0001376804

True

0001376804

2022-01-01

2022-03-31

0001376804

2021-12-31

0001376804

2020-12-31

0001376804

2021-01-01

2021-12-31

0001376804

2020-01-01

2020-12-31

0001376804

us-gaap:PreferredStockMember

2019-12-31

0001376804

us-gaap:CommonStockMember

2019-12-31

0001376804

us-gaap:AdditionalPaidInCapitalMember

2019-12-31

0001376804

us-gaap:RetainedEarningsMember

2019-12-31

0001376804

2019-12-31

0001376804

us-gaap:PreferredStockMember

2020-12-31

0001376804

us-gaap:CommonStockMember

2020-12-31

0001376804

us-gaap:AdditionalPaidInCapitalMember

2020-12-31

0001376804

us-gaap:RetainedEarningsMember

2020-12-31

0001376804

us-gaap:PreferredStockMember

2020-01-01

2020-12-31

0001376804

us-gaap:CommonStockMember

2020-01-01

2020-12-31

0001376804

us-gaap:AdditionalPaidInCapitalMember

2020-01-01

2020-12-31

0001376804

us-gaap:RetainedEarningsMember

2020-01-01

2020-12-31

0001376804

us-gaap:PreferredStockMember

2021-01-01

2021-12-31

0001376804

us-gaap:CommonStockMember

2021-01-01

2021-12-31

0001376804

us-gaap:AdditionalPaidInCapitalMember

2021-01-01

2021-12-31

0001376804

us-gaap:RetainedEarningsMember

2021-01-01

2021-12-31

0001376804

us-gaap:PreferredStockMember

2021-12-31

0001376804

us-gaap:CommonStockMember

2021-12-31

0001376804

us-gaap:AdditionalPaidInCapitalMember

2021-12-31

0001376804

us-gaap:RetainedEarningsMember

2021-12-31

0001376804

vnue:StageItCorpMember

2020-01-01

2020-12-31

0001376804

vnue:StageItCorpMember

2021-01-01

2021-09-30

0001376804

vnue:TgriMember

2021-01-01

2021-12-31

0001376804

vnue:StageItCorpMember

2020-12-31

0001376804

vnue:StageItCorpMember

2021-09-30

0001376804

vnue:TgriMember

2022-01-01

2022-03-31

0001376804

vnue:VnueIncFormerlyTgriMember

2021-01-01

2021-12-31

0001376804

vnue:VnueIncVnueWashingtonMember

2021-01-01

2021-12-31

0001376804

vnue:VnueLlcMember

2021-01-01

2021-12-31

0001376804

us-gaap:OfficeEquipmentMember

vnue:StageItCorpMember

2020-01-01

2020-12-31

0001376804

us-gaap:FurnitureAndFixturesMember

vnue:StageItCorpMember

2020-01-01

2020-12-31

0001376804

us-gaap:OfficeEquipmentMember

vnue:StageItCorpMember

2021-01-01

2021-09-30

0001376804

us-gaap:FurnitureAndFixturesMember

vnue:StageItCorpMember

2021-01-01

2021-09-30

0001376804

us-gaap:OfficeEquipmentMember

2022-01-01

2022-03-31

0001376804

us-gaap:FurnitureAndFixturesMember

2022-01-01

2022-03-31

0001376804

vnue:WarrantsMember

2021-01-01

2021-12-31

0001376804

vnue:ConvertibleNotesPayableThreeMember

2021-01-01

2021-12-31

0001376804

vnue:StageItCorpMember

2019-12-31

0001376804

us-gaap:ComputerEquipmentMember

vnue:StageItCorpMember

2020-12-31

0001376804

us-gaap:ComputerEquipmentMember

vnue:StageItCorpMember

2019-12-31

0001376804

us-gaap:ComputerEquipmentMember

vnue:StageItCorpMember

2021-09-30

0001376804

2022-03-31

0001376804

vnue:WarrantsMember

2022-01-01

2022-03-31

0001376804

vnue:ConvertibleNotesPayablesMember

2022-01-01

2022-03-31

0001376804

us-gaap:OfficeEquipmentMember

2022-03-31

0001376804

us-gaap:FurnitureAndFixturesMember

2022-03-31

0001376804

2021-01-01

2021-03-31

0001376804

vnue:MTAgreementMember

2021-01-01

2021-12-31

0001376804

2021-06-30

0001376804

2020-01-09

0001376804

vnue:MTAgreementMember

2022-01-01

2022-03-31

0001376804

vnue:ChiefExecutiveOfficersMember

2021-01-01

2021-12-31

0001376804

2019-01-01

2019-12-31

0001376804

vnue:TwoOfficersMember

2022-03-31

0001376804

vnue:TwoOfficersMember

2021-12-31

0001376804

vnue:ChiefExecutiveOfficersMember

2022-01-01

2022-03-31

0001376804

vnue:ChiefExecutiveOfficersMember

2021-12-31

0001376804

us-gaap:DividendDeclaredMember

2017-10-01

2017-10-16

0001376804

us-gaap:DividendDeclaredMember

2018-10-01

2018-10-16

0001376804

us-gaap:DividendDeclaredMember

2018-01-01

2018-12-31

0001376804

us-gaap:DividendDeclaredMember

2022-03-31

0001376804

us-gaap:DividendDeclaredMember

2021-12-31

0001376804

us-gaap:DividendDeclaredMember

2017-10-16

0001376804

2018-12-31

0001376804

us-gaap:ConvertibleNotesPayableMember

2019-01-01

2019-12-31

0001376804

vnue:PledgeMusicIncMember

vnue:BusinessAcquisitionMember

2019-01-01

2019-12-31

0001376804

vnue:NotePayableMember

2021-12-31

0001376804

vnue:VariousConvertibleNotesMember

2021-12-31

0001376804

vnue:VariousConvertibleNotesMember

2020-12-31

0001376804

vnue:YlimitLlccConvertibleNotesMember

2021-12-31

0001376804

vnue:YlimitLlccConvertibleNotesMember

2020-12-31

0001376804

vnue:GolockCapitalLlcConvertibleNotesMember

2021-12-31

0001376804

vnue:GolockCapitalLlcConvertibleNotesMember

2020-12-31

0001376804

vnue:OtherConvertibleNotesMember

2021-12-31

0001376804

vnue:OtherConvertibleNotesMember

2020-12-31

0001376804

vnue:NotePayableMember

2021-01-01

2021-12-31

0001376804

vnue:OfficersMember

2021-01-01

2021-12-31

0001376804

vnue:OfficersMember

2021-12-31

0001376804

2021-04-01

2021-06-30

0001376804

vnue:ConvertibleNotesPayableThreeMember

2021-12-31

0001376804

vnue:ConvertibleNotesPayableThreeMember

2020-12-31

0001376804

vnue:ConvertibleNotesPayableThreeMember

vnue:YLimitLLCMember

2019-10-01

2019-12-31

0001376804

vnue:ConvertibleNotesPayableThreeMember

vnue:YLimitLLCMember

2019-12-31

0001376804

vnue:FebruaryNineTwentyTwentyMember

vnue:YLimitLLCMember

2019-01-01

2019-12-31

0001376804

vnue:FebruaryNineTwentyTwentyMember

vnue:YLimitLLCMember

2021-01-01

2021-12-31

0001376804

vnue:GolockCapitalLlcConvertibleNotesMember

2017-12-31

0001376804

vnue:GolockCapitalLlcConvertibleNotesMember

2017-09-01

2017-12-31

0001376804

vnue:GolockCapitalLlcConvertibleNotesMember

2018-02-02

0001376804

vnue:GolockCapitalLlcConvertibleNotesMember

2018-01-02

2018-02-02

0001376804

vnue:GolockCapitalLlcConvertibleNoteMember

2018-01-02

2018-02-02

0001376804

vnue:GolockCapitalLlcConvertibleNotesMember

2018-12-31

0001376804

vnue:GolockMember

2019-04-01

2019-04-29

0001376804

vnue:AmendmentMember

vnue:GolockMember

2019-12-31

0001376804

vnue:AmendmentMember

vnue:GolockMember

2019-01-01

2019-12-31

0001376804

vnue:GolockCapitalLlcConvertibleNotesMember

2021-01-01

2021-12-31

0001376804

vnue:GHSInvestmentsMember

2021-12-31

0001376804

vnue:GHSInvestmentsMember

2021-01-01

2021-12-31

0001376804

vnue:AmendmentMember

vnue:LenderMember

2021-12-31

0001376804

srt:MinimumMember

vnue:OptionPricingModelsMember

2020-12-31

0001376804

srt:MaximumMember

vnue:OptionPricingModelsMember

2020-12-31

0001376804

vnue:OptionPricingModelsMember

2020-12-31

0001376804

vnue:OptionPricingModelsMember

2020-01-01

