By David Ricketts

Of Financial News

Legal & General Investment Management has said it will

target companies deemed not to be paying their fair share of tax,

homing in on those using "aggressive" practices in the wake of the

Covid-19 pandemic.

Governments around the world have pumped hundreds of billions of

pounds into Covid-19 relief schemes since the onset of the crisis

in March 2020, with taxes likely to be one of the first areas

targeted as they seek to rebuild public finances.

Covid-19 support efforts have already cost the U.K. around 407

billion pounds ($559.30 billion).

"Tax transparency is definitely going to be much higher up the

agenda," Sacha Sadan, director of investment stewardship at LGIM,

told Financial News.

"It's for the obvious reasons, like people saying 'I've paid my

share.' But when you look at governments around the world, their

balance sheets are looking quite stretched. Governments will start

to come after companies that aren't paying, which is a business

risk."

U.K. Chancellor Rishi Sunak announced in the March Budget that

he wouldn't raise income tax, national insurance or VAT in the

immediate aftermath of Covid-19.

However, the taxes businesses pay on profits will rise from the

current rate of 19% to 25% in 2023. This will apply only to

companies with more than GBP250,000 in annual profits.

Among the questions that LGIM will ask boards is how many tax

disputes they have around the world, how comfortable they are with

their current tax policies, and if they think their rate of tax is

sustainable.

"We are not saying what the tax rate should be. It may well be

your tax rate is very low, but you need a good explanation in 2021

why you are comfortable with being perceived not to be paying your

fair share," said Mr. Sadan.

The U.K.'s largest asset manager, which oversees GBP1.3

trillion, also plans to take a tough stance on gender and ethnic

diversity on boards this year, echoing similar pledges by large

shareholders over the past 12 months.

According to LGIM's 10th annual active ownership report, which

details how the asset manager voted at annual general meetings last

year, it opposed the election of 55 directors in the U.K. over low

levels of diversity in 2020.

On gender, it voted against 10 Japanese companies including

Olympus, Central Japan Railway and Kubota for failing to have a

woman on their board.

It also engaged with 44 S&P 500 firms and 35 FTSE 100

companies whose board membership showed a lack of ethnic diversity.

From 2022, LGIM will vote against the chair of the board or of the

nomination committee if there is still no ethnic diversity at board

level.

Following the killing of George Floyd in the U.S. last year,

LGIM wrote to more than 30 FTSE 100 companies urging them to

improve ethnic diversity in their boardrooms. It said it expected

boards to have at least one director of Black, Asian or other

minority ethnic origin in place by January 2022.

A study from the Parker Review, the official body set up to

boost ethnic diversity on boards, revealed that there were 37 FTSE

100 companies with no BAME directors.

"Most companies will get there, but not all will," said Mr.

Sadan.

"I completely understand that by next February there might be

some companies that will not have got there, but that will not stop

us. We have to vote, otherwise we won't keep the momentum," said

Mr. Sadan.

Mr. Sadan said executive pay will also feature highly on LGIM's

agenda at this year's annual shareholder meetings.

The asset manager voted against the adoption of 38% of new

remuneration policies at U.K. companies last year for failing to

meet pay principles, according to its active ownership report.

Some shareholders have already taken action over executive

remuneration this year.

Imperial Brands PLC, the cigarette maker, suffered a shareholder

revolt last month after investors voiced concerns over the

remuneration package of chief executive Stefan Bomhard.

Around 40% of shareholders voted against the company's

remuneration report after Mr. Bomhard's GBP1.3 million salary was

found to be more than 12% more than his long-standing predecessor,

Alison Cooper.

Investors have warned that executive remuneration will be one of

the most closely watched areas this year.

"If you've taken taxpayer money, you've sacked people and you've

cut your dividend, you'll want a good reason to be paying bonuses

to executives this year," said Mr. Sadan.

Website: www.fnlondon.com

(END) Dow Jones Newswires

March 31, 2021 07:27 ET (11:27 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

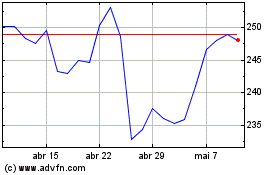

Legal & General (LSE:LGEN)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

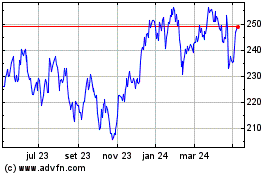

Legal & General (LSE:LGEN)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024