Hipgnosis Songs Fund to Sell Catalogues to Fund Buybacks, Cut Debt

14 Setembro 2023 - 4:37AM

Dow Jones News

By Ian Walker

Hipgnosis Songs Fund is planning to sell 29 catalogues and a

portfolio of non-core songs for $465 million to Hipgnosis Songs

Capital to fund a share buyback program and reduce debt, as part of

a plan to boost its share price.

The London-listed music investor said Thursday that it is

planning to buyback up to $180 million worth of shares and repay

$250 million that has been drawn under the company's revolving

credit facility.

The proposals are conditional upon shareholder approval at a

general meeting to be held on Oct. 25.

Hipgnosis Songs Capital is a partnership between Hipgnosis Song

Management and funds managed and/or advised by Blackstone.

"As a board, we have been clear for some time that the company's

share price does not fully reflect the value of Hipgnosis Songs

Fund's portfolio," Chairman Andrew Sutch said.

"Having consulted with many of our largest shareholders,

considered a wide range of options and taken independent advice we

are confident the proposals set out today provide a compelling

opportunity to deliver immediate shareholder value whilst

protecting our ability to deliver superior returns over the medium

term,"

Shares at 0701 GMT were up 6.0 pence, or 6.45%, at 99.0

pence.

Write to Ian Walker at ian.walker@wsj.com

(END) Dow Jones Newswires

September 14, 2023 03:22 ET (07:22 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

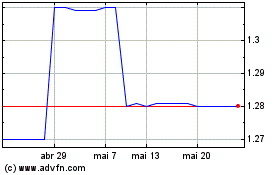

Hipgnosis Songs (LSE:SOND)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

Hipgnosis Songs (LSE:SOND)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024