Pernod Ricard's Pricing Power Drove 1st Half Growth; Plans Further Hikes Ahead -- Update

16 Fevereiro 2023 - 4:56AM

Dow Jones News

By Joshua Kirby

Pernod Ricard SA isn't seeing any hit to its sales from rising

inflation and lower consumer spending power, and plans to use

further price increases to fuel its top line in the second half of

the fiscal year.

Setting out results for the six months to Dec. 31, the French

drinks group said Thursday that a strong pricing dynamic and a

premium portfolio had helped it maintain sales growth at 12%, and

to shore up its profit margins.

Recurring operating profit rose at the same pace as sales,

climbing 12% to 2.42 billion euros ($2.59 billion) for the

half-year.

The maker of Martell cognac and Absolut vodka in fact posted a

slight pick-up in the pace of sales growth in the latter three

months, despite weakness in China, where strict sanitary measures

remained in place for much of the period. Second-quarter sales

totalled EUR3.81 billion, ahead of analysts' expectations according

to a FactSet-compiled poll.

Growth was helped in the Americas by favorable U.S. shipment

phasings and by a general recovery of the travel-retail business,

Pernod Ricard said. But pricing was also key, outweighing volume

growth for several of its strategic brands including Martell,

coconut liqueur Malibu and Scotch-whisky brand Ballantine's.

"Particularly strong pricing dynamic illustrates the

attractiveness of our portfolio of premium brands and enabled us to

sustain margins in an inflationary context," Chief Executive

Alexandre Ricard said. The company said it plans further price

increases in the second half of the year.

The group didn't set out numerical guidance but said it expects

further top-line growth in the rest of the fiscal year, though it

noted that this would be in the context of a "normalizing

environment." It also expects to sustain its operating margin,

despite a planned step-up in investment in capital expenditure and

in its strategic inventories. The company will focus on operational

efficiency in order to offset cost inflation, it said.

The company will launch a share buyback of EUR300 million

imminently. The buyback is part of a EUR750 million program for

fiscal 2023 set out last year.

Write to Joshua Kirby at joshua.kirby@wsj.com;

@joshualeokirby

(END) Dow Jones Newswires

February 16, 2023 02:41 ET (07:41 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

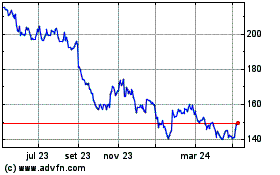

Pernod Ricard (EU:RI)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

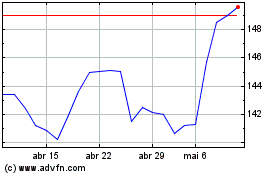

Pernod Ricard (EU:RI)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024