2020-12-31

0001376804

vnue:OptionPricingModelsMember

2021-01-01

2021-12-31

0001376804

2019-06-01

2019-07-02

0001376804

vnue:SeriesAConvertiblePreferredStockMember

2021-12-31

0001376804

vnue:SeriesAConvertiblePreferredStockMember

2020-12-31

0001376804

vnue:SeriesAConvertiblePreferredStockMember

2019-05-22

0001376804

vnue:SeriesAConvertiblePreferredStockMember

2020-05-01

2020-05-22

0001376804

vnue:SeriesAConvertiblePreferredStockMember

2019-01-01

2019-12-31

0001376804

vnue:TwoConvertibleNoteholdersMember

2019-01-01

2019-12-31

0001376804

vnue:TwoConvertibleNoteholdersMember

2021-01-01

2021-12-31

0001376804

vnue:NonRedeemablePreferredStockAMember

vnue:StageItCorpMember

2020-12-31

0001376804

vnue:NonRedeemablePreferredStockA1Member

vnue:StageItCorpMember

2020-12-31

0001376804

vnue:NonRedeemablePreferredStockA2Member

vnue:StageItCorpMember

2020-12-31

0001376804

vnue:NonRedeemablePreferredStockA3Member

vnue:StageItCorpMember

2020-12-31

0001376804

vnue:PreferredStockAMember

vnue:StageItCorpMember

2020-12-31

0001376804

vnue:PreferredStockA1Member

vnue:StageItCorpMember

2020-12-31

0001376804

vnue:PreferredStockA2Member

vnue:StageItCorpMember

2020-12-31

0001376804

vnue:PreferredStockA3Member

vnue:StageItCorpMember

2020-12-31

0001376804

vnue:PreferredStockAMember

vnue:StageItCorpMember

2021-09-30

0001376804

vnue:PreferredStockA1Member

vnue:StageItCorpMember

2021-09-30

0001376804

vnue:PreferredStockA2Member

vnue:StageItCorpMember

2021-09-30

0001376804

vnue:PreferredStockA3Member

vnue:StageItCorpMember

2021-09-30

0001376804

vnue:SeriesAConvertiblePreferredStockMember

2019-07-02

0001376804

us-gaap:SeriesAPreferredStockMember

2021-12-31

0001376804

us-gaap:SeriesAPreferredStockMember

2022-03-31

0001376804

vnue:SeriesBConvertiblePreferredStockMember

2022-01-03

0001376804

vnue:SeriesBConvertiblePreferredStockMember

2021-12-28

2022-01-03

0001376804

us-gaap:SeriesBPreferredStockMember

2022-03-31

0001376804

us-gaap:SeriesBPreferredStockMember

2021-12-31

0001376804

vnue:WarrantOneMember

2021-01-01

2021-12-31

0001376804

vnue:InitialJointVentureAgreementMember

vnue:MriMember

vnue:September12018Member

2021-01-01

2021-12-31

0001376804

vnue:ArtistAgreementMember

vnue:IBreakHorsesMember

2015-10-01

2015-10-31

0001376804

vnue:September12018Member

vnue:InitialJointVentureAgreementMember

vnue:MriMember

2022-01-01

2022-03-31

0001376804

2017-12-31

0001376804

us-gaap:SubsequentEventMember

2022-03-01

2022-03-17

0001376804

vnue:RevenueFactoringAgreementMember

vnue:StageItCorpMember

2020-01-01

2020-12-31

0001376804

us-gaap:SubsequentEventMember

vnue:StageItCorpMember

2022-02-14

0001376804

us-gaap:SubsequentEventMember

vnue:StageItCorpMember

2022-02-02

2022-02-14

0001376804

us-gaap:SubsequentEventMember

us-gaap:RestrictedStockMember

vnue:StageItCorpMember

2022-02-02

2022-02-14

0001376804

srt:ScenarioForecastMember

vnue:StageItCorpMember

2022-02-14

0001376804

srt:ScenarioForecastMember

vnue:StageItCorpMember

2022-02-02

2022-02-14

0001376804

srt:ScenarioForecastMember

us-gaap:RestrictedStockMember

vnue:StageItCorpMember

2022-02-02

2022-02-14

0001376804

us-gaap:SubsequentEventMember

2022-04-01

2022-05-19

0001376804

vnue:PreferredStockAMember

vnue:StageItCorpMember

2019-12-31

0001376804

vnue:PreferredStockA1Member

vnue:StageItCorpMember

2019-12-31

0001376804

vnue:PreferredStockA2Member

vnue:StageItCorpMember

2019-12-31

0001376804

vnue:PreferredStockA3Member

vnue:StageItCorpMember

2019-12-31

0001376804

vnue:StageItCorpMember

2019-01-01

2019-12-31

0001376804

vnue:PreferredStockSeriesAMember

vnue:StageItCorpMember

2018-12-31

0001376804

vnue:PreferredStockSeriesAOneMember

vnue:StageItCorpMember

2018-12-31

0001376804

vnue:PreferredStockSeriesATwoMember

vnue:StageItCorpMember

2018-12-31

0001376804

vnue:PreferredStockSeriesAThreeMember

vnue:StageItCorpMember

2018-12-31

0001376804

us-gaap:CommonStockMember

vnue:StageItCorpMember

2018-12-31

0001376804

us-gaap:AdditionalPaidInCapitalMember

vnue:StageItCorpMember

2018-12-31

0001376804

us-gaap:RetainedEarningsMember

vnue:StageItCorpMember

2018-12-31

0001376804

vnue:TotalMember

vnue:StageItCorpMember

2018-12-31

0001376804

vnue:PreferredStockSeriesAMember

vnue:StageItCorpMember

2019-12-31

0001376804

vnue:PreferredStockSeriesAOneMember

vnue:StageItCorpMember

2019-12-31

0001376804

vnue:PreferredStockSeriesATwoMember

vnue:StageItCorpMember

2019-12-31

0001376804

vnue:PreferredStockSeriesAThreeMember

vnue:StageItCorpMember

2019-12-31

0001376804

us-gaap:CommonStockMember

vnue:StageItCorpMember

2019-12-31

0001376804

us-gaap:AdditionalPaidInCapitalMember

vnue:StageItCorpMember

2019-12-31

0001376804

us-gaap:RetainedEarningsMember

vnue:StageItCorpMember

2019-12-31

0001376804

vnue:TotalMember

vnue:StageItCorpMember

2019-12-31

0001376804

vnue:PreferredStockSeriesAMember

vnue:StageItCorpMember

2019-01-01

2019-12-31

0001376804

vnue:PreferredStockSeriesAOneMember

vnue:StageItCorpMember

2019-01-01

2019-12-31

0001376804

vnue:PreferredStockSeriesATwoMember

vnue:StageItCorpMember

2019-01-01

2019-12-31

0001376804

vnue:PreferredStockSeriesAThreeMember

vnue:StageItCorpMember

2019-01-01

2019-12-31

0001376804

us-gaap:CommonStockMember

vnue:StageItCorpMember

2019-01-01

2019-12-31

0001376804

us-gaap:AdditionalPaidInCapitalMember

vnue:StageItCorpMember

2019-01-01

2019-12-31

0001376804

us-gaap:RetainedEarningsMember

vnue:StageItCorpMember

2019-01-01

2019-12-31

0001376804

vnue:TotalMember

vnue:StageItCorpMember

2019-01-01

2019-12-31

0001376804

vnue:PreferredStockSeriesAMember

vnue:StageItCorpMember

2020-01-01

2020-12-31

0001376804

vnue:PreferredStockSeriesAOneMember

vnue:StageItCorpMember

2020-01-01

2020-12-31

0001376804

vnue:PreferredStockSeriesATwoMember

vnue:StageItCorpMember

2020-01-01

2020-12-31

0001376804

vnue:PreferredStockSeriesAThreeMember

vnue:StageItCorpMember

2020-01-01

2020-12-31

0001376804

us-gaap:CommonStockMember

vnue:StageItCorpMember

2020-01-01

2020-12-31

0001376804

us-gaap:AdditionalPaidInCapitalMember

vnue:StageItCorpMember

2020-01-01

2020-12-31

0001376804

us-gaap:RetainedEarningsMember

vnue:StageItCorpMember

2020-01-01

2020-12-31

0001376804

vnue:TotalMember

vnue:StageItCorpMember

2020-01-01

2020-12-31

0001376804

vnue:PreferredStockSeriesAMember

vnue:StageItCorpMember

2020-12-31

0001376804

vnue:PreferredStockSeriesAOneMember

vnue:StageItCorpMember

2020-12-31

0001376804

vnue:PreferredStockSeriesATwoMember

vnue:StageItCorpMember

