Total Debt Reduction of $244 Million in 2024,

Capping a Two-Year Total Debt Reduction of $647 Million

2025 Guidance Midpoint Indicates Double-Digit

Adjusted EBITDA & Adjusted EPS Growth, and Improving Cash

Flow

Active Discussions Well Underway Regarding

Potential Sale of Products & Healthcare Services (P&HS)

Segment

Board of Directors Authorizes Share Repurchase

Program of Up to $100 Million

Owens & Minor, Inc. (NYSE: OMI) today reported financial

results for the fourth quarter and year ended December 31,

2024.

“We are pleased with the progress that we have made against the

strategy as outlined at our Investor Day in December 2023. As a

reminder, we committed to optimizing our Products & Healthcare

Services business, leveraging our leading Patient Direct platform,

and building balance sheet flexibility through deleveraging. Within

P&HS we continue to see momentum in broadening our product

portfolio, developing a streamlined and efficient manufacturing

footprint, and enhancing our distribution capabilities. Within

Patient Direct, we continue to leverage our footprint and broad

product offering to support home-based care for millions of

patients with chronic conditions. These capabilities, combined with

positive demographic trends and expanding home treatment options,

leaves us very bullish on the future of this business. Finally, we

repaid $647 million of debt over the last two years which helps

provide the financial flexibility to pursue the acquisition of

Rotech - which we believe will drive long-term shareholder value,”

said Edward A. Pesicka, President & Chief Executive Officer of

Owens & Minor.

Pesicka added, “Our commitment to directing capital toward the

higher growth and higher margin Patient Direct segment has been

increasingly evident in recent years and is consistent with our

strategy. As a logical next step, we have been actively engaged in

robust discussions regarding the potential sale of our Products

& Healthcare Services segment.”

Pesicka concluded, “In the meantime, we remain focused on

delivering a strong 2025 and are confident in our ability to

achieve double-digit adjusted EBITDA growth while improving cash

flow.”

Financial

Summary (1) (2)

FYE

FYE

($ in millions, except per share data)

4Q24

4Q23

2024

2023

Revenue

$

2,696

$

2,656

$

10,701

$

10,334

Operating (loss) income, GAAP

$

(262

)

$

60

$

(208

)

$

105

Adj. Operating Income, Non-GAAP

$

95

$

111

$

313

$

305

Net (loss) income, GAAP

$

(296

)

$

18

$

(363

)

$

(41

)

Adj. Net Income, Non-GAAP

$

43

$

54

$

119

$

106

Adj. EBITDA, Non-GAAP

$

138

$

170

$

523

$

526

Net (loss) income per common share,

GAAP

$

(3.84

)

$

0.23

$

(4.73

)

$

(0.54

)

Adj. Net Income per share, Non-GAAP

$

0.55

$

0.69

$

1.53

$

1.36

(1) Reconciliations of the differences

between the non-GAAP financial measures presented in this release

and their most directly comparable GAAP financial measures are

included in the tables below.

(2) Non-GAAP results in this table exclude

a goodwill impairment charge of $305 million, net of tax. Refer to

footnote (3) of the GAAP/Non-GAAP Reconciliations below.

Share Repurchase

Authorization

On February 26, 2025, the Owens & Minor Board of Directors

authorized a share repurchase program of up to $100 million over

the next 24 months. Under the program, Owens & Minor may

repurchase shares of common stock on a discretionary basis from

time to time through open market repurchases, privately negotiated

transactions and 10b5-1 trading plans.

2025 Financial Outlook

The Company issued its outlook for 2025; summarized below:

- Revenue for 2025 to be in a range of $10.85 billion to $11.15

billion

- Adjusted EBITDA for 2025 to be in a range of $560 million to

$590 million

- Adjusted EPS for 2025 to be in a range of $1.60 to $1.85

The Company’s outlook for 2025 excludes any impact of the

previously announced Rotech acquisition, any potential transaction

involving the Products & Healthcare Services segment, or share

repurchase activity, and contains assumptions, including current

expectations regarding the impact of general economic

conditions.

