Beike Jumps After First-Quarter Revenue Beat, $1 Billion Buyback Program

01 Junho 2022 - 12:13AM

Dow Jones News

By Clarence Leong

Shares of KE Holdings Inc., commonly known as Beike, jumped

Wednesday morning in Hong Kong after the company posted a quarterly

revenue beat and announced a $1 billion buyback program.

The Chinese provider of housing transactions and services'

shares rose as much as 15% early in the Hong Kong session, and were

last 13% higher at HK$35.05. Beike's American depositary shares

gained 17% overnight to US$13.40, paring year-to-date losses to

33%.

The stock gains come after the company posted first-quarter

results on Tuesday. It swung to a 618.0 million yuan (US$92.6

million) loss from CNY1.06 billion profit, while revenue fell 39%

to CNY12.55 billion, but still beat a FactSet-derived consensus

estimate of CNY12.20 billion.

Beike also proposed buying back up to $1 billion ADSs over a

12-month period.

"The repurchases are expected to be carried out as soon as

legally permissible" after shareholders' approval is obtained, it

said Tuesday.

The stock's strong performance comes despite the company warning

of a tough quarter ahead. It forecast that revenue will drop

57%-59% from a year earlier in the second quarter due to Covid-19

measures in China hurting operations and the potential impact of

recent policies for the real-estate sector.

Write to Clarence Leong at clarence.leong@wsj.com

(END) Dow Jones Newswires

May 31, 2022 22:58 ET (02:58 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

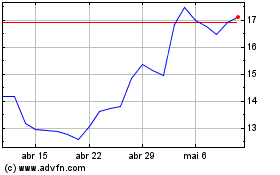

KE (NYSE:BEKE)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

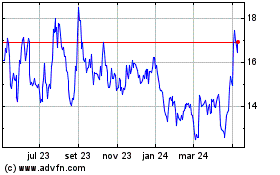

KE (NYSE:BEKE)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024