2020-12-31

0001376804

vnue:PreferredStockSeriesAThreeMember

vnue:StageItCorpMember

2020-12-31

0001376804

us-gaap:CommonStockMember

vnue:StageItCorpMember

2020-12-31

0001376804

us-gaap:AdditionalPaidInCapitalMember

vnue:StageItCorpMember

2020-12-31

0001376804

us-gaap:RetainedEarningsMember

vnue:StageItCorpMember

2020-12-31

0001376804

vnue:TotalMember

vnue:StageItCorpMember

2020-12-31

0001376804

vnue:StageItCorpMember

2018-12-31

0001376804

vnue:PromissoryNotesMember

vnue:StageItCorpMember

2020-12-31

0001376804

vnue:PromissoryNotesMember

vnue:StageItCorpMember

2019-12-31

0001376804

us-gaap:ConvertibleNotesPayableMember

vnue:StageItCorpMember

2020-12-31

0001376804

vnue:StageItCorpMember

2020-01-01

2020-09-30

0001376804

vnue:PreferredStockSeriesAMember

vnue:StageItCorpMember

2020-01-01

2020-09-30

0001376804

vnue:PreferredStockSeriesAOneMember

vnue:StageItCorpMember

2020-01-01

2020-09-30

0001376804

vnue:PreferredStockSeriesATwoMember

vnue:StageItCorpMember

2020-01-01

2020-09-30

0001376804

vnue:PreferredStockSeriesAThreeMember

vnue:StageItCorpMember

2020-01-01

2020-09-30

0001376804

us-gaap:CommonStockMember

vnue:StageItCorpMember

2020-01-01

2020-09-30

0001376804

us-gaap:AdditionalPaidInCapitalMember

vnue:StageItCorpMember

2020-01-01

2020-09-30

0001376804

us-gaap:RetainedEarningsMember

vnue:StageItCorpMember

2020-01-01

2020-09-30

0001376804

vnue:TotalMember

vnue:StageItCorpMember

2020-01-01

2020-09-30

0001376804

vnue:PreferredStockSeriesAMember

vnue:StageItCorpMember

2021-01-01

2021-09-30

0001376804

vnue:PreferredStockSeriesAOneMember

vnue:StageItCorpMember

2021-01-01

2021-09-30

0001376804

vnue:PreferredStockSeriesATwoMember

vnue:StageItCorpMember

2021-01-01

2021-09-30

0001376804

vnue:PreferredStockSeriesAThreeMember

vnue:StageItCorpMember

2021-01-01

2021-09-30

0001376804

us-gaap:CommonStockMember

vnue:StageItCorpMember

2021-01-01

2021-09-30

0001376804

us-gaap:AdditionalPaidInCapitalMember

vnue:StageItCorpMember

2021-01-01

2021-09-30

0001376804

us-gaap:RetainedEarningsMember

vnue:StageItCorpMember

2021-01-01

2021-09-30

0001376804

vnue:TotalMember

vnue:StageItCorpMember

2021-01-01

2021-09-30

0001376804

vnue:PreferredStockSeriesAMember

vnue:StageItCorpMember

2020-09-30

0001376804

vnue:PreferredStockSeriesAOneMember

vnue:StageItCorpMember

2020-09-30

0001376804

vnue:PreferredStockSeriesATwoMember

vnue:StageItCorpMember

2020-09-30

0001376804

vnue:PreferredStockSeriesAThreeMember

vnue:StageItCorpMember

2020-09-30

0001376804

us-gaap:CommonStockMember

vnue:StageItCorpMember

2020-09-30

0001376804

us-gaap:AdditionalPaidInCapitalMember

vnue:StageItCorpMember

2020-09-30

0001376804

us-gaap:RetainedEarningsMember

vnue:StageItCorpMember

2020-09-30

0001376804

vnue:TotalMember

vnue:StageItCorpMember

2020-09-30

0001376804

vnue:PreferredStockSeriesAMember

vnue:StageItCorpMember

2021-09-30

0001376804

vnue:PreferredStockSeriesAOneMember

vnue:StageItCorpMember

2021-09-30

0001376804

vnue:PreferredStockSeriesATwoMember

vnue:StageItCorpMember

2021-09-30

0001376804

vnue:PreferredStockSeriesAThreeMember

vnue:StageItCorpMember

2021-09-30

0001376804

us-gaap:CommonStockMember

vnue:StageItCorpMember

2021-09-30

0001376804

us-gaap:AdditionalPaidInCapitalMember

vnue:StageItCorpMember

2021-09-30

0001376804

us-gaap:RetainedEarningsMember

vnue:StageItCorpMember

2021-09-30

0001376804

vnue:TotalMember

vnue:StageItCorpMember

2021-09-30

0001376804

vnue:StageItCorpMember

2020-09-30

0001376804

us-gaap:SeriesBPreferredStockMember

2020-12-31

0001376804

vnue:PreferredASharesMember

2020-12-31

0001376804

vnue:PreferredBSharesMember

2020-12-31

0001376804

vnue:PreferredASharesMember

2021-12-31

0001376804

vnue:PreferredBSharesMember

2021-12-31

0001376804

vnue:PreferredASharesMember

2021-01-01

2021-03-31

0001376804

vnue:PreferredBSharesMember

2021-01-01

2021-03-31

0001376804

us-gaap:CommonStockMember

2021-01-01

2021-03-31

0001376804

us-gaap:AdditionalPaidInCapitalMember

2021-01-01

2021-03-31

0001376804

us-gaap:RetainedEarningsMember

2021-01-01

2021-03-31

0001376804

vnue:PreferredASharesMember

2022-01-01

2022-03-31

0001376804

vnue:PreferredBSharesMember

2022-01-01

2022-03-31

0001376804

us-gaap:CommonStockMember

2022-01-01

2022-03-31

0001376804

us-gaap:AdditionalPaidInCapitalMember

2022-01-01

2022-03-31

0001376804

us-gaap:RetainedEarningsMember

2022-01-01

2022-03-31

0001376804

vnue:PreferredASharesMember

2021-03-31

0001376804

vnue:PreferredBSharesMember

2021-03-31

0001376804

us-gaap:CommonStockMember

2021-03-31

0001376804

us-gaap:AdditionalPaidInCapitalMember

2021-03-31

0001376804

us-gaap:RetainedEarningsMember

2021-03-31

0001376804

2021-03-31

0001376804

vnue:PreferredASharesMember

2022-03-31

0001376804

vnue:PreferredBSharesMember

2022-03-31

0001376804

us-gaap:CommonStockMember

2022-03-31

0001376804

us-gaap:AdditionalPaidInCapitalMember

2022-03-31

0001376804

us-gaap:RetainedEarningsMember

2022-03-31

0001376804

vnue:VNUEAcquisitionMember

2022-02-01

2022-02-14

0001376804

vnue:VNUEAcquisitionMember

2022-02-13

0001376804

vnue:VariousConvertibleNotesMember

2022-03-31

0001376804

vnue:GolockCapitalLlcConvertibleNotesMember

2022-03-31

0001376804

vnue:OtherConvertibleNotesMember

2022-03-31

0001376804

vnue:GolockCapitalLlcConvertiblesNotesMember

2018-01-02

2018-02-02

0001376804

vnue:GHSInvestmentsMember

2022-03-31

0001376804

vnue:AmendmentMember

vnue:GolockMember

2019-04-01

2019-04-29

0001376804

vnue:GolockCapitalLlcConvertibleNotesMember

2022-01-01

2022-03-31

0001376804

vnue:AmendmentMember

vnue:LenderMember

2022-03-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-1/A

Amendment

No. 3

REGISTRATION

STATEMENT

UNDER

THE SECURITIES ACT OF 1933

VNUE, INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

98-0543851 |

| (State

of Incorporation) |

|

(IRS

Employer

Identification

Number) |

104 West 29th Street, 11th Floor

New

York, NY 10001

(833) 937-5493

(Address,

including zip code, and telephone number, including area code,

of

registrant’s principal executive offices)

Copies

of all correspondence to:

The

Doney Law Firm

4955

S. Durango Rd. Ste. 165

Las

Vegas, NV 89113

Tel. No.: (702) 982-5686

(Address, including zip code, and telephone, including area code)

Approximate

date of commencement of proposed sale of the securities to the public:

From time to time after the effective date of this registration

