Quarterly Report (10-q)

06 Maio 2022 - 1:19PM

Edgar (US Regulatory)

false12-312022Q10000216085100002160852022-01-012022-03-310000216085us-gaap:CommonStockMember2022-01-012022-03-310000216085us-gaap:CommonClassAMember2022-01-012022-03-310000216085us-gaap:CommonClassAMember2022-04-300000216085us-gaap:CommonStockMember2022-04-3000002160852022-03-3100002160852021-12-310000216085us-gaap:CommonClassAMember2022-03-310000216085hvt:CommonStockNotConvertibleMember2021-12-310000216085hvt:CommonStockNotConvertibleMember2022-03-310000216085us-gaap:CommonClassAMember2021-12-3100002160852021-01-012021-03-310000216085hvt:CommonStockNotConvertibleMember2022-01-012022-03-310000216085us-gaap:CommonClassAMember2021-01-012021-03-310000216085hvt:CommonStockNotConvertibleMember2021-01-012021-03-3100002160852020-12-3100002160852021-03-310000216085us-gaap:RetainedEarningsMember2021-12-310000216085us-gaap:TreasuryStockCommonMember2021-12-310000216085us-gaap:AdditionalPaidInCapitalMember2021-12-310000216085us-gaap:CommonStockMemberus-gaap:CommonClassAMember2021-12-310000216085us-gaap:AdditionalPaidInCapitalMember2020-12-310000216085us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310000216085us-gaap:AccumulatedOtherComprehensiveIncomeMember2020-12-310000216085us-gaap:RetainedEarningsMember2020-12-310000216085us-gaap:CommonClassAMemberus-gaap:CommonStockMember2020-12-310000216085us-gaap:TreasuryStockCommonMember2020-12-310000216085hvt:CommonStockNotConvertibleMemberus-gaap:CommonStockMember2021-12-310000216085us-gaap:CommonStockMemberhvt:CommonStockNotConvertibleMember2020-12-310000216085us-gaap:RetainedEarningsMember2021-01-012021-03-310000216085us-gaap:RetainedEarningsMember2022-01-012022-03-310000216085us-gaap:RetainedEarningsMemberhvt:CommonStockNotConvertibleMember2022-01-012022-03-310000216085us-gaap:RetainedEarningsMemberus-gaap:CommonClassAMember2021-01-012021-03-310000216085us-gaap:CommonClassAMemberus-gaap:RetainedEarningsMember2022-01-012022-03-310000216085hvt:CommonStockNotConvertibleMemberus-gaap:RetainedEarningsMember2021-01-012021-03-310000216085hvt:CommonStockNotConvertibleMemberus-gaap:CommonStockMember2021-01-012021-03-310000216085us-gaap:CommonStockMemberus-gaap:CommonClassAMember2021-01-012021-03-310000216085us-gaap:TreasuryStockCommonMember2022-01-012022-03-310000216085us-gaap:AdditionalPaidInCapitalMember2021-01-012021-03-310000216085us-gaap:AdditionalPaidInCapitalMember2022-01-012022-03-310000216085us-gaap:CommonStockMemberhvt:CommonStockNotConvertibleMember2022-01-012022-03-310000216085us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-03-310000216085us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-01-012021-03-310000216085hvt:CommonStockNotConvertibleMemberus-gaap:CommonStockMember2022-03-310000216085us-gaap:CommonStockMemberus-gaap:CommonClassAMember2021-03-310000216085hvt:CommonStockNotConvertibleMemberus-gaap:CommonStockMember2021-03-310000216085us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-03-310000216085us-gaap:RetainedEarningsMember2021-03-310000216085us-gaap:CommonClassAMemberus-gaap:CommonStockMember2022-03-310000216085us-gaap:RetainedEarningsMember2022-03-310000216085us-gaap:TreasuryStockCommonMember2022-03-310000216085us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-03-310000216085us-gaap:AdditionalPaidInCapitalMember2021-03-310000216085us-gaap:AdditionalPaidInCapitalMember2022-03-310000216085us-gaap:TreasuryStockCommonMember2021-03-310000216085us-gaap:RevolvingCreditFacilityMember2022-03-310000216085us-gaap:RevolvingCreditFacilityMember2022-01-012022-03-310000216085us-gaap:RevolvingCreditFacilityMember2021-12-310000216085hvt:MattressesMember2022-01-012022-03-310000216085hvt:AccessoriesAndOtherMember2022-01-012022-03-310000216085hvt:CaseGoodsMember2021-01-012021-03-310000216085hvt:CaseGoodsMember2022-01-012022-03-310000216085hvt:DiningRoomFurnitureMember2021-01-012021-03-310000216085hvt:MattressesMember2021-01-012021-03-310000216085hvt:OccasionalMember2021-01-012021-03-310000216085hvt:AccessoriesAndOtherMember2021-01-012021-03-310000216085hvt:UpholsteryMember2022-01-012022-03-310000216085hvt:DiningRoomFurnitureMember2022-01-012022-03-310000216085hvt:BedroomFurnitureMember2022-01-012022-03-310000216085hvt:UpholsteryMember2021-01-012021-03-310000216085hvt:OccasionalMember2022-01-012022-03-310000216085hvt:BedroomFurnitureMember2021-01-012021-03-310000216085srt:MaximumMember2022-03-310000216085srt:MinimumMember2022-03-310000216085hvt:ServiceBasedRestrictedStockAwardsMember2021-12-310000216085hvt:PerformanceBasedRestrictedStockAwardsMember2021-12-310000216085hvt:PerformanceBasedRestrictedStockAwardsMember2022-01-012022-03-310000216085hvt:ServiceBasedRestrictedStockAwardsMember2022-01-012022-03-310000216085hvt:PerformanceBasedRestrictedStockAwardsMember2022-03-310000216085hvt:ServiceBasedRestrictedStockAwardsMember2022-03-310000216085srt:MaximumMemberhvt:ServiceBasedRestrictedStockAwardsMember2022-01-012022-03-310000216085srt:MinimumMemberhvt:ServiceBasedRestrictedStockAwardsMember2022-01-012022-03-310000216085us-gaap:SellingGeneralAndAdministrativeExpensesMember2021-01-012021-03-310000216085us-gaap:SellingGeneralAndAdministrativeExpensesMember2022-01-012022-03-31xbrli:sharesiso4217:USDiso4217:USDxbrli:shareshvt:Segmentxbrli:purehvt:Leasehvt:Vote