Key assumptions supporting the Company’s 2025 financial guidance

include:

- Gross margin of 20.75% to 21.25%

- Interest expense of $138 million to $142 million

- Adjusted effective tax rate of 29.0% to 30.0%

- Diluted weighted average shares of ~80 million

- Capital expenditures, gross, of $250 million to $270

million

- Stable commodity prices

- FX rates as of 12/31/2024

Although the Company does provide guidance for adjusted EBITDA

and adjusted EPS (which are non-GAAP financial measures), it is not

able to forecast the most directly comparable measures calculated

and presented in accordance with GAAP without unreasonable effort.

Certain elements of the composition of the GAAP amounts are not

predictable, making it impracticable for the Company to forecast.

Such elements include, but are not limited to, exit and realignment

charges and acquisition-related charges, which could have a

significant and unpredictable impact on our GAAP results. As a

result, no GAAP guidance or reconciliation of the Company’s

adjusted EBITDA guidance or adjusted EPS guidance is provided. The

outlook is based on certain assumptions that are subject to the

risk factors discussed in the Company’s filings with the SEC.

Financial Advisor

Citi is serving as exclusive financial advisor to Owens &

Minor in connection with the potential sale of the Products &

Healthcare Services (P&HS) segment.

Investor Conference Call for Fourth

Quarter and Full Year 2024 Financial Results

Owens & Minor will host a conference call for investors and

analysts on Friday, February 28, 2025, at 8:30 a.m. EST.

Participants may access the call via the toll-free dial-in number

at 1-888-300-2035, or the toll dial-in number at 1-646-517-7437.

The conference ID access code is 1058917. All interested

stakeholders are encouraged to access the simultaneous live webcast

by visiting the investor relations page of the Owens & Minor

website available at

investors.owens-minor.com/events-and-presentations/. A replay of

the webcast can be accessed following the presentation at the link

provided above.

Safe Harbor

This release is intended to be disclosure through methods

reasonably designed to provide broad, non-exclusionary distribution

to the public in compliance with the SEC’s Fair Disclosure

Regulation. This release contains certain “forward-looking”

statements made pursuant to the Safe Harbor provisions of the

Private Securities Litigation Reform Act of 1995. These statements

include, but are not limited to, the statements in this release

regarding our future prospects and performance, including our

expectations with respect to our financial performance, our 2025

financial results, Owens & Minor’s ability to successfully

complete the sale of the P&HS business in any specific

transaction on favorable terms or at all, our ability to raise

additional financing for our acquisition of Rotech on favorable

terms or at all, the risk that the proposed acquisition of Rotech

will not be consummated in a timely manner or at all, our

cost-saving initiatives, future indebtedness and growth, industry

trends, as well as statements related to our expectations regarding

the performance of our business, including our ability to address

macro and market conditions. Forward-looking statements involve

known and unknown risks and uncertainties that may cause our actual

results in future periods to differ materially from those projected

or contemplated in the forward-looking statements. Investors should

refer to Owens & Minor’s Annual Report on Form 10-K for the

year ended December 31, 2024, expected to be filed with the SEC on

or around February 28, 2025, including the section captioned “Item

1A. Risk Factors,” as applicable, and subsequent quarterly reports

on Form 10-Q and current reports on Form 8-K filed with or

furnished to the SEC, for a discussion of certain known risk

factors that could cause the Company’s actual results to differ

materially from its current estimates. These filings are available

at www.owens-minor.com. Given these risks and uncertainties, Owens

& Minor can give no assurance that any forward-looking

statements will, in fact, transpire and, therefore, cautions

investors not to place undue reliance on them. Owens & Minor

specifically disclaims any obligation to update or revise any

forward-looking statements, whether as a result of new information,

future developments or otherwise.

About Owens & Minor

Owens & Minor, Inc. (NYSE: OMI) is a Fortune 500 global

healthcare solutions company providing essential products and

services that support care from the hospital to the home. For over

100 years, Owens & Minor and its affiliated brands, Apria®,

Byram® and HALYARD*, have helped to make each day better for the

patients, providers, and communities we serve. Powered by more than

20,000 teammates worldwide, Owens & Minor delivers comfort and

confidence behind the scenes so healthcare stays at the forefront.