statement.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, check the following box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to rule 462(c) under the Securities Act, check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company,

or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller

reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer |

☐ |

Accelerated

filer |

☐ |

| Non-accelerated filer |

☒ |

Smaller

reporting company |

☒ |

| |

Emerging

Growth Company |

☐ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

The

Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant

shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance

with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the

Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The

information in this prospectus is not complete and may be changed. The Selling Stockholders may not sell these securities until the registration

statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and

it is not soliciting an offer to buy these securities in any state where the offer, solicitation or sale is not permitted.

PRELIMINARY

PROSPECTUS, SUBJECT TO COMPLETION, DATED JULY 14, 2022

VNUE,

INC.

Up to 432,003,060 Shares of Common Stock

This prospectus relates to

the resale of up to 432,003,060 shares of common stock, represented as Purchase Notice Shares issuable to GHS Investments, LLC (“GHS”),

the selling stockholder, pursuant to an Equity Financing Agreement (the “Financing Agreement”), dated June 6, 2022, that

we entered into with GHS. The Purchase Agreement permits us to issue Purchase Notices to GHS for up to Ten Million Dollars ($10,000,000)

in shares of our common stock through the earlier of 24 months from the date of the Financing Agreement or until $10,000,000 of such

shares have been subject of a Purchase Notice.

The selling stockholder may

sell all or a portion of the shares being offered pursuant to this prospectus at fixed prices, at prevailing market prices at the time

of sale, at varying prices or at negotiated prices.

GHS is an “underwriter”

within the meaning of the Securities Act, in connection with the resale of our common stock under the equity line Financing Agreement,

and any broker-dealers or agents that are involved in such resales may be deemed to be “underwriters” within the meaning

of the Securities Act in connection therewith. In such event, any commissions received by such broker-dealers or agents and any profit

on the resale of the shares purchased by them may be deemed to be underwriting commissions or discounts under the Securities Act.

We are not selling any shares

of Common Stock under this prospectus and will not receive any of the proceeds from the resale of the Common Stock by GHS (referred to

herein as the “Selling Stockholder”). We will pay for expenses of this offering, except that the Selling Stockholder will

pay any broker discounts or commissions or equivalent expenses and expenses of its legal counsel applicable to the sale of its shares.

There are no arrangements to place the funds received in an escrow, trust, or similar arrangement and the funds will be available to

us following deposit into our bank account.

The

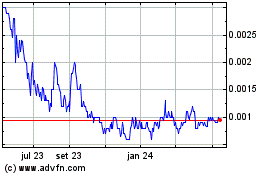

Common Stock is quoted on the OTC Markets, under the symbol “VNUE.” On July 13, 2022, the last reported sale price of the

Common Stock on the OTC Markets was $0.0040 per share.

Investing

in our common stock involves a high degree of risk. Before deciding whether to invest in our securities, you should consider carefully

the risks that we have described on page 5 of this prospectus under the caption “Risk Factors” and in the documents incorporated

by reference into this prospectus.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is July 14, 2022.

TABLE

OF CONTENTS

We

have not, and the Selling Stockholder has not, authorized anyone to provide you with information other than that contained or incorporated

by reference in this prospectus and any applicable prospectus supplement or amendment. We have not, and the Selling Stockholder has not,

authorized any person to provide you with different information. This prospectus is not an offer to sell, nor is it an offer to buy, these

securities in any jurisdiction where the offer is not permitted. The information contained or incorporated by reference in this prospectus

and any applicable prospectus supplement or amendment is accurate only as of its date. Our business, financial condition, results of operations,

and prospects may have changed since that date.

ABOUT

THIS PROSPECTUS

This

prospectus is part of a registration statement that we have filed with the Securities and Exchange Commission (the “SEC”)

pursuant to which the Selling Stockholder named herein may, from time to time, offer and sell or otherwise dispose of the securities covered

by this prospectus. You should not assume that the information contained in this prospectus is accurate on any date subsequent to the

date set forth on the front cover of this prospectus or that any information we have incorporated by reference is correct on any date

subsequent to the date of the document incorporated by reference, even though this prospectus is delivered or securities are sold or otherwise

disposed of on a later date. It is important for you to read and consider all information contained in this prospectus, including the

Information Incorporated by Reference herein, in making your investment decision. You should also read and consider the information in

the documents to which we have referred you under the captions “Where You Can Find More Information” and “Incorporation

of Information by Reference” in this prospectus.

Neither

we nor the Selling Stockholder have authorized any dealer, salesman or other person to give any information or to make any representation

other than those contained or incorporated by reference in this prospectus. You must not rely upon any information or representation not

contained or incorporated by reference in this prospectus. This prospectus does not constitute an offer to sell or the solicitation of

an offer to buy any of our securities other than the securities covered hereby, nor does this prospectus constitute an offer to sell or

the solicitation of an offer to buy any securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation

in such jurisdiction. Persons who come into possession of this prospectus in jurisdictions outside the United States are required to inform

themselves about, and to observe, any restrictions as to the offering and the distribution of this prospectus applicable to those jurisdictions.