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

| ☒ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the quarterly period ended March 31, 2022

|

OR

| ☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the transition period from ___ to ___

|

Commission file number: 1-14445

HAVERTY FURNITURE COMPANIES, INC.

(Exact name of registrant as specified in its charter)

|

Maryland

|

|

58-0281900

|

|

(State or other jurisdiction of incorporation or organization)

|

|

(I.R.S. Employer Identification No.)

|

|

780 Johnson Ferry Road, Suite 800

Atlanta,

Georgia

|

|

30342

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

|

(404) 443-2900

|

|

(Registrant’s telephone number, including area code)

|

Securities registered pursuant to Section 12(b) of the Securities Exchange Act of 1934

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock

|

HVT

|

NYSE

|

|

Class A Common Stock

|

HVTA

|

NYSE

|

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of

1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ⌧ No ◻

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405

of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ⌧ No ◻

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non‑accelerated filer, a smaller reporting

company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

Large accelerated filer

|

☒

|

|

Accelerated filer

|

☐

|

|

Non-accelerated filer

|

☐

|

|

Smaller reporting company

|

☐

|

|

Emerging growth company

|

☐

|

|

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ◻

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ⌧

The numbers of shares outstanding of the registrant’s two classes of $1 par value common stock

as of October 28, 2021, were: Common Stock – 15,419,859; Class A Common Stock – 1,283,260.

HAVERTY FURNITURE COMPANIES, INC.

INDEX

| |

|

Page No.

|

| |

|

|

|

PART I.

|

|

|

| |

|

|

| |

|

|

| |

|

|

| |

March 31, 2022

(unaudited) and December 31, 2021

|

1

|

| |

|

|

| |

Three Months Ended March 31, 2022

and 2021 (unaudited)

|

2

|

| |

|

|

| |

Three Months Ended March 31, 2022 and 2020 (unaudited)

|

3

|

| |

|

|

| |

|

4

|

| |

|

|

| |

|

11

|

| |

|

|

| |

|

14

|

| |

|

|

| |

|

14

|

| |

|

|

|

PART II.

