

9,981

14,418

Other income (expense), net

(1,706

)

98

(467

)

(1,314

)

Adjusted EBITDA (as a percentage of total

revenue)

$

23,913

13.4

%

$

30,657

16.9

%

$

76,339

14.2

%

$

95,001

17.3

%

Shares used in computing net income (loss)

per share amounts:

Basic

130,970

122,556

128,750

120,042

Diluted

135,742

124,253

131,744

121,874

GAAP net income (loss) per share -

Basic

$

0.02

$

(0.17

)

$

(0.17

)

$

(0.37

)

GAAP net income (loss) per share -

Diluted

$

0.02

$

(0.17

)

$

(0.17

)

$

(0.37

)

Non-GAAP net income per share - Basic

$

0.11

$

0.12

$

0.29

$

0.39

Non-GAAP net income per share -

Diluted

$

0.11

$

0.12

$

0.28

$

0.39

(1)

Amount includes an out-of-period

adjustment associated with state and local taxes.

(2)

Non-GAAP adjustments do not have a

material impact on our federal income tax provision due to past

non-GAAP losses.

(3)

Amounts represent contractual interest

expense and does not include amortization of debt discount and

issuance costs.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250203066974/en/

8x8, Inc.

Media: PR@8x8.com

Investor Relations: Investor.relations@8x8.com

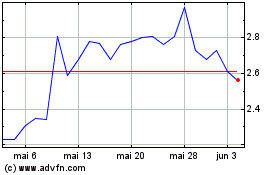

8x8 (NASDAQ:EGHT)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

8x8 (NASDAQ:EGHT)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025