We

further note that the representations, warranties and covenants made in any agreement that is filed as an exhibit to any document that

is incorporated by reference in the accompanying prospectus were made solely for the benefit of the parties to such agreement, including,

in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation,

warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly,

such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

Unless

the context otherwise requires, references in this prospectus to “VNUE,” the “Company,” “we,” “us,”

and “our” refer to VNUE, Inc.

PROSPECTUS

SUMMARY

The

following is a summary of what we believe to be the most important aspects of our business and the offering of our securities under this

prospectus. We urge you to read this entire prospectus, including the more detailed financial statements, notes to the financial statements

and other information incorporated by reference from our other filings with the SEC. Each of the risk factors could adversely affect our

business, operating results and financial condition, as well as adversely affect the value of an investment in our securities.

Overview

We are a music technology

company that utilizes our platforms to record love concerts and then sell the content to consumers. We make content we record available

to the set.fm platform, as well as our website, immediately after the show is finished. Our technology helps artists and record labels

generate alternative income from the recorded content. We also offer high end collectible products such as CDs, USB drives and laminates,

which feature our fully mixed and mastered live concert content.

Until

the acquisition of Stage It, described below, we had two products:

|

● |

Set.fm™

/ DiscLive Network™ - Our consumer app platform allows customers to download and purchase, via their individual mobile

device, the concert they just attended. There are also physical collectible products which are recorded and sold at shows as well as online

through the Company’s exclusive partner DiscLive Network™. The app itself is free to download, and allows for in app

purchases regarding the content. (Currently, this is the only platform that generates any revenue for the Company.) |

|

● |

Soundstr™ -

a comprehensive music identification and rights management Cloud platform that we are developing, when fully deployed, can accurately

track and audit public performances of music, creating a more transparent ecosystem for general music licensing and associated royalty

payments, which will help ensure the correct stakeholders are compensated through the use of our “big data” collection. |

While

Set.fm™ and Soundstr™ are proprietary marks of the Company, DiscLive, and its related marks and names are not owned by the

Company and are owned and utilized by RockHouse Live Media Productions, Inc. The Company has not filed any formal trademark applications

relating to Set.fm™ with the United States US Patent and Trademark Office but has been using these marks openly since 2017 and claims

common law rights to them.

The

Company currently only generates revenue from Set.fm and from DiscLive by (a) recording the audio of live concerts and then selling the

content “instantly” through its set.fm website, as well as the IOS Set.fm mobile application, and (b) selling content on physical

products such as CDs, which are burned on-site where customers can purchase them. Our customers are fans of live music and the bands which

we record.

Customers

want to “take home” their experience of the concerts they attend. Our Company enters into agreement with certain bands and

artists, and record labels if a particular artist under contract with the label. Our teams then follow that artist or band while they

are on tour and record every show on that tour. Our Company uses its own recording and sound equipment while recording concerts.

As

we partner with both artists and labels, we market our services on their websites, their social media platforms, their mailing lists,

as well as our own websites and social networks. Furthermore, partnerships, with companies similar to Ticketmaster, allow us to market

to customers when they buy tickets to see certain artists in concert.

On

February 13, 2022, the Company entered into an Agreement and Plan of Merger (the “Merger Agreement”) with VNUE Acquisition

Inc., a Delaware corporation and wholly-owned subsidiary of the Company (“MergerCo”), Stage It Corp., a Delaware corporation

(“Stage It”), and the stockholders’ representative for Stage It, pursuant to which the Company agreed to acquire Stage

It for $10 million (the “Merger Consideration”), by merging MergerCo with and into Stage It, with Stage It continuing as the

surviving entity and wholly owned subsidiary of the Company (the “Merger”).

Pursuant to the Merger Agreement,

each of Stage It’s outstanding shares (including common and preferred shares) will be converted into the right to receive the applicable

portion of the Merger Consideration. A portion of the Merger Consideration will be paid in cash and take the form of satisfying certain

outstanding debt obligations of Stage It, as outlined in a Closing Payment Certificate to the Merger Agreement, and the other portion

will be paid in shares of the Company’s common stock or preferred stock, with the actual number of such shares to be issued reduced

by the cash component outlaid in the transaction. A portion of the Merger Consideration, $1 million, will be held back for the purposes

of satisfying certain contingent obligations of Stage It. Though the period ended March 31, 2022 the Company has paid approximately $1,568,000

in purchase consideration and expenses related to the acquisition.

The

Merger Agreement also allows for the issuance of earn out shares, not to exceed the overall Merger Consideration, provided that certain

EBIDTA requirements are met over the course of 18 months.

On

February 14, 2022, the Company completed the acquisition of Stage It. As a result of the Closing, Stage It became a wholly-owned subsidiary

of the Company. For the acquisition, the Company will issue the initial 135,000,000 shares and pay certain amounts as detailed under

Merger Consideration in the Merger Agreement. The price to be paid in cash and stock for the Earnout Shares and Holdback Shares are set

forth in the Merger Agreement.

With

the addition of Stage It (Stage It.com), VNUE will have the ability to livestream concerts and other events, adding to the pool of other

live music focused technology services. Stage It is an established platform where concerts or other live events may be ticketed (just

like an in-person event), and fans who pay for tickets may enjoy a performance or other engagement by watching digital video as it occurs

on their web browser. For example, an artist can create an event through the platform, and then, in advance, let their fans know they

can purchase the ability to view the concerts on the Stage It platform. Fans then buy the ability to access these concerts, and at the

designated time, the fan may then observe the live performance on Stage It.com.

Covid-19

The

full extent of the impact of the COVID-19 pandemic on our business, operations and financial results will depend on numerous evolving

factors that we may not be able to accurately predict at the present time. In an effort to contain COVID-19 or slow its spread, governments

around the world have enacted various measures, including orders to close all businesses not deemed “essential,” isolate residents

to their homes or places of residence, and practice social distancing when engaging in essential activities. We anticipate that these

actions and the global health crisis caused by COVID-19 will negatively impact business activity across the globe. The music industry

in general has changed dramatically as a result of the pandemic restrictions. While concerts and other events struggle to stay alive,

virtual entertainment has increased. Covid-19 has had a material adverse effect on our live recording business and the music industry

in general. Substantially all of our future set.fm and DiscLive business is dependent on success of public events and gatherings. We believe

that the vaccination efforts throughout the world are having a positive impact on the population that may enable more live music events

to be held in the future which would be beneficial to our business, however, there can be no assurances on the timing of when this may

occur or whether it will occur at all.

Specific

to our company operations, during the pandemic period, we have enacted precautionary measures to protect the health and safety of our

employees and partners. These measures include closing our office, having employees work from home, and eliminating all travel. While

having employees work from home may have a negative impact on efficiency and may result in negligible increases in costs, it does have

an impact on our ability to execute on our agreements to deliver our core products.

We

will continue to actively monitor the situation and may take further actions that alter our business operations as may be required by

federal, state, local or foreign authorities, or that we determine are in the best interests of our employees, customers, partners and

stockholders. It is not clear what the potential effects any such alterations or modifications may have on our business, including the

effects on our customers, partners, or vendors, or on our financial results.

