Nokia to Cut Thousands of Jobs as Telecom Operators Pare Back Spending -- Update

19 Outubro 2023 - 5:49AM

Dow Jones News

By Dominic Chopping

Nokia plans to cut thousands of jobs as it seeks to save up to

1.2 billion euros ($1.26 billion) amid a sharp downturn in spending

by telecom operators.

The Finnish telecommunications company said it could cut as much

as 16% of its workforce, with demand weakening in its

network-infrastructure and mobile-networks businesses as customers

face a tough macroeconomic environment beset by high inflation and

rising interest rates. Operators are also working through

stockpiles of inventory that were ordered during previous periods

of tight-supply.

Nokia's comments mirror those made by Swedish rival Ericsson

earlier this week, with the two Nordic telecom gear giants also

having faced challenges from a shift in business mix from

higher-margin 5G work in early-mover markets such as North America

to lower-margin developing markets such as India.

However, after a period of frantic 5G roll-outs in India, work

there is starting to level off.

"We saw some moderation in the pace of 5G deployment in India

which meant the growth there was no longer enough to offset the

slowdown in North America," Nokia Chief Executive Pekka Lundmark

said.

Sales at Nokia's network infrastructure business fell 14% in the

quarter due to weaker customer spending while mobile networks sales

fell 19% due to the moderating 5G deployments in India.

The company said it continues to believe in the mid- to

long-term attractiveness of its markets, as cloud computing and

artificial intelligence revolutions won't progress without

significant investments in networks that offer vastly greater

capabilities, but given the uncertain timing of a market recovery

it is now taking steps to weather this period of market

weakness.

Nokia is targeting between EUR800 million and EUR1.2 billion in

cost savings by 2026 to keep it on track to deliver its long-term

comparable operating margin target of at least 14% by 2026.

It will cut between 9,000 and 14,000 jobs from its total

workforce of 86,000, with the exact figure dependent on how market

demand evolves.

The company backed its sales and comparable operating margin

targets but said it is now tracking toward the lower end of the

sales range and toward the midpoint of the operating margin

range.

Nokia targets full-year sales of between EUR23.2 billion and

EUR24.6 billion and an operating margin of 11.5% to 13.0%.

The company posted a 45% fall in its third-quarter comparable

net profit to EUR304 million as sales fell 20% to EUR4.98

billion.

Analysts polled by FactSet had expected comparable net profit of

EUR399 million on sales of EUR5.67 billion.

Write to Dominic Chopping at dominic.chopping@wsj.com

(END) Dow Jones Newswires

October 19, 2023 04:34 ET (08:34 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

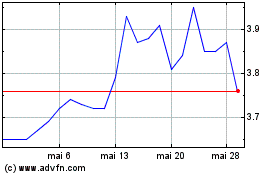

Nokia (NYSE:NOK)

Gráfico Histórico do Ativo

De Abr 2024 até Mai 2024

Nokia (NYSE:NOK)

Gráfico Histórico do Ativo

De Mai 2023 até Mai 2024