UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-A

FOR REGISTRATION OF CERTAIN CLASSES OF SECURITIES

PURSUANT TO SECTION 12(b) OR 12(g) OF THE

SECURITIES EXCHANGE ACT OF 1934

Helius Medical

Technologies, Inc.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

36-4787690 |

(State or other jurisdiction of

incorporation or organization) |

|

(IRS Employer

Identification No.) |

642 Newton Yardley Road, Suite 100

Newtown, PA |

|

18940 |

| (Address of principal executive offices) |

|

(Zip Code) |

Securities to be registered pursuant to Section

12(b) of the Act:

| Title

of each class to be so registered |

|

Name of

each exchange on which each class is to be registered |

| Not Applicable |

|

Not Applicable |

If this form relates to the registration of a

class of securities pursuant to Section 12(b) of the Exchange Act and is effective pursuant to General Instruction A.(c) or (e), check

the following box. ¨

If this form relates to the registration of a

class of securities pursuant to Section 12(g) of the Exchange Act and is effective pursuant to General Instruction A.(d) or (e), check

the following box. x

If this form relates to the registration of a

class of securities concurrently with a Regulation A offering, check the following box. ¨

Securities Act registration statement or Regulation

A offering statement file number to which this form relates: N/A (if applicable)

Securities to be registered pursuant to Section 12(g) of the Act:

| Series

B Preferred Stock, par value $0.001 per share |

| (Title of class) |

INFORMATION REQUIRED IN REGISTRATION STATEMENT

Item 1. Description of Registrant’s Securities To Be Registered.

On March 23, 2023, our board of directors (the

“Board”) declared a dividend of one one-thousandth of a share of our Series B Preferred Stock, par value $0.001

per share (“Series B Preferred Stock”), on each outstanding share of our Class A Common Stock, par value $0.001

per share (“Class A Common Stock”), to stockholders of record on April 3, 2023 (the “Record Date”).

General; Transferability. The Board

has adopted resolutions providing that shares of Series B Preferred Stock will be uncertificated. As a result, outstanding shares of

Series B Preferred Stock will be represented in book-entry form. The certificate of designation governing Series B Preferred Stock provides

that shares of Series B Preferred Stock may not be transferred by any holder thereof except in connection with a transfer by such holder

of any shares of Class A Common Stock held by such holder, in which case a number of one one-thousandths (1/1,000ths) of a share of Series

B Preferred Stock equal to the number of shares of Class B Common Stock to be transferred by such holder will be automatically transferred

to the transferee of such shares of Class B Common Stock.

Voting Rights. Each share of Series

B Preferred Stock will entitle the holder thereof to 1,000,000 votes per share (and, for the avoidance of doubt, each fraction of a share

of Series B Preferred Stock will have a ratable number of votes). Thus, each one-thousandth of a share of Series B Preferred Stock will

entitle the holder thereof to 1,000 votes. The outstanding shares of Series B Preferred Stock will vote together with the outstanding

shares of Class B Common Stock as a single class exclusively with respect to (1) any proposal to adopt an amendment to our Amended and

Restated Certificate of Incorporation, as amended (the “Certificate of Incorporation”), to reclassify the outstanding

shares of Class A Common Stock into a smaller number of shares of Class A Common Stock at a ratio specified in or determined in accordance

with the terms of any such amendment (the “Reverse Stock Split”) and (2) any proposal to adjourn any meeting

of stockholders called for the purpose of voting on Reverse Stock Split (the “Adjournment Proposal”). The Series

B Preferred Stock will not be entitled to vote on any other matter, except to the extent required under the Delaware General Corporation

Law.

Unless otherwise provided on any applicable proxy

or ballot with respect to the voting on the Reverse Stock Split or the Adjournment Proposal, as applicable, the holder of each share

of Series B Preferred Stock (or fraction thereof) entitled to vote on the Reverse Stock Split or the Adjournment Proposal, as applicable,

at any meeting of stockholders held to vote on the Reverse Stock Split will be cast in the same manner as the vote, if any, of the holder

of the share of Class A Common Stock (or fraction thereof) in respect of which such share of Series B Preferred Stock (or fraction thereof)

was issued as a dividend is cast on the Reverse Stock Split or the Adjournment Proposal, as applicable, and the proxy or ballot with

respect to shares of Class B Common Stock held by any holder on whose behalf such proxy or ballot is submitted will be deemed to include

all shares of Series B Preferred Stock (or fraction thereof) held by such holder. Holders of Series B Preferred Stock will not receive

a separate ballot or proxy to cast votes with respect to the Series B Preferred Stock on the Reverse Stock Split or the Adjournment Proposal

brought before any meeting of stockholders held to vote on the Reverse Stock Split.