Description

of the Equity Financing Agreement

On

June 6, 2022, the Company entered into an Equity Financing Agreement (“Financing Agreement”) and Registration Rights Agreement

(“Registration Agreement”) with GHS. Under the terms of the Financing Agreement, GHS agreed to provide the Company with up

to Ten Million ($10,000,000) upon effectiveness of a registration statement on Form S-1 (the “Registration Statement”) filed

with the U.S. Securities and Exchange Commission (the “Commission”)

Following

effectiveness of the Registration Statement, the Company shall have the discretion to deliver puts to GHS and GHS will be obligated to

purchase shares of the Company’s common stock, par value $0.0001 per share (the “Common Stock”) based on the investment

amount specified in each put notice. The maximum amount that the Company shall be entitled to put to GHS in each put notice shall not

exceed two hundred percent (200%) of the average daily trading dollar volume of the Company’s Common Stock during the ten (10)

trading days preceding the put, in an amount equaling less than ten thousand dollars ($10,000) or greater than five hundred thousand

dollars ($500,000). Pursuant to the Equity Financing Agreement, GHS and its affiliates will not be permitted to purchase and the Company

may not put shares of the Company’s Common Stock to GHS that would result in GHS’s beneficial ownership equaling more than

4.99% of the Company’s outstanding Common Stock. The price of each put share shall be equal to eighty percent (80%) of the Market

Price (as defined in the Equity Financing Agreement). Following an up-list to the NASDAQ or an equivalent national exchange by the Company,

the Purchase price shall mean ninety percent (90%) of the Market Price, subject to a floor of $.0001 per share. Puts may be delivered

by the Company to GHS until the earlier of twenty-four (24) months after the effectiveness of the Registration Statement or the date

on which GHS has purchased an aggregate of $10,000,000 worth of Common Stock under the terms of the Equity Financing Agreement.

Additionally,

concurrently with the execution of definitive agreements, the Company shall issue common shares to the Investor representing a dollar

value equal to one percent (1.0%) of the Commitment Amount (the “Commitment Shares”). The Commitment Shares shall be calculated

at the applicable Purchase Price on the trading day immediately preceding the execution of definitive agreements. This includes 29,069,768

commitment shares that have not yet been issued by the Company, but will be issued once the company increases its authorized common stock

to accommodate the issuance. The Company anticipates the increase to authorized from 2,000,000,000 shares of common stock to 4,000,000,000

shares of common stock, par value $0.0001 per share, will be filed with the State of Nevada on July 14, 2022, 20 days after it was mailed

to our shareholders. The issuance is expected to occur on July 14, 2022 or shortly thereafter.

The

Registration Rights Agreement provides that the Company shall (i) use its best efforts to file with the Commission the Registration Statement

within 30 days of the date of the Registration Rights Agreement; and (ii) have the Registration Statement declared effective by the Commission

within 30 days after the date the Registration Statement is filed with the Commission, but in no event more than 90 days after the Registration

Statement is filed.

THE

OFFERING

| Common stock to be offered by the Selling Stockholder |

|

Up to 432,003,060 shares. |

| |

|

|

| Shares of Common Stock outstanding before this offering |

|

1,474,473,903 shares. |

| |

|

|

| Shares of Common Stock outstanding after this offering |

|

1,906,476,963 shares. |

| |

|

|

| Offering Price Per Share |

|

The Selling Stockholder GHS identified in this prospectus may sell

all or a portion of the shares being offered under the Financing Agreement at fixed prices and prevailing market prices at the time

of sale, at varying prices or at negotiated prices. |

| |

|

|

| Use of Proceeds |

|

We will not receive any proceeds from the sale of Common Stock by the

Selling Stockholder. |

| |

|

|

| Duration of Offering |

|

The offering shall terminate on the earlier of (i) the date when the

sale of all shares being registered is completed, or (ii) a year from the date of effectiveness of this Prospectus. |

| |

|

|

| Risk Factors |

|

This investment involves a high degree of risk. See “Risk Factors”

for a discussion of factors you should consider carefully before making an investment decision. |

| |

|

|

| OTC Markets symbol |

|

“VNUE.” |

RISK

FACTORS

This

investment has a high degree of risk. Before you invest you should carefully consider the risks and uncertainties described below and

the other information in this prospectus. If any of the following risks actually occur, our business, operating results and financial

condition could be harmed and the value of our stock could go down. This means you could lose all or a part of your investment.

Risk

Related to Covid 19

Our

business and future operations may be adversely affected by epidemics and pandemics, such as the recent COVID-19 outbreak.

We

may face risks related to health epidemics and pandemics or other outbreaks of communicable diseases, which could result in a widespread

health crisis that could adversely affect general commercial activity and the economies and financial markets of the country as a whole.

For example, the recent outbreak of Covid-19, which began in China, has been declared by the World Health Organization to be a “pandemic,”

has spread across the globe, including the United States of America.

Covid-19

has had a material adverse effect on our live recording business and the music industry in general. Substantially all of our future set.fm

and DiscLive business is dependent on success of public events and gatherings. We believe that the vaccination efforts throughout the

world are having a positive impact on the population that may enable more live music events to be held in the future which would be beneficial

to our business, however, there can be no assurances on the timing of when this may occur or whether it will occur at all.

Risks

Related to Our Financial Condition

Because

we have a limited operating history, you may not be able to accurately evaluate our operations.

We

have had limited operations to date and have generated limited revenues. Therefore, we have a limited operating history upon which to

evaluate the merits of investing in our company. Potential investors should be aware of the difficulties normally encountered by new companies

and the high rate of failure of such enterprises. The likelihood of success must be considered in light of the problems, expenses, difficulties,

complications and delays encountered in connection with the operations that we plan to undertake. These potential problems include, but

are not limited to, unanticipated problems relating to the ability to generate sufficient cash flow to operate our business, and additional

costs and expenses that may exceed current estimates. We expect to incur significant losses into the foreseeable future. We recognize

that if the effectiveness of our business plan is not forthcoming, we will not be able to continue business operations. There is no history

upon which to base any assumption as to the likelihood that we will prove successful, and it is doubtful that we will continue to generate

operating revenues or ever achieve profitable operations. If we are unsuccessful in addressing these risks, our business will most likely

fail.

We

are dependent on outside financing for continuation of our operations.

Because

we have generated limited revenues and currently operate at a loss, we are completely dependent on the continued availability of financing

in order to continue our business. There can be no assurance that financing sufficient to enable us to continue our operations will be

available to us in the future.

We

are dependent on outside financing for continuation of our operations.

Because

we have generated limited revenues and currently operate at a loss, we are completely dependent on the continued availability of financing

in order to continue our business operations. There can be no assurance that financing sufficient to enable us to continue our operations

will be available to us in the future.

We

will need additional funds to complete further development of our business plan to achieve a sustainable level where ongoing operations

can be funded out of revenues. We anticipate that we must raise $2,500,000 for our operations for the next 12 months, and $5,000,000 to

fully implement our business plan to its fullest potential and achieve our growth plans. There is no assurance that any additional financing

will be available or if available, on terms that will be acceptable to us.

Our

failure to obtain future financing or to produce levels of revenue to meet our financial needs could result in our inability to continue

as a going concern and, as a result, our investors could lose their entire investment.

Our

operating results may fluctuate, which could have a negative impact on our ability to grow our client base, establish sustainable revenues

and succeed overall.

Our

results of operations may fluctuate as a result of a number of factors, some of which are beyond our control including but not limited

to:

|

● |

general

economic conditions in the geographies and industries where we sell our services and conduct operations; legislative policies where we

sell our services and conduct operations; |

|

● |

the

budgetary constraints of our customers; seasonality; |

|

● |

success

of our strategic growth initiatives; |

|

● |

costs

associated with the launching or integration of new or acquired businesses; timing of new product introductions by us, our suppliers and

our competitors; product and service mix, availability, utilization and pricing; |

|

● |

the

mix, by state and country, of our revenues, personnel and assets; movements in interest rates or tax rates; |

|

● |

changes

in, and application of, accounting rules; changes in the regulations applicable to us; and litigation matters; |

As

a result of these factors, we may not succeed in our business and we could go out of business.