|

|

|

| |

|

|

| |

|

15

|

| |

|

|

| |

|

15

|

| |

|

|

| |

|

15 |

| |

|

|

| |

Item 6. Exhibits

|

16 |

PART I. FINANCIAL INFORMATION

Item 1. Financial Statements

HAVERTY FURNITURE COMPANIES, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

|

(In thousands)

|

|

March 31,

2022

|

|

|

December 31,

2021

|

|

| |

|

(Unaudited)

|

|

|

|

|

|

Assets

|

|

|

|

|

|

|

|

Current assets

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$

|

162,340

|

|

|

$

|

166,146

|

|

|

Restricted cash and cash equivalents

|

|

|

6,715

|

|

|

|

6,716

|

|

|

Inventories

|

|

|

119,857

|

|

|

|

112,031

|

|

|

Prepaid expenses

|

|

|

10,633

|

|

|

|

12,418

|

|

|

Other current assets

|

|

|

13,585

|

|

|

|

11,746

|

|

|

Total current assets

|

|

|

313,130

|

|

|

|

309,057

|

|

|

Property and equipment, net

|

|

|

128,721

|

|

|

|

126,099

|

|

|

Right-of-use lease assets

|

|

|

221,083

|

|

|

|

222,356

|

|

|

Deferred income taxes

|

|

|

18,252

|

|

|

|

16,375

|

|

|

Other assets

|

|

|

12,699

|

|

|

|

12,403

|

|

|

Total assets

|

|

$

|

693,885

|

|

|

$

|

686,290

|

|

|

Liabilities and Stockholders’ Equity

|

|

|

|

|

|

|

|

|

|

Current liabilities

|

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$

|

32,415

|

|

|

$

|

31,235

|

|

|

Customer deposits

|

|

|

98,528

|

|

|

|

98,897

|

|

|

Accrued liabilities

|

|

|

48,876

|

|

|

|

46,664

|

|

|

Current lease liabilities

|

|

|

33,923

|

|

|

|

33,581

|

|

|

Total current liabilities

|

|

|

213,742

|

|

|

|

210,377

|

|

|

Noncurrent lease liabilities

|

|

|

197,265

|

|

|

|

196,771

|

|

|

Other liabilities

|

|

|

22,478

|

|

|

|

23,172

|

|

|

Total liabilities

|

|

|

433,485

|

|

|

|

430,320

|

|

| |

|

|

|

|

|

|

|

|

|

Stockholders’ equity

|

|

|

|

|

|

|

|

|

|

Capital Stock, par value $1 per share

|

|

|

|

|

|

|

|

|

|

Preferred Stock, Authorized – 1,000 shares; Issued: None

|

|

|

|

|

|

|

|

|

|

Common Stock, Authorized – 50,000 shares; Issued: 2022 – 29,924; 2021 – 29,907

|

|

|

29,924

|

|

|

|

29,907

|

|

|

Convertible Class A Common Stock, Authorized – 15,000 shares; Issued: 2022 – 1,809; 2021 – 1,809

|

|

|

1,809

|

|

|

|

1,809

|

|

|

Additional paid-in capital

|

|

|

104,345

|

|

|

|

102,572

|

|

|

Retained earnings

|

|

|

358,084

|

|

|

|

342,983

|

|

|

Accumulated other comprehensive loss

|

|

|

(2,253

|

)

|

|

|

(2,293

|

)

|

|

Less treasury stock at cost – Common Stock (2022 – 14,507 and 2021 – 14,069 shares) and

Convertible Class A Common Stock (2022 and 2021 – 522 shares)

|

|

|

(231,509

|

)

|

|

|

(219,008

|

)

|

|

Total stockholders’ equity

|

|

|

260,400

|

|

|

|

255,970

|

|

|

Total liabilities and stockholders’ equity

|

|

$

|

693,885

|

|

|

$

|

686,290

|

|

See notes to these condensed consolidated financial statements.

HAVERTY FURNITURE COMPANIES, INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

| |

|

Three Months Ended

March 31,

|

|

|

(In thousands, except per share data - unaudited)

|

|

2022

|

|

|

2021

|

|

| |

|

|

|

|

|

|

|

Net sales

|

|

$

|

238,946

|

|

|

$

|

236,491

|

|

|

Cost of goods sold

|

|

|

97,985

|

|

|

|

101,457

|

|

|

Gross profit

|

|

|

140,961

|

|

|

|

135,034

|

|

| |

|

|

|

|

|

|

|

|

|

Expenses:

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative

|

|

|

115,154

|

|

|

|

109,762

|

|

|

Other expense (income), net

|

|

|

161

|

|

|

|

(36

|

)

|

|

Total expenses

|

|

|

115,315

|

|

|

|

109,726

|

|

| |

|

|

|

|

|

|

|

|

|

Income before interest and income taxes

|

|

|

25,646

|

|

|

|

25,308

|

|

|

Interest income, net

|

|

|

74

|

|

|

|

56

|

|

| |

|

|

|

|

|

|

|

|

|

Income before income taxes

|

|

|

25,720

|

|

|

|

25,364

|

|

|

Income tax expense

|

|

|

6,359

|

|

|

|

5,958

|

|

|

Net income

|

|

$

|

19,361

|

|

|

$

|

19,406

|

|

| |

|

|

|

|

|

|

|

|

|

Other comprehensive income

|

|

|

|

|

|

|

|

|

|

Adjustments related to retirement plans; net of tax expense of $14 in 2022 and $16 in 2021

