Hong Kong Exchange to Engage With LSEG Shareholders on Merits of Bid -- Update

13 Setembro 2019 - 12:42PM

Dow Jones News

--Hong Kong Exchanges said LSEG combination a highly compelling

opportunity

--HK Exchange believes shareholders should have opportunity to

weigh bid versus Refinitiv deal

--LSEG shares up 2.1%

By Adriano Marchese

Hong Kong Exchanges & Clearing Ltd. (0388.HK) said Friday

that it intends to talk to the London Stock Exchange Group PLC

(LSE.LN) shareholders and show to them why its offer would be

better than the U.K. bourse's acquisition of Refinitiv.

Earlier Friday, the LSEG board had rejected the proposed 29.6

billion-pound ($36.5 billion) cash and share offer from the HK

Exchange and said that it didn't see any merits in further

talks.

In response, the HK Exchange said that it continues to believe

that the proposed combination with LSEG represents a highly

compelling strategic opportunity, and it is disappointed that the

LSEG board has declined to properly engage with it.

In particular, HK Exchange said it had hoped to demonstrate why

it believes that the benefits of its proposal significantly

outweigh those of the proposed acquisition of Refinitiv.

Earlier, LSEG said the board unanimously rejected the bid by the

HK Exchange, and that it had fundamental concerns about the key

aspects of the conditional proposal which included strategy,

deliverability, form of consideration and value.

The price bid price was a 23% premium to the LSEG's closing

share price of 6,804 pence on Tuesday and puts an enterprise value

on the exchange of GBP31.6 billion, including debt.

LSEG said it remains committed to and continues to make good

progress on its proposed acquisition of Refinitiv Holdings Ltd.,

which it agreed to buy on Aug. 1 in a $27 billion all-share deal

including debt.

It is buying the business from a consortium of companies that

includes Reuters and funds affiliated with U.S. asset manager

Blackstone Group Inc. (BX). Under the terms of the proposed

transaction the current owners of Refinitiv will retain a 37% stake

in the combined business after completion.

At 1443 GMT, shares are up 154.0 pence, or 2.1% at 7402.0

pence.

Write to Adriano Marchese at adriano.marchese@dowjones.com

(END) Dow Jones Newswires

September 13, 2019 11:27 ET (15:27 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

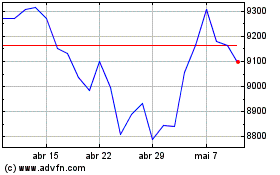

London Stock Exchange (LSE:LSEG)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

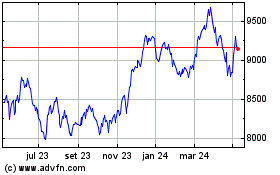

London Stock Exchange (LSE:LSEG)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024