Owens & Minor exists because every day, everywhere, Life Takes

Care™. For more information about Owens & Minor and our

affiliated brands, visit owens-minor.com or follow us on LinkedIn

and Instagram.

* Registered Trademark or Trademark of O&M Halyard or its

affiliates.

Exhibit 99.1

Owens & Minor, Inc.

Consolidated Statements of Operations

(unaudited)

(dollars in thousands, except per share

data)

Three Months Ended December

31,

2024

2023

Net revenue

$

2,696,073

$

2,656,150

Cost of goods sold

2,116,307

2,086,227

Gross profit

579,766

569,923

Distribution, selling and administrative

expenses

493,066

457,225

Goodwill impairment charge

307,112

—

Acquisition-related charges and intangible

amortization

25,148

26,427

Exit and realignment charges, net

24,632

24,310

Other operating (income) expense, net

(8,225

)

1,940

Operating (loss) income

(261,967

)

60,021

Interest expense, net

35,696

36,863

Loss on extinguishment of debt

790

860

Other expense, net

1,199

1,301

(Loss) income before income taxes

(299,652

)

20,997

Income tax (benefit) provision

(3,535

)

3,213

Net (loss) income

$

(296,117

)

$

17,784

Net (loss) income per common share:

Basic

$

(3.84

)

$

0.23

Diluted

$

(3.84

)

$

0.23

Owens & Minor, Inc.

Consolidated Statements of Operations

(unaudited)

(dollars in thousands, except per share

data)

Years Ended December

31,

2024

2023

Net revenue

$

10,700,883

$

10,333,967

Cost of goods sold

8,481,728

8,208,806

Gross profit

2,219,155

2,125,161

Distribution, selling and administrative

expenses

1,909,791

1,813,559

Goodwill impairment charge

307,112

—

Acquisition-related charges and intangible

amortization

86,543

101,037

Exit and realignment charges, net

110,162

99,127

Other operating expense, net

13,316

6,930

Operating (loss) income

(207,769

)

104,508

Interest expense, net

143,804

157,915

Loss (gain) on extinguishment of debt

1,101

(3,518

)

Other expense, net

4,683

4,837

Loss before income taxes

(357,357

)

(54,726

)

Income tax provision (benefit)

5,329

(13,425

)

Net loss

$

(362,686

)

$

(41,301

)

Net loss per common share:

Basic

$

(4.73

)

$

(0.54

)

Diluted

$

(4.73

)

$

(0.54

Owens & Minor, Inc.

Condensed Consolidated Balance Sheets

(unaudited)

(dollars in thousands)

December 31,

December 31,

2024

2023

Assets

Current assets

Cash and cash equivalents

$

49,382

$

243,037

Accounts receivable, net

690,241

598,257

Merchandise inventories

1,131,879

1,110,606

Other current assets

149,515

150,890

Total current assets

2,021,017

2,102,790

Property and equipment, net

509,347

543,972

Operating lease assets

355,627

296,533

Goodwill

1,331,281

1,638,846

Intangible assets, net

298,726

361,835

Other assets, net

140,158

149,346

Total assets

$

4,656,156

$

5,093,322

Liabilities and equity

Current liabilities

Accounts payable

$

1,251,964

$

1,171,882

Accrued payroll and related

liabilities

151,039

116,398

Current portion of long-term debt

45,549

206,904

Other current liabilities

425,187

396,701

Total current liabilities

1,873,739

1,891,885

Long-term debt, excluding current

portion

1,808,047

1,890,598

Operating lease liabilities, excluding

current portion

286,212

222,429

Deferred income taxes, net

22,456

41,652

Other liabilities

100,476

122,592

Total liabilities

4,090,930

4,169,156

Total equity

565,226

924,166

Total liabilities and equity

$

4,656,156

$

5,093,322

Owens & Minor, Inc.