|

|

$

|

40

|

|

|

$

|

49

|

|

| |

|

|

|

|

|

|

|

|

|

Comprehensive income

|

|

$

|

19,401

|

|

|

$

|

19,455

|

|

| |

|

|

|

|

|

|

|

|

|

Basic earnings per share:

|

|

|

|

|

|

|

|

|

|

Common Stock

|

|

$

|

1.14

|

|

|

$

|

1.07

|

|

|

Class A Common Stock

|

|

$

|

1.08

|

|

|

$

|

1.00

|

|

| |

|

|

|

|

|

|

|

|

|

Diluted earnings per share:

|

|

|

|

|

|

|

|

|

|

Common Stock

|

|

$

|

1.11

|

|

|

$

|

1.04

|

|

|

Class A Common Stock

|

|

$

|

1.05

|

|

|

$

|

0.98

|

|

| |

|

|

|

|

|

|

|

|

|

Cash dividends per share:

|

|

|

|

|

|

|

|

|

|

Common Stock

|

|

$

|

0.25

|

|

|

$

|

0.22

|

|

|

Class A Common Stock

|

|

$

|

0.23

|

|

|

$

|

0.20

|

|

See notes to these condensed consolidated financial statements.

HAVERTY FURNITURE COMPANIES, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

|

(In thousands - unaudited)

|

|

Three Months Ended

March 31,

|

|

| |

|

2022

|

|

|

2021

|

|

|

Cash Flows from Operating Activities:

|

|

|

|

|

|

|

|

Net income

|

|

$

|

19,361

|

|

|

$

|

19,406

|

|

|

Adjustments to reconcile net income to net cash provided by operating activities:

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

4,272

|

|

|

|

3,992

|

|

|

Share-based compensation expense

|

|

|

2,307

|

|

|

|

2,679

|

|

|

Other

|

|

|

(1,877

|

)

|

|

|

(915

|

)

|

|

Changes in operating assets and liabilities:

|

|

|

|

|

|

|

|

|

|

Inventories

|

|

|

(7,826

|

)

|

|

|

(13,661

|

)

|

|

Customer deposits

|

|

|

(369

|

)

|

|

|

18,545

|

|

|

Other assets and liabilities

|

|

|

1,120

|

|

|

|

(2,777

|

)

|

|

Accounts payable and accrued liabilities

|

|

|

3,590

|

|

|

|

(7,668

|

)

|

|

Net cash provided by operating activities

|

|

|

20,578

|

|

|

|

19,601

|

|

| |

|

|

|

|

|

|

|

|

|

Cash Flows from Investing Activities:

|

|

|

|

|

|

|

|

|

|

Capital expenditures

|

|

|

(7,107

|

)

|

|

|

(4,745

|

)

|

|

Net cash used in investing activities

|

|

|

(7,107

|

)

|

|

|

(4,745

|

)

|

| |

|

|

|

|

|

|

|

|

|

Cash Flows from Financing Activities:

|

|

|

|

|

|

|

|

|

|

Proceeds from borrowings under revolving credit facility

|

|

|

—

|

|

|

|

—

|

|

|

Payments of borrowings under revolving credit facility

|

|

|

—

|

|

|

|

—

|

|

|

Net change in borrowings under revolving credit facility

|

|

|

—

|

|

|

|

—

|

|

| |

|

|

|

|

|

|

|

|

|

Dividends paid

|

|

|

(4,260

|

)

|

|

|

(3,987

|

)

|

|

Common stock repurchased

|

|

|

(12,501

|

)

|

|

|

—

|

|

|

Other

|

|

|

(517

|

)

|

|

|

(801

|

)

|

|

Net cash used in financing activities

|

|

|

(17,278

|

)

|

|

|

(4,788

|

)

|

| |

|

|

|

|

|

|

|

|

|

(Decrease) increase in cash, cash equivalents and restricted cash equivalents during the period

|

|

|

(3,807

|

)

|

|

|

10,068

|

|

|

Cash, cash equivalents and restricted cash equivalents at beginning of period

|

|

|

172,862

|

|

|

|

206,771

|

|

|

Cash, cash equivalents and restricted cash equivalents at end of period

|

|

$

|

169,055

|

|

|

$

|

216,839

|

|

See notes to these condensed consolidated financial statements.

