Former Wells Fargo Executive Carrie Tolstedt Agrees to Pay $3 Million SEC Fine

30 Maio 2023 - 7:11PM

Dow Jones News

By Mary de Wet

The former head of Wells Fargo & Co.'s community bank,

Carrie Tolstedt, has agreed to pay a $3 million penalty stemming

from charges brought in 2020 for her role in allegedly misleading

investors, the Securities and Exchange Commission said Tuesday.

Tolstedt in March pleaded guilty to obstructing regulators who

tried to examine allegations of sales misconduct at the business

she ran.

The SEC previously settled related charges against Wells Fargo

and its former CEO and chairman, John Stumpf.

Tolstedt, who retired from the bank in 2016, was a key figure in

the fake-accounts scandal, in which regulators alleged that

executives set high sales goals that encouraged low-level employees

to open fake and unauthorized bank accounts.

Without admitting or denying the SEC's allegations, Tolstedt

agreed to a final judgment permanently enjoining her from violating

the antifraud and other provisions of the federal securities laws

and imposing a permanent officer-and-director bar, the commission

said.

In addition to the $3 million civil penalty, Tolstedt agreed to

pay disgorgement of $1.5 million plus prejudgment interest of

$447,874, the SEC said.

The SEC said it would combine this money with $500 million paid

by Wells Fargo and the $2.5 million penalty paid by Stumpf in

previous settlements and distribute the sum to harmed investors.

The settlement is subject to court approval.

Under a separate settlement with the Office of the Comptroller

of the Currency, Tolstedt has been barred from the banking industry

and must pay a $17 million fine.

Write to Mary de Wet at mary.dewet@dowjones.com

(END) Dow Jones Newswires

May 30, 2023 17:56 ET (21:56 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

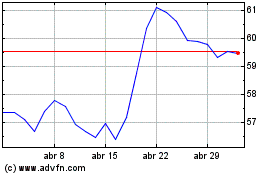

Wells Fargo (NYSE:WFC)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

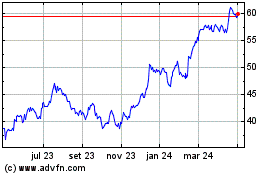

Wells Fargo (NYSE:WFC)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024