UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

DATE OF REPORT (DATE OF EARLIEST EVENT REPORTED)

May 12, 2014

RAYONIER INC.

COMMISSION FILE NUMBER 1-6780

Incorporated in the State of North Carolina

I.R.S. Employer Identification Number 13-2607329

1301 Riverplace Boulevard, Jacksonville, Florida 32207

(Principal Executive Office)

Telephone Number: (904) 357-9100

Check the appropriate box below if the form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

|

| |

o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

RAYONIER INC.

TABLE OF CONTENTS

|

| | | | | |

| | | | PAGE |

Item 5.02. | | | | 1 |

|

Item 9.01. | | | | 2 |

|

| | | | 3 |

|

| | | | 4 |

|

|

| |

ITEM 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

On May 12, 2014, Rayonier Inc. (the “Company”) announced that David L. Nunes will become its new Chief Executive Officer and President upon completion of the previously announced separation of the Company’s performance fibers business from its forest resources and real estate businesses (the “Separation”), which is anticipated to occur mid-year 2014. At such time, Paul Boynton, the Company’s current Chairman, Chief Executive Officer and President will resign from such positions to become Chairman, Chief Executive Officer and President of Rayonier Advanced Materials Inc., the newly formed company that will contain the performance fibers business of the Company following the Separation.

Prior to the Separation, Mr. Nunes will serve as the Company’s Chief Operating Officer, effective as of June 9, 2014, and will report to Mr. Boynton. The Company also intends to appoint Mr. Nunes to the Company’s Board of Directors as of the time of the Separation.

Mr. Nunes has been President and Chief Executive Officer, and Director, with Pope Resources, A Delaware Limited Partnership (“Pope Resources”), since January 2002, and held various roles with Pope Resources since 1997, including President and Chief Operating Officer from September 2000 to January 2002, Senior Vice President Acquisitions & Portfolio Development from November 1998 to August 2000 and Vice President Portfolio Development from December 1997 to October 1998. Prior to joining Pope Resources, Mr. Nunes held numerous positions with the Weyerhaeuser Company from 1988 to 1997, most recently as Strategic Planning Director, and was involved in export log sales and marketing, timberland acquisitions, strategic planning, mergers and acquisitions, and capital planning. He has a B.A. in Economics from Pomona College and an MBA from the Tepper School of Business at Carnegie Mellon University.

In connection with his appointment as Chief Executive Officer and President following the Separation, and as Chief Operating Officer until such time, Mr. Nunes will receive the following compensation:

| |

▪ | an annual base salary of $550,000; |

| |

▪ | an incentive target cash bonus equal to 100% of his base salary, subject to the terms and conditions of the Company’s Non-Equity Incentive Plan and the Company’s Annual Corporate Bonus Program, with a minimum guaranteed 2014 bonus amount of $300,000; |

| |

▪ | a sign-on bonus of $250,000; |

| |

▪ | an equity award under the Rayonier Incentive Stock Plan in an amount of up to $500,000 allocated 100% to Performance Shares to be granted as of July 21, 2014 and having a performance period anticipated to commence as of the date of Separation and continue through December 31, 2016; |

| |

▪ | a restricted stock award under the Rayonier Incentive Stock Plan with a value of $3.0 million with a grant date as of July 21, 2014 and vesting on the fifth anniversary of Mr. Nunes start date; |

| |

▪ | participation as a Tier 1 participant in the Rayonier Executive Severance Pay Plan (“Severance Plan”), which provides for specified severance payments in the event of a change in control, as more fully described in the Severance Plan, a copy of which is filed herewith as Exhibit 10.1 and incorporated herein by reference; |

| |

▪ | enhanced severance protection in an amount equal to Mr. Nunes’ annual base salary and target bonus in the event of termination of employment without cause or for good reason (including in the event Mr. Nunes is prevented from serving as Chief Executive Officer and President as a result of the Company’s failure to complete the Separation), for a period of two years following Mr. Nunes’ hire date; |

| |

▪ | relocation benefits including a lump sum payment of $60,000 (grossed up for taxes), and other customary benefits provided to executives of the Company; |

| |

▪ | participation in the Senior Executive Tax and Financial Planning Program with a reimbursement limit of $25,000 per year; and |

| |

▪ | indemnification benefits by the Company pursuant to the Company’s standard indemnification agreement for its executive officers. |

Mr. Nunes will not receive any compensation for his services as a director of the Company.

