SocGen Posts Unexpected Loss on Soaring Provisions, Impairments

03 Agosto 2020 - 2:48AM

Dow Jones News

By Pietro Lombardi

Societe Generale SA vowed to cut costs in its global markets

business after the lender swung to an unexpected loss in the second

quarter as it set aside more money for potential loan losses and

posted impairments related to the unit housing investment bank

operations.

Net loss for the period was 1.26 billion euros ($1.48 billion)

compared with a profit of EUR1.05 billion a year earlier, the

French bank said Monday.

France's third-largest listed bank by assets stowed away EUR1.28

billion for soured loans, a sharp increase from the EUR314 million

reported for the same period last year. In addition, it posted

impairments related to its global banking and investor-solutions

business, which includes investment banking and asset management:

EUR684 million of goodwill impairment and EUR650 million due to

impairment of deferred tax assets.

Net banking income, the bank's top-line revenue figure, fell

almost 16% to EUR5.30 billion.

Analysts had forecast a quarterly profit of EUR139 million on

revenue of EUR5.45 billion, according to a consensus forecast

provided by FactSet.

Write to Pietro Lombardi at pietro.lombardi@dowjones.com;

@pietrolombard10

(END) Dow Jones Newswires

August 03, 2020 01:33 ET (05:33 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

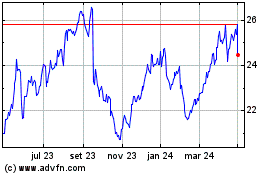

Societe Generale (EU:GLE)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

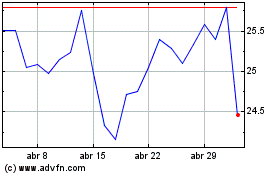

Societe Generale (EU:GLE)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024