As

a growing company, we have yet to achieve a profit and may not achieve a profit in the near future, if at all.

We

have not yet produced any profit and may not in the near future, if at all. While we have generated limited revenue, all related party,

we cannot be certain that we will be able to realize sufficient revenue to achieve profitability. Further, many of our competitors have

a significantly larger industry presence and revenue stream but have yet to achieve profitability. Our ability to continue as a going

concern is dependent upon raising capital from financing transactions, increasing revenue and keeping operating expenses below our revenue

levels in order to achieve positive cash flows, none of which can be assured.

Risks

Related to Intellectual Property

We

may be subject to intellectual property infringement claims, which may be expensive to defend and may disrupt our business and operations.

We

cannot be certain that our operations or any aspects of our business do not or will not infringe upon or otherwise violate intellectual

property rights held by third parties. We have not but in the future may be, subject to legal proceedings and claims relating to the intellectual

property rights of others. There could also be existing intellectual property of which we are not aware that our products may inadvertently

infringe. We cannot assure you that holders of intellectual property purportedly relating to some aspect of our technology or business,

if any such holders exist, would not seek to enforce such intellectual property against us in the United States, or any other jurisdictions.

If we are found to have violated the intellectual property rights of others, we may be subject to liability for our infringement activities

or may be prohibited from using such intellectual property, and we may incur licensing fees or be forced to develop alternatives of our

own. In addition, we may incur significant expenses, and may be forced to divert management’s time and other resources from our

business and operations to defend against these infringement claims, regardless of their merits. Successful infringement or licensing

claims made against us may result in significant monetary liabilities and may materially disrupt our business and operations by restricting

or prohibiting our use of the intellectual property in question, and our business, financial position and results of operations could

be materially and adversely affected.

Our

commercial success depends significantly on our ability to develop and commercialize our services and platform without infringing the

intellectual property rights of third parties.

Our

commercial success will depend, in part, on operating our business without infringing the trademarks or proprietary rights of third parties.

Third parties that believe we are infringing on their rights could bring actions against us claiming damages and seeking to enjoin the

development, marketing and distribution of our services and platform. If we become involved in any litigation, it could consume a substantial

portion of our resources, regardless of the outcome of the litigation. If any of these actions are successful, we could be required to

pay damages and/or to obtain a license to continue to develop or market our products, in which case we may be required to pay substantial

royalties. However, any such license may not be available on terms acceptable to us or at all.

Risks

Related to Legal Uncertainty

Compliance

with changing regulation of corporate governance and public disclosure may result in additional expenses.

Changing

laws, regulations and standards relating to corporate governance and public disclosure, including the Sarbanes-Oxley Act of 2002 and new

SEC regulations, are creating uncertainty for companies such as ours. These new or changed laws, regulations and standards are subject

to varying interpretations in many cases due to their lack of specificity, and as a result, their application in practice may evolve over

time as new guidance is provided by regulatory and governing bodies, which could result in continuing uncertainty regarding compliance

matters and higher costs necessitated by ongoing revisions to disclosure and governance practices. We are committed to maintaining high

standards of corporate governance and public disclosure. As a result, we intend to invest resources to comply with evolving laws, regulations

and standards, and this investment may result in increased general and administrative expenses and a diversion of management time and

attention from revenue-generating activities to compliance activities. If our efforts to comply with new or changed laws, regulations

and standards differ from the activities intended by regulatory or governing bodies due to ambiguities related to practice, our reputation

may be harmed.

If

we fail to comply with the new rules under the Sarbanes-Oxley Act related to accounting controls and procedures, or if material weaknesses

or other deficiencies are discovered in our internal accounting procedures, our stock price could decline significantly.

We

are exposed to potential risks from legislation requiring companies to evaluate internal controls under Section 404(a) of the Sarbanes-Oxley

Act of 2002. As a smaller reporting company, we are required to provide a report on the effectiveness of its internal controls over financial

reporting, and we will be exempt from auditor attestation requirements concerning any such report so long as we are a smaller reporting

company. There is a greater likelihood of material weaknesses in our internal controls, which could lead to misstatements or omissions

in our reported financial statements as compared to issuers that have conducted such evaluations.

In

its assessment of the effectiveness of internal control over financial reporting as of September 30, 2021, the Company determined that

there were deficiencies that constituted material weaknesses, as described below.

|

● |

Lack

of proper segregation of duties due to limited personnel. |

|

● |

Lack

of a formal review process that includes multiple levels of review. |

|

● |

Lack

of adequate policies and procedures for accounting for financial transactions. |

|

● |

Lack

of independent board member(s) |

|

● |

Lack

of independent audit committee |

Material

weaknesses and deficiencies could cause investors to lose confidence in our company and result in a decline in our stock price and consequently

affect our financial condition. In addition, if we fail to achieve and maintain the adequacy of our internal controls, we may not be able

to ensure that we can conclude on an ongoing basis that we have effective internal controls over financial reporting in accordance with

Section 404 of the Sarbanes-Oxley Act. Moreover, effective internal controls, particularly those related to revenue recognition, are necessary

for us to produce reliable financial reports and are important to helping prevent financial fraud. If we cannot provide reliable financial

reports or prevent fraud, our business and operating results could be harmed, investors could lose confidence in our reported financial

information, and the trading price of our common stock could drop significantly. In addition, we cannot be certain that additional material

weaknesses or significant deficiencies in our internal controls will not be discovered in the future.

Risks

Related to Our Business

If

we fail to keep up with industry trends or technological developments, our business, results of operations and financial condition may

be materially and adversely affected.

The

live music content industry is rapidly evolving and subject to continuous technological changes. Our success will depend on our ability

to keep up with the changes in technology and user behavior resulting from new developments and innovations. For example, as we provide

our product and service offerings across a variety of mobile systems and devices, we are dependent on the interoperability of our services

with popular mobile devices and mobile operating systems that we do not control, such as Android and iOS. If any changes in such mobile

operating systems or devices degrade the functionality of our services or give preferential treatment to competitive services, the usage

of our services could be adversely affected.

Technological

innovations may also require substantial capital expenditures in product development as well as in modification of products, services

or infrastructure. We cannot assure you that we can obtain financing to cover such expenditure. If we fail to adapt our products and services

to such changes in an effective and timely manner, we may suffer from decreased user base, which, in turn, could materially and adversely

affect our business, financial condition and results of operations

Rapidly

evolving technologies could cause demand for our products to decline or could cause our products to become obsolete.

Current

or future competitors may develop technological or product innovations that address live music content in a manner that is, or is perceived

to be, equivalent or superior to our products. In the technology market in particular, innovative products have been introduced which

have the effect of revolutionizing a product category and rendering many existing products obsolete. If competitors introduce new products

or services that compete with or surpass the quality or the price/performance of our products, we may be unable to attract and retain

users or to maintain or increase revenues from our users. We may not anticipate such developments and may be unable to adequately compete

with these potential solutions. As a result of these or similar potential developments, in the future it is possible that competitive

dynamics in our market may require us to reduce prices for our paid for products, which could harm our net revenues, gross margin and

operating results or cause us to incur losses.

Our

business depends on our users having continued and unimpeded access to the Internet. Companies providing access to the Internet may be

able to block or degrade our calls, or block access to our website or charge us or our users additional fees for our products.

All

of our users rely on open, unrestricted access to the Internet to use our products. If they have limited, restricted or no access at all

to the Internet, or their connection to the Internet is interrupted or disturbed, they may be less likely to use our products as a result.