Dividend Rights. The holders of

Series B Preferred Stock, as such, will not be entitled to receive dividends of any kind.

Liquidation Preference. The Series

B Preferred Stock will rank senior to the Class A Common Stock as to any distribution of our assets upon a liquidation, dissolution or

winding up of our company, whether voluntarily or involuntarily (a “Dissolution”). Upon any Dissolution, each

holder of outstanding shares of Series B Preferred Stock will be entitled to be paid out of our assets available for distribution to

stockholders, prior and in preference to any distribution to the holders of Class A Common Stock, an amount in cash equal to $0.001 per

outstanding share of Series B Preferred Stock.

Redemption. All shares of Series

B Preferred Stock that are not present in person or by proxy at any meeting of stockholders held to vote on the Reverse Stock Split as

of immediately prior to the opening of the polls at such meeting (the “Initial Redemption Time”) will automatically

be redeemed by us at the Initial Redemption Time without further action on our part or on the part of the holder of shares of Series

B Preferred Stock (the “Initial Redemption”). Any outstanding shares of Series B Preferred Stock that have

not been redeemed pursuant to the Initial Redemption will automatically be redeemed in whole, but not in part, at the close of business

on the earlier of (i) the business day established by the Board in its sole discretion and (ii) the first business day following the

date on which our stockholders approve the Reverse Stock Split.

Each share of Series B Preferred Stock redeemed

in accordance with the certificate of designation governing the Series B Preferred Stock (the “Certificate of Designation”)

will be deemed to be redeemed immediately prior to the redemption time described above. From and after such redemption time, each share

of Series B Preferred Stock redeemed pursuant to the Certificate of Designation will no longer be deemed to be outstanding and all rights

in respect of such share of Series B Preferred Stock will cease, except for the right to receive $0.001 in cash.

Taxation. The dividend of one one-thousandth

of a share of Series B Preferred Stock is not expected to be taxable to stockholders or to us. However, stockholders may, depending upon

the circumstances, recognize taxable income in the event of the redemption of the Series B Preferred Stock as described above.

Miscellaneous. The Series B Preferred

Stock is not convertible into, or exchangeable for, shares of any other class or series of our stock or other securities. The Series

B Preferred Stock has no stated maturity and is not subject to any sinking fund.

* * * * *

The foregoing description of the Series B Preferred

Stock does not purport to be complete and is qualified in its entirety by reference to the Certificate of Designation, which is filed

as Exhibit 3.1 hereto and is incorporated herein by reference.

Item 2. Exhibits.

SIGNATURE

Pursuant to the requirements of Section 12 of

the Securities Exchange Act of 1934, the registrant has duly caused this registration statement to be signed on its behalf by the undersigned,

thereunto duly authorized.

| Date: March 24, 2023 |

HELIUS MEDICAL TECHNOLOGIES, INC. |

| |

|

|

| |

By: |

/s/ Jeffrey S. Mathiesen |

| |

|

Jeffrey S. Mathiesen |

| |

|

Chief Financial Officer |

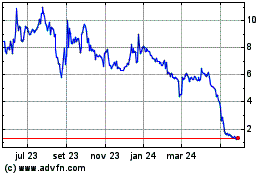

Helius Medical Technolog... (NASDAQ:HSDT)

Gráfico Histórico do Ativo

De Jan 2025 até Fev 2025

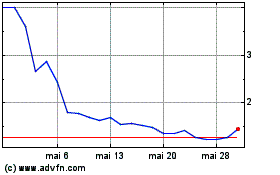

Helius Medical Technolog... (NASDAQ:HSDT)

Gráfico Histórico do Ativo

De Fev 2024 até Fev 2025