HAVERTY FURNITURE COMPANIES, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

NOTE A - Business and Basis of Presentation

Haverty Furniture Companies, Inc. (“Havertys,” “the Company,” “we,” “our,” or “us”) is a retailer of a broad line of residential furniture in the middle to

upper-middle price ranges. We operate all of our stores using the Havertys brand and do not franchise our concept. We operate within a single

reportable segment. The accompanying unaudited condensed consolidated financial statements have been prepared in accordance with the instructions to Form 10-Q and, therefore, do not include all information and footnotes required by United States of

America generally accepted accounting principles (“U.S. GAAP”) for complete financial statements. The Company believes that the disclosures made are adequate to make the information not misleading. The financial statements include the accounts of the

Company and its wholly owned subsidiary. All significant intercompany accounts and transactions have been eliminated in consolidation. We believe all adjustments, normal and recurring in nature, considered necessary for a fair presentation have been

included. We suggest that these condensed consolidated financial statements should be read in conjunction with the consolidated financial statements and accompanying footnotes included in our latest Annual Report on Form 10-K.

The preparation of interim condensed consolidated financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect

the reported amounts of assets and liabilities, disclosures of contingent assets and liabilities, and reported amounts of revenue and expenses. Actual results could differ from those estimates.

The Company is subject to various claims and legal proceedings covering a wide range of matters, including with respect to product liability and personal injury

claims, that arise in the ordinary course of its business activities. We currently have no pending claims or legal proceedings that we believe would be reasonably likely to have a material adverse effect on our financial condition, results of

operations or cash flows. However, there can be no assurance that either future litigation or an unfavorable outcome in existing claims will not have a material impact on our business, reputation, financial position, cash flows or results of

operations.

Note B – COVID-19

The novel coronavirus disease (“COVID-19”) pandemic and its contributory effects on the economy continue to impact our business and results of operations. During the three months

ended March 31, 2022, we experienced, among other things, rising product prices, volatile transportation costs, and supply chain disruptions. Furthermore, discretionary consumer spending has been adversely impacted by rising inflation, including fuel

costs, and interest rates. All of these factors, impacted our business in the first quarter of 2022. The extent and duration of any future impact resulting from the COVID-19 pandemic is not fully known, and we may experience additional significant

COVID-19 related disruptions in the future as a result.

NOTE C – Stockholders’ Equity

The following outlines the changes in each caption of stockholders’ equity for the current and comparative periods and the dividends per share for each class of

shares.

For the three months ended March 31, 2022:

|

(in thousands)

|

|

Common Stock

|

|

|

Class A

Common Stock

|

|

|

Additional

Paid-In Capital

|

|

|

Retained

Earnings

|

|

|

Accumulated Other

Comprehensive Loss

|

|

|

Treasury

Stock

|

|

|

Total

|

|

|

Balances at December 31, 2021

|

|

$

|

29,907

|

|

|

$

|

1,809

|

|

|

$

|

102,572

|

|

|

$

|

342,983

|

|

|

$

|

(2,293

|

)

|

|

$

|

(219,008

|

)

|

|

$

|

255,970

|

|

|

Net income

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

19,361

|

|

|

|

|

|

|

|

|

|

|

|

19,361

|

|

|

Dividends declared:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock, $0.25 per

share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(3,964

|

)

|

|

|

|

|

|

|

|

|

|

|

(3,964

|

)

|

|

Class A Common Stock, $0.23

per share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(296

|

)

|

|

|

|

|

|

|

|

|

|

|

(296

|

)

|

|

Acquisition of treasury stock

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(12,501 |

) |

|

|

(12,501 |

) |

|

Restricted stock issuances

|

|

|

17 |

|

|

|

|

|

|

|

(534 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(517 |

) |

|

Amortization of restricted stock

|

|

|

|

|

|

|

|

|

|

|

2,307

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,307

|

|

|

Other comprehensive income

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

40

|

|

|

|

|

|

|

|

40

|

|

|

Balances at March 31, 2022

|

|

$

|

29,924

|

|

|

$

|

1,809

|

|

|

$

|

104,345

|

|

|

$

|

358,084

|

|

|

$

|

(2,253

|

)

|

|

$

|

(231,509

|

)

|

|

$

|

260,400

|

|

For the three months ended March 31, 2021:

|

(in thousands)

|

|

Common Stock

|

|

|

Class A

Common Stock

|

|

|

Additional

Paid-In Capital

|

|

|

Retained

Earnings

|

|

|

Accumulated Other

Comprehensive Loss

|

|

|

Treasury

Stock

|

|

|

Total

|

|

|

Balances at December 31, 2020

|

|

$

|

29,600

|

|

|

$

|

1,996

|

|

|

$

|

96,850

|

|

|

$

|

304,626

|

|

|

$

|

(2,560

|

)