A copy of the press release announcing Mr. Nunes’ appointments is attached hereto as Exhibit 99.1.

|

| |

ITEM 9.01. | Financial Statements and Exhibits. |

|

| | | |

10.1 |

| | Rayonier Inc. Executive Severance Pay Plan, as amended. |

99.1 |

| | Press Release, dated May 12, 2014. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of l934, the registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | |

| | RAYONIER INC. (Registrant) |

| | |

BY: | | /s/ MICHAEL R. HERMAN |

| | Michael R. Herman |

| | Senior Vice President and |

| | General Counsel

|

May 12, 2014

EXHIBIT INDEX

|

| | | | |

EXHIBIT NO. | | DESCRIPTION | | LOCATION |

10.1 | | Rayonier Inc. Executive Severance Pay Plan, as amended. | | Incorporated by reference to Exhibit 10.3 to the Company's December 31, 1997 Form 10-K. |

99.1 | | Press Release, dated May 12, 2014. | | Filed herewith. |

News Release

Contacts:

Investors Ed Kiker 904-357-9186

Media Russell Schweiss 904-357-9158

Rayonier Names David Nunes Post-Separation CEO for Rayonier

Veteran Timberland Executive Will Serve as COO of Rayonier Inc.

Until Its Upcoming Separation into Two Industry-Leading Companies

JACKSONVILLE, Fla., May 12, 2014 - Rayonier (NYSE:RYN) today announced the appointment of David L. Nunes as chief operating officer. Upon Rayonier’s previously announced mid-year separation, Nunes will assume the role of President and CEO of Rayonier and Paul Boynton, Rayonier’s current Chairman, President and CEO, will become Chairman, President and CEO of Rayonier Advanced Materials.

“Dave will provide strong leadership and direction to the new Rayonier,” said Boynton. “With 30 years of industry experience, he will continue Rayonier’s long legacy of growing shareholder value and provide strategic direction to one of the best teams of timber and real estate professionals in our industry.”

Nunes will join Rayonier Inc. on June 9 as chief operating officer and will play a key role in finalizing the separation of the company. Upon completion of the separation, he will assume responsibility for the leadership of Rayonier Inc. As previously announced, Rayonier’s Performance Fibers division will become Rayonier Advanced Materials; an independent company initially focused on the production of high-purity cellulose specialty products.

Nunes brings three decades of timber and real estate industry leadership to his new role, including more than 15 years as a senior executive. He joins Rayonier Inc. from Pope Resources (NASDAQ: POPE), where he has served as president and CEO since 2002.

Nunes joined Pope Resources in 1997 as director of portfolio management, working with prospective investors on developing timberland investment portfolios. He became vice president of portfolio development, and then served two years as senior vice president of acquisitions and portfolio development before being named president and COO in 2000.

Appointed president and CEO in 2002, Nunes launched the company’s private equity timber fund business, which now manages timberlands in three funds. Pope Resources also manages development acreage in the Seattle metropolitan area. In his tenure as CEO, Nunes has consistently delivered value to Pope’s unitholders.

Previously, Nunes spent nine years with Weyerhaeuser Company, joining the organization in 1988 as a business analyst and advancing through a number of leadership roles to become director of corporate strategic planning.

Following the separation, Richard Kincaid, director, will become chairman of Rayonier Inc.