Some

of these internet providers have stated that they may take measures that could increase the cost of customers’ use of our products

by restricting or prohibiting the use of their lines or access points to the Internet for our products, by filtering, blocking, delaying,

or degrading the packets of data used to transmit our communications, and by charging increased fees to our users for access to our products.

Some

Internet access providers have additionally, or alternatively, contractually restricted their customers’ access to Internet communications

products through their terms of service. Customers of these and other Internet access providers may not be aware that technical disruptions

or additional tariffs are the act of other parties, which could harm our brand. Even if customers understand that we are not the source

of such disruptions, they may be less likely to use our products as a result.

In

the United States, the European Union and other jurisdictions, regulatory authorities are in the process of examining the adoption of

“network neutrality” policies, which aim to treat all Internet traffic equally, and developing or considering laws and regulations

to codify acceptable behaviors on the part of network operators and access providers when providing consumers and businesses with access

to the Internet. Different regulatory authorities have different approaches to this policy area both from a substantive and procedural

perspective. Any failure on the part of regulatory authorities to protect the accessibility of the Internet to all, or any particular

category of, Internet subscribers, or their failure to protect the delivery on a non-discriminatory basis of user communications over

the Internet, regardless of type or service, could harm our results of operations and prospects.

Our

business depends on the continued reliability of the Internet infrastructure.

If

Internet service providers and other third parties providing Internet services have outages or deteriorations in their quality of service,

our customers will not have access to our products or may experience a decrease in the quality of our products.

Furthermore,

as the rate of adoption of new technology increases, the networks on which our products rely in certain countries may not be able to sufficiently

adapt to the increased demand for their products and services. Frequent or persistent interruptions could cause current or potential users

to believe that our systems are unreliable, leading them to switch to our competitors or to avoid our products, and could permanently

harm our reputation and brands.

We

cannot control internet based delays and interruptions, which may negatively affect our customers and thus our revenues.

Any

delay or interruption in the services by these third parties service providers could result in delayed or interrupted service to our customers

and could harm tour business. Accordingly, we could be adversely affected if such third party service providers fail to maintain consistent

and reliable services, or fail to continue to make these services available to us on economically acceptable terms, or at all. These suppliers

could also be adversely impacted by the COVID-19 pandemic, which could affect their ability to deliver their services to our customers

in a satisfactory manner, or at all.

Digital

piracy continues to adversely impact our business.

A

substantial portion of our revenue comes from the distribution of music which is potentially subject to unauthorized consumer copying

and widespread digital dissemination without an economic return to us, including as a result of “stream-ripping.” In its Music

Listening 2019 report, IFPI surveyed 34,000 Internet users to examine the ways in which music consumers aged 16 to 64 engage

with recorded music across 21 countries. Of those surveyed, 23% used illegal stream-ripping services, the leading form of music piracy.

Organized industrial piracy may also lead to decreased revenues. The impact of digital piracy on legitimate music revenues and subscriptions

is hard to quantify, but we believe that illegal file sharing and other forms of unauthorized activity, including stream manipulation,

have a substantial negative impact on music revenues. If we fail to obtain appropriate relief through the judicial process or the complete

enforcement of judicial decisions issued in our favor (or if judicial decisions are not in our favor), if we are unsuccessful in our efforts

to lobby governments to enact and enforce stronger legal penalties for copyright infringement or if we fail to develop effective means

of protecting and enforcing our intellectual property (whether copyrights or other intellectual property rights such as patents, trademarks

and trade secrets) or our music entertainment-related products or services, our results of operations, financial position and prospects

may suffer.

If

we are unable to successfully manage growth, our operations could be adversely affected.

Our

progress is expected to require the full utilization of our management, financial and other resources, which to date has occurred with

limited working capital. Our ability to manage growth effectively will depend on our ability to improve and expand operations, including

our financial and management information systems, and to recruit, train and manage personnel. There can be no absolute assurance that

management will be able to manage growth effectively.

If

we do not properly manage the growth of our business, we may experience significant strains on our management and operations and disruptions

in our business. Various risks arise when companies and industries grow quickly. If our business or industry grows too quickly, our ability

to meet customer demand in a timely and efficient manner could be challenged. We may also experience development delays as we seek to

meet increased demand for our services and platform. Our failure to properly manage the growth that we or our industry might experience

could negatively impact our ability to execute on our operating plan and, accordingly, could have an adverse impact on our business, our

cash flow and results of operations, and our reputation with our current or potential customers.

We

may fail to successfully integrate our acquisitions or otherwise be unable to benefit from pursuing acquisitions.

We

believe there are meaningful opportunities to grow through acquisitions and joint ventures across all service categories and we expect

to continue a strategy of selectively identifying and acquiring businesses with complementary services. We may be unable to identify,

negotiate, and complete suitable acquisition opportunities on reasonable terms. There can be no assurance that any business acquired by

us will be successfully integrated with our operations or prove to be profitable to us. We may incur future liabilities related to acquisitions.

Should any of the following problems, or others, occur as a result of our acquisition strategy, the impact could be material:

|

● |

difficulties

integrating personnel from acquired entities and other corporate cultures into our business; difficulties integrating information systems;

|

|

● |

the

potential loss of key employees of acquired companies; |

|

● |

the

assumption of liabilities and exposure to undisclosed or unknown liabilities of acquired companies; or the diversion of management attention

from existing operations. |

Risks

Associated with Management and Control Persons

We

are dependent on the continued services of Zach Bair and if we fail to keep him or fail to attract and retain qualified senior executive

and key technical personnel, our business will not be able to expand.

We

are dependent on the continued availability of Zach Bair, and the availability of new employees to implement our business

plans. The market for skilled employees is highly competitive, especially for employees in our industry. Although we expect that our planned

compensation programs will be intended to attract and retain the employees required for us to be successful, there can be no assurance

that we will be able to retain the services of all our key employees or a sufficient number to execute our plans, nor can there be any

assurance we will be able to continue to attract new employees as required.

Our

personnel may voluntarily terminate their relationship with us at any time, and competition for qualified personnel is intense. The process

of locating additional personnel with the combination of skills and attributes required to carry out our strategy could be lengthy, costly

and disruptive.

If

we lose the services of key personnel or fail to replace the services of key personnel who depart, we could experience a severe negative

effect on our financial results and stock price. The loss of the services of any key personnel, marketing or other personnel or our failure

to attract, integrate, motivate and retain additional key employees could have a material adverse effect on our business, operating and

financial results and stock price.

Our

lack of adequate D&O insurance may also make it difficult for us to retain and attract talented and skilled directors and officers.

In

the future we may be subject to additional litigation, including potential class action and stockholder derivative actions. Risks associated

with legal liability are difficult to assess and quantify, and their existence and magnitude can remain unknown for significant periods

of time. To date, we have not obtained directors and officers liability (“D&O”) insurance. Without adequate D&O insurance,

the amounts we would pay to indemnify our officers and directors should they be subject to legal action based on their service to the

Company could have a material adverse effect on our financial condition, results of operations and liquidity. Furthermore, our lack of

adequate D&O insurance may make it difficult for us to retain and attract talented and skilled directors and officers, which could

adversely affect our business.

The

elimination of monetary liability against our directors, officers and employees under our Articles of Incorporation and the existence

of indemnification rights to our directors, officers and employees may result in substantial expenditures by our Company and may discourage

lawsuits against our directors, officers and employees.

Our

Articles of Incorporation contain provisions that eliminate the liability of our directors for monetary damages to our Company and shareholders.

Our bylaws also require us to indemnify our officers and directors. We may also have contractual indemnification obligations under our

agreements with our directors, officers and employees. The foregoing indemnification obligations could result in our company incurring

substantial expenditures to cover the cost of settlement or damage awards against directors, officers and employees that we may be unable