Barclays Markets Risky AT1 Bonds, Following Other European Banks

15 Novembro 2023 - 3:03PM

Dow Jones News

By Miriam Mukuru

Barclays said it is marketing Additional Tier 1 bonds, a risky

form of debt which offer high yields, making it the third major

European bank to issue such bonds in the last week.

Initial price talk for the bonds is at 10.5%, with a call

period--the time until the bonds can be redeemed--in six years'

time, the bank said Wednesday.

AT1 bonds are risky debt created after the global financial

crisis which act as safety buffers if a bank's capital levels fall

below a certain threshold. They can be converted into equity or

written down if the bank runs into trouble.

Last week, UBS and Societe Generale both issued AT1 bonds.

In UBS's case, this was the first AT1 bond since it took over

Credit Suisse. Credit Suisse's AT1 bonds were completely written

down in March as part of the rescue and acquisition by UBS, scaring

investors away from AT1 markets.

Barclays confirmed the bonds are convertible into shares upon

any "trigger event."

Barclays' AT1 bonds will be redeemable on the first call period

from Dec. 15, 2029 to June 15, 2030, Barclays said.

Interest payments on the bonds will be quarterly in arrears,

starting from March 15, 2024, it said.

Interest payments are "fully discretionary, may be cancelled in

whole or in part, and are non-cumulative," the bank said.

So far, only one bank has skipped coupon payments in the history

of AT1 bonds, CreditSights said in a note.

"In June 2017, [Bremer Landesbank] announced it would not be

paying coupons on its two euro AT1s, reflecting insufficent ADI

(Available Distributable Items)," CreditSights said.

Bloomberg reported that Barclays has seen more than $5 billion

of investor demand for these bonds so far.

Write to Miriam Mukuru at miriam.mukuru@wsj.com

(END) Dow Jones Newswires

November 15, 2023 12:48 ET (17:48 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

Barclays (LSE:BARC)

Gráfico Histórico do Ativo

De Mar 2024 até Abr 2024

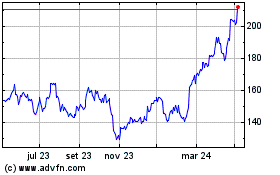

Barclays (LSE:BARC)

Gráfico Histórico do Ativo

De Abr 2023 até Abr 2024