Consolidated Statements of Cash Flows

(unaudited)

(dollars in thousands)

Three Months Ended December

31,

2024

2023

Operating activities:

Net (loss) income

$

(296,117

)

$

17,784

Adjustments to reconcile net (loss) income

to cash provided by operating activities:

Depreciation and amortization

65,187

70,737

Goodwill impairment charge

307,112

—

Share-based compensation expense

7,555

5,801

Loss on extinguishment of debt

790

860

Deferred income tax benefit

(10,996

)

(7,333

)

Changes in operating lease right-of-use

assets and lease liabilities

3,088

1,470

Gain from sales and dispositions of

property and equipment

(7,023

)

(8,420

)

Changes in operating assets and

liabilities:

Accounts receivable

(33,663

)

88,457

Merchandise inventories

106,205

(22,719

)

Accounts payable

(99,074

)

(15,341

)

Net change in other assets and

liabilities

25,434

(22,497

)

Other, net

2,503

2,966

Cash provided by operating

activities

71,001

111,765

Investing activities:

Additions to property and equipment

(62,834

)

(50,392

)

Additions to computer software

(8,602

)

(5,933

)

Proceeds from sales of property and

equipment

18,667

17,929

Other, net

465

(518

)

Cash used for investing

activities

(52,304

)

(38,914

)

Financing activities:

Borrowings under amended Receivables

Financing Agreement

179,400

—

Repayments under amended Receivables

Financing Agreement

(179,400

)

—

Borrowings under Revolving Credit

Facility

635,800

—

Repayments under Revolving Credit

Facility

(635,800

)

—

Repayments of debt

(32,750

)

(50,504

)

Other, net

(10,346

)

(711

)

Cash used for financing

activities

(43,096

)

(51,215

)

Effect of exchange rate changes on

cash, cash equivalents and restricted cash

(1,309

)

1,128

Net (decrease) increase in cash, cash

equivalents and restricted cash

(25,708

)

22,764

Cash, cash equivalents and restricted

cash at beginning of period

75,090

250,160

Cash, cash equivalents and restricted

cash at end of period(1)

$

49,382

$

272,924

Supplemental disclosure of cash flow

information:

Income taxes (received) paid, net

$

(2,057

)

$

515

Interest paid

$

37,269

$

52,168

Noncash investing activity:

Unpaid purchases of property and equipment

and computer software at end of period

$

84,562

$

77,279

_________________

(1) There was no restricted cash as of

December 31, 2024. Restricted cash as of September 30, 2024 was $30

million and includes amounts held in an escrow account as required

by the Centers for Medicare & Medicaid Services (CMS) in

conjunction with the Bundled Payments for Care Improvement (BPCI)

initiatives related to wind-down costs of a subsidiary, Fusion5, as

well as restricted cash deposits received under the Master

Receivables Purchase Agreement to be remitted to a third-party

financial institution.

Owens & Minor, Inc.

Consolidated Statements of Cash Flows

(unaudited)

(dollars in thousands)

Years Ended December

31,

2024

2023

Operating activities:

Net loss

$

(362,686

)

$

(41,301

)

Adjustments to reconcile net loss to cash

provided by operating activities:

Depreciation and amortization

264,775

287,377

Goodwill impairment charge

307,112

—

Share-based compensation expense

26,836

23,218

Loss (gain) on extinguishment of debt

1,101

(3,518

)

Deferred income tax benefit

(26,115

)

(23,648

)

Changes in operating lease right-of-use

assets and lease liabilities

10,244

(47

)

Gain from sales and dispositions of

property and equipment

(44,705

)

(34,882

)

Changes in operating assets and

liabilities:

Accounts receivable

(94,550

)

165,167

Merchandise inventories

(26,228

)

224,338

Accounts payable

65,187

30,997

Net change in other assets and

liabilities

30,153

100,370

Other, net

10,371

12,639

Cash provided by operating

activities

161,495

740,710

Investing activities:

Additions to property and equipment

(210,865

)

(190,870

)

Additions to computer software

(17,297

)

(17,022

)

Proceeds from sales of property and

equipment

103,426

71,574

Other, net

8,203

(936

)

Cash used for investing

activities

(116,533

)

(137,254

)

Financing activities:

Borrowings under amended Receivables

Financing Agreement

1,465,800

476,000

Repayments under amended Receivables

Financing Agreement

(1,465,800

)

(572,000

)

Borrowings under Revolving Credit

Facility

635,800

—

Repayments under Revolving Credit

Facility

(635,800

)

—

Repayments of debt

(244,197

)

(320,693

)

Other, net

(23,406

)

