Current Report Filing (8-k)

07 Novembro 2016 - 7:29PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported):

November 2, 2016

Excel Corporation

(Exact Name of Registrant as Specified

in Charter)

|

Delaware

|

|

333-173702

|

|

27-3955524

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification No.)

|

|

6363

North State Highway 161 Suite 310 Irving TX

|

|

75038

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number,

including area code:

(972) 476-1000

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Item 1.01. Entry into a Material

Definitive Agreement.

On November 2,

2016, Excel Corporation (“Excel” or the “Company”) and certain of the Company’s subsidiaries

entered into a Loan and Security Agreement (the “Loan Agreement”) with GACP Finance Co. LLC as administrative

agent (“Agent”) and the other lenders as from time to time party thereto. The Loan Agreement has a three-year

term and provides for term loan commitments of up to $25,000,000 consisting of an Initial Term Loan in the amount of

$13,500,000 and a Delayed Draw Term Loan in the amount of $11,500,000 (each a “Loan” or together

“Loans”). The Company used the proceeds from the Initial Term Loan to repay all of its existing secured debt. The

Company expects to use the Delayed Draw Term Loan to fund acquisitions of portfolios of recurring residual revenues

from credit and debit card transactions or companies that own these portfolios. Funding of Delayed Draw Term Loan is subject

to certain conditions including but not limited to borrowing base limitations and further lender due diligence.

The Loans accrue

interest of 18% per annum of which 13% is payable in cash monthly and 5% is payable in kind (PIK). Pursuant to the Loan Agreement,

the Loans are secured by substantially all of the assets of the Company including but not limited to the Company’s residual

portfolios. In addition, certain of Excel’s subsidiaries are guarantors under the Loan Agreement.

The Loan

Agreement contains customary events of default, including but not limited to non-payment of principal or other amounts under

the Loan Agreement, breach of covenants and certain voluntary and involuntary bankruptcy events. The Loan Agreement also

contains certain financial covenants including maintenance of certain EBITDA levels and minimum liquidity. If

any event of default occurs and is continuing, the Agent declare all amounts owed to be due (except for a bankruptcy event of

default), in which case such amounts will automatically become due and payable.

The foregoing description

of the Loan Agreement is not complete and is qualified in its entirety by reference to the full text of the Loan Agreement, a copy

of which is filed as Exhibit 10.1 hereto and incorporated by reference herein.

Item 1.02. Termination of a Material

Definitive Agreement.

Concurrently with

the execution of the Loan Agreement, the Company repaid in full approximately $8.0 million of notes incurred by its eVance subsidiary

with the acquisition of the US assets of Calpian Inc. on November 31, 2015 (the “eVance Notes”). The eVance Notes required

interest payments monthly with interest rates increasing from 12% per annum to 17% per annum and were scheduled to mature on November

31, 2016. The eVance Notes were secured by substantially all of the assets of eVance and were guaranteed by Excel.

The Company

also prepaid in full the outstanding principal and interest of $338,333 owed to BlueAcre Ventures under a Residual Loan

Agreement dated June 30, 2014 between Blue Acre Ventures and Excel’s Payprotec Oregon LLC subsidiary (the BAV

Note”). The BAV Note was in the original principal amount of $1.2 million, provided for monthly principal and interest

payments of $48,333 through May 2017. The BAV Note was secured by certain of the Company’s residual portfolios.

The Company also

repaid in full the $500,000 note payable to SME Funding LLC executed in December 2015. This note provided for monthly interest

payments at a rate of 12% per annum and was scheduled to mature in December 2016. This note was secured by certain of the Company’s

residual portfolios.

Item 2.03. Creation of a Direct

Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information

set forth in Item 1.01 above is incorporated herein by this reference.

Item 9.01. Exhibits

|

Exhibit No.

|

|

|

|

10.1*

|

|

Loan and Security Agreement Dated November 2, 2016 Among GACP Finance Co. LLC., as Agent, the Lenders as time to time party hereto, as lenders, Excel Corporation, as Borrower, and certain subsidiaries of Borrower, as Guarantors

|

* The Company has

omitted schedules and other similar attachments to such agreement pursuant to Item 601(b) of Regulation S-K. The Company will

furnish a copy of such omitted documents to the SEC upon request.

SIGNATURES

Pursuant to the

requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the

undersigned thereunto duly authorized.

|

|

EXCEL CORPORATION

|

|

|

|

|

|

/s/ Robert L. Winspear

|

|

|

Robert L. Winspear

|

|

|

Chief Financial Officer

|

Date: November 7, 2016

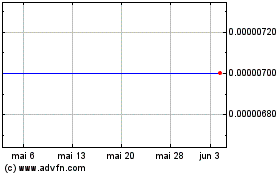

Excel (CE) (USOTC:EXCC)

Gráfico Histórico do Ativo

De Fev 2025 até Mar 2025

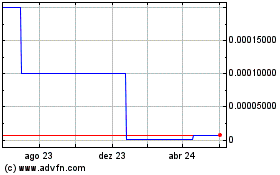

Excel (CE) (USOTC:EXCC)

Gráfico Histórico do Ativo

De Mar 2024 até Mar 2025

Notícias em tempo-real sobre Excel Corporation (CE) da OTCMarkets bolsa de valores: 0 artigos recentes

Mais Notícias de Excel Corp