|

|

$

|

(177,545

|

)

|

|

$

|

252,967

|

|

|

Net income

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

19,406

|

|

|

|

|

|

|

|

|

|

|

|

19,406

|

|

|

Dividends declared:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Stock, $0.22 per

share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(3,717

|

)

|

|

|

|

|

|

|

|

|

|

|

(3,717

|

)

|

|

Class A Common Stock, $0.20

per share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(270

|

)

|

|

|

|

|

|

|

|

|

|

|

(270

|

)

|

|

Class A conversion

|

|

|

154 |

|

|

|

(154 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

|

Restricted stock issuances

|

|

|

35 |

|

|

|

|

|

|

|

(835 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(800 |

) |

|

Amortization of restricted stock

|

|

|

|

|

|

|

|

|

|

|

2,679

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,679

|

|

|

Other comprehensive income

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

49

|

|

|

|

|

|

|

|

49

|

|

|

Balances at March 31, 2021

|

|

$

|

29,789

|

|

|

$

|

1,842

|

|

|

$

|

98,694

|

|

|

$

|

320,045

|

|

|

$

|

(2,511

|

)

|

|

$

|

(177,545

|

)

|

|

$

|

270,314

|

|

NOTE D – Interim LIFO Calculations

We calculate the LIFO index annually. Accordingly, interim LIFO calculations must necessarily be based on management’s estimates of inventory levels and

inflation rates. Since these estimates may be affected by factors beyond management’s control, interim results are subject to change based upon the final year-end LIFO inventory valuations.

NOTE E – Fair Value of Financial Instruments

The fair values of our cash and cash equivalents, restricted cash and cash equivalents, accounts

receivable, accounts payable and customer deposits approximate their carrying values due to their short-term nature. The assets related to our self-directed, non-qualified deferred compensation plans for certain executives and employees are valued

using quoted market prices multiplied by the number of shares held, a Level 1 valuation technique.

NOTE F – Credit Agreement

We have a $60.0 million revolving credit facility

(the “Credit Agreement”) which matures on September 27, 2024 and is secured primarily by our inventory. Availability fluctuates based on a

borrowing base calculation reduced by outstanding letters of credit.

At March 31, 2022 and December 31, 2021, there were no

outstanding borrowings under the Credit Agreement. The borrowing base and net availability was $34.7 million at March 31, 2022.

Note G – Revenues

We recognize revenue from merchandise sales and related service fees, net of expected returns and sales tax, at

the time the merchandise is delivered to the customer. We record customer deposits when payments are received in advance of the delivery of merchandise, which totaled $98.5 million and $98.9 million at March 31, 2022 and December 31, 2021,

respectively. Of the customer deposit liabilities at December 31, 2021, approximately $17.0 million has not been recognized through net

sales in the three months ended March 31, 2022.

The following table presents our revenues disaggregated by each major product category and service (dollars in thousands, amounts and percentages may not always add

due to rounding):

| |

|

Three Months Ended March 31,

|

|

| |

|

2022

|

|

|

2021

|

|

|

(In thousands)

|

|

Net Sales

|

|

|

% of

Net Sales

|

|

|

Net Sales

|

|

|

% of

Net Sales

|

|

|

Merchandise:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Case Goods

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Bedroom Furniture

|

|

$

|

31,348

|

|

|

|

13.1

|

%

|

|

$

|

39,178

|

|

|

|

16.6

|

%

|

|

Dining Room Furniture

|

|

|

26,022

|

|

|

|

10.9

|

|

|

|

27,599

|

|

|

|

11.7

|

|

|

Occasional

|

|

|

16,818

|

|

|

|

7.0

|

|

|

|

22,064

|

|

|

|

9.3

|

|

| |

|

|

74,188

|

|

|

|

31.0

|

|

|

|

88,841

|

|

|

|

37.6

|

|

|

Upholstery

|

|

|

111,186

|

|

|

|

46.5

|

|

|

|

95,626

|

|

|

|

40.4

|

|

|

Mattresses

|

|

|

19,733

|

|

|

|

8.3

|

|

|

|

20,481

|

|

|

|

8.7

|

|

|

Accessories and Other (1)

|

|

|

33,839

|

|

|

|

14.2

|

|

|

|

31,543

|

|

|

|

13.3

|

|

| |

|

$

|

238,946

|

|

|

|

100.0

|

%

|

|

$

|

236,491

|

|

|

|

100.0

|

%

|

| (1) |

Includes

delivery charges and product protection.

|

NOTE H – Leases

We have operating leases for retail stores, offices, warehouses, and certain equipment. Our leases have remaining lease terms of 1 year to 14 years, some of which

include options to extend the leases for up to 20 years. We determine if an arrangement is or contains a lease at lease inception. Our

leases do not have any residual value guarantees or any restrictions or covenants imposed by lessors. We have lease agreements for real estate with lease and non-lease components, which are accounted for separately.