(637

)

Cash used for financing

activities

(267,603

)

(417,330

)

Effect of exchange rate changes on

cash, cash equivalents and restricted cash

(901

)

613

Net (decrease) increase in cash, cash

equivalents and restricted cash

(223,542

)

186,739

Cash, cash equivalents and restricted

cash at beginning of period

272,924

86,185

Cash, cash equivalents and restricted

cash at end of period(1)

$

49,382

$

272,924

Supplemental disclosure of cash flow

information:

Income taxes paid (received), net

$

5,553

$

(6,283

)

Interest paid

$

141,547

$

153,247

Noncash investing activity:

Unpaid purchases of property and equipment

and computer software at end of period

$

84,562

$

77,279

_________________

(1) There was no restricted cash as of

December 31, 2024. Restricted cash as of December 31, 2023 was $30

million and includes amounts held in an escrow account as required

by the Centers for Medicare & Medicaid Services (CMS) in

conjunction with the Bundled Payments for Care Improvement (BPCI)

initiatives related to wind-down costs of a subsidiary, Fusion5, as

well as restricted cash deposits received under the Master

Receivables Purchase Agreement to be remitted to a third-party

financial institution.

Owens & Minor, Inc.

Summary Segment Information

(unaudited)

(dollars in thousands)

Three Months Ended December

31,

2024

2023

% of

% of

consolidated

consolidated

Amount

net revenue

Amount

net revenue

Net revenue:

Products & Healthcare Services

$

2,001,050

74.22

%

$

1,991,716

74.99

%

Patient Direct

695,023

25.78

%

664,434

25.01

%

Consolidated net revenue

$

2,696,073

100.00

%

$

2,656,150

100.00

%

% of segment

% of segment

Operating income:

net revenue

net revenue

Products & Healthcare Services

$

25,825

1.29

%

$

33,244

1.67

%

Patient Direct

69,558

10.01

%

77,514

11.67

%

Acquisition-related charges and intangible

amortization

(25,148

)

(26,427

)

Exit and realignment charges, net

(24,632

)

(24,310

)

Goodwill impairment charge

(307,112

)

—

Litigation and related charges (1)

(458

)

—

Consolidated operating (loss) income

$

(261,967

)

$

60,021

Depreciation and amortization:

Products & Healthcare Services

$

11,407

$

12,019

Patient Direct

34,959

36,685

Intangible amortization

13,770

20,831

Other (2)

5,051

1,202

Consolidated depreciation and

amortization

$

65,187

$

70,737

Capital expenditures:

Products & Healthcare Services

$

20,920

$

11,405

Patient Direct

50,516

44,920

Consolidated capital expenditures

$

71,436

$

56,325

(1)

Litigation and related charges are

reported within Other operating (income) expense, net in our

Statements of Operations. Refer to footnote 4 in the GAAP/Non-GAAP

Reconciliations below.

(2)

Other depreciation and amortization

expense is captured within exit and realignment charges, net or

acquisition-related charges and intangible amortization for the

three months ended December 31, 2024 and 2023.

Owens & Minor, Inc.

Summary Segment Information

(unaudited)

(dollars in thousands)

Years Ended December

31,

2024

2023

% of

% of

consolidated

consolidated

Amount

net revenue

Amount

net revenue

Net revenue:

Products & Healthcare Services

$

8,020,771

74.95

%

$

7,781,395

75.30

%

Patient Direct

2,680,112

25.05

%

2,552,572

24.70

%

Consolidated net revenue

$

10,700,883

100.00

%

$

10,333,967

100.00

%

% of segment

% of segment

Operating income:

net revenue

net revenue

Products & Healthcare Services

$

53,012

0.66

%

$

57,809

0.74

%

Patient Direct

260,155

9.71

%

246,863

9.67

%

Acquisition-related charges and intangible

amortization

(86,543

)

(101,037

)

Exit and realignment charges, net

(110,162

)

(99,127

)

Goodwill impairment charge

(307,112

)

—

Litigation and related charges (1)

(17,119

)

—

Consolidated operating (loss) income

$

(207,769

)

$

104,508

Depreciation and amortization:

Products & Healthcare Services

$

45,835

$

47,756

Patient Direct

141,032

152,583

Intangible amortization

64,943

83,522

Other (2)

12,965

3,516

Consolidated depreciation and

amortization

$

264,775

$

287,377

Capital expenditures:

Products & Healthcare Services

$

50,050

$

29,361

Patient Direct

178,112

178,531

Consolidated capital expenditures

$

228,162

$

207,892

(1)

Litigation and related charges are

reported within Other operating (income) expense, net in our

Statements of Operations. Refer to footnote 4 in the GAAP/Non-GAAP

Reconciliations below.

