Current Report Filing (8-k)

08 Junho 2022 - 5:07PM

Edgar (US Regulatory)

0001376804

false

0001376804

2022-06-06

2022-06-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF

THE

SECURITIES EXCHANGE ACT OF 1934

Date

of Report (Date of earliest event reported): June 6, 2022

Vnue, Inc.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

000-53462 |

|

98-0543851 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S.

Employer

Identification No.) |

104 West 29th Street, 11th Floor, New York, NY |

|

10001 |

| (Address

of principal executive offices) |

|

(Zip

Code) |

Registrant’s

telephone number, including area code: (833) 937-5493

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant

under any of the following provisions:

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act: None

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01 Entry into a Material Definitive Agreement.

On

June 3, 2022, the Company entered into an Exchange Agreement with GHS Investments, LLC (“GHS”), whereby GHS agreed

to purchase 266 shares of the Company’s Series B Convertible Preferred Stock in exchange for retiring two convertible promissory

notes held in our company with principal and accrued but unpaid interest of $267,194.

Also

on June 6, 2022, the Company entered into an Equity Financing Agreement (“Financing Agreement”) and Registration Rights

Agreement (“Registration Agreement”) with GHS. Under the terms of the Financing Agreement, GHS agreed to provide the

Company with up to Ten Million ($10,000,000) upon effectiveness of a registration statement on Form S-1 (the “Registration

Statement”) filed with the U.S. Securities and Exchange Commission (the “Commission”)

Following

effectiveness of the Registration Statement, the Company shall have the discretion to deliver puts to GHS and GHS will be obligated

to purchase shares of the Company’s common stock, par value $0.0001 per share (the “Common Stock”) based on

the investment amount specified in each put notice. The maximum amount that the Company shall be entitled to put to GHS in each

put notice shall not exceed three hundred percent (200%) of the average daily trading dollar volume of the Company’s Common

Stock during the ten (10) trading days preceding the put, in an amount equaling less than ten thousand dollars ($10,000) or greater

than five hundred thousand dollars ($500,000). Pursuant to the Equity Financing Agreement, GHS and its affiliates will not be

permitted to purchase and the Company may not put shares of the Company’s Common Stock to GHS that would result in GHS’s

beneficial ownership equaling more than 4.99% of the Company’s outstanding Common Stock. The price of each put share shall

be equal to eighty percent (80%) of the Market Price (as defined in the Equity Financing Agreement). Following an up-list to the

NASDAQ or an equivalent national exchange by the Company, the Purchase price shall mean ninety percent (90%) of the Market Price,

subject to a floor of $.0001 per share. Puts may be delivered by the Company to GHS until the earlier of twenty-four (24) months

after the effectiveness of the Registration Statement or the date on which GHS has purchased an aggregate of $10,000,000 worth

of Common Stock under the terms of the Equity Financing Agreement.

Additionally,

concurrently with the execution of definitive agreements, the Company shall issue common shares to the Investor representing a

dollar value equal to one percent (1.0%) of the Commitment Amount (the “Commitment Shares”). The Commitment Shares

shall be calculated at the applicable Purchase Price on the trading day immediately preceding the execution of definitive agreements.

The

Registration Rights Agreement provides that the Company shall (i) use its best efforts to file with the Commission the Registration

Statement within 30 days of the date of the Registration Rights Agreement; and (ii) have the Registration Statement declared effective

by the Commission within 30 days after the date the Registration Statement is filed with the Commission, but in no event more

than 90 days after the Registration Statement is filed.

The

foregoing description of the Exchange Agreement, Finance Agreement and Registration Agreement does not purport to be complete

and is qualified in its entirety by reference to the full text of the form of the documents, which are attached as Exhibits 10.1

to 10.3 to this Current Report on Form 8-K, respectively, and are hereby incorporated herein by reference.

Item

3.02 Unregistered Sales of Equity Securities.

The

information set forth in Item 1.01 of this Current Report on Form 8-K is incorporated by reference into this Item 3.02.

The

securities were not registered under the Securities Act, but qualified for exemption under Section 4(a)(2) and/or Regulation D

of the Securities Act. The securities were exempt from registration under Section 4(a)(2) of the Securities Act because the issuance

of such securities by the Company did not involve a “public offering,” as defined in Section 4(a)(2) of the Securities

Act, due to the insubstantial number of persons involved in the transaction, size of the offering, manner of the offering and

number of securities offered. The Company did not undertake an offering in which it sold a high number of securities to a high

number of investors. In addition, the Investors had the necessary investment intent as required by Section 4(a)(2) of the Securities

Act since the Investors agreed to, and received, the securities bearing a legend stating that such securities are restricted pursuant

to Rule 144 of the Securities Act. This restriction ensures that these securities would not be immediately redistributed into

the market and therefore not be part of a “public offering.” Based on an analysis of the above factors, the Company

has met the requirements to qualify for exemption under Section 4(a)(2) of the Securities Act.

Item

9.01 Financial Statements and Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

Vnue,

Inc.

| /s/

Zach Bair |

|

| Zach

Bair |

|

| Chief

Executive Officer |

|

| |

|

| Date:

June 8, 2022 |

|

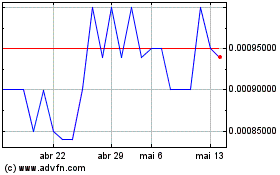

VNUE (PK) (USOTC:VNUE)

Gráfico Histórico do Ativo

De Out 2024 até Nov 2024

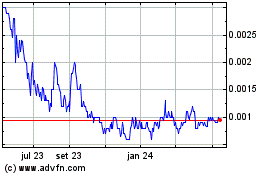

VNUE (PK) (USOTC:VNUE)

Gráfico Histórico do Ativo

De Nov 2023 até Nov 2024

Notícias em tempo-real sobre VNUE Inc (PK) da OTCMarkets bolsa de valores: 0 artigos recentes

Mais Notícias de Vnue, Inc.