“In preparation for the separation, we’ve strategically aligned our businesses to maximize their growth potential,” Kincaid said. “We’ve added high quality timberlands in the Gulf States, divested our non-core timberlands and increased our ownership in New Zealand. Additionally, our Real Estate business has obtained key land use

1301 Riverplace Blvd., Jacksonville, FL 32207 904-357-9100

entitlements to position our HBU portfolio for enhanced sales values. Dave’s experience in strategic planning and growing and diversifying timberland portfolios will play a key role in our timber and real estate strategies moving forward. The Board is excited to work with Dave to maximize shareholder value following the separation.”

“This is an exciting time to join Rayonier and I’m honored to accept this opportunity,” Nunes said. “Rayonier is an industry leader with top talent and an outstanding timberland portfolio serving U.S. and Pacific Rim markets. Coupled with the best HBU portfolio in the industry, Rayonier is well positioned to capitalize on the rebounding economy and housing markets. Rayonier’s unique combination of assets and talent will ensure that we continue the company’s long history of delivering value to our shareholders.”

Nunes holds a Bachelor of Arts in Economics from Pomona College and an MBA from the Tepper School of Business at Carnegie Mellon University.

_____________________________________________________________________________________

About Rayonier:

Rayonier is a leading international forest products company with three core businesses: Forest Resources, Real Estate and Performance Fibers. The company owns, leases or manages 2.6 million acres of timber and land in the United States and New Zealand. The company's holdings include approximately 200,000 acres with residential and commercial development potential along the Interstate 95 corridor between Savannah, Ga., and Daytona Beach, Fla. Its Performance Fibers business is one of the world's leading producers of high-value specialty cellulose fibers, which are used in products such as filters, pharmaceuticals and LCD screens. Approximately 50 percent of the company's sales are outside the U.S. to customers in approximately 20 countries. Rayonier is structured as a real estate investment trust. More information is available at www.rayonier.com.

Forward-Looking Statements

Certain statements in this document regarding anticipated financial, legal or other outcomes including business and market conditions, outlook and other similar statements relating to Rayonier's future events, developments or financial or operational performance or results, are "forward-looking statements" made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 and other federal securities laws. These forward looking statements are identified by the use of words such as "may," "will," "should," "expect," "estimate," "believe," "intend,” "anticipate" and other similar language. However, the absence of these or similar words or expressions does not mean that a statement is not forward-looking. While management believes that these forward-looking statements are reasonable when made, forward-looking statements are not guarantees of future performance or events and undue reliance should not be placed on these statements.

Although Rayonier believes that the expectations reflected in any forward-looking statements are based on reasonable assumptions, it can give no assurance that these expectations will be attained and it is possible that actual results may differ materially from those indicated by these forward-looking statements due to a variety of risks and uncertainties. Such factors include, but are not limited to: uncertainties as to the timing of the spin-off and whether it will be completed, the possibility that various closing conditions for the spin-off may not be satisfied or waived, the expected tax treatment of the spin-off, the impact of the spin-off on the businesses of Rayonier and the Performance Fibers company, the ability of both companies to meet debt service requirements, the availability and terms of financing and expectations of credit rating. Other important factors are described in the company’s most recent Form 10-K and 10-Q reports on file with the Securities and Exchange Commission that could cause actual results or events to differ materially from those expressed in forward-looking statements that may have been made in this document. Rayonier assumes no obligation to update these statements except as is required by law.

# # #

1301 Riverplace Blvd., Jacksonville, FL 32207 904-357-9100

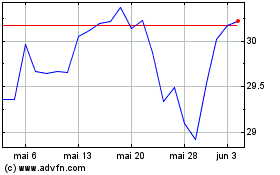

Rayonier (NYSE:RYN)

Gráfico Histórico do Ativo

De Jun 2024 até Jul 2024

Rayonier (NYSE:RYN)

Gráfico Histórico do Ativo

De Jul 2023 até Jul 2024