(2)

Other depreciation and amortization

expense is captured within exit and realignment charges, net or

acquisition-related charges and intangible amortization for the

years ended December 31, 2024 and 2023.

Owens & Minor, Inc.

Net (Loss) Income Per Common Share

(unaudited)

(dollars in thousands, except per share

data)

Three Months Ended December

31,

Years Ended December

31,

2024

2023

2024

2023

Net (loss) income

$

(296,117

)

$

17,784

$

(362,686

)

$

(41,301

)

Weighted average shares outstanding -

basic

77,169

76,284

76,741

75,785

Dilutive shares

—

1,491

—

—

Weighted average shares outstanding -

diluted

77,169

77,775

76,741

75,785

Net (loss) income per common share:

Basic

$

(3.84

)

$

0.23

$

(4.73

)

$

(0.54

)

Diluted

$

(3.84

)

$

0.23

$

(4.73

)

$

(0.54

)

Share-based awards of approximately 1.4

million and 1.5 million shares for the three months and year ended

December 31, 2024 and 1.6 million for the year ended December 31,

2023 were excluded from the calculation of net loss per diluted

common share as the effect would be anti-dilutive.

Owens & Minor, Inc.

GAAP/Non-GAAP Reconciliations

(unaudited)

(dollars in thousands, except per share

data)

The following table provides a

reconciliation of reported operating (loss) income, net (loss)

income and net (loss) income per share to non-GAAP measures used by

management.

Three Months Ended December

31,

Years Ended December

31,

2024

2023

2024

2023

Operating (loss) income, as reported

(GAAP)

$

(261,967

)

$

60,021

$

(207,769

)

$

104,508

Acquisition-related charges and intangible

amortization (1)

25,148

26,427

86,543

101,037

Exit and realignment charges, net (2)

24,632

24,310

110,162

99,127

Goodwill impairment charge (3)

307,112

—

307,112

—

Litigation and related charges (4)

458

—

17,119

—

Operating income, adjusted (non-GAAP)

(Adjusted Operating Income)

$

95,383

$

110,758

$

313,167

$

304,672

Operating (loss) income as a percent of

net revenue (GAAP)

(9.72

)%

2.26

%

(1.94

)%

1.01

%

Adjusted operating income as a percent of

net revenue (non-GAAP)

3.54

%

4.17

%

2.93

%

2.95

%

Net (loss) income, as reported (GAAP)

$

(296,117

)

$

17,784

$

(362,686

)

$

(41,301

)

Pre-tax adjustments:

Acquisition-related charges and intangible

amortization (1)

25,148

26,427

86,543

101,037

Exit and realignment charges, net (2)

24,632

24,310

110,162

99,127

Goodwill impairment charge (3)

307,112

—

307,112

—

Litigation and related charges (4)

458

—

17,119

—

Other (5)

1,221

1,425

2,823

(1,260

)

Income tax benefit on pre-tax adjustments

(6)

(19,168

)

(16,383

)

(58,834

)

(52,095

)

One-time income tax charge (7)

—

—

17,233

—

Net income, adjusted (non-GAAP) (Adjusted

Net Income)

$

43,286

$

53,563

$

119,472

$

105,508

Net (loss) income per common share, as

reported (GAAP)

$

(3.84

)

$

0.23

$

(4.73

)

$

(0.54

)

After-tax adjustments:

Acquisition-related charges and intangible

amortization (1)

0.22

0.23

0.83

0.96

Exit and realignment charges, net (2)

0.21

0.22

1.04

0.95

Goodwill impairment charge (3)

3.95

—

3.97

—

Litigation and related charges (4)

—

—

0.17

—

Other (5)

0.01

0.01

0.03

(0.01

)

One-time income tax charge (7)

—

—

0.22

—

Net income per common share, adjusted

(non-GAAP) (Adjusted EPS)

$

0.55

$

0.69

$

1.53

$

1.36

Owens & Minor, Inc.