Certain of our lease agreements for retail stores include variable lease payments, generally based on sales volume. The variable portion of payments are not

included in the initial measurement of the right-of-use asset or lease liability due to uncertainty of the payment amount and are recorded as lease expense in the period incurred. Certain of our equipment lease agreements include variable lease

costs, generally based on usage of the underlying asset (mileage, fuel, etc.). The variable portion of payments are not included in the initial measurement of the right-of-use asset or lease liability due to uncertainty of the payment amount and

are recorded in the period incurred.

As of March 31, 2022, we had entered into one lease

for an additional retail location which had not yet commenced.

Lease expense is charged to selling, general and administrative expenses. Components of lease expense were as follows (in thousands):

| |

|

Three Months Ended March 31,

|

|

| |

|

2022

|

|

|

2021

|

|

|

Operating lease cost

|

|

$

|

11,739

|

|

|

$

|

11,806

|

|

|

Variable lease cost

|

|

|

1,695

|

|

|

|

1,508

|

|

|

Total lease expense

|

|

$

|

13,434

|

|

|

$

|

13,314

|

|

Supplemental cash flow information related to leases is as follows (in thousands):

| |

|

Three Months Ended March 31,

|

|

| |

|

2022

|

|

|

2021

|

|

|

Cash paid for amounts included in the measurement of lease liabilities:

|

|

|

|

|

|

|

|

Operating cash flows from operating leases

|

|

$

|

9,629

|

|

|

$

|

13,093

|

|

|

Right-of-use assets obtained in exchange for lease obligations:

|

|

|

|

|

|

|

|

|

|

Operating leases

|

|

$

|

8,382

|

|

|

$

|

4,125

|

|

NOTE I – Income Taxes

Our effective tax rate for the three months ended March 31, 2022 and 2021 was 24.7% and 23.5%, respectively. The primary difference in the effective rate and the statutory rate was

due to state income taxes and the impact from vested stock awards.

NOTE J – Stock Based Compensation Plans

As more fully discussed in Note 12 of the notes to the consolidated financial statements in our 2021 Annual Report on Form 10-K, we have awards outstanding for

Common Stock under stock-based employee compensation plans.

The following table summarizes our award activity during the three months ended March 31, 2022:

| |

|

Service-Based

Restricted Stock Awards

|

|

|

Performance-Based

Restricted Stock Awards

|

|

| |

|

Shares or Units (#)

|

|

|

Weighted-Average

Award Price ($)

|

|

|

Shares or Units (#)

|

|

|

Weighted-Average

Award Price ($)

|

|

|

Outstanding at December 31, 2021

|

|

|

219,082

|

|

|

$ |

27.10

|

|

|

|

328,267

|

|

|

$ |

23.96

|

|

|

Granted/Issued

|

|

|

153,681

|

|

|

|

28.86

|

|

|

|

103,104

|

|

|

|

28.86

|

|

|

Awards vested or rights exercised(1)

|

|

|

—

|

|

|

|

—

|

|

|

|

(34,940

|

)

|

|

|

20.28

|

|

|

Forfeited

|

|

|

(2,050

|

)

|

|

|

33.01

|

|

|

|

—

|

|

|

|

—

|

|

|

Additional units earned due to performance

|

|

|

—

|

|

|

|

—

|

|

|

|

59,249

|

|

|

|

31.39

|

|

|

Outstanding at March 31, 2022

|

|

|

370,713

|

|

|

$ |

27.80

|

|

|

|

455,680

|

|

|

$ |

26.54

|

|

|

Restricted units expected to vest

|

|

|

|

|

|

|

|

|

|

|

455,680

|

|

|

$ |

26.54

|

|

| (1) |

Includes shares repurchased from employees for employee’s tax liability.

|

The aggregate intrinsic value of outstanding service-based restricted stock awards was approximately $10.2 million at March 31, 2022. The restrictions on the service-based awards generally lapse or vest annually, primarily over one-year and three-year periods.