GAAP/Non-GAAP Reconciliations

(unaudited), continued

(dollars in thousands)

The following tables provide

reconciliations of net (loss) income and total debt to non-GAAP

measures used by management.

Three Months Ended December

31,

Years Ended December

31,

2024

2023

2024

2023

Net (loss) income, as reported (GAAP)

$

(296,117

)

$

17,784

$

(362,686

)

$

(41,301

)

Income tax (benefit) provision

(3,535

)

3,213

5,329

(13,425

)

Interest expense, net

35,696

36,863

143,804

157,915

Acquisition-related charges and intangible

amortization (1)

25,148

26,427

86,543

101,037

Exit and realignment charges, net (2)

24,632

24,310

110,162

99,127

Other depreciation and amortization

(8)

46,367

48,704

186,867

200,339

Litigation and related charges (4)

458

—

17,119

—

Stock compensation (9)

7,304

5,181

25,131

20,942

LIFO (credits) and charges (10)

(10,074

)

5,655

912

2,402

Goodwill impairment charge (3)

307,112

—

307,112

—

Other (5)

1,221

1,425

2,823

(1,260

)

Adjusted EBITDA (non-GAAP)

$

138,212

$

169,562

$

523,116

$

525,776

December 31,

December 31,

2024

2023

Total debt, as reported (GAAP)

$

1,853,596

$

2,097,502

Cash and cash equivalents

(49,382

)

(243,037

)

Net debt (non-GAAP)

$

1,804,214

$

1,854,465

_________________ The following items have been excluded in our

non-GAAP financial measures:

(1) Acquisition-related charges and intangible amortization for

the three months and year ended December 31, 2024 includes $11

million and $22 million of acquisition-related costs related to the

expected acquisition of Rotech, which consisted primarily of legal

and professional fees. For the three months and year ended December

31, 2023, we incurred $6 million and $18 million of

acquisition-related costs, consisting of costs primarily related to

the acquisition of Apria, Inc., as well as amortization of

intangible assets established during acquisition method of

accounting for business combinations. Acquisition-related charges

consist primarily of one-time costs related to acquisitions,

including transaction costs necessary to consummate acquisitions,

which consist of investment banking advisory fees and legal fees,

director and officer tail insurance expense, as well as transition

costs, such as severance and retention bonuses, information

technology (IT) integration costs and professional fees. These

amounts are highly dependent on the size and frequency of

acquisitions and are being excluded to allow for a more consistent

comparison with forecasted, current and historical results.

(2) During the three months and year ended December 31, 2024

exit and realignment charges, net were $25 million and $110

million. These charges primarily related to our (1) Operating Model

Realignment Program of $19 million and $95 million, including

professional fees, severance, and other costs to streamline

functions and processes, (2) costs related to IT strategic

initiatives such as converting certain divisions to common IT

systems of $1.2 million and $15 million and (3) other costs

associated with strategic initiatives of $4.8 million and $7.5

million for the three months and year ended December 31, 2024. Exit

and realignment charges, net also included a $7.4 million gain on

the sale of our corporate headquarters for the year ended December

31, 2024. During the three months and year ended December 31, 2023,

exit and realignment charges, net were $24 million and $99 million.

These charges primarily related to our (1) Operating Model

Realignment Program of $19 million and $83 million, including

professional fees, severance and other costs to streamline

functions and processes, (2) IT strategic initiatives such as

converting to common IT systems of $2.5 million and $9.2 million

and, (3) other costs associated with strategic initiatives of $2.7

million and $7.0 million for the three months and year ended

December 31, 2023. These costs are not normal recurring, cash

operating expenses necessary for the Company to operate its

business on an ongoing basis.

(3) Goodwill impairment charge relates to a non-cash goodwill

impairment charge recognized in the Apria reporting unit during the

quarter ended December 31, 2024 resulting from a combination of

factors, including fourth quarter 2024 market changes inclusive of

a decline in Owens & Minor’s stock price and rising interest

rates. Additionally, anticipated changes in pricing of a capitated

contract within the Apria division also contributed to this charge.