The total fair value of performance-based restricted stock awards that vested during the three months ended March 31, 2022

was approximately $1.0 million. The aggregate intrinsic value of outstanding performance awards at March

31, 2022 expected to vest was approximately $12.5 million. The performance awards are based on one-year performance periods but cliff vest in approximately three years from grant date.

The compensation for all awards is charged to selling, general and administrative expense over the respective grants’ vesting periods, primarily on a straight-line

basis. The amount charged was approximately $2.3 million and $2.7 million for the three months ended March 31, 2022 and 2021, respectively. Forfeitures are recognized as they occur. As of March 31, 2022, the total compensation cost related

to unvested equity awards was approximately $11.8 million and is expected to be recognized over a weighted-average period of 2.0 years.

NOTE K – Earnings Per Share

We report our earnings per share using the two-class method. The income per share for each class of common stock is calculated assuming 100% of our earnings are distributed as dividends to each class of common stock based on the contractual rights of the classes.

The Common Stock of the Company has a preferential dividend rate of at least 105% of the dividend paid on the Class A Common Stock. The Class A Common Stock, which has ten

votes per share as opposed to one vote per share for the Common Stock (on all matters other than the election of directors), may be

converted at any time on a one-for-one basis into Common Stock at the option of the holder of the Class A Common Stock.

| |

|

Three Months Ended

March 31,

|

|

| |

|

2022

|

|

|

2021

|

|

|

Numerator:

|

|

|

|

|

|

|

|

Common:

|

|

|

|

|

|

|

|

Distributed earnings

|

|

$

|

3,964

|

|

|

$

|

3,717

|

|

|

Undistributed earnings

|

|

|

14,008

|

|

|

|

14,262

|

|

|

Basic

|

|

|

17,972

|

|

|

|

17,979

|

|

|

Class A Common earnings

|

|

|

1,389

|

|

|

|

1,427

|

|

|

Diluted

|

|

$

|

19,361

|

|

|

$

|

19,406

|

|

| |

|

|

|

|

|

|

|

|

|

Class A Common:

|

|

|

|

|

|

|

|

|

|

Distributed earnings

|

|

$

|

296

|

|

|

$

|

270

|

|

|

Undistributed earnings

|

|

|

1,093

|

|

|

|

1,157

|

|

| |

|

$

|

1,389

|

|

|

$

|

1,427

|

|

|

Denominator:

|

|

|

|

|

|

|

|

|

|

Common:

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding - basic

|

|

|

15,706

|

|

|

|

16,793

|

|

|

Assumed conversion of Class A Common Stock

|

|

|

1,287

|

|

|

|

1,431

|

|

|

Dilutive options, awards and common stock equivalents

|

|

|

520

|

|

|

|

507

|

|

|

Total weighted-average diluted Common Stock

|

|

|

17,513

|

|

|

|

18,731

|

|

| |

|

|

|

|

|

|

|

|

|

Class A Common:

|

|

|

|

|

|

|

|

|

|

Weighted average shares outstanding

|

|

|

1,287

|

|

|

|

1,431

|

|

| |

|

|

|

|

|

|

|

|

|

Basic earnings per share:

|

|

|

|

|

|

|

|

|

|

Common Stock

|

|

$

|

1.14

|

|

|

$

|

1.07

|

|

|

Class A Common Stock

|

|

$

|

1.08

|

|

|

$

|

1.00

|

|

| |

|

|

|

|

|

|

|

|

|

Diluted earnings per share:

|

|

|

|

|

|

|

|

|

|

Common Stock

|

|

$

|

1.11

|

|

|

$

|

1.04

|

|

|

Class A Common Stock

|

|

$

|

1.05

|

|

|

$

|

0.98

|

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto duly

authorized.

| |

|

|

HAVERTY FURNITURE COMPANIES, INC.

(Registrant)

|

| |

|

|

|

| |

|

|

|

|

Date: May 6, 2022

|

|

By:

|

/s/ Clarence H. Smith

|

| |

|

|

Clarence H. Smith

|

| |

|

|

Chairman of the Board

and Chief Executive Officer

|

| |

|

|

(principal executive officer)

|

| |

|

|

|

| |

|

|

|

| |

|

By:

|

/s/ Richard B. Hare

|

| |

|

|

Richard B. Hare

|

| |

|

|

Executive Vice President and

Chief Financial Officer

(principal financial and accounting officer)

|

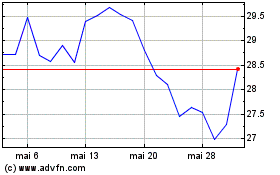

Haverty Furniture Compan... (NYSE:HVT)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

Haverty Furniture Compan... (NYSE:HVT)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025