This is a non-cash charge and does not occur in the ordinary course

of our business and is inherently unpredictable in timing and

amount.

(4) Litigation and related charges includes settlement costs and

related charges of legal matters within our Apria division. These

costs do not occur in the ordinary course of our business, are

non-recurring/infrequent and are inherently unpredictable in timing

and amount.

(5) For the three months and year ended December 31, 2024 and

2023, other includes interest costs and net actuarial losses

related to our frozen noncontributory, unfunded retirement plan for

certain retirees in the United States (U.S.). Additionally, other

for the three months and year ended December 31, 2024 includes

losses on extinguishment of debt of $0.8 million and $1.1 million.

For the three months and year ended December 31, 2023 other

includes loss on extinguishment of debt of $0.9 million and a

(gain) on extinguishment of debt of $(3.5) million associated with

the early retirement of indebtedness of $46 million and $314

million.

(6) These charges have been tax effected by determining the

income tax rate depending on the amount of charges incurred in

different tax jurisdictions and the deductibility of those charges

for income tax purposes.

(7) One-time income tax charge, recorded during the three months

ended June 30, 2024, excluding the impact of incremental interest,

relates to a recent decision associated with the Notice of Proposed

Adjustments received in 2020 and 2021. The matter at hand, as

discussed in previously filed SEC documents, is related to past

transfer pricing methodology which is no longer employed. We

believe the matter will be concluded without further impact to our

financial results.

(8) Other depreciation and amortization relates to property and

equipment and capitalized computer software, excluding such amounts

captured within exit and realignment charges, net or

acquisition-related charges and intangible amortization.

(9) Stock compensation includes share-based compensation expense

related to our share-based compensation plans, excluding such

amounts captured within exit and realignment charges, net or

acquisition-related charges and intangible amortization.

(10) LIFO (credits) and charges includes non-cash adjustments to

merchandise inventories valued at the lower of cost or market, with

the approximate cost determined by the last-in, first-out (LIFO)

method for distribution inventories in the U.S. within our Products

& Healthcare Services segment.

Use of Non-GAAP

Measures

This earnings release contains financial measures that are not

calculated in accordance with U.S. generally accepted accounting

principles (GAAP). In general, the measures exclude items and

charges that (i) management does not believe reflect Owens &

Minor, Inc.’s (the Company) core business and relate more to

strategic, multi-year corporate activities; or (ii) relate to

activities or actions that may have occurred over multiple or in

prior periods without predictable trends. Management uses these

non-GAAP financial measures internally to evaluate the Company’s

performance, evaluate the balance sheet, engage in financial and

operational planning and determine incentive compensation.

Management provides these non-GAAP financial measures to

investors as supplemental metrics to assist readers in assessing

the effects of items and events on its financial and operating

results and in comparing the Company’s performance to that of its

competitors. However, the non-GAAP financial measures used by the

Company may be calculated differently from, and therefore may not

be comparable to, similarly titled measures used by other

companies.

The non-GAAP financial measures disclosed by the Company should

not be considered substitutes for, or superior to, financial

measures calculated in accordance with GAAP, and the financial

results calculated in accordance with GAAP and reconciliations to

those financial statements set forth above should be carefully

evaluated.

OMI-CORP

OMI-IR

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250228859189/en/

Investors Alpha IR Group

Jackie Marcus or Nick Teves OMI@alpha-ir.com

Jonathan Leon Executive Vice President & Chief Financial

Officer Investor.Relations@owens-minor.com

Media Stacy Law

media@owens-minor.com

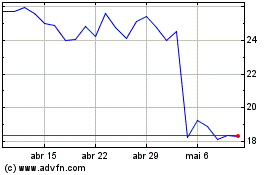

Owens and Minor (NYSE:OMI)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

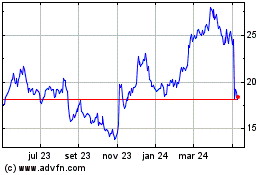

Owens and Minor (